Denison Mines Boosts Inferred Resource for Midwest Uranium Project

The last resource estimate for the Athabasca Basin-based project was completed in 2006; the new version was created without additional drilling.

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) announced an increase in the resource estimate for the Midwest uranium project on Tuesday (March 27).

The Athabasca Basin-based project is a joint venture between Denison (25.17 percent), Orano Canada (69.16 percent) and OURD Canada (5.67 percent).

According to Denison, the asset now holds a total inferred resource of 18.2 million pounds of U3O8 (846,000 tonnes at 1 percent U3O8) above a cut-off grade of 0.1 percent U3O8.

Midwest hosts the high-grade Midwest Main and Midwest A uranium deposits, which are along strike and within 6 kilometers of the J Zone deposit and Huskie deposit at Denison’s majority owned Waterbury Lake project. The updated resource estimate has increased the inferred resources for both deposits.

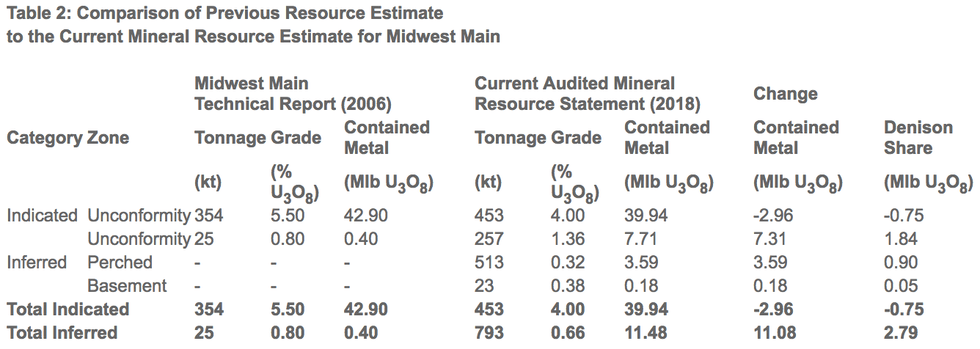

Compared to the previous estimate, which was published over a decade ago in 2006, Midwest Main’s inferred resource rose by 11.08 million pounds of U3O8 to come in at 11.48 million pounds of U3O8 grading 0.66 percent U3O8.

For its part, Midwest A saw its inferred resource rise by 2.42 million pounds of U3O8 to hit 6.72 million pounds of U3O8 grading 5.81 percent U3O8.

Denison notes that the increase for Midwest Main can be attributed to the incorporation of additional zones of mineralization and a reinterpreted mineralization model, among other things. Meanwhile, the rise for Midwest A was largely due to “re-estimation of the High Grade Zone using more appropriate resource modelling methods and the availability of measured density data.”

The chart below compares the current resource estimate for Midwest and the one produced in 2006:

Chart via Denison Mines.

“This updated and independently audited mineral resource estimate for Midwest is supported by an upgraded project database, vastly improved 3D models and industry best-practice estimation procedures for high-grade Athabasca uranium deposits,” said Dale Verran, Denison’s vice president, exploration.

He added, “[w]ith the application of more rigorous and robust estimation procedures, in accordance with NI 43-101, we are pleased to see a significant increase in overall project resources, without additional recent drilling.” Verran also said the update will help ready Midwest for future development.

Denison’s other assets in the Athabasca Basin include a 22.5-percent stake in the McClean Lake uranium mill, which is now processing ore from the Cigar Lake mine, and a 60-percent interest in the Wheeler River uranium project. Wheeler River hosts the high-grade Phoenix and Gryphon deposits.

Year-to-date Denison’s share price is down about 25 percent on both the TSX and NYSEAMERICAN.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.