US Takes Action on Foreign Dependence as Rare Earths Scare Continues

The US Department of Commerce is calling on other government bodies to help find domestic deposits of key resources like rare earths.

The US Department of Commerce (DOC) is calling on other government bodies to help find domestic deposits of key resources. The move is an attempt to free the country of its dependence on foreign nations for critical metals.

The announcement comes after two weeks of concerns that China will limit rare earth exports to the US in retaliation to President Donald Trump’s ever-growing list of tariffed and taxed goods.

A rare earth quota could potentially impact a number of industries that rely on the diverse group of metals to manufacture electronic and technological products.

The report, titled “A Federal Strategy to Ensure a Reliable Supply of Critical Minerals,” was uploaded as an unsecured document on Tuesday (June 4) by the DOC.

With six distinct calls to action, the goal, as outlined in the document, is to make America’s economy and defense more secure. It asks the Department of the Interior (DOI) to: locate domestic supplies of critical minerals; ensure access to information necessary for the study and production of these minerals; and expedite permitting for minerals projects.

“Thanks to President Trump’s leadership, today’s federal strategy lays out a blueprint for America to once again be a leader in the critical minerals sector,” DOI Secretary David Bernhardt said in a subsequent announcement. “As with our energy security, the Trump Administration is dedicated to ensuring that we are never held hostage to foreign powers for the natural resources critical to our national security and economic growth.”

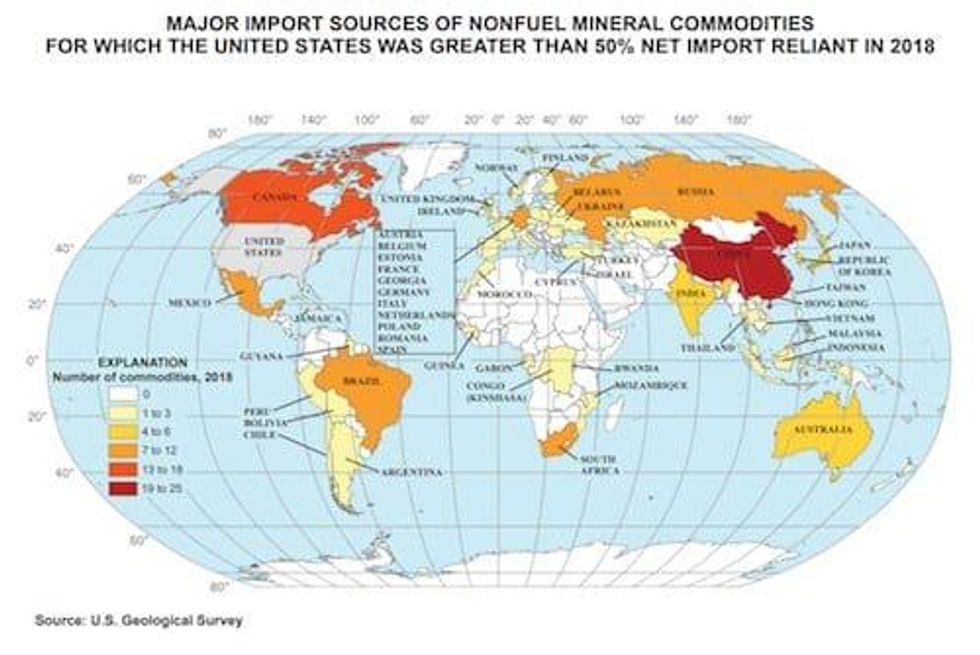

Image courtesy of the US Geological Survey.

The US is heavily reliant on foreign imports of rare earths, uranium and a dozen other resources in order to generate electricity, provide materials to the technology and electronics sectors and more.

While the DOI may be amped and ready to identify new resources and mining opportunities for the nation, David Anonychuk, managing director of M.Plan International, pointed out that it takes quite a long time to get a rare earth mining project in full swing.

“Most rare earth juniors are at an exploration or early project stage, so it will take considerable time to fully develop projects, perhaps seven to 10 years from resource estimate to project production. The exploration phase can last two to three years,” he said to the Investing News Network.

“The project study phase for mineral resource through to feasibility study can take five to seven years or more, with environmental permitting and social being the longest path. Project construction is about two years to get to commissioning.”

When you add it all together, it could take the US as long as 20 years to build a reliable, steady supply of rare earths.

However, the announcement could entice explorers and mining companies to start the long process.

“The investment community will be taking a new look at rare earth junior mining companies and projects. That is the upside given the US/China trade dispute and recent media attention on rare earths,” said Anonychuk. “Exploration programs should pick up; however, (companies) will need to secure new funding given the renewed interest.”

In addition to offering support and fast tracking for permits for the mining sector, the US will also look to other methods of recovery to bolster its resource stocks.

“Alternatives, such as recycling, processing mine waste, extraction from seawater, or even filtering them from energy byproducts, could prove valuable sources for critical minerals,” states the report.

There is also a “buy American” caveat that would see all US departments that use natural resources only source domestically produced minerals and metals.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.