The International Manganese Institute just released its October report on supply and demand trends for the manganese market.

The International Manganese Institute (IMnI) just put out its research report for October, giving a good overview of manganese supply and demand trends.

In particular, the organization looks at the performance of various manganese alloys, starting with silicomanganese. It’s seen a continued decrease in production year-on-year due to reduced demand from steelmakers in China, India and the US. Large production cuts in South Africa and Brazil due to higher electricity prices have also stilted its production.

“Production declined in all regions except Europe, supported by lower imports due to the weaker euro and the AD investigation against Indian SiMn,” IMnI’s report states. “In India, production cuts due to slow demand from export markets and domestic steelmakers hit by postponed infrastructure projects. Indian SiMn smelters also face low liquidity and very tight margins, while stocks are rising.”

High-carbon ferromanganese production also dropped in all regions in the month of July, again due to decreased demand from steelmakers. Smelters in Brazil and South Africa reduced output because of weak international demand and the high price of electricity. The US also saw a drop in production during the summer slowdown.

Refined ferromanganese production was also on the decline in the summer months due to production cuts in Asia, Africa and the Commonwealth of Independent States. On the other hand, Europe had an increase in output during the same period.

Steel market in focus

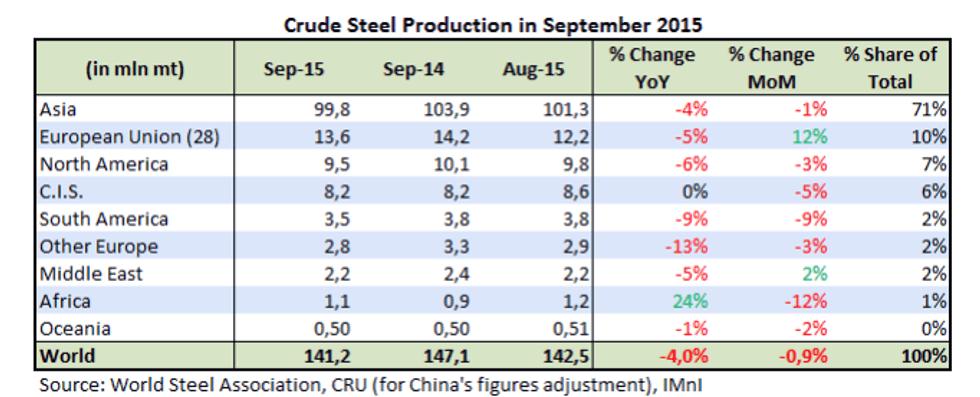

As the above information shows, steel market dynamics exert a fair amount of sway over the manganese market. That’s because manganese is essential for steel production. The following chart, found in the report from IMnI, gives an overview of the most recent information available on global crude steel production:

Company news

Though it reported fairly positive quarterly results in September, South32 (ASX:S32) is looking to cut costs sharply amid falling commodities prices. In fact, the company said told The Wall Street Journal in October that it is completing a review of all its functional support — that should deliver a 25-percent reduction in costs totaling about US$130 million.

Gulf Manganese (ASX:GMC) announced the appointment of Hamish Bohannan as its new CEO in October. The company also reported the results of a Review of Manganese Prospects and Deposits in Indonesia conducted by SRK Consulting.

Securities Disclosure: I, Kristen Moran, hold no direct investment interest in any company mentioned in this article.

Related reading:

Manganese Supply and Demand Trends for the Start of 2015