Additional Deals for Ontario Retail Shops Go Public

More partnerships between public cannabis companies and winners of the limited licenses for Ontario dispensaries are appearing.

After an initial round of deals, more partnerships between winners of the limited licenses for Ontario dispensaries and cannabis public companies are appearing.

While the deals vary in scope and extent, the vast majority of Canadian public firms securing deals want an entry point to the coveted marijuana market.

This week, two new deals were confirmed for the set up of shops; they will be part of the initial 25 stores scheduled to open April 1.

On Thursday (March 21), Alberta-based retailer and accessory developer High Tide (CSE:HITI,OTC Pink:HTDEF) confirmed its third deal to assist in the development of an Ontario marijuana dispensary.

This dispensary is being proposed for a location in Toronto. High Tide has assisted two other lottery winners with setting up their shops under the brand name Canna Cabana.

“As the realities of a compressed schedule and complex project became clear, the third winner realized that they would benefit from our help,” Raj Grover, president and CEO of High Tide, said in a press release.

The retailer announced the issuance of restricted warrants, exercisable for the purchase of 4 million shares in the company, at a price of C$0.40 per share.

“The restricted warrants are part of the company’s consideration for the acquisition of the entity operating a fully-licensed cannabis retail store and shall only vest upon the closing of the potential acquisition, which is subject to Alcohol and Gaming Commission of Ontario (AGCO) approval,” High Tide announced.

Shares of High Tide rose 6.25 percent to finish the day at a price of C$0.51. Over a year-to-date period, the retailer has seen its shares increase in value by 23.08 percent.

High Tide offers support deal to struggling retail winner

According to High Tide, the third license holder to partner with the retailer “acknowledged its need for support” and elected the public firm for a deal.

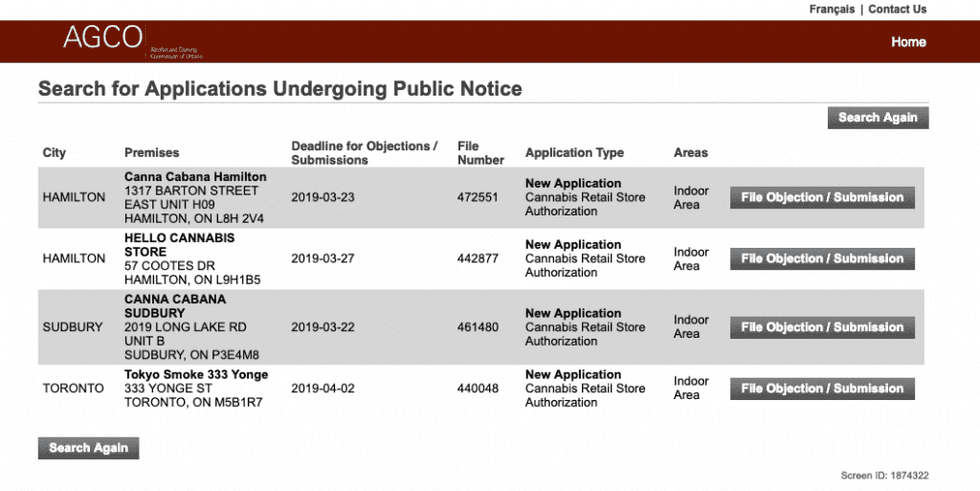

Current AGCO public notice files show that consultations are being held for Canna Cabana stores in Hamilton and Sudbury. The public notice also shows that a location near Yonge-Dundas Square, in the heart of Toronto, Ontario, is set to become a Tokyo Smoke dispensary.

Screenshot via AGCO.

Tokyo Smoke is a cannabis brand acquired by licensed producer (LP) Canopy Growth (NYSE:CGC,TSX:WEED) as part of a larger deal for former public firm Hiku Brands.

This represents the second store under the Canopy umbrella in the Ontario market, as a Tweed store in London is under review by the AGCO.

“Tokyo Smoke has come to an agreement with one of the Ontario lottery winners to utilize our brand for their Toronto store,” Canopy told Global News. “The lottery winner will have full ownership and control over the Toronto store.”

Ruling on these deals up to Ontario regulatory agency

While these deals remain subject to the approval of the AGCO, the proliferation of these partnerships — including with some of the biggest names in the industry — shows the pressure to set up these shops.

After switching gears on a previously outlined plan for the Ontario retail market, Doug Ford’s Progressive-Conservative government announced it would privatize the whole space but prevent LPs from dominating by placing a hard cap of one store license at a production facility.

Ontario changed course again in December 2018, indicating that, due to pressure from a shortage of product, the province would create a lottery for the first 25 stores to open starting in April 1.

Since the restrictions for participating in this lottery were limiting, non-retailer parties ended up obtaining spots in the coveted 25-winner list.

In January, Trina Fraser, cannabis lawyer with Brazeau Seller Law, told the Canadian Press many of the winners did not have “industry experience.”

Under the regulation, winners of the retail licenses are not permitted to transfer the title holder to another controlling party.

Boom of deals between cannabis public companies and Ontario retailers

Alongside High Tide, Choom (CSE:CHOO,OTCQB:CHOOF), Fire & Flower Holdings (TSXV:FAF) and a partnership between Inner Spirit Holdings (CSE:ISH) and LP Newstrike Brands (TSXV:HIP,OTC Pink:NWKRF) all secured deals with Ontario license holders in February, representing the first batch of these agreements.

“It was no secret that deals were being tabled in the week that our retail operators had to complete their retail operator license application,” Brenna Boonstra, director of quality and regulatory consulting with Cannabis Compliance, told the Investing News Network (INN).

Aurora Cannabis (NYSE:ACB,TSX:ACB), a major LP in the space, holds investment interests in both High Tide and Choom.

In an update to investors, Aurora confirmed its support for High Tide’s deals with Ontario lottery winners.

Aurora completed a C$10-million investment in High Tide in December 2018.

Another LP set to gain a stake in the Ontario retail market is HEXO (NYSEAMERICAN:HEXO,TSX:HEXO) thanks to a friendly acquisition offer worth C$263 million for Newstrike, which recently partnered with Inner Spirit.

“We welcome and look forward to working with the HEXO team and building on the foundation that has been put in place,” Darren Bondar, president and CEO of Inner Spirit, told INN in an email statement.

Inner Spirit is set to “build out the store location, license its [Spiritleaf] brand and operating standards, and provide expert product training.” Up Cannabis, a Newstrike brand, will be highlighted in an “experiential hub” at the location.

While the majority of these deals are for help in setting up proposed shops, another public cannabis firm secured a different type of agreement.

On Monday (March 18), Origin House (CSE:OH,OTCQX:ORHOF) announced that its subsidiary Trichome Financial had offered C$2 million as part of a revolving credit facility and term loan to one of the confirmed retail owners in Ontario.

Afzal Hasan, president and general counsel of Origin House, told INN that, after surveying the Ontario retail market, many operators are still “looking for either capital or operational support.”

The store from Trichome’s partners will be located in Brampton, Ontario under the brand name Ganjika House.

“It’s also been quite a confusing and challenging market in terms of the hysteria that surrounded it,” said Hasan. “Trying to do rational business deals is a challenging exercise.”

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Inner Spirit Holdings and High Tide are clients of the Investing News Network. This article is not paid-for content.