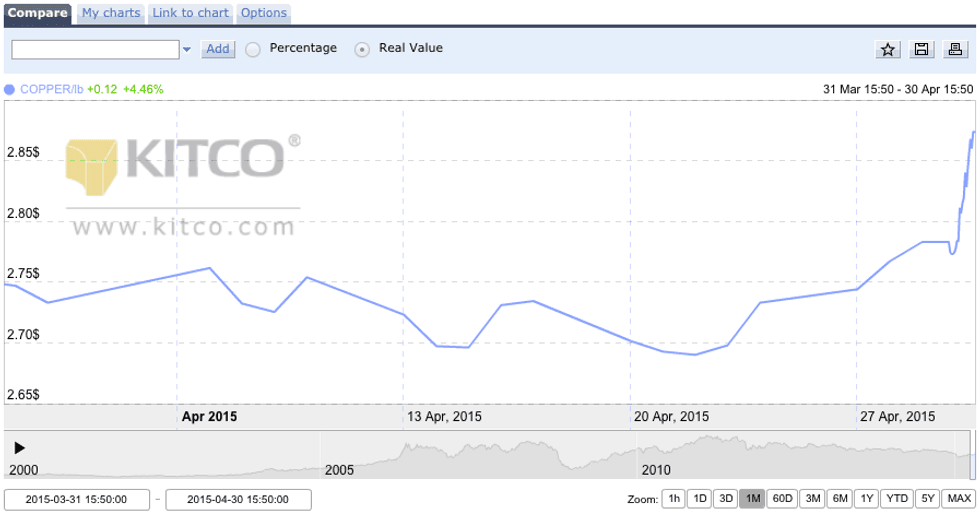

The copper price has put on a rather lackluster performance so far in 2015, but the red metal broke that trend this week. On Thursday, it rose 3.25 percent to reach $2.87 per pound. That puts copper closer to $3 than it’s been since the start of the year.

The copper price has put on a rather lackluster performance so far in 2015, but the red metal broke that trend this week. On Thursday, it rose 3.25 percent to reach $2.87 per pound. That puts copper closer to $3 than it’s been since the start of the year.

Driving that change was a weaker US dollar, Investing.com reported. According to the latest update from the US Federal Reserve, interest rates will remain the same for now. However the Fed also “offered little hints” on the timing of an eventual rate hike. Speculation over further economic stimulus in China provided additional support for the copper price this week, according to the news outlet.

Copper price April 2015. Courtesy of Kitco.

Stefan Ioannou of Haywood Securities agrees that the rise in copper prices could be attributed to the recent break in this year’s dollar strength. “The US dollar is definitely starting to weaken a little bit. Two or three weeks ago, the Canadian FX rate was about $1.27 … now it’s $1.20. So it is losing ground,” he said. “That will immediately bode well for commodity prices that are quoted in US dollars.”

Ioannou also pointed out that other base metals have recently seen price rises as well. “There definitely seems to be a positive movement in a bunch of the base metals,” he said, noting that the zinc price has risen over the past week. On Thursday, zinc was up 2.28 percent, trading at $1.07 per pound, and Ioannou added that zinc inventories have dropped below 500,000 tonnes on the London Metal Exchange.

Taking a look at copper inventories, Ioannou stated that inventories on the London Metal Exchange are flat, but that inventories on the Shanghai Metal Exchange are a different story. “The Shanghai inventories for copper were down about 10 percent over the last week, which is notable for sure,” he said. Furthermore, the analyst stated that Shanghai inventories have dropped 23 percent over the past month. “So it’s dropping,” he said. “There is definitely copper being used up [in inventories] in China and going somewhere else.”

To be sure, Thursday’s gain in the copper price came as analysts held predictions of further downside for the metal. Still, dropping inventories appear to be a good sign for the copper price in general, and investors will be watching closely to see whether the recent price rise continues.

Company news

Nevsun Resources (TSX:NSU,NYSEMKT:NSU) released positive results from exploration at its Harena deposit, located 10 kilometers south of its Bisha mine in Eritrea. Ioannou is pleased with the results, and upped his price target for Nevsun from $5 to $5.50 per share. “Harena is bigger than the average [VMS deposit] now, and it’s got very good grades,” he said. “On a standalone, Harena would be a company maker.”

Meanwhile, Foran Mining (TSXV:FOM) reported results from drilling at its Bigstone deposit, 25 kilometers southwest of its flagship McIlvenna Bay deposit. The third of six infill drill holes intersected broad, closely spaced intervals of copper-gold mineralization, with highlights including 31 meters of 2.59 percent copper and 0.67 g/ gold and 23.5 meters of 1.54 percent copper and 0.36 g/t gold.

Bigstone has a historic 3.75-million-tonne mineral resource estimate from 1990 grading 2.03 percent copper and 0.33 g/t gold, but Foran is not treating that estimate as current.

Last Friday, Callinex Mines (TSXV:CNX) announced the completion of a Phase 1 drill campaign designed to confirm historic mineralization and to test targets in the vicinity of its Pine Bay deposit. Two of five holes intersected high-grade copper mineralization, and one hole intersected 18.1 meters of 5.5 percent copper equivalent. The company expects to complete an expanded Phase 2 drill campaign this summer.

Finally, Nevada Copper (TSX:NCU) reported results from three initial drill holes from the open-pit drilling program at its Pumpkin Hollow project in Nevada. Greg French, Nevada Copper’s vice president of project development and exploration, said that results continue to expand mineralization at the deposit, with highlights including a 125.5-meter zone averaging 0.42 percent copper.

Securities Disclosure: I, Teresa Matich, hold no direct investment interest in any company mentioned in this article.

Related reading: