Zinc prices rallied to their highest level in two-weeks driven by persistent supply concerns.

Zinc prices hit a two-week high on Wednesday (November 22) supported by persistent supply worries.

LME zinc closed up 1.2 percent at $3,228 per tonne after touching $3,240 earlier in the day, its highest level since the beginning of the month.

Environmental inspections in China, the world’s top zinc-producing country, have resulted in reduced production or the closure of many zinc mines across the country, fueling shortages concerns.

“In zinc, reduced Chinese mine production will keep balances tight, supporting prices over the next six months,” JP Morgan (NYSE:JPM) said in a note.

Another sign that the zinc market is tight are the low levels for treatment charges (TCs), which are an indication that concentrate supplies are thin, said Robin Bhar, head of metals research at Societe Generale (EPA:GLE).

“I still think prices need to stay at this level to get more supply. Spot TCs are still low, they haven’t picked up, so there’s a need to incentivise more supply,” he said.

Similarly, FocusEconomics analysts said that supply-side factors continue to be largely behind the surge in prices this year. China’s environmental crackdown and output cuts in other key zinc-producing countries have contributed in pushing prices higher.

“Additionally, reports of declining inventories and the latest demand forecast for the commodity suggests that the market will remain tight for the foreseeable future,” analysts said in their latest commodities report.

In fact, according to data from the International Lead and Zinc Study Group (ILSZ), the global zinc market deficit widened to 39,800 tonnes in September from a revised deficit of 38,700 tonnes in August.

What’s ahead for prices

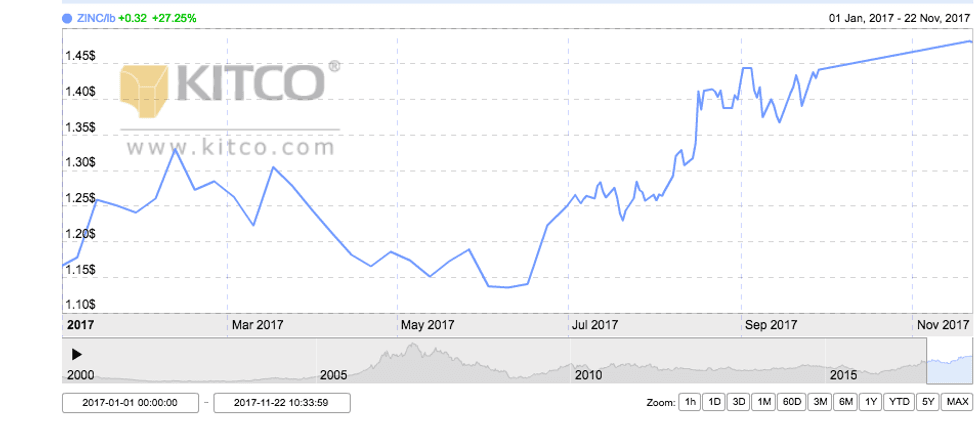

As the chart below shows, zinc prices have surged more than 27 percent since January and almost 3 percent since the beginning of the last quarter.

Chart via Kitco.com

Looking ahead, FocusEconomics panelists estimate that the average zinc price for Q4 2017 will be $3,055. The most bullish forecast for the quarter comes from Pezco, which is calling for a price of $3,277; meanwhile, JP Morgan is the most bearish with a forecast of $2,450.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.