Copper Outlook 2021: Prices to Remain High and Volatile

What’s the copper outlook for 2021? Read on to learn what analysts see coming for the red metal next year.

Click here to read the latest copper outlook.

Copper had an interesting year to say the least, as the coronavirus pandemic impacted supply and demand dynamics for the red metal.

After hitting its lowest point in four years in March, copper had a stellar rebound, with prices breaking the US$7,000 per tonne mark and hitting their highest point to date on December 4 at US$7,741.50.

With the year at an end, the Investing News Network (INN) asked analysts in the field for their thoughts on what’s ahead for the vital base metal. Read on for their predictions.

Copper outlook 2021: Price performance review

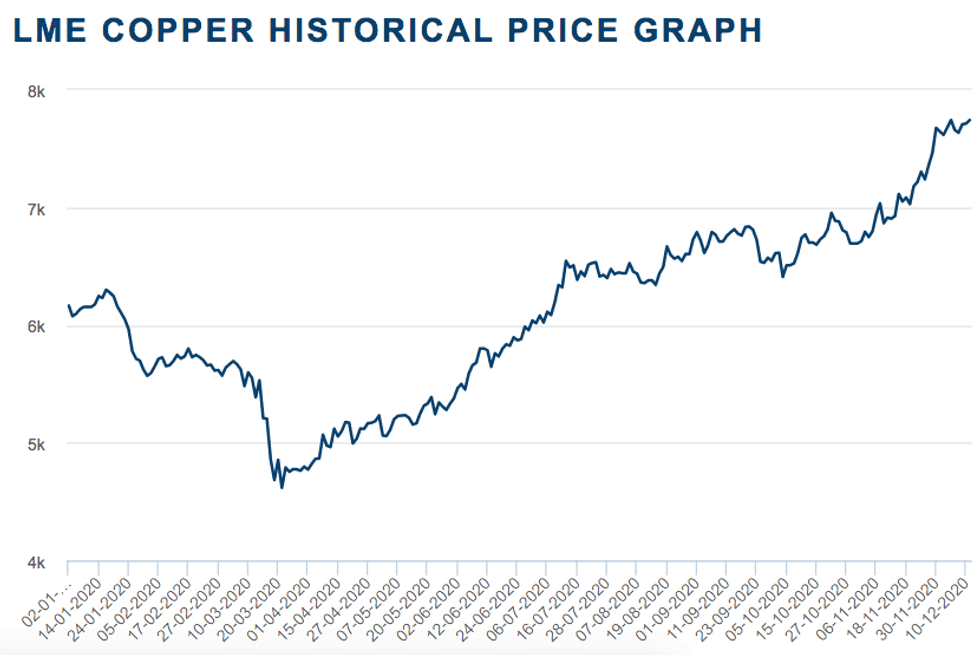

Copper prices started the year ― and the decade ― trending above US$6,000, but as the coronavirus spread throughout the world, containment measures and lockdowns started to hit supply and demand. By March, copper had sunk to its lowest point at US$4,617.50.

2020 copper price performance. Chart via the London Metal Exchange.

But the second quarter of the year kicked off with a recovery in China, which was hit first by the pandemic and is the world’s top copper consumer. Copper’s rebound continued through the third and fourth quarters, when prices hit a seven year high.

Speaking about surprises in 2020, Charlie Durant of CRU Group told INN that the fall and subsequent China-led recovery in the London Metal Exchange three month copper price was dramatic.

“I think that the most interesting part of the story has been how quickly Chinese purchasing recovered and how much metal has been sucked into China,” he said.

Ryan Cochrane of Open Mineral agreed, saying prices recovered faster than he had expected.

“Prices have been driven by tremendous Chinese imports (concentrates and cathode), while the concentrate market has remained very tight (with lingering disruptions),” he said.

Aside from the speed and extent of the recovery in Chinese demand, Karen Norton of Refinitiv highlighted the robustness of Chilean copper mine output as also quite surprising — in particular the growth from Collahuasi, the world’s second biggest mine.

“The market is overextended at the moment, so we would expect a pullback at some point in the next month or so. But overall positive sentiment looks set to prevail into 2021 with the vaccine providing hope for stronger recovery in demand,” Norton told INN.

Copper outlook 2021: Demand to grow

Copper demand was hit hard during Q1, with some estimating that Chinese demand fell by as much as a quarter during that time frame. China consumes more than 50 percent of the world’s copper.

For Norton, it now looks as if Chinese demand may even post a slight increase this year, fueled in part by stockpile buying and record-high cathode imports.

“This has helped to drive prices higher in recent months, but it may be that this may negate part of the demand strength anticipated next year,” she said. “Even so, Chinese demand is still expected to grow at a stronger pace than in recent years, helped in part by this year’s low base for comparison, but also by the strength of infrastructure investment.”

CRU is expecting China to see growth in refined copper consumption of around 2 percent in 2020.

“The most recent Chinese macroeconomic data is generally robust, with monthly real estate completions turning positive,” Durant said. “For 2021, we think that stimulus measures, a recovery in the automotive sector and a buoyant construction market can again help power Chinese refined copper demand growth to over 2 percent year-on-year.”

For his part, Open Mineral’s Cochrane is expecting to see continued robust demand and strong imports of raw materials, as well as refined products in China.

“Though with such a demand slump outside of China in 2020, much of the incremental global growth for 2021 is actually contingent on a rebound outside (of the Asian country),” he added, saying one of the countries that could see a tremendous rebound in demand growth in 2021 is India.

When asked about China, Commodity Market Analytics’ Dan Smith told INN he is also expecting growth of 2 percent in 2021, building on double-digit growth this year.

“Most countries in the world will bounce back strongly in 2021 as they recover from COVID-19-related lockdowns. Fastest growth is likely to take place in Japan and Europe as activity fell the most in 2020.”

Demand in the rest of the world has struggled in 2020, falling by about 9 percent, according to CRU.

“COVID-19 second waves are still causing uncertainty about the path ahead. 2021 should see a recovery, and we expect growth of over 7 percent,” Durant explained to INN. “However, demand outside of China will still be below 2018 levels.”

Recent vaccine approvals and rollouts around the world have brought new hope into the markets, sending most base metals into rallies; as economies open up, demand for copper could also increase.

“With the rollout of a COVID-19 vaccine now happening in the UK, Europe and the US will likely follow suit shortly after,” Cochrane said. “So 2021 should see lockdown measures easing significantly on balance.”

Interestingly, CRU has revised its previous judgment on when a vaccine will be widely available, shifting it from the middle of next year to the first half of next year.

“Although vaccines will not resolve the pandemic in Q1, we expect the encouraging vaccine news to provide a boost to confidence and spending in Europe and the US, which has led us to raise our economic growth forecasts in the first quarter of 2021,” Durant said.

But vaccine availability in South America, where top producers of copper are located, could be different.

“(I) would expect a vaccine rollout to be slower, and there could continue to be isolated disruptions to supply for 2021,” Cochrane said.

Looking over to the US, many wonder if Joe Biden’s presidency could benefit demand for the red metal.

“Overall Biden will have a bullish impact on copper,” Smith said. “His pursuit of a greener agenda will see encouragement of renewable power and electric vehicles, which will both boost copper demand.”

Norton also said the Biden administration will likely have a positive impact on copper demand over the medium to long term with its green energy policies pointing to more copper-intensive usage.

“The impact of this administration is likely to be more far reaching than just on the country’s demand, however, in that it will help to ease geopolitical tensions and lead to a generally less risk-averse backdrop,” she said to INN. “While there is unlikely to be an immediate change in policies with regard to tariffs, for instance, fears of escalating trade war tensions that have tended to weigh on sentiment have eased considerably.”

Copper outlook 2021: Supply chain scrutiny to increase

Looking over to the supply side of the copper market, the world’s two largest mining nations ― Chile and Peru ― are expected to grow next year, particularly Peru, which was also worst hit by the pandemic this year, according to Refinitiv.

“Barring unforeseen disruptions, we are forecasting growth of around 300,000 tonnes in Peru in 2021,” Norton said. “Chilean production held up relatively well this year and is expected to post reasonable growth next year despite the earlier reduction in guidance for Escondida in the year to (the end of) June.”

Aside from COVID-19, there are other factors that could also impact South America and as a result the copper supply chain.

“In 2021, Chile and Peru, which account for 40 percent of global mine output, have general elections,” Durant said. “Chile is also seeking to write a new constitution, and Chilean mining unions are likely to be emboldened by high metal prices as they begin a busy schedule of labor contract negotiations.”

CRU has upped its 2021 mine disruption allowance to 6 percent, although it still expects production to increase 3 percent.

In 2021, areas of supply growth for copper are likely to include the Democratic Republic of Congo, Indonesia and Panama, according to Smith.

“While high copper prices will improve the attractiveness of new copper projects, the biggest traditional challenges are finding good-quality projects in countries with stable governments and mining codes,” he said. “Extra pressure is also now coming from an increasing focus on high standards regarding ESG, with investors and directors reluctant to get involved with projects that could be environmentally damaging, particularly with regard to greenhouse gas emissions and waste disposal.”

Durant also said the scrutiny of the copper supply chain will intensify in 2021, with ESG issues ranging from emissions to community relations taking center stage.

“Resulting rebalancing of company mining asset portfolios could create merger and acquisition opportunities that should also be aided by the high copper price,” he added.

For juniors or developers of copper and copper-gold concentrates, Cochrane said 2021 should be an exceptional time to raise financing and advance projects; that’s because copper prices are strong, and fundamentals for the copper market are robust in the short to medium term, as well as the long term.

Copper outlook 2021: Key factors to watch for

As the new year begins, there are key factors investors should watch that could impact the copper space.

Speaking about prices in 2021, Norton said copper prices currently look overbought. “We believe that there will be a selloff at some point (on) either side of the new year,” she said.

“However, that is not to say that they will not strengthen again subsequently, and with the market looking to be in a modest deficit in 2021, prices are likely to be well supported in the main and new multi-year highs likely to be reached.”

Similarly, Smith expects prices to remain high and volatile through most of 2021, with the strong likelihood of a surge above US$8,000.

“Beyond this, the trend is likely to be downwards as supply starts to adjust to higher demand,” he added.

CRU is forecasting that the London Metal Exchange three month copper price will remain at or above US$7,000 over the next 12 months.

“Bulls will argue the copper price rally is still in its infancy given low exchange stocks and the prospect of a balanced market next year,” Durant said. “Bears will point to 90th percentile cash costs for miners of just US$5,000. That uncertainty means 2021 could be a year of significant price volatility.”

Open Mineral’s Cochrane also expects prices to remain well above US$7,000 in 2021. He added that one factor to watch next year is where benchmark treatment charges/refining charges settle.

“Expectations are generally for a rollover or even slightly lower terms than this year’s (US$62 per tonne/US$0.062 per pound), although at these levels — given weak sulfuric acid pricing — smelters will be under pressure in 2021,” he said.

Commenting on other factors to watch, Durant said China built significant copper inventories this year, with the market believing that the State Reserve Bureau (SRB) accounted for a good proportion of these.

“There is the possibility that this continues in 2021,” he said. “If so, cathode imports, which reached a record this year, might stay higher than expected. Alternatively, if non-SRB held stocks come back to the market, then Chinese imports could disappoint.”

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.