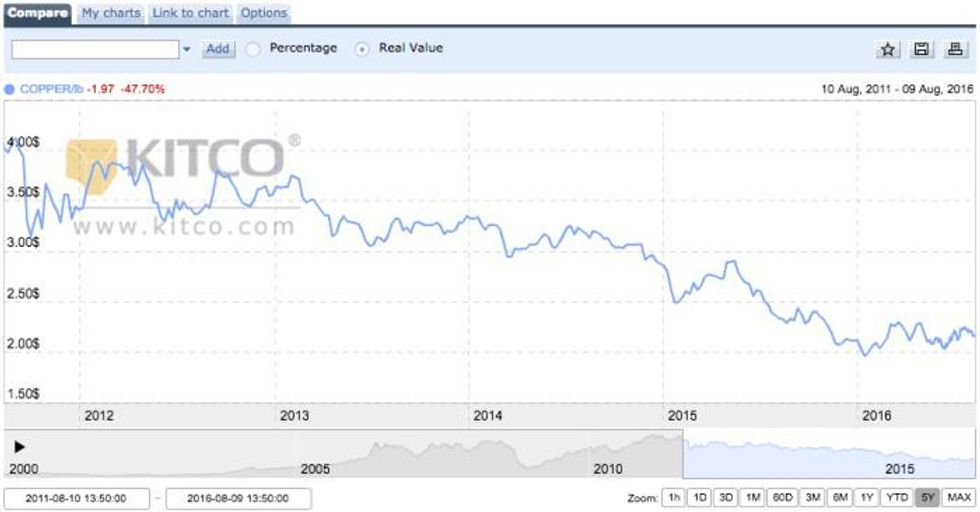

Copper prices have been under pressure in recent years, but the red metal has seen some modest gains in 2016. Here’s a look at the copper price forecast for the rest of the year.

Copper prices have been under pressure in recent years, but the red metal has seen some modest gains in 2016. That’s leading some analysts to up their copper price forecast for the year.

There’s no doubt that copper has underperformed other metals so far in 2016 (gold and silver are up 25 percent and 40 percent respectively), but the red metal has still held its ground in 2016, halting the steady decline in prices over the past five years.

Currently, copper prices are up about 2 percent overall for the year, trading at $2.16 per pound.

FocusEconomics states in the August edition of its Consensus Forecast Commodities report, “[a]fter hitting a multi-year low at the beginning of this year, copper prices have been fl uctuating around a mild upward trend before broadly stabilizing in July and at the beginning of August.” On the London Metal Exchange, spot copper was sitting at US$4,779 on August 5th.

In terms of the copper price forecast for the rest of 2016, analysts are split.

Goldman Sachs recently warned of a “supply storm” for copper, forecasting for the red metal to fall to $4,500 per ton in the next three months and to $4,000 over the next year. According to Bloomberg, the company stated in a note last week, “Company guidance and our estimates suggest that copper is entering the eye of the supply storm … [t]his ‘wall of supply’ is expected to translate into higher copper smelter and refinery charges and ultimately, higher refined-copper production, set against softening demand growth.”

However, another report from Bloomberg put out in early July noted that CRU Group sees copper producers running into difficulties with supply expansions. Only six out of about 80 planned developments or expansions are expected to be finished by the end of the decade, which could put copper supplies in a tight spot and potentially provide a bit of upward pressure for prices. “Our project pipeline has thinned considerably over the last year as we have factored in further delays,” CRU’s Christine Meilton told the publication.

Out of 16 copper price forecasts gathered by FocusEconomics, the lowest price expected was US$4,180 per metric ton for the fourth quarter, while the top forecast was US$5,350 per metric ton. Here’s a sample of a few other price predictions from the report:

- Standard Chartered Bank—$5,150

- Barclays—$4,300

- Capital Economics—$4,845

- JP Morgan—$4,400

- Danske Bank—$5,000

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Teresa Matich, hold no direct investment interest in any company mentioned in this article.

**The article below was originally published in September of 2014. Please scroll to the top of the page for more up to date information**

Copper to Shift into Deficit by 2016, 2017: Stefan Ioannou (September 2014)

With the scandal surrounding Chinese shadow lending earlier this year and a flurry of mergers and acquisitions (M&A) this summer, the copper space has certainly seen some excitement this year. But now that calls for a surplus have been replaced with cries for a shortage, it can be difficult for investors to figure out what’s really going on with the red metal.

To get a little more insight into the copper market, Copper Investing News (CIN) caught up with with Stefan Ioannou, mining analyst at Haywood Securities. In the interview below, Ioannou breaks down the effects of Chinese shadow lending, talks about what the current state of the market means for mining companies and gives his outlook for copper prices.

Overall, Ioannou sees copper sitting around $3.25 for the rest of the year, with a deficit pushing prices higher later in 2016 and into 2017.

CIN: In your view, how have copper prices performed so far this year? Were there any surprises for you?

SI: Year-to-date, the copper price has been in line with what we’ve been expecting. The average is $3.15, and it’s about $3.20 right now, so no major surprises.

I think the one thing that caught everyone a little off guard was the impact of Chinese shadow lending. It caused some volatility, especially early in the year when we saw copper drop below $3. It has since recovered, but that did cause a lot of uncertainty.

CIN: With that in mind, could you give our readers a bit of an overview of what happened in terms of Chinese shadow lending?

SI: Essentially what happened was that the Chinese were buying copper and keeping it in non-bonded warehouses, then using it as collateral to get low-cost loans to slip into higher-yielding investment vehicles. However, it became pretty apparent that there was some fraudulent activity going on — basically these guys were using the same block of physical copper as collateral on multiple loans.

A big concern was that with the fraudulent activity and the government tightening down on the whole situation, we were going to see those Chinese investors look for other means or other forms of collateral to do their financings with. That meant that all that copper in these non-bonded warehouses was potentially going to hit the market and flood it, at least for the short term.

CIN: That happened in the first half of the year — is it still affecting the copper market?

SI: Since then there have been a lot more stringent regulations put into place, but there is still some uncertainty lingering in the market. I think we’re through the worst of it, but the issue did cause copper to dip down to the $3 level earlier this year.

CIN: Thanks for clearing that up. Are there any other things investors should be watching to get cues on the copper market?

SI: In terms of things to watch in the copper space, the most transparent inventory is the London Metal Exchange (LME). Information on LME volumes is readily available, but keep in mind, the inventory is only one piece of about a six- or seven-piece pie. It does give a bit of an indication, but there’s also the COMEX, there’s the Shanghai, there are mine inventories, there’s recycling and then there are all the non-bonded stockpiles as well. Also, remember that LME inventories were falling notably as Chinese shadow lenders moved the metal into non-bonded warehouses. However, as noted earlier, this metal was not being physically consumed to make computers and refrigerators, but rather was being stored as collateral on other investments.

All that said, over the last couple of months we’ve been seeing that total exchanges such as the LME, Shanghai and COMEX are on the down. They are decreasing. Year-to-date, all three combined are actually down 49 percent, and that includes the LME being down year-to-date almost 60 percent. It was quite high to start the year off, but we’re getting down to levels that are relatively low. We’re talking five to six weeks of consumption versus much bigger numbers previously.

CIN: What about real demand from China? There’s been a lot of talk surrounding China buying copper to build cities that don’t seem to be inhabited. Is that a good thing for the copper market?

SI: The one issue with China, and not just for copper, but for anything, is that it’s a bit of a black box. That means getting reliable, consistent data is difficult from the outside, and that is a concern. China is consuming all these metals and commodities, and they have these massive growth plans, but is that a paper bag that’s going to fall apart at some point? Is there a glass ceiling? Time will tell, obviously.

If you start breaking it down to the population of the country, if even a small fraction of those people want to move into a western lifestyle — they want to live in cities and have iPhones and all that sort of thing — there’s a massive amount of consumption coming down the pipeline to support that.

It’s a big paradigm shift for China. It’s obviously a manufacturing center of the world, and right now with a lot of that manufacturing things get made there and sent elsewhere. At some point though, a greater proportion of China’s manufacturing will be consumed internally. The population figures underpinning this anticipated internal demand are obviously very significant and will in turn drive the country’s demand for copper and other commodities.

CIN: Just to talk a bit about copper supply and demand predictions overall this year, there have been calls for a surplus and lower overall prices. However, I’ve also seen predictions of the biggest deficit in seven years. How do investors navigate through that conflicting information? Who is right?

SI: A lot of it is global demand for the metal — and of course, when we say global, one of the biggest pieces of that global demand picture is China — and the encouraging thing there is China’s Purchasing Managers’ Index. It’s one small piece of data, but what we’ve seen over the past couple of months is that it is rising steadily. Assuming that trend keeps going, we are in a current surplus situation, and that will slowly get eroded away. The question is just how fast.

Realistically, I think we’re going to see copper probably trade in the range that it’s at right now for the next year or two. I think it will be early or mid-2016 before we really start to see the demand side take over the supply side on the curve.

CIN: What will be driving that shift?

SI: Well, there are a couple big things in the background driving that longer-term outlook. In the last few years we’ve seen a lot of major miners, the guys with the big, big projects, really shift focus to cost cutting at their existing operations as opposed to sinking capital into new development operations. That’s great for the bottom line today, but in terms of future supply, it definitely sets that back.

These are copper projects that still need to come online at some point and, if anything, they’ve all been delayed by a year or two — if not more — going forward. It’s like a self-fulfilling prophecy for the majors, because obviously cutting costs today increases their bottom line in the short term, and the effect of that is to drive up copper prices in the future because there just isn’t as much physical copper available.

CIN: So you’ve been seeing a lot of copper companies having difficulty getting their projects going?

SI: Yes. The mines that have been shelved are the ones that were still in the feasibility stage, where ground hasn’t actually been broken yet. We’ve seen a number of those projects get pushed back. With the ones that are in construction, a common theme in the mining space is cost overrun on the CAPEX side. It’s an unfortunate reality of the mining business and continues to cause grief for a lot of guys who are in the process of trying to build mines today.

CIN: How about with the junior or mid-tier companies? There’s been some M&A activity in those arenas recently.

SI: We’ve definitely seen companies position themselves opportunistically to take advantage of some of the larger or “better” development assets that are out there. For example, if you look at Rosemont, Augusta Resource’s (TSX:AZC) project, it’s a big copper mine and it’s quite robust in terms of what the feasibility study delivers. Obviously there’s a permitting challenge there, so I’d say Hudbay Minerals (TSX:HBM) is going into it with a very long-term view. It’s something they can acquire today for relatively cheap, and then as long as they’re not too aggressive on the timeline, I think they can make it dovetail with their existing operations.

The same can probably be said for First Quantum Minerals (TSX:FM) and its recent acquisition of Lumina Copper (TSXV:LCC). It’s a matter of getting your ducks in a row so that when copper prices are higher you’ve already got the project. You’re not paying a massive premium for them when copper is at $4. You’re getting them at a discount when copper is $3 or less. They’re taking advantage of sale prices right now.

Those are just a few examples. Keep in mind, there are also a number of big projects out there right now that are held by junior companies, and while they’ve done a lot of good exploration work and development work in terms of the engineering of these things, the next step is to finance. For a junior with a sub-$100-million market cap, trying to get over the hurdle of raising project financing to build a $1-, $2 or even $3-billion base metals project is next to impossible in these markets. And with the majors taking their own focus off some of these larger-scale development assets, it leaves a lot of these juniors high and dry.

CIN: That being said, what’s your overall prediction for the copper price?

SI: Again, realistically I see copper in that $3.25-a-pound range for this year, next year and into at least the first half of 2016, but as we hit that second half of 2016 and more so into 2017, 2018 there are some indications that we could start to see the market slip from surplus into deficit on the supply side. That’s going to obviously support copper prices higher. I don’t think seeing a four in front of the copper price is an unrealistic expectation from a medium-term perspective.

CIN: Are there any other factors we haven’t talked about that you see affecting the copper price?

SI: The one wildcard in the background is always unanticipated shutdowns at some of the big operations. We always see strikes pop out of nowhere, and with something like an Escondida having strike action, you turn off a couple percent of world production overnight; that can definitely cause short-term fluctuations in the copper price. It also isn’t common for analysts to add consideration for that type of event, so it’s something that’s not usually forecasted into a lot of numbers.

Not that Mount Polley is the world’s biggest copper mine, but if what happened with Imperial Metals (TSX:III) happened at a bigger mine, that could actually impact significant production. For example, the open-pit wall failure we saw at Bingham Canyon a couple of years ago comes to mind.

Unforeseen events aside, there is arguably room for the copper price to come down given that even the higher-cost producers are still generating profits at $3 copper. The copper price would probably have to drop below the $2.50 range before impacting existing production associated with the upper end of the copper cash cost curve.

CIN: Well, it sounds like things are looking up for copper for the most part. Thanks for your insight into the copper market and for taking the time to speak with us today.

SI: Thank you.

**The article above was originally published in September of 2014. Please scroll to the top of the page for more up to date information**

Securities Disclosure: I, Teresa Matich, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Interviews conducted by the Investing News Network are edited for clarity. The Investing News Network does not guarantee the accuracy or thoroughness of the information reported. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Related reading:

LME Copper Stockpiles Down, Deficit on the Horizon