Antofagasta Takes Top Spot as Biggest Exploration Spender Worldwide

Juniors are usually responsible for discoveries and early stage exploration, but 2014 has seen bigger miners spend their fair share. According to a recent report from SNL Metals and Mining, 39 large miners will account for 40 percent of global exploration spending in 2014, with Antofagasta being the biggest spender of them all.

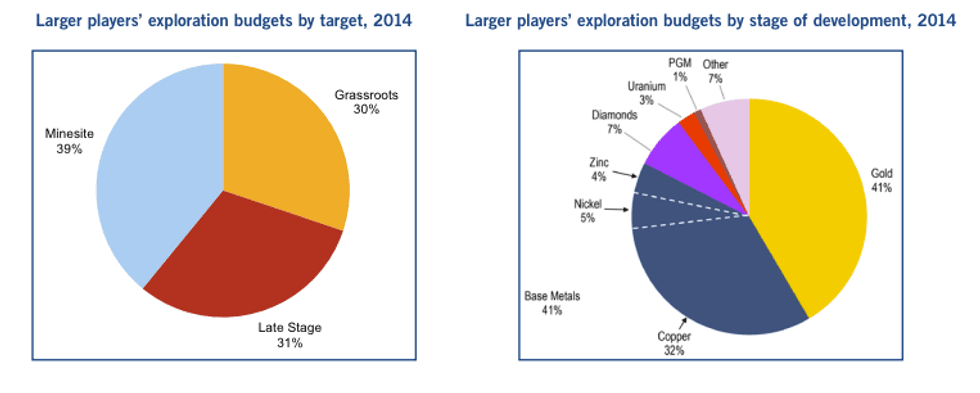

Part of SNL’s latest corporate exploration strategies (CES) study looks at companies that budgeted at least US$50 million for exploration in 2014. It states that 39 companies budgeted $4.33 billion in total — a sizeable chunk of the US$10.74 billion budgeted worldwide. Gold represents 41 percent of the exploration budgets for those larger miners this year, while copper represents 32 percent; other commodities, including diamonds, silver and potash, account for 7 percent each.

Interestingly, those exploration dollars are not being spent entirely on late-stage work. As the diagrams below show, 30 percent of the budgets for those 39 miners is being allocated to grassroots exploration.

Images from this SNL Metals & Mining white paper.

Companies in the lead

For 2014, Antofagasta had the largest nonferrous exploration budget globally. While that includes some work focused on feasibility work and late-stage exploration, make no mistake — the company is also putting forward a “strong grassroots effort” in Europe, Africa, Australia and the Americas.

To be sure, a strong exploration effort is likely necessary for the company as falling grades and higher costs continue to cut into its production and profits. As an October 29 article from Reuters notes, the company recorded reduced third-quarter output compared to Q3 2013 due to production stoppages at some of its operations and harder (more difficult to process) ore at its Los Pelambres operations.

Vale (NYSE:VALE) was the second-biggest spender, focusing on late-stage exploration work, while Fresnillo (LSE:FRES), the world’s largest primary silver producer, came in third place.

Juniors feeling the squeeze

As an SNL white paper on the CES study points out, “[c]onventional wisdom holds that the major companies leave grassroots exploration to the juniors.” However, the report suggests that larger miners have ended up driving early stage exploration this year simply because juniors have had so much difficulty securing financing.

That’s certainly the sentiment coming from the juniors. Responding to a survey on the market this year, Robert Carrington, CEO of Colombian Mines (TSXV:CMJ) said that one of the most challenging aspects of the market this year was a “lack of investor interest,” where investors seemed to see good drill results as selling opportunities rather than reasons to buy or hold a company’s stock. Similarly, InZinc Mining (TSXV:IZN) CEO Chris Staargaard pegged “[t]he inability to raise enough cash to fund significant physical work on the ground” as a major issue in 2014.

Certainly, it’s been a tough year for juniors, and SNL’s look at where exploration spending is coming from paints an even more poignant picture. As we move towards the end of the year, investors and miners alike will no doubt be hoping for a brighter year in 2015.

Securities Disclosure: I, Teresa Matich, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Colombian Mines and InZinc Mining are clients of the Investing News Network. This article is not paid-for content.