Surge Acquires Additional Gold-Copper Mineral Claims in the Golden Triangle Adding to its Sizable Land Position in British Columbia

Surge Exploration Inc. (TSXV:SUR, OTC:SURJF. FRA:DJ5C) has recently acquired 100% interest in additional Gold Copper mineral claims adjoining its Trapper Lake Property in Northern BC

Surge Exploration Inc. (“the Company” or “Surge”) (TSXV:SUR, OTC:SURJF. FRA:DJ5C) announces that it has recently acquired 100% interest in additional Gold Copper mineral claims adjoining its Trapper Lake Property in Northern British Columbia near the Golden Bear Mine, a 480,000 oz Au past producer, currently owned by Newmont Goldcorp Corporation (NYSE: NEM, TSX: NGT). It should be noted that results from nearby and/or adjacent properties are not necessarily indicative or reflective of mineralization that may be hosted on the Company’s property.

Subject to the terms and conditions of the resultant Purchase and Sale Agreement dated September 5, 2019, for the new mineral claims, Surge agrees to make a cash payment to the vendor in the amount of $17,400 and issuing 500,000 fully paid and non-assessable common shares in the capital of the Company. The transaction is subject to TSX Venture Exchange (“Exchange”) approval.

All shares issued are subject to a four month and a day hold period in accordance with applicable securities laws.

The mineral claims owned by Surge is also partly adjoining the Thorn Project currently owned by Brixton Metals Corp. (“Brixton”) (BBB: TSXV) located in the Sutlahine River area of northwestern British Columbia (northern tip of the “Golden Triangle”). At the Thorn Project, Brixton reported on July 15, 2019 a new drill hole intercept of 1.97 grams per tonne gold equivalent across 554.70 meters including 135.96M of 1.35 g/t Au, 0.31% Cu, 133.62 g/t Ag or 5.00 g/t Au including 6M of 3.56% Cu, 3.37 g/t Au, 257.77 g/t Ag. Again, results from nearby and/or adjacent properties are not necessarily indicative or reflective of mineralization that may be hosted on the Company’s property.

Surges’ land acquisition complements its previously announced 220 sq. km mineral claim staking program Golden Triangle, reiterating the Company’s commitment to region. These new claims have been acquired to provide additional exploration potential within BC’s Golden Triangle, a regionally important geological and structural trend in Canada. A large portion of the new property is adjoining both the Thorn Project and the boundaries of the Golden Bear Mine.

In Brixton’s news release dated Aug 27, 2019 (Brixton News Release) they reported that they have commenced a phase two exploration program at its Thorn Project consisting of approximately 7,000 to 10,000 metres of HQ and NQ size core drilling with two drills on 2 distinct porphyry targets within the Camp Creek Copper Corridor and the Chivas zone. In this news release, Brixton also confirmed that it has recently staked an additional 862 square kilometres of new mineral claims adjoining the Surge Exploration Mineral Claims for a new total mineral claim area of 1,858 square kilometres of wholly owned tenure in the area.

Tim Fernback, Surge CEO states “To put this in perspective, the total area explored by Surge is approximately equal to ninety-five times (95 X) the size of New York’s famous Central Park or five and a half times (5.5X) the size of the entire island of Manhattan. With Brixton Metals announcing on August 8, 2019that renowned gold mining investor, Mr. Eric Sprott, through 2176423 Ontario Ltd. (a corporation which is beneficially owned by him) acquired 22,250,000 Units for total consideration of $4,005,000 of its recently completed $7.7 million private placement, this area appears to be quite active for gold exploration. It is notable that following the completion of the August 2019 private placement, Mr. Sprott’s holdings including previously held shares will represent 18.25% of the issued and outstanding common shares of Brixton Metals, on a non-diluted basis.

This area has already generated several promising projects, and is the subject of significant interest and exploration expenditure in 2019 with recent discoveries by Brixton Metals, Stuhini Exploration., Dunnedin Ventures, Garibaldi Resources, and IMGM International Mining Canada. Furthermore, this region is host to numerous operating mines, good infrastructure including experienced exploration and supporting services. Our exploration team believes that this land package is strategically situated to exploit the high gold and copper values of the region.”

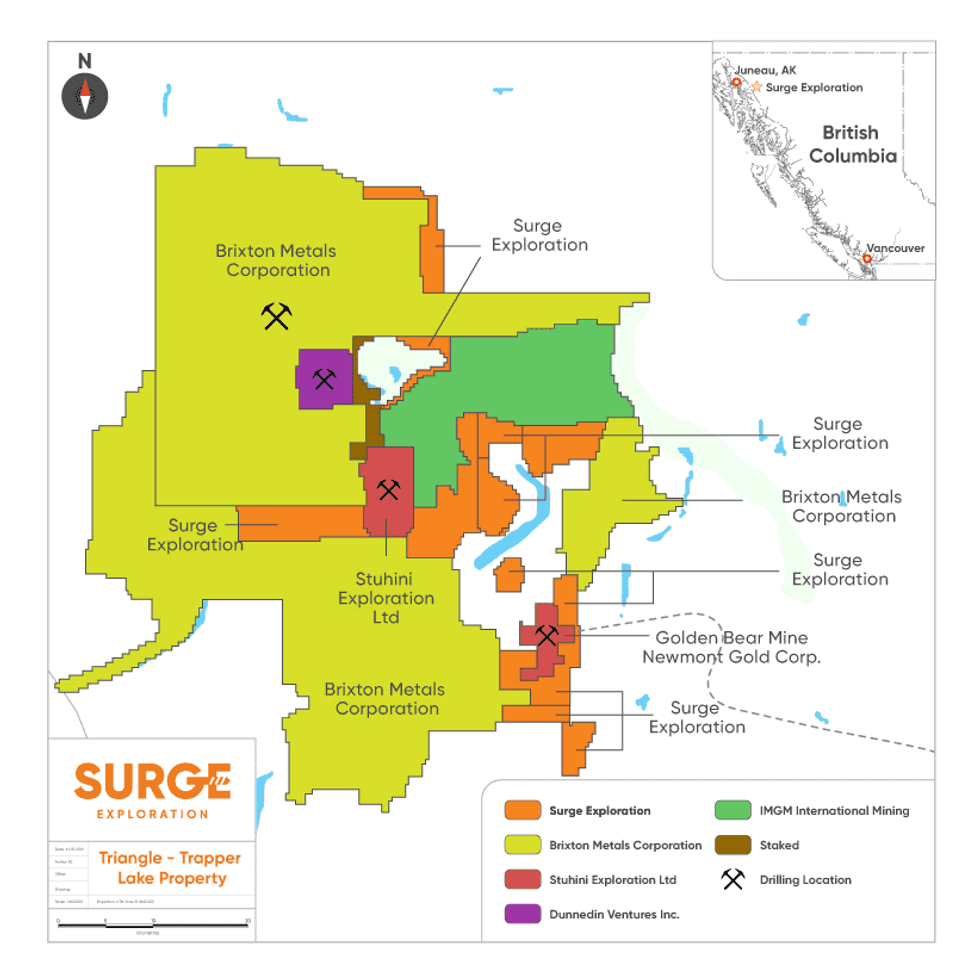

Map of Properties

Click Image To View Full Size

About the Property

The Company owns 100% interest in the Golden Triangle – Trapper Lake Group of 23 mineral claims which are located in the prolific Golden Triangle Region of northwestern British Columbia approximately 90 km ENE from Juneau, Alaska. Surges’ staking program acquired an area of approx. 325 sq. km within the regionally important geological and structural trend. A large portion of the new property is adjacent to the Thorn Project owned by Brixton Metal’s Corp. (“Brixton”, TSXV: BBB) with the balance covering prospective open ground containing numerous B.C. Minfile showings with Cu, Ag, Au values adjoining the boundaries of Newmont Goldcorp’s Golden Bear Mine, a 480,000 oz Au past producer.

In Brixton’s news release dated July 15, 2019 (Brixton News Release), they reported results from drill hole THN19-150, which was drilled to 829.06 metres depth at the Oban diatreme breccia pipe within the Camp Creek copper corridor. Brixton reported a drill hole intercept of 1.97 grams per tonne gold equivalent across 554.70 meters including 135.96M of 1.35 g/t Au, 0.31 % Cu, 133.62 g/t Ag or 5.00 g/t Aueq including 6M of 3.56% Cu, 3.37 g/t Au, 257.77 g/t Ag. Structural mapping and soil-rock geochemistry at the Chivas zone and relogging of select core from the Glenfiddich zone were also conducted as part of the overall exploration program at the Thorn Project.

About Surge Exploration Inc.

The Company is a Canadian-based mineral exploration company which has been active in the resource sector in British Columbia and elsewhere in Canada.

Golden Triangle – Trapper Lake Property (Copper Gold), British Columbia

The Company owns 100% interest in the Golden Triangle – Trapper Lake Group of 23 mineral claims which are located in the prolific Golden Triangle Region of northwestern British Columbia approximately 90 km ENE from Juneau, Alaska. Surges’ staking program totals an area of approximately 325 sq. km within the regionally important geological and structural trend. A large portion of the new property is adjacent to the Thorn Project owned by Brixton Metal’s Corp. (“Brixton”, TSXV: BBB) with the balance covering prospective open ground containing numerous B.C. Minfile showings with Cu, Ag, Au values adjoining the boundaries of the Golden Bear Mine, a 480,000 oz Au past producer.

In Brixton’s news release dated July 15, 2019 (Brixton News Release), they reported results from drill hole THN19-150, which was drilled to 829.06 metres depth at the Oban diatreme breccia pipe within the Camp Creek copper corridor. Brixton reported a drill hole intercept of 1.97 grams per tonne gold equivalent across 554.70 meters including 135.96M of 1.35 g/t Au, 0.31 % Cu, 133.62 g/t Ag or 5.00 g/t Aueq including 6M of 3.56% Cu, 3.37 g/t Au, 257.77 g/t Ag. Structural mapping and soil-rock geochemistry at the Chivas zone and relogging of select core from the Glenfiddich zone were also conducted as part of the overall exploration program at the Thorn Project.

Mineral Mountain Properties (Copper Gold) British Columbia

The Company owns a 100% interest in the Omineca Group of 12 claim blocks which are located in the Omineca Mining Division of north-central British Columbia, approximately 150 km north of Fort St. James. The claims are not subject to any royalty terms, back-in rights, payments or any other agreements and encumbrances.

B.C. Minfile assessment report data indicates that most of the area covered by the Omineca Group claim blocks were at one time or another covered by staking during surges of exploration in B.C. dating from the 1940’s to present day. Largely the claims appear to have been minimally explored with little follow-up. However, some work was recorded on several claims with results for stream sediment sampling showing anomalous to highly anomalous results for gold in a few areas. These areas were recommended for detailed follow-up, however due to a previous commodity price downturn no further work was recorded.

Prominent among early discoveries in the Omineca region were the nearby Lustdust/Stardust property (Sun Metals Corp. TSXV: SUNM) covering a large, coherent integrated porphyry-skarn-manto, epithermal system; the Kwanika property (Serengeti Resources Inc./POSCO Daewoo TSXV: SIR) a promising advanced stage copper-gold project; the Lorraine property (Teck Resources and Sun Metals) host to a significant copper gold NI 43-101 compliant resource. The Surge tenures are located between the Kemess North project being developed by Centerra Gold’s subsidiary Aurico Metals and Centerra Gold’s operation Mt Milligan mine.

Hedge Hog Property, (Copper Gold) British Columbia

The Company has an option to earn an undivided 60% interest seven mineral tenure covering 2,418 hectares (5,972 acres) located approximately 80 km northeast of the town of Quesnel, BC and 20 km north of the historic gold mining towns of Wells and Barkerville.

Ontario Cobalt Properties (Cobalt) Ontario

The Company has an option to earn an undivided 60% interest in the Glencore Bucke Property and the Teledyne Property, located in Cobalt, Ontario Canada.

On Behalf of the Board of Directors

“Tim Fernback”

Tim Fernback

President & CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements which include, but are not limited to, comments that involve future events and conditions, which are subject to various risks and uncertainties. Except for statements of historical facts, comments that address resource potential, upcoming work programs, geological interpretations, receipt and security of mineral property titles, availability of funds, and others are forward-looking. Forward-looking statements are not guarantees of future performance and actual results may vary materially from those statements. General business conditions are factors that could cause actual results to vary materially from forward-looking statements.

Source: www.thenewswire.com