Cobalt Outlook 2022: Rapid EV Growth to Drive Demand, Resilience in Prices

After a year in which prices outperformed expectations, what is the cobalt outlook for 2022? Analysts share their thoughts.

Click here to read the latest cobalt outlook.

This time last year, cobalt market watchers were expecting demand from the electric vehicle (EV) sector to continue to thrive, supporting a higher price environment.

Cobalt, a key element in lithium-ion batteries, experienced supply chain challenges due to the COVID-19 pandemic, with lockdowns and containment measures testing its resilience.

With the new year now in full swing, the Investing News Network (INN) reached out to cobalt experts to get more insight about the cobalt outlook for 2022.

How did cobalt prices perform in 2021?

Looking back at how prices performed in 2021, there’s little doubt that cobalt beat expectations after a 2020 that brought a price rebound following years of decline.

“Price performance has certainly surprised to the upside this year, but it reflects strong downstream demand, particularly from EVs, which have continued to outperform market expectations, and tight market conditions overall,” Harry Fisher of CRU Group told INN.

Cobalt kicked off 2021 on an uptrend as investors turned their attention to the EV sector and battery metals.

Market conditions remained very strong during the first half, and prices continued to rally through Q4. Experts expected that cobalt would finish the year more than twice where it started in January 2021.

“The cobalt market outperformed expectations in Q4, as the cobalt metal price rally sustained throughout the quarter ― although this was not altogether a surprise considering market fundamentals,” Greg Miller of Benchmark Mineral Intelligence told INN.

That means it wasn’t just the bullish outlook for battery demand that helped cobalt in 2021. The upswing in prices was underpinned by several converging factors, Miller explained, which included increased restocking from industrial sectors and ongoing disruptions to supply chains globally.

Surplus inventory held mainly in the hands of traders, paired with limited metal production in China through the year ― which is the traditional counterweight to price rises ex-China ― were also factors pushing prices up.

Commenting on the biggest surprise of late 2021 in the cobalt market, the Benchmark Mineral Intelligence analyst said it was the extent to which the China and ex-China markets diverged.

“Prices in the Chinese domestic market failed to keep pace with other regions, in part due to negative sentiment over growing lithium-iron-phosphate (LFP) utilization, with refiners reporting that they were operating at a loss for much of the quarter,” he explained to INN.

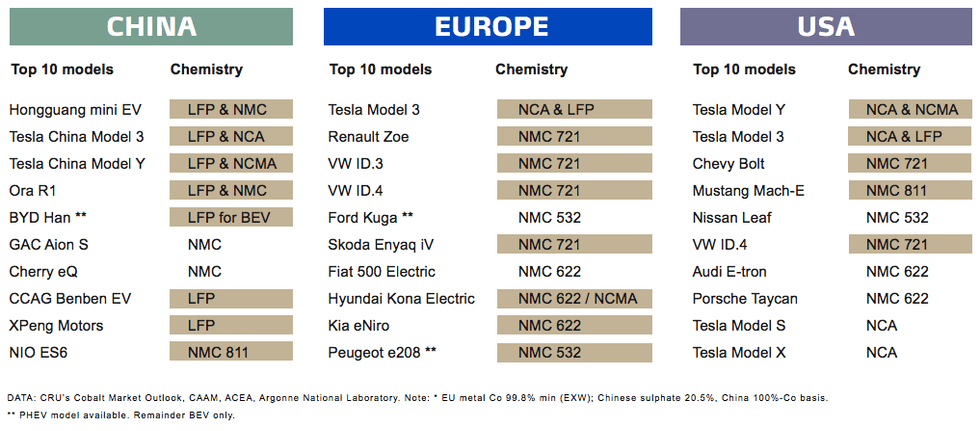

The growing LFP cathode market in China was a topic of concern for many cobalt investors in 2021, as this type of cathode — which is also used in electric car batteries — doesn’t use cobalt. Cathodes containing cobalt include nickel-cobalt-manganese (NCM) and nickel-cobalt-aluminum (NCA).

How could supply and demand factors affect cobalt prices in 2022?

It has been clearly established that the EV industry is a key driver for cobalt, with demand increasing this past year on the back of higher sales that materialized in key regions such as Europe. “EVs remain the real driving force of the cobalt market and will continue to see substantial gains in 2022,” Fisher said.

As mentioned, this past year, worries among cobalt investors increased as the use of LFP cathodes picked up pace, with many speculating how much this could impact the cobalt space.

“I don’t think investors should be too concerned, as we see absolute cobalt demand continuing to increase throughout the demand,” Miller said. “Ultimately, we see structural deficits emerging in the cobalt market from 2025, so new technologies will be needed to bridge these supply shortfalls.”

CRU also continues to see the battery market dominated by both NCM and LFP chemistries for EV applications.

“LFP has built market share in China through 2021 due to the popularity of mini EV models such as the Hongguang mini ― but NCM will hold ground for longer-range, larger and higher-performance vehicles,” Fisher said. “We expect that cobalt demand will remain robust for this reason despite LFP’s recent performance.”

Cobalt chemical use in electric vehicles.

Chart via the Cobalt Institute.

In 2022, Benchmark Mineral Intelligence expects cobalt demand from the battery sector to grow by over 30 percent, supported by new EV model launches and governmental legislation.

But of course, cobalt is not only used in EV batteries, and demand from other segments is looking to improve in the next 12 months. “Demand from other segments is also expected to grow, particularly from the superalloy industry on improved prospects for global aviation,” Miller said.

CRU is also expecting other demand sectors to recover in 2022.

“Aerospace is showing some very early signs of recovery, and will continue to see gradual improvements subject to new concerns around the Omicron variant, which could slow international travel once again,” Fisher said.

In terms of supply, output is expected to increase once again in 2022.

“(This will) support the rapid demand growth expected in the mid to long term,” Fisher said. “Growth will come from the Democratic Republic of Congo (DRC), as well as Indonesia, as two of the high-pressure acid leach (HPAL) facilities continue their ramp up and further new capacity is commissioned.”

Output from the DRC, the top-producing country, is expected to come from Glencore's (LSE:GLEN,OTC Pink:GLCNF) Mutanda mine restart, increased output at Katanga and expansions at Tenke Fungurume.

As 2021 came to a close, many market watchers were paying particular attention to contract negotiations for cobalt ― which sets the stage for market developments into the new year.

“Contract negotiations have now been finalized for 2022 and demand has been very strong, with many sellers negotiating premia compared to previous years where flat prices or discounts were more common,” Fisher said.

A key trend seen in the space was longer-term contracts on the back of rising prices.

“Long-term contracts will remain king in the cobalt market next year,” Miller said. “Those who eschewed long-term contracts in late 2020, in the hope of securing a better deal in the spot market in 2021, struggled to secure material and often had to pay a premium to do so.”

For junior miners, 2022 will be a year when challenges to secure investment from capital markets will remain.

“It’s a crowded field, with much of the focus right now on the lithium market,” Miller said.

All in all, Benchmark Mineral Intelligence is expecting the market to transition into a slight surplus in 2022. Meanwhile, CRU believes the market will be finely balanced in 2022 compared to the relatively wide deficit in 2021.

“However, risks are weighted towards a deficit developing as EV demand continues to grow rapidly and market tightness persists due to supply chain constraints,” Fisher said.

In fact, according to data from S&P Global Market Intelligence, in 2021, monthly cobalt exports from the DRC were on average 23.2 percent lower than pre-COVID-19 levels, reflecting inefficiencies across land transport and port operations compounded by global shipping delays.

“To date, most of the impact of COVID-19 on cobalt supply has been felt by supply chain logistics rather than mining operations,” Alice Yu, senior analyst at S&P Global Market Intelligence, said. “Early data suggests the Omicron variant spreads faster and, though symptoms appear to be mild, vaccines are less effective against it, which presents potential risks of further lockdowns and impacts to mine operations.”

There are also renewed concerns over potential disruptions at the cobalt receiving end, with lockdowns in parts of China’s Ningbo city in Zhejiang province, home to one of the world’s largest container ports.

What is ahead for cobalt prices in 2022?

In 2022, prices are expected to remain strong, and this has been further supported by recent annual contract negotiations, according to CRU’s Fisher.

“The upward trend is likely to slow as some new supply comes online to bring the market closer to balance relative to 2021, and relieve some tightness,” he said. “However, ongoing supply chain and container shipping constraints may maintain market tightness and see prices move higher.”

Meanwhile, Miller expects prices to soften from Q4 levels next year, as the market transitions back into a slight surplus in light of increased supply out of the DRC and the commissioning of new projects in Indonesia.

“However, we are unlikely to see prices collapse like they did in 2018/2019, as the market is set to remain well supported by strong demand-side fundamentals,” Miller said. “Moreover, the emergence of the Omicron variant of COVID-19 threatens to delay the easing of logistics bottlenecks, which could provide further support to prices.”

For her part, Yu said the cobalt market has been critically affected by logistical challenges, and the emergence of Omicron means supply constraints will likely continue to dominate cobalt prices in 2022.

“If prolonged, those constraints could support elevated prices and remind battery makers of the concentration risks in cobalt supply, potentially speeding up cobalt thrifting in batteries,” the analyst added.

What are the key factors that could affect cobalt prices in 2022?

For Miller, an important trend to watch next year is how battery industry demand for cobalt metal impacts pricing.

“We are seeing increased metal consumption from ESG-conscious end consumers in the battery supply chain, driving increased competition for the limited available supply,” he added.

Commenting on what factors he will be paying attention to in 2022, Fisher said EV sales will continue to be a key catalyst. On the demand side, he will also be watching the aerospace sector's recovery, which will be subject to COVID-19 travel restrictions and the impact of Omicron.

“Supply chain and container shipping constraints slowing cobalt hydroxide volumes from the DRC to China” will be another factor to pay attention to, Fisher said.

On the supply side, ongoing ramp up of HPAL operations in Indonesia and any announcements of further expansions ― as well as Mutanda’s restart and other supply additions in the DRC ― are some of the catalysts to watch out for in 2022, according to the analyst.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Cobalt Stocks: 5 Biggest Producers (Updated 2022) ›

- Top 11 Battery Metals Stocks on the TSX and TSXV in 2022 ›

- How to Invest in Cobalt ›

- Top 3 Canadian Cobalt Stocks of 2022 ›

- Cobalt Market Update: Q3 2022 in Review ›

- Cobalt Market Update: Q3 2022 in Review ›

- How to Invest in Battery Metals ›