Copper is holding above US$5,000 per tonne as countries begin easing lockdown measures, but volatility is set to remain in the space.

As activity in top consumer China continues to pick up, copper prices have been trending upwards on hopes that demand will bounce back.

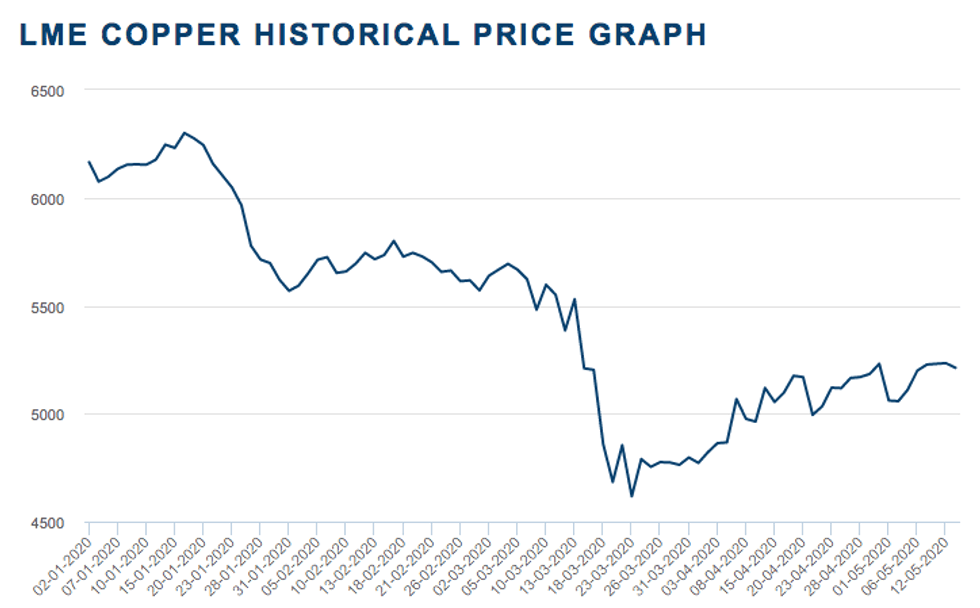

Copper has had a bright May so far, rebounding from its lowest point in 2020 on March 23 at US$4,617.50 per tonne to US$5,212 on May 13. Prices hit an eight-week high on Monday (May 10) at US$5,370.

“Copper prices have been boosted in recent weeks by improved risk appetite,” Dan Smith of Commodity Markets Analytics told the Investing News Network. “Key developments in the past couple of weeks have been improved Chinese demand and the lifting of lockdowns in other key consuming areas such as Europe and the US.”

For Smith, a key indicator is that consumption of thermal coal in China was up 8 percent year-on-year in early May, showing that electricity consumption is now back on a solid growth path and the country is clearly experiencing a V-shaped recovery.

“Also treatment charges have tumbled by more than 20 percent, reflecting tight mine supply globally due to virus-related restrictions,” he said. “While Peruvian supply is likely to trend up in the weeks ahead, global mine supply still looks constrained.”

Copper was on track for a weekly loss on Friday (May 15) as fears that the global economy will be sluggish for longer than expected put pressure on prices. US Federal Reserve chair Jerome Powell warned on Wednesday (May 12) to expect an “extended period” of weak growth and stagnant incomes, with the overall process of recovery to be slow.

Chart via LME

Despite this week’s performance, copper prices are expected to pick up this year on expectations that COVID-19 will be contained, according to FocusEconomics analysts.

“Copper demand from China is slated to recover in the coming months as indicated by a sharp rebound in the manufacturing PMI in March,” they said in their latest report. “Nevertheless, prices are unlikely to gain significant ground before global economic activity gets back on track.”

For Smith, prices are approaching a key level at around US$5,407, and if this can be broken soon, a rapid upward move towards US$6,000 is likely.

“I remain bullish and expect prices to be higher by year-end,” he said. “Volatility will remain high for sure and prices will inevitably swing significantly on COVID-19-related news.”

Most analysts have pointed out that the pandemic has hit copper demand harder than supply, but it will be less impacted than other base metals. The market is expected to see a surplus of around 400,000 tonnes this year from previous forecasts for a balanced market.

“Virus containment measures have weighed heavily on copper demand,” Capital Economics Kieran Clancy said. “That said, the growing list of cutbacks at mines in Latin America should eventually start to weigh on refined supply and reduce the size of the surplus as the year progresses.”

Capital Economics anticipates that the copper price will recover quicker than most other base metal prices over the coming years.

For S&P Global Market Intelligence analyst Tom Rutland LME, copper cash prices are expected to fall to average US$5,702 in 2020 down from US$6,005 in 2019. Meanwhile, analysts recently polled by FocusEconomics expect copper prices to average US$5,333 in 2020.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.