Interest in phosphate companies is slowly climbing as the market tries to shake itself out of its summer dormancy. Here’s a look at where phosphate’s future may lie.

With phosphate prices at US$110 per ton, there hasn’t been any change in the market since May. However, recent moves by several companies indicate increased interest in the market, meaning phosphate’s summer dormancy may be on its way out.

Here’s a look at what a few phosphate companies are up to and why they — and some analysts — are positive about the industry’s prospects.

Mosaic believes in growing demand

Mosaic (NYSE:MOS) came out swinging at the end of October, announcing as part of its Q3 results that it is forecasting record potash and phosphate shipments.

“Yeah, there’s ups and downs, dips and valleys, but the trend is unrelenting. It is upward,” said Jim Prokopanko, CEO of the company.

Mosaic estimates that its shipments of phosphate products could hit as high as 66.5 million tons, representing a 1.5-million-ton gain.

“Going into 2015 we see continued demand momentum, and feel Mosaic is well positioned for growth as fundamentals improve,” Prokopanko added.

Some companies have echoed that stance, moving ahead with takeovers to help boost phosphate output.

For instance, CI Resources (ASX:CII) moved a step closer to completing its takeover of Phosphate Resources after hitting 95-percent voting power on November 11. The newly formed entity will own a phosphate rock mine on Christmas Island, and it is expected to export approximately 700,000 tons of phosphate products per year to markets in Oceania and Southeast Asia.

Agriculture could provide boost

Meanwhile, some analysts remain upbeat about the agriculture sector — and by extension, the phosphate industry.

Fertoz (ASX:FTZ) submitted an application last week to extract roughly 75,000 tons of phosphate rock per year from its Wapiti project in British Columbia, in large part to take advantage of local agricultural users. It’s currently able to extract 17,500 tons from the property. In a release, the company notes that farms in the area are a mixture of broad-acre and intensive agricultural operations, so it would be able to distribute the product to a range of third parties.

The news dovetails with Ethan Park’s comments in a previous article by Potash Investing News. Essentially, Park believes that the agriculture industry is set to expand as the world’s population grows, which could help reignite interest in the potash and phosphate markets.

The caveat

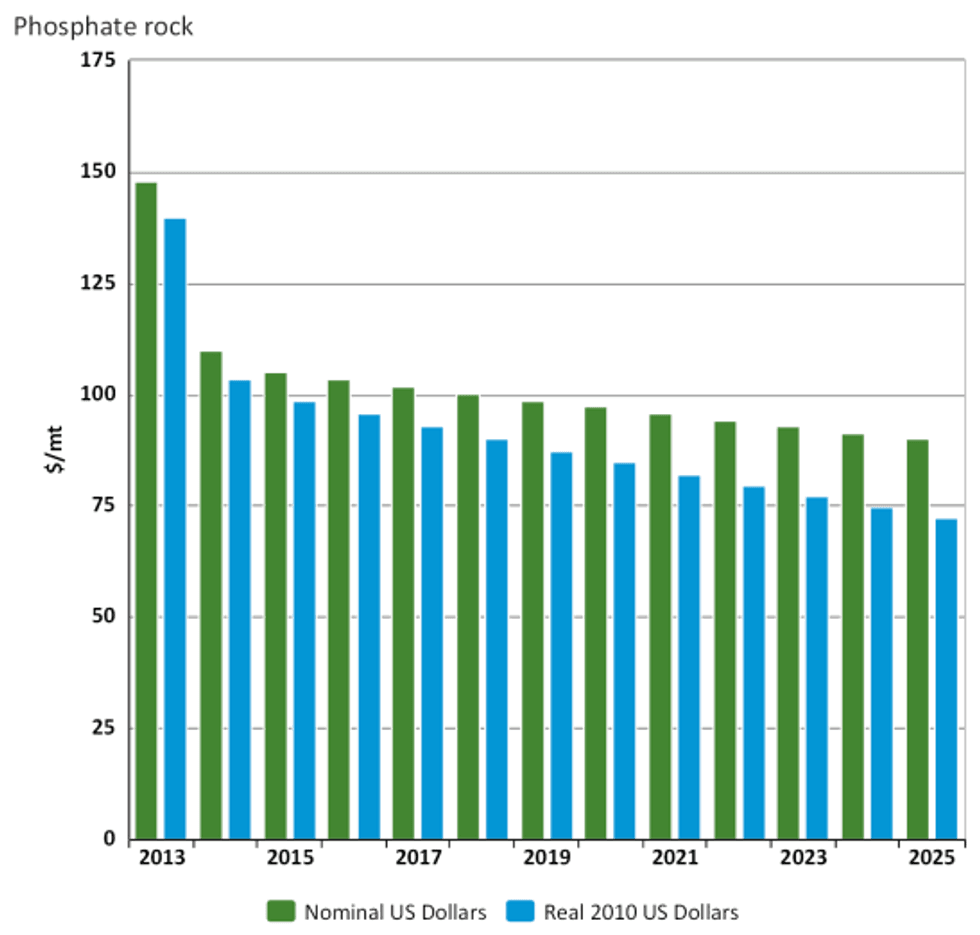

Despite all that positivity, a bright future is not guaranteed for phosphate. The World Bank released a commodities price report in October that runs through price outlooks for various commodities. The grim news for phosphate? Over the next 12 years, the organization estimates phosphate dropping from current prices to US$90 a ton.

In its October 2014 report, the organization states that while fertilizers have recently been able to reverse a downward trend, phosphate is likely to be heavily hit.

Relatedly, for all of Mosaic’s bluster that demand is growing, the company’s Q3 report glosses over falling output from its own projects. It cut back phosphate fertilizer production due to high production costs and sliding grain prices. Its projected phosphate volumes also dropped to a range of 2.5 to 2.8 million tons from 3.4 million tons this time last year.

At this point investors will have to wait and see whose forecast turns out to be correct.

Securities Disclosure: I, Nick Wells, hold no direct or indirect investment in any of the companies mentioned in this article.