Interest in the cobalt market continued to rise in 2017, but what is the cobalt outlook for the year ahead? Analysts share their thoughts here.

This time last year, cobalt, a key component of the lithium-ion batteries used to power electric vehicles (EVs), was expected to shine.

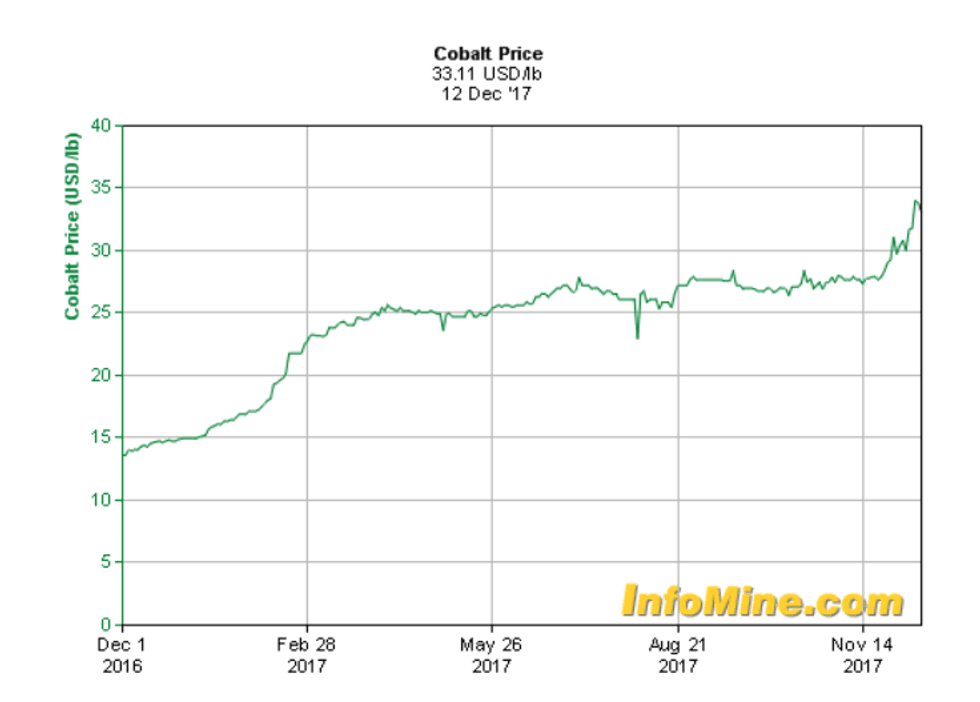

Now that 2017 is ending, it’s impossible to deny that cobalt has been one of the biggest stories of the year. Interest in the battery metal has increased exponentially, and LME prices have surged more than 120 percent since the beginning of the year. What’s more, several TSX– and TSXV-listed cobalt stocks have gained over 100 percent year-to-date.

With 2017 drawing to a close, the Investing News Network reached out to cobalt experts to get more insight about the future of the metal. Read on to learn what analysts expect in terms of the cobalt outlook next year, from supply and demand to potential price catalysts.

Cobalt outlook 2018: Price performance review

Cobalt prices have been on an uptrend since the beginning of the year. In fact, LME cobalt prices are up almost 120 percent since January on the back of a strong EV demand outlook and supply worries.

As the chart below shows, LME cobalt prices started the year at $32,500 per tonne, and have moved upward since then. The highest point of the year was reached last week, when prices hit $75,000.

Chart via InfoMine.

“This 130-percent increase was likely due to both demand and speculation, but it’s clear that investing in opportunities along the vehicle electrification supply chain is a theme all investors began taking seriously in 2017,” said Chris Berry of House Mountain Partners and the Disruptive Discoveries Journal.

Berry added that one of this year’s main trends was larger institutional funds taking the time to better understand the cobalt supply chain.

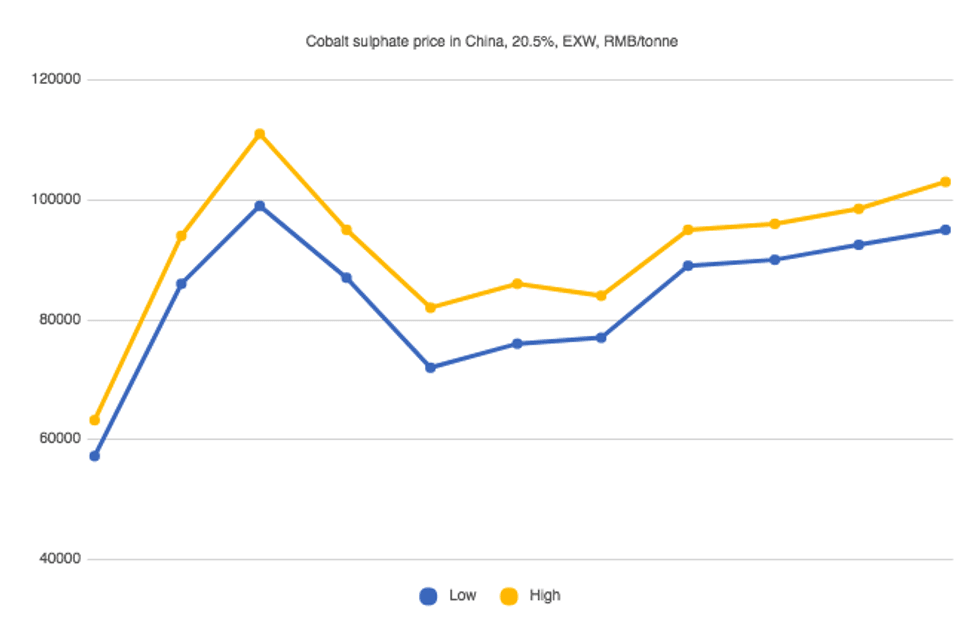

LME cobalt data is one of the ways investors can track prices, but it is important to understand that in a lithium-ion battery there is actually no cobalt metal. It is cobalt chemicals that appears in these batteries, with cobalt sulfate being one of the preferred feedstocks for cathode manufacturers.

“The prices are intrinsically linked, because if one was far cheaper than the other the industry would just buy that,” said Benchmark Mineral Intelligence’s Caspar Rawles. He noted that cobalt sulfate is “certainly something I think people should look at if they’re trying to get specifically into the battery space.”

As the chart below shows, cobalt sulfate prices have also increased significantly this year.

Chart via Benchmark Mineral Intelligence.

In 2017, lithium-ion batteries continued to be one of the main drivers for cobalt prices, as each battery contains approximately 15 kilograms of cobalt chemicals.

“What is important to realize is that China produced 80 percent of the world’s cobalt chemicals and a lot of their feedstock for that comes from concentrates from the Democratic Republic of Congo (DRC),” said Rawles. He added that any change in the country can have a real impact on prices for cobalt chemicals.

Another trend seen this year has been “a growing awareness of the different cathode technologies, such as NMC (nickel–manganese-cobalt), moving towards a less ‘cobalt-heavy’ chemistry and replacing this with nickel,” Berry explained. “While this likely means less cobalt per battery, the ramp up in gigafactory-scale capacity over the next five years likely means we’ll use much more cobalt than was forecast even a couple of years ago,” he added.

For investors interested in knowing what else happened in 2017, we’ve put together a cobalt 2017 trends article. Click here to read more.

Cobalt outlook 2018: Supply and demand

Looking ahead to 2018, the dynamics between an increasing demand forecast and supply constraints are set to continue. “The dominant trends in 2018 will be tight supply and increasing demand leading to higher prices, driven by rising demand primarily from the EV industry,” Rawles said.

According to Benchmark Mineral Intelligence, the total supply needed to meet demand for all cobalt uses next year will be 105,000 tonnes. However, more than 50 percent of the world’s supply comes from the DRC, a politically unstable country where mining has been linked to child labor.

Rawles said he sees the DRC becoming “a bigger portion of the cobalt supply pie,” and said that there will be “no lithium-ion battery industry without growing DRC cobalt supply.”

One of the main projects expected to bring new production into the market next year is located in the African country and run by Katanga Mining (TSX:KAT). Earlier this year, Glencore (LSE:GLEN) upped its stake in the project, which has been on care and maintenance since 2015.

The Swiss mining giant has recently announced that it is set to more than double production from the operation by 2019. CEO Ivan Glasenberg also confirmed that the company is in talks with Tesla (NASDAQ:TSLA), Apple (NASDAQ:AAPL) and VW (ETR:VOW) for cobalt supply deals, although he made it clear that the miner will not sign fixed-price contracts.

“We expect [Katanga] to return to production in the second quarter, with an expanded capacity of 22,000 tonnes per annum initially, although production will be brought on in stages and [it will] take some years to build up to this,” Rawles said. He added that even though the market needs cobalt supply from the DRC, new supply outside the country has a “unique and strong position to gain auto battery market share while offering guaranteed ‘clean’ cobalt.”

Looking over to demand, the electric car revolution will continue to drive prices as supply constraints also increase. In fact, Benchmark Mineral Intelligence forecasts that the cobalt market will reach a deficit in 2022/2023 as “this is when [it] estimate[s] the wider adoption of EVs will happen.”

As demand for lithium-ion batteries increases, cobalt supply will need to reach 180,000 tonnes by 2026, according to the London-based firm.

“I still struggle to see where an ample supply of cobalt will come from to satisfy most EV demand projections,” Berry said. “With the realization that additional mining capacity will be needed to satisfy EV demand, the eyes of the market have started to shift towards smaller-market-cap companies that are development stage and looking at funding opportunities,” he added.

In terms of prices, Rawles doesn’t expect them to rise as much in percentage terms as they have in the past 12 to 18 months. “[But] I do expect prices to continue to rise as supplies remain tight and more auto manufacturers look to secure long-term supplies of cobalt,” he said.

Despite Glencore bringing new production to the market, which could help manage price increases, Rawles forecasts that the upward trend in prices will continue at a “more stable rate” over the year.

Cobalt outlook 2018: Key factors to watch

After a bright 2017, cobalt-focused investors are now wondering about key factors to watch next year. As mentioned above, one of the main catalysts in 2018 will be the much-expected restart of Katanga Mining. “If this is delayed in any way I would expect prices to rise more sharply,” Rawles said.

Another key factor to watch next year will be whether car manufacturers “skip the whole supply chain” to directly source raw feedstock from miners, as was seen in the lithium space this year with the offtake agreement between Pilbara Minerals (ASX:PLS) and Great Wall (HKEX:2333).

“It will be interesting to see if this happens in the cobalt market in order for auto manufacturers to secure supply, and it could also bring new projects to market more quickly than expected,” Rawles said. In addition, investors watch how the increasing scrutiny and work on the cobalt supply chain impacts pricing structures, and “if a differential will be more clear between ‘clean’ and ‘untraceable’ products.”

Indeed, transparency and responsible sourcing have been one of the main cobalt trends surrounding the market in the past few weeks. In November, Amnesty International released a report warning that electric car companies are “not doing enough” to tackle human right abuses in their cobalt supply chains.

“I think you may see a premium develop for ‘ethically sourced’ cobalt, though this will remain difficult to prove and would take some time to filter into the market. With Glencore as 30 percent of the cobalt industry, it is their cost structure that aspirants to cobalt supply must compete with,” said Berry, adding that he is optimistic on the battery metals space going forward.

“I have been bullish on this sector for several years now, and see no reason to change that view as the market cap expansion of various companies has opened them up as investment opportunities to a whole new class of investor,” he said.

Berry summarized the factors investors interested in cobalt should pay attention to in 2018 as follows:

- Keep a close eye on the trend in EV sales both inside and outside of China;

- Watch for any accelerated change in battery chemistry;

- Watch to see how Glencore and [Eurasian Resources Group] increase cobalt production out of the DRC;

- Watch for streaming deals in the cobalt space;

- Watch the pace of funding in the cobalt sector for any drop off;

- Watch to see how all of the announced lithium-ion battery factory capacity gets funded;

- Watch for advances in autonomous vehicle technology and adoption — understanding how this will affect the insurance markets is important;

- Watch for a major downstream player such as an original equipment manufacturer to make a sizeable investment in mining capacity — this is the real key to growth in the sector going forward.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.