Aluminum Price Outlook: BMO Says 'Lower for Longer'

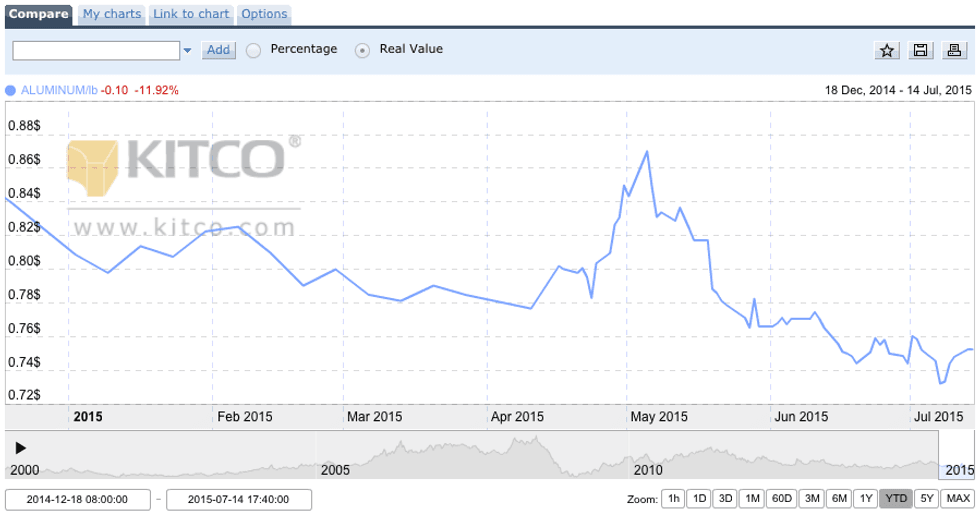

Other than a brief price spike in May, the aluminum price hasn’t performed well this year. Unfortunately, the aluminum price outlook for the rest of 2015 isn’t looking much better.

Other than a brief price spike in May, the aluminum price hasn’t performed well this year. Unfortunately, the aluminum price outlook for the rest of 2015 isn’t looking much better.

The aluminum price has fallen 11 percent year-to-date, to $0.75 per pound, and has lost 13 percent since hitting a high of $0.87 on May 5.

That fall has largely been driven by continued oversupply in the aluminum space. According to Metal Miner, global primary aluminum production is up 12 percent compared to a year ago, marking the fastest growth rate since 2011. And while some might be optimistic that China will cut supply, Metal Miner said that “remains a pipedream.”

Smelters outside of China continue to be pressured by the poor aluminum price outlook, and the country keeps pushing to export record amounts of aluminum this year, Bloomberg reported. China accounts for half of the world’s aluminum output.

“The aluminum price is going to be pretty horrible for a while, until we see some western world production cuts,” Citigroup analyst David Wilson told the publication.

Lower aluminum price outlook

Based on that scenario, Metal Miner’s aluminum price outlook is for the metal to continue trending lower, and BMO Capital Markets has also recently lowered its aluminum price outlook. As outlined in its Q3 2015 Commodity Canvas, BMO now expects the aluminum price to come in at US$0.78 in 2015, compared to an earlier prediction of $0.83. For 2016, the firm has revised its aluminum price outlook down from US$0.90 to $0.80.

Certainly, China’s growing aluminum exports are a concern for the supply side of the aluminum market. As BMO notes, previous analysis of the “Ex-China” primary aluminum market no longer applies, as Chinese exports are expected to saturate that previously protected space.

Meanwhile, low-cost production outside of China is “no longer only in the hands of Russia- and Quebec-based hydropowered smelters,” another factor weighing on the aluminum price outlook.

“China’s newest (and very large, 300ktpa+) smelters are located in coal-captive regions, using newer technology that is also more electricity-efficient,” BMO’s note explains. “Rio Tinto’s (NYSE:RIO,ASX:RIO,LSE:RIO) modernized Kitimat smelter incurred a capex bill of US$3.5B – there are likely few smelters that can afford such modernization given low aluminum prices since the financial crisis.”

Taking a look at regional premiums, the firm states that those numbers fell much more quickly than expected, and are not likely to reach higher levels again any time soon.

“We don’t believe premiums will rise again as the market must now work through significant inventory that is decreasingly tied up in financing deals,” BMO states. “Further, we estimate US$0.07/lb is a reasonable long-term premium (U.S. Midwest) given transportation/insurance costs to transport marginal supply of metal from the Middle East.”

Certainly, that aluminum price outlook is troubling for aluminum companies. Indeed, the share prices of producers such as Alcoa (NYSE:AA) and United Co. Rusal (FWB:R6L) have fallen roughly 30 percent since the start of the year, and an article from Forbes notes that Alcoa’s latest earnings results missed analyst expectations.

Still, Alcoa Chairman and CEO Klaus Kleinfeld is positive on the company’s future, and on its performance amidst the low aluminum price. “In the upstream, our Alumina business delivered its best first half since 2007 and our lower cost metals business showed resilience in the face of strong market headwinds,” he said in a release last Wednesday. “Productivity and cash generation were excellent.”

Certainly, aluminum investors will be keeping a close eye on the company in the coming quarters and on changing aluminum price outlooks.

Securities Disclosure: I, Teresa Matich, hold no direct investment interest in any company mentioned in this article.