Crypto Market Recap: SEC Nominee Atkins Grilled on Crypto, UAE to Launch CBDC

Elsewhere in the crypto space, the UK's Financial Conduct Authority has introduced a new framework to increase crypto sector oversight.

Here's a quick recap of the crypto landscape for Friday (March 28) as of 9:00 p.m. UTC.

Bitcoin and Ethereum price update

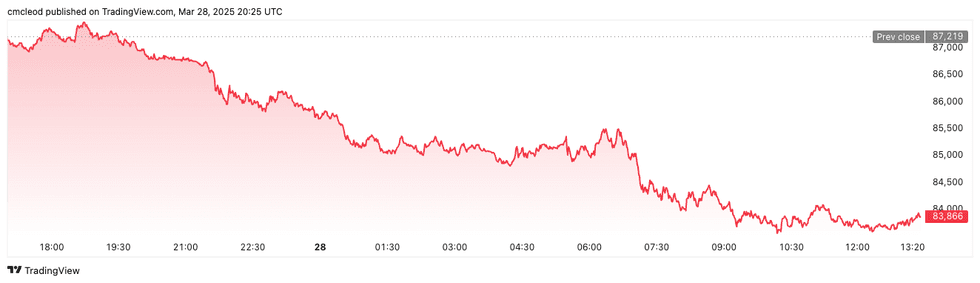

Bitcoin (BTC) is currently trading at US$83,780.06, a 3.7 percent decrease over the past 24 hours. The day's trading range has seen a low of US$83,609.35 and a high of US$85,503.88.

Bitcoin performance, March 28, 2025.

Chart via TradingView.

Deribit's US$16 billion Bitcoin options expiry on Friday had US$75,000 max pain, down from the projected US$85,000, and a 0.58 put/call ratio. There was a high amount of call option open interest at the US$100,000 strike price.

Bitcoin’s subsequent decline indicates post-expiry market adjustments.

Ethereum (ETH) is priced at US$1,875.25, a 6.4 percent decrease over 24 hours. The cryptocurrency reached an intraday low of US$1,866.54 and a high of US$1,900.19.

Altcoin price update

- Solana (SOL) is currently valued at US$129.44, down 6.9 percent over the past 24 hours. SOL experienced a low of US$129.17 and a high of US$131.56 on Friday.

- XRP is trading at US$2.18, reflecting a 6.9 percent decrease over the past 24 hours. The cryptocurrency recorded an intraday low of US$2.16 and a high of US$2.22.

- Sui (SUI) is priced at US$2.49, showing a 9.7 percent decrease over the past 24 hours. It achieved a daily low of US$2.49 and a high of US$2.56.

- Cardano (ADA) is trading at US$0.6961, reflecting a 5.2 percent decrease over the past 24 hours. Its lowest price on Friday was US$0.66925, with a high of US$0.7031.

Crypto news to know

SEC onboards Musk's DOGE team members

Reuters reported that the US Securities and Exchange Commission (SEC) has begun onboarding members from Elon Musk’s Department of Government Efficiency (DOGE) team.

“Our intent will be to partner with the DOGE representatives and cooperate with their request following normal processes for ethics requirements, IT security or system training, and establishing their need to know before granting access to restricted systems and data,” states an email to SEC staff, according to Reuters.

Atkins questioned at Senate confirmation hearing

SEC nominee Paul Atkins testified before the Senate Committee on Banking on Thursday (March 27).

During the hearing, he was questioned by Senate lawmakers regarding the sale of his consulting firm, Patomak Global Partners, which advised bankrupt cryptocurrency exchange FTX.

“Your clients pay you north of US$1,200 an hour for advice on how to influence regulators like the SEC, and if you’re confirmed, you will be in a prime spot to deliver for all those clients who’ve been paying you millions of dollars for years,” said Senator Elizabeth Warren during the hearing. She also requested that Atkins disclose the firm's potential buyers, suggesting they may “buying access to the future chair of the SEC."

Atkins said he will abide by the process of government ethics, but did not directly answer Warren's question.

Senator John Kennedy also grilled Atkins about whether he will pursue the parents of FTX founder Sam Bankman-Fried, who Kennedy alleged may have been involved in and profited from his business affairs. Kennedy said if Atkins' position with the SEC is confirmed, he will “pounce on (Atkins) like a ninja” to investigate the matter further.

United Arab Emirates set to launch Digital Dirham CBDC

The United Arab Emirates is moving forward with its central bank digital currency (CBDC) plans, announcing that the Digital Dirham will be launched for retail use by the last quarter of 2025, the Khaleej Times reported.

The central bank of the United Arab Emirates has developed an integrated Digital Dirham platform that will support retail, wholesale and cross-border transactions.

The CBDC will be accessible through licensed financial institutions, including banks, fintech firms and exchange houses, and will be accepted alongside physical cash across all payment channels.

This initiative follows the United Arab Emirates' efforts to regulate stablecoins and aligns with global trends, as countries like China, Russia and Sweden also push forward with CBDC pilot programs.

The United Arab Emirates' Digital Dirham is expected to enhance financial security, streamline transactions and provide regulatory oversight beyond what private stablecoins can offer.

UK regulator plans to enforce stricter crypto authorization regime

The UK's Financial Conduct Authority (FCA) announced that it will introduce a new authorization framework for crypto firms in 2026, significantly increasing regulatory scrutiny in the sector.

Under the proposed "gateway regime," crypto companies, including major exchanges such as Coinbase and Gemini, will need to obtain authorization to operate beyond existing anti-money laundering (AML) requirements.

The FCA has been tightening its oversight, with only 50 out of 368 applicants successfully registering under its AML framework since 2020. Upcoming consultations will define which crypto activities require authorization, with a focus on stablecoins, trading platforms and staking services.

Industry participants have just over a year to prepare for these stricter compliance measures, which are expected to reshape the regulatory landscape for digital assets in the UK.

BlackRock expands Bitcoin ETP to Europe

BlackRock has launched its iShares Bitcoin exchange-traded product (ETP) in Europe, making it available on major exchanges like Xetra, Euronext Amsterdam and Euronext Paris.

This expansion is a milestone for institutional Bitcoin adoption in the region, following the success of BlackRock’s US-based iShares Bitcoin Trust ETF (NASDAQ:IBIT), which has accumulated over US$49 billion in assets.

However, analysts believe that demand for the European ETP will be more muted, citing differences in market structure, investor appetite and regulatory clarity.

While Bitcoin exchange-traded funds (ETFs) in the US have benefited from deep institutional participation, the European market is still developing. Experts suggest that BlackRock’s entry into Europe could encourage further institutional involvement, but widespread adoption may take time as regulatory frameworks evolve.

Nasdaq files to list Grayscale's spot Avalanche ETF

Nasdaq is seeking permission from the SEC to list Grayscale Investments’ spot Avalanche ETF. The proposed AVAX ETF would be a conversion of Grayscale Investments’ close-ended AVAX fund, launched in August 2024, which currently holds around US$1.76 million worth of assets under management.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.