The Conversation (0)

LiCo Receives $600,000 from Exercise of Warrants Provides Financing Update

Nov. 22, 2017 07:08AM PST

Battery Metals InvestingLiCo Energy Metals Inc. (“the Company” or “LiCo”) TSX-V: LIC, OTCQB: WCTXF is pleased to provide an update on its non-brokered private placement offering of up to $960,000 previously announced on October 24, 2017

LiCo Energy Metals Inc. (TSXV: LIC, OTCQB: WCTXF) is pleased to provide an update on its non-brokered private placement offering of up to $960,000 previously announced on October 24, 2017. The private placement details and subscription agreements will now be available to investors on the Stockhouse Deal Room (Stockhouse Deal Room).

The private placement consists of up to 8,000,000 flow-through units (“FT Units”) and up to 4,000,000 non flow-through units (“Units”) both at a price of $0.08 per FT Unit and $0.08 per Unit. Each FT Unit and Unit is comprised of one common share of the Company and one share purchase warrant. Each share purchase warrant will entitle the holder thereof to purchase one additional common share of the Company at an exercise price of $0.10 per share, for a period of two years from closing, subject to TSX Venture Exchange (“Exchange”) approval.

The Company also announces that in the previous two weeks, it has received total funds of $600,000 by way of exercise of 8,000,000 share purchase warrants at $0.075 per share.

The Stockhouse Deal Room is an equity investment platform created specifically for public companies to access investors. Stockhouse has more than 1 million unique visitors a month and provides access to a large number of qualified and accredited investors. The private placement offering of FT Units and Units is available at the Stockhouse Deal Room and LiCo Energy Metals Private Placement. Subscription agreements can be completed in full through the Stockhouse Deal Room or are available directly from the Company to Accredited Investors. The minimum subscription is $5,000 and the Company intends to close all subscriptions by November 30, 2017.

Finder’s fees will be paid in connection with the private placement and all finder’s fee payable are subject to Exchange approval.

The proceeds from the FT Units will be used to advance the Company’s Teledyne and Glencore Bucke Properties, in Cobalt Ontario. The proceeds from the Units will be used for advancement and development of the Company’s other mineral exploration projects and for general working capital purposes.

All securities issued in connection with the private placement are subject to a four month and a day hold period in accordance with applicable Securities Laws.

About LiCo Energy Metals: https://licoenergymetals.com/

LiCo Energy Metals Inc. is a Canadian based exploration company whose primary listing is on the TSX Venture Exchange. The Company’s focus is directed towards exploration for high value metals integral to the manufacture of lithium ion batteries.

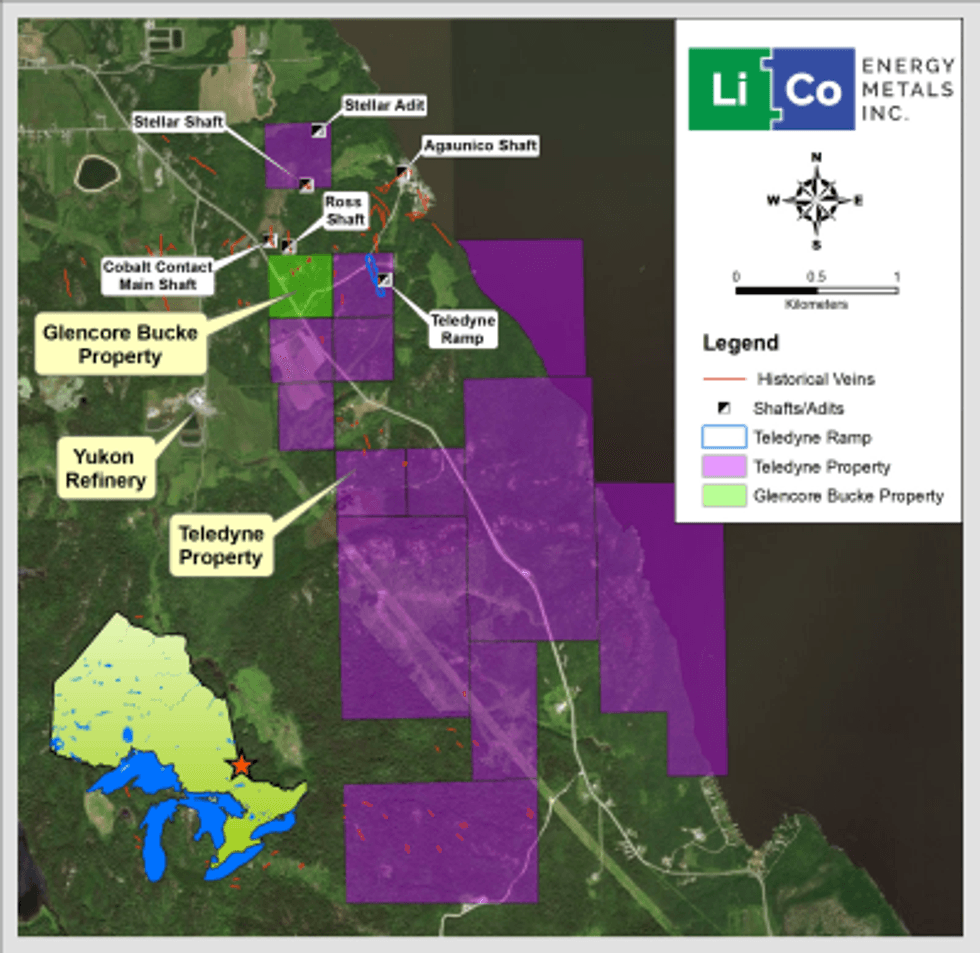

Glencore Bucke Cobalt Project, Cobalt, Ontario:

The Company has entered into a property purchase agreement to acquire a 100% interest from Glencore Canada Corporation (subsidiary of Glencore plc) in the Glencore Bucke Property, situated in Bucke Township, 6 km east-northeast of Cobalt, Ontario, subject to a back-in provision, production royalty and off-take agreement. Strategically, the Glencore Bucke Property consists of 16.2 hectares and sits along the west boundary of LiCo’s Teledyne Cobalt Project. The Property covers the southern extension of the #3 vein that was historically mined on the neighbouring Cobalt Contact Property located to the north of the Glencore Bucke Property. Diamond drilling in 1981 on the Glencore Bucke Property delineated two zones of mineralization measuring 150 m and 70 m in length.

Ontario Teledyne Cobalt Project:

The Company has an option to earn 100% ownership, subject to a royalty, in the Teledyne Project located near Cobalt. Ontario. The Property adjoins the south and west boundaries of claims that hosted the Agaunico Mine. From 1905 through to 1961, the Agaunico Mine produced a total of 4,350,000 lbs. of cobalt and 980,000 oz. of silver. A significant portion of the cobalt that was produced at the Agaunico Mine located along structures that extended southward onto property currently under option to LiCo Energy Metals.

Click Image To View Full Size

Chile Purickuta Lithium Project:

The Purickuta Project is located within Salar de Atacama, a salt flat encompassing 3,000 km2, being about 100 km long, 80 km wide and home to approximately 37% of the worlds Lithium production. The salar possesses a very high grade of both Lithium (1,840mg/l) and Potassium (22,630mg/l and is close to power, labour, communications, transportation and other infrastructure. The property of 160 hectares is enveloped by a concession owned by Sociedad Quimica y Minera (“SQM”) and lies, significantly, within a few kilometers of the property of CORFO (the Chilean Economic Development Agency) where its leases to both SQM and Albermarle’s Rockwood Lithium Corp Together these two companies have combined production of over 62,000 tonnes of LCE (Lithium Carbonate Equivalent) annually making up 100% of Chile’s current lithium output. The unique characteristics of Salar de Atacama make finished lithium carbonate easier and cheaper to produce than any of its peer group globally.

Purickuta is a smaller exploitation concession rather than a large exploration concession thereby accelerating the task of taking the project to production once a measured reserve can be established. Currently, the Chilean government retains ownership of lithium separate from other minerals and thus production can only proceed upon receipt of a special lithium operation contract know as a “CEOL”. In the future, it will be necessary for LiCo and partner to negotiate a production contract with CORFO concurrently with completing any positive feasibility study. “Chile, which has one of the world’s most plentiful supplies of lithium, is pushing ahead with new policies to develop those reserves”. (Reuters Jan 2, 2017).

Nevada Dixie Valley Lithium Project:

The Company has an option to acquire a 100% interest, subject to a 3% NSR, on a large lithium exploration project at the Humboldt Salt Marsh in Dixie Valley, Nevada. The geologic setting and presence of lithium in active geothermal fluids and surface salts in Dixie Valley match characteristics of producing lithium brine deposits at Clayton Valley, Nevada and in South America.

Nevada Black Rock Desert Lithium Project:

The Company has entered into an option agreement whereby the Company may earn an undivided 100% interest, subject to a 3% NSR, in the Black Rock Desert Lithium Project in southwest Black Rock Desert, Washoe County, Nevada.

The Company is planning an exploration programs on a number of its properties over the next several months.

On Behalf of the Board of Directors

Tim Fernback, President & CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information:

This news release may contain forward-looking statements which include, but are not limited to, comments that involve future events and conditions, which are subject to various risks and uncertainties. Except for statements of historical facts, comments that address resource potential, upcoming work programs, geological interpretations, receipt and security of mineral property titles, availability of funds, and others are forward-looking. Forward-looking statements are not guarantees of future performance and actual results may vary materially from those statements. General business conditions are factors that could cause actual results to vary materially from forward-looking statements.

Click here to connect with LiCo Energy Metals Inc. (TSXV: LIC, OTCQB: WCTXF) for an Investor Presentation

The private placement consists of up to 8,000,000 flow-through units (“FT Units”) and up to 4,000,000 non flow-through units (“Units”) both at a price of $0.08 per FT Unit and $0.08 per Unit. Each FT Unit and Unit is comprised of one common share of the Company and one share purchase warrant. Each share purchase warrant will entitle the holder thereof to purchase one additional common share of the Company at an exercise price of $0.10 per share, for a period of two years from closing, subject to TSX Venture Exchange (“Exchange”) approval.

The Company also announces that in the previous two weeks, it has received total funds of $600,000 by way of exercise of 8,000,000 share purchase warrants at $0.075 per share.

The Stockhouse Deal Room is an equity investment platform created specifically for public companies to access investors. Stockhouse has more than 1 million unique visitors a month and provides access to a large number of qualified and accredited investors. The private placement offering of FT Units and Units is available at the Stockhouse Deal Room and LiCo Energy Metals Private Placement. Subscription agreements can be completed in full through the Stockhouse Deal Room or are available directly from the Company to Accredited Investors. The minimum subscription is $5,000 and the Company intends to close all subscriptions by November 30, 2017.

Finder’s fees will be paid in connection with the private placement and all finder’s fee payable are subject to Exchange approval.

The proceeds from the FT Units will be used to advance the Company’s Teledyne and Glencore Bucke Properties, in Cobalt Ontario. The proceeds from the Units will be used for advancement and development of the Company’s other mineral exploration projects and for general working capital purposes.

All securities issued in connection with the private placement are subject to a four month and a day hold period in accordance with applicable Securities Laws.

About LiCo Energy Metals: https://licoenergymetals.com/

LiCo Energy Metals Inc. is a Canadian based exploration company whose primary listing is on the TSX Venture Exchange. The Company’s focus is directed towards exploration for high value metals integral to the manufacture of lithium ion batteries.

Glencore Bucke Cobalt Project, Cobalt, Ontario:

The Company has entered into a property purchase agreement to acquire a 100% interest from Glencore Canada Corporation (subsidiary of Glencore plc) in the Glencore Bucke Property, situated in Bucke Township, 6 km east-northeast of Cobalt, Ontario, subject to a back-in provision, production royalty and off-take agreement. Strategically, the Glencore Bucke Property consists of 16.2 hectares and sits along the west boundary of LiCo’s Teledyne Cobalt Project. The Property covers the southern extension of the #3 vein that was historically mined on the neighbouring Cobalt Contact Property located to the north of the Glencore Bucke Property. Diamond drilling in 1981 on the Glencore Bucke Property delineated two zones of mineralization measuring 150 m and 70 m in length.

Ontario Teledyne Cobalt Project:

The Company has an option to earn 100% ownership, subject to a royalty, in the Teledyne Project located near Cobalt. Ontario. The Property adjoins the south and west boundaries of claims that hosted the Agaunico Mine. From 1905 through to 1961, the Agaunico Mine produced a total of 4,350,000 lbs. of cobalt and 980,000 oz. of silver. A significant portion of the cobalt that was produced at the Agaunico Mine located along structures that extended southward onto property currently under option to LiCo Energy Metals.

Click Image To View Full Size

Chile Purickuta Lithium Project:

The Purickuta Project is located within Salar de Atacama, a salt flat encompassing 3,000 km2, being about 100 km long, 80 km wide and home to approximately 37% of the worlds Lithium production. The salar possesses a very high grade of both Lithium (1,840mg/l) and Potassium (22,630mg/l and is close to power, labour, communications, transportation and other infrastructure. The property of 160 hectares is enveloped by a concession owned by Sociedad Quimica y Minera (“SQM”) and lies, significantly, within a few kilometers of the property of CORFO (the Chilean Economic Development Agency) where its leases to both SQM and Albermarle’s Rockwood Lithium Corp Together these two companies have combined production of over 62,000 tonnes of LCE (Lithium Carbonate Equivalent) annually making up 100% of Chile’s current lithium output. The unique characteristics of Salar de Atacama make finished lithium carbonate easier and cheaper to produce than any of its peer group globally.

Purickuta is a smaller exploitation concession rather than a large exploration concession thereby accelerating the task of taking the project to production once a measured reserve can be established. Currently, the Chilean government retains ownership of lithium separate from other minerals and thus production can only proceed upon receipt of a special lithium operation contract know as a “CEOL”. In the future, it will be necessary for LiCo and partner to negotiate a production contract with CORFO concurrently with completing any positive feasibility study. “Chile, which has one of the world’s most plentiful supplies of lithium, is pushing ahead with new policies to develop those reserves”. (Reuters Jan 2, 2017).

Nevada Dixie Valley Lithium Project:

The Company has an option to acquire a 100% interest, subject to a 3% NSR, on a large lithium exploration project at the Humboldt Salt Marsh in Dixie Valley, Nevada. The geologic setting and presence of lithium in active geothermal fluids and surface salts in Dixie Valley match characteristics of producing lithium brine deposits at Clayton Valley, Nevada and in South America.

Nevada Black Rock Desert Lithium Project:

The Company has entered into an option agreement whereby the Company may earn an undivided 100% interest, subject to a 3% NSR, in the Black Rock Desert Lithium Project in southwest Black Rock Desert, Washoe County, Nevada.

The Company is planning an exploration programs on a number of its properties over the next several months.

On Behalf of the Board of Directors

Tim Fernback, President & CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information:

This news release may contain forward-looking statements which include, but are not limited to, comments that involve future events and conditions, which are subject to various risks and uncertainties. Except for statements of historical facts, comments that address resource potential, upcoming work programs, geological interpretations, receipt and security of mineral property titles, availability of funds, and others are forward-looking. Forward-looking statements are not guarantees of future performance and actual results may vary materially from those statements. General business conditions are factors that could cause actual results to vary materially from forward-looking statements.

Click here to connect with LiCo Energy Metals Inc. (TSXV: LIC, OTCQB: WCTXF) for an Investor Presentation

Source: www.thenewswire.com