Crypto Market Recap: Loopscale Faces US$5.8 Million Hack, Coinbase Preps New Institutional Offering

Coinbase is set to debut a fund that offers Bitcoin holders a passive income-earning opportunity.

Here's a quick recap of the crypto landscape for Monday (April 28) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ethereum and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ethereum price update

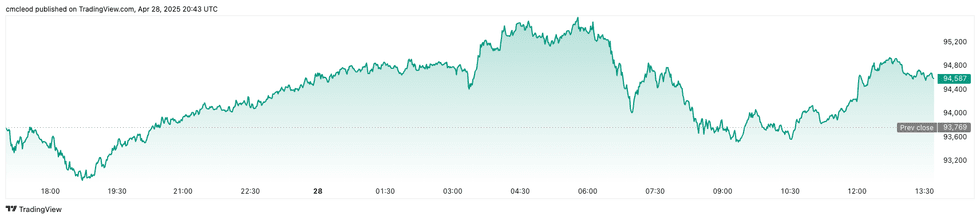

Bitcoin (BTC) was priced at US$94,867.28 as markets closed for the day, up 0.4 percent in 24 hours. The day's range has seen a low of US$93,589.07 and a high of US$95,212.29.

Bitcoin performance, April 28, 2025.

Chart via TradingView.

Bitwise CEO Hunter Horsley said heightened institutional activity drove Bitcoin’s rally to US$94,000.

In a client note, Greg Cipolaro, the global head of research at NYDIG, said, “Bitcoin has acted less like a liquid levered version of levered US equity beta and more like the non-sovereign issued store of value that it is.” However, it’s worth noting that Bitcoin fell by about US$2,000 after the markets opened in tandem with declining US Treasury yields.

Ethereum (ETH) ended the day at US$1,799.74, a 0.5 percent decrease over the past 24 hours. The cryptocurrency reached an intraday low of US$1,754.97 and a high of US$1,803.29.

Altcoin price update

- Solana (SOL) ended the day valued at US$148.64, down one percent over 24 hours. SOL experienced a low of US$145.89 and peaked at $150.06.

- XRP traded at US$2.30, reflecting a 0.8 percent increase over 24 hours. The cryptocurrency recorded an intraday low of US$2.26 and reached its highest point at US$2.31.

- Sui (SUI) was priced at US$3.61, showing an increase of 0.6 percent over the past 24 hours. It achieved a daily low of US$3.55 and a high of US$3.73.

- Cardano (ADA) was trading at US$0.7091, up 1.1 percent over the past 24 hours. Its lowest price on Monday was US$0.6879, with a high of US$0.7136.

Today's crypto news to know

US$330 million Bitcoin transfer sparks concern

On-chain investigator and analyst ZachXBT has called out a “suspicious transfer” of 3,520 BTC to a new address just after midnight on Monday; the coins were worth approximately US$330.7 million at the time.

“Shortly after the funds began to be laundered via 6+ instant exchanges and was swapped for XMR causing the XMR price to spike 50%,” Zach wrote, adding that the move was “likely a theft” roughly an hour later.

Zach concluded that a longtime holder using major exchanges to suddenly transfer a large sum in many small, costly increments to instant exchanges would be an inefficient method for legitimate use.

To date, there has been no confirmation of anyone coming forward to say they have been robbed. Monero’s price has retracted to near its post-spike price, up 10 percent in 24 hours to US$253.09 at the time of writing.

Loopscale suffers hack, bounty negotiations ongoing

On Saturday (April 26), approximately US$5.8 million of USDC and SOL were stolen from the Solana-based DeFi protocol Loopscale. Roughly US$5.7 million UDSC and around 1,200 SOL were taken from Genesis vaults.

Loopscale’s analysis reveals that the attackers manipulated Loopscale’s RateX PT token, which allowed them to exploit a flaw in how the system determined the value of deposited assets.

The stolen funds represent around 12 percent of Loopscale’s total value locked.

In response, Loopscale suspended all withdrawals from its vaults and temporarily halted trading. The platform has offered the attackers a 10 percent bounty and said it would not pursue legal action if the remaining 90 percent is returned. According to Loopscale’s update, posted on X on Sunday (April 27) evening, the attackers agreed to return the funds in exchange for a bounty, but said they expected 20 percent. According to the latest update from Etherscan, negotiations are ongoing, and there have been no reports of the funds being returned as of the time of writing.

Strategy stacks US$1.42 billion in Bitcoin

Bitcoin bull Michael Saylor’s firm, Strategy, added another 15,355 BTC to its holdings last week, spending roughly US$1.42 billion between April 21 and 27 as Bitcoin surged past the US$90,000 mark.

According to Strategy’s April 28 filing with the US Securities and Exchange Commission, the purchase was made at an average price of US$92,737 per Bitcoin, bringing the company’s total haul to a staggering 553,555 BTC — now valued at more than US$50 billion. The move marks Strategy’s largest Bitcoin acquisition since late March and reflects the firm's aggressive accumulation strategy despite growing market volatility.

On social media, Saylor celebrated the purchase, noting that Strategy’s Bitcoin yield now sits at 13.7 percent year-to-date, and reaffirmed his belief that Bitcoin remains massively undervalued despite its recent rally.

With the company’s market cap pushing toward US$100 billion and Bitcoin trading around US$95,000, Strategy’s latest moves signal continued institutional confidence in Bitcoin as a core asset class.

Grayscale pushes SEC to approve Ethereum ETF staking

Grayscale Investments is renewing pressure on the US Securities and Exchange Commission (SEC) to allow staking activities for Ethereum exchange-traded funds (ETFs), highlighting that restrictive rules have already cost US funds more than US$61 million in foregone rewards.

In a high-level meeting with the SEC’s Crypto Task Force, Grayscale executives presented a proposal to amend existing Ethereum ETF filings to permit staking, emphasizing the competitive disadvantage US funds now face compared to their European and Canadian counterparts.

Grayscale argued that staking would not only enhance investor returns but also contribute to Ethereum network security, supporting a more resilient decentralized infrastructure.

The company also laid out a liquidity management plan to address concerns about redemption risks, including credit facilities and liquidity sleeves with custodians like Coinbase Custody.

Coinbase to launch Bitcoin yield fund

Coinbase is set to introduce the Coinbase Bitcoin Yield Fund on May 1, which will offer exposure to institutional investors from outside the US. “This fund is a conservative strategy that seeks a 4-8 percent net return in Bitcoin per year, over a market cycle, with investors subscribing and redeeming in Bitcoin,” the company said on Monday.

The yield will be generated through a cash-and-carry strategy, through the difference between spot Bitcoin prices and derivatives, as Bitcoin itself lacks a built-in mechanism for generating passive income like staking on other blockchains.

According to Coinbase, custodians of the fund will trade using third-party custody integrations to lessen counterparty risk, avoiding higher-risk Bitcoin lending and systematic call selling.

SEC’s Peirce likens US crypto regulation to "floor is lava," demands real reform

SEC Commissioner Hester Peirce delivered a blistering critique of US crypto regulations, comparing them to the children’s game "floor is lava," where firms must hop precariously across unclear legal guidelines to avoid regulatory pitfalls.

Speaking at the SEC’s “Know Your Custodian” roundtable on April 25, Peirce criticized the lack of coherent, actionable rules for investment advisers, custodians and exchanges dealing with crypto assets.

She stressed that without clear definitions around securities classifications and custodial qualifications, the industry is being paralyzed by uncertainty, stifling innovation and deterring responsible market participants.

Fellow commissioner Mark Uyeda reinforced Peirce’s warnings, urging the SEC to expand custodial options by recognizing state-chartered trust companies, a move he said is essential to the healthy development of crypto trading platforms and alternative trading systems.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.