What’s the zinc outlook for 2018? Analysts predict another great year for the base metal, which reached multi-year highs in 2017.

Zinc prices trended upward in 2017, and have now surged more than 21 percent year-to-date. Luckily for fans of the base metal, many analysts remain bullish for 2018.

Supply concerns have hit the refined zinc market in recent months, with prices reaching a decade high in August and continuing to trade above the $3,000-per-tonne level since then. As of Monday (December 11), LME zinc was changing hands at $3,092.

Read on to learn more what experts expect in terms of the zinc outlook next year, from supply and demand to potential price catalysts. All in all, the year looks set to be a good one.

Zinc outlook 2018: Price performance

In 2016, zinc was the best-performing LME metal, jumping more than 64 percent in 12 months. In 2017, zinc continued to climb, but at a slower pace; as mentioned, it’s gained over 21 percent since January.

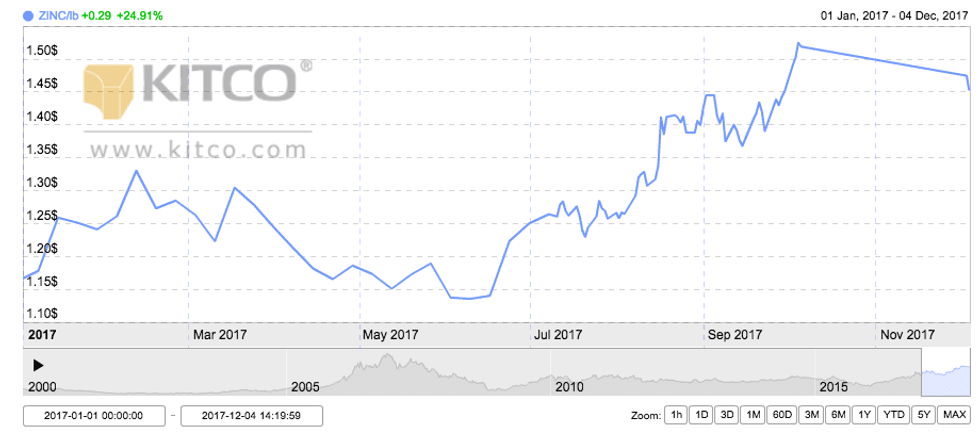

As the chart below from Kitco shows, zinc’s highest point of the year came in October, when it hit a more than decade high of $3,369.50. Supply worries and a strong Chinese demand outlook supported the base metal’s rapid price rally.

Chart via Kitco.

The lowest point of the year for zinc came in June, when prices were trading at $2,435. A stronger US dollar and risk aversion due to geopolitical tensions turned investors away from the base metal.

One of the key zinc trends this year has been the depletion of zinc stocks built up over the past 10 years; they have run out due to mine closures and cutbacks.

According to CRU Group, that led to a deeper refined zinc metal deficit and to a drawdown in global stocks. “We correctly forecast physical market tightening, but the strong price reaction came sooner than we were expecting,” analysts at the firm said.

Similarly, CPM Group (HKEX:1932) commodity analyst Yvonne Li said that the tightness in the physical market was the main factor supporting significantly higher zinc prices this year. “[It] lasted longer than I had expected,” she added.

For his part, Junior Stock Review founder Brian Leni said that while he was expecting higher zinc prices in 2017, that didn’t translate into gains for the junior zinc stocks as he had estimated. “Companies with quality projects haven’t received much attention and, for the most part, have traded sideways in the second half of 2017,” he commented. Zinc CEOs have also identified this problem.

Zinc outlook 2018: Supply and demand dynamics

As mentioned, zinc prices have remained high in 2017, supported largely by supply-side factors.

According to the International Lead and Zinc Study Group, global refined zinc metal production is forecast to fall by 1.4 percent this year, to 13.53 million tonnes. However, next year the group predicts an increase of 3.9 percent, to 14.06 million tonnes.

That said, CRU Group analysts expect around 775,000 tonnes of new zinc mine supply to come onstream next year, with MMG’s (HKEX:1208) Dugald River mine and Vedanta’s (LSE:VED) Gamsberg mine being notable contributors to production.

Aside from those projects, Li expects East Siberian Metals’ Ozernoye field project and Mehdiabad mine to bring new production between 2018 and 2022. “These are expected to help significantly ease the tightness in the refined zinc market during the later years of the forecast period,” she said.

Despite those additions, CRU Group analysts believe global zinc stocks will continue to be rapidly drawn down in the first half of 2018, although this depletion will slow down in the second half of the year.

“Combined exchange zinc stocks at LME-registered and SHFE-registered warehouses could rise probably in the second half of 2018,” said Li, explaining that this will be a consequence of refined supplies rising and demand growth underperforming due to a slowdown in China’s economic growth.

“[That’s because] the government [will] rein in its debt problems while tackling pollution. However, because of the sheer size of the Chinese market, demand will increase but at a slower pace,” she added.

Similarly, CRU Group analysts expect Chinese zinc demand to grow next year, but at a slower rate. “High prices will also begin to constrain demand growth next year in China and elsewhere,” they added.

Outside of China, Li expects demand in the US and Europe to increase next year as industrial activities in both economies continue to gather pace.

With all that in mind, analysts forecast that the refined zinc market will remain in deficit in 2018. CRU Group estimates that the deficit will moderate from this year’s 750,000 tonnes to around 200,000 tonnes. Meanwhile, CPM Group expects the refined zinc market deficit to reach 400,000 tonnes in 2017, but come off to approximately 220,000 tonnes in 2018.

Zinc outlook 2018: Key factors to watch

As the new year starts, investors should keep an eye on several catalysts that could impact the zinc market. CRU Group analysts mentioned Glencore’s (LSE:GLEN) mine output and the price-related response of Chinese mine supply as major factors that could potentially impact the market.

“Moving into next year, with concentrate stocks exhausted, the degree of the seasonal winter slowdown in Chinese mine supply will be crucial in determining … refined metal market tightness,” they added.

Similarly, Li suggested that investors watch winter capacity cuts in China, which depend on pollution levels and how local governments carry out the winter cuts. “Our base case is that the winter cuts will happen, and will provide strong underlying support to prices in the next couple of months,” she explained.

Looking ahead, zinc prices are on track to climb even higher in 2018 than they were this year. “On an annual average, basis zinc prices could rise to $2,904 this year and $3,154 in 2018,” said Li.

Leni also remains very bullish on zinc, and expects the metal to continue to head toward $2 per pound, supported by falling global inventories, Chinese mine closures and stable steel market demand.

However, he noted that investors should watch if Glencore decides to bring its 500,000 tonnes of production back online. “While Glencore’s tonnes wouldn’t hit the market overnight, I do believe the news would resonate quite quickly, sending at least a temporary downward spike in the zinc price,” he noted.

Meanwhile, firms polled by FocusEconomics estimate that the average zinc price for 2018 will be $3,009. The most bullish forecast for the year comes from TD Economics, which is calling for a price of $3,362; Danske Bank (CPH:DANSKE) is the most bearish with a forecast of $2,650.

For investors interested in zinc stocks, there are many zinc-focused companies to keep an eye on next year. According to Leni, some of them include Adventus Zinc (TSXV:ADZN), Solitario Zinc (TSX:SLR), Tinka Resources (TSXV:TK) and Vendetta Mining (TSXV:VTT).

However, he warned investors that “in a rising zinc price environment, many junior companies will boast a focus or exposure to zinc. More than ever, it will be paramount to do your due diligence.”

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.