Crypto Market Recap: Stablecoin Market Makes Headway, SharpLink Stocks Up on ETH

The crypto market pulled back as attacks in the Middle East sent investors toward traditional safe-haven assets.

Here's a quick recap of the crypto landscape for Friday (June 13) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ethereum and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ethereum price update

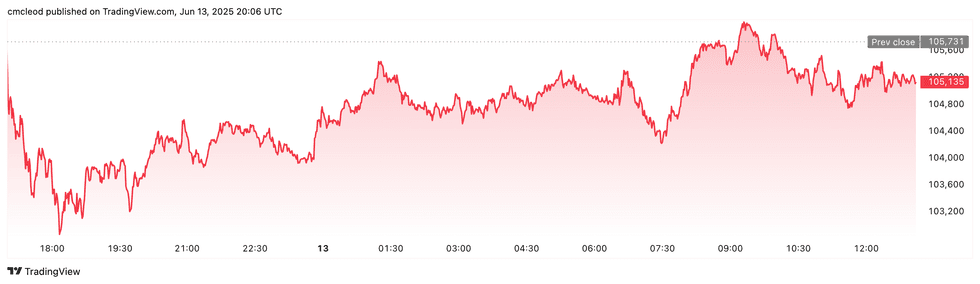

Bitcoin (BTC) was priced at US$105,555, a decrease of 1.6 percent in 24 hours after an earlier slide of over 4 percent. The day's range for the cryptocurrency brought a low of US$104,309 and a high of US$105,918.

Bitcoin price performance, June 13, 2025.

Chart via TradingView.

Bitcoin dropped sharply after Israel's airstrikes on Iran, with over US$400 million in long trades wiped out before its price consolidated at around US$105,000. This came just days after Bitcoin came close to its May 22 record of US$111,940.

Gold and oil prices rose while Bitcoin fell, and a Bollinger band analysis shows a typical three push pattern, often signaling the end of a rally. Popular trader CrypNuevo said there could be “more upside” to come as long as the price doesn’t dip below the US$100,000 level.

Ethereum (ETH) ended the day at US$2,529.19, a 6.3 percent decrease over the past 24 hours, after reaching an intraday low of US$2,513.97 and a high of US$2,576.80.

Altcoin price update

- Solana (SOL) closed at US$145.08, down 6.3 percent over 24 hours. SOL experienced a low of US$144.19 and reached a high of US$148.20 on Friday.

- XRP was trading at US$2.13, down by 3.6 percent in 24 hours. The cryptocurrency's lowest valuation today was US$2.12, and its highest was US$2.16.

- Sui (SUI) was trading at US$3.01, showing a decrease of 7.5 percent over the past 24 hours. It reached an intraday low of US$2.98 and a high of US$3.07.

- Cardano (ADA) closed at US$0.6319, down 5.5 percent over the past 24 hours. Its lowest valuation on Friday was US$0.6291, and its highest valuation was US$0.6426.

Today's crypto news to know

Tether expands gold exposure

Tether Investments has acquired a 31.9 percent stake in Canadian gold royalty firm Elemental Altus Royalties (TSXV:ELE,OTCQX:ELEMF) via the purchase of 78,421,780 common shares from La Mancha Investments.

Valued at C$1.55 (US$1.14) per share, the transaction cost Tether roughly US$89.4 million and brings its total stake in the royalty firm to 33.7 percent. While the official announcement didn’t come until Thursday (June 12), the deal was finalized on Tuesday (June 10). The company also shared that it signed an option agreement that will allow it to acquire a further 34,444,580 common shares owned by AlphaStream subsidiary Alpha 1 SPV.

Executing the option would bring Tether's interest in Elemental Altus to 47.7 percent.

“Tether’s growing investments in gold and Bitcoin reflect our forward-looking strategy to build a more resilient and transparent financial system,” Paolo Ardoino, CEO of Tether, said. “By gaining exposure to a diversified portfolio of gold royalties through Elemental, we are strengthening the backing of our ecosystem while advancing Tether Gold and future commodity-backed digital assets.”

Betting platform becomes second largest ETH holder

Sports betting platform SharpLink Gaming (NASDAQ:SBET) has become the world’s largest publicly traded ETH holder with its latest acquisition of 176,271 ETH for approximately US$463 million.

The company has an average acquisition price of US$2,626 per coin.

According to a Friday announcement, the company has increased its ETH holdings by 11.8 percent per share since June 2, primarily using US$79 million raised through its stock sales, in addition to an earlier private investment.

The company said over 95 percent of its ETH was deployed in staking and liquid staking platforms, earning yield while contributing to Ethereum’s network security.

“This is a landmark moment for SharpLink and for public company adoption of digital assets,” said Rob Phythian, CEO of SharpLink Gaming. “Our decision to make ETH our primary treasury reserve asset reflects deep conviction in its role as programmable, yield-bearing digital capital.”

Retail giants explore stablecoin issuance

Walmart (NYSE:WMT) and Amazon (NASDAQ:AMZN) are reportedly in talks to launch their own stablecoins, according to sources cited in a Wall Street Journal report published on Friday morning.

The move would mark a shift in how these two major retailers manage payments, with the potential to eliminate billions in bank fees and streamline e-commerce and cross-border transactions.

This report comes days after the US Senate advanced the Guiding and Establishing National Innovation for US Stablecoins, or GENIUS Act, in a 68 to 30 procedural vote.

On Thursday, a notice was issued by Senate Democrats for a full chamber vote on the GENIUS Act. It is scheduled for June 17, coinciding with the start of the Federal Open Market Committee's two day meeting.

Coinbase announces several new offerings

Coinbase made a series of announcements on Thursday at its annual State of Crypto Summit, unveiling a plan to evolve from a crypto exchange into a full-scale decentralized and centralized financial app.

First, the company’s chief legal officer, Paul Grewal, revealed that all tokens on Coinbase’s Ethereum Layer 2 network, Base, are now tradable directly on the Coinbase platform, giving developers building on Base access to Coinbase’s ecosystem of over 100 million users. Meanwhile, Max Branzburg, Coinbase’s vice president of consumer and business products, announced that the company will soon offer perpetual futures contracts under Commodity Futures Trading Commission oversight, marking a major easing of restrictions for US crypto traders.

Also at the event, a partnership was announced between Coinbase and Shopify (NYSE:SHOP) that Shopify has begun accepting payments in USDC stablecoin from customers on Base. Currently in early access, the new payment option could help normalize on-chain payments among mainstream e-commerce businesses and consumers.

Coinbase also introduced the Coinbase One Card, a co-branded American Express (NYSE:AXP) credit card slated for release this fall that will offer up to 4 percent cashback in Bitcoin.

Finally, it revealed Coinbase Business, a new full-stack platform offering for streamlining financial workflows with features including instant crypto payment settlements, up to 4.1 percent annual percentage yield on USDC and streamlined integration with accounting tools such as Intuit (NASDAQ:INTU) QuickBooks and XERO (NASDAQ:XRX).

These announcements help further Coinbase’s vision to position itself as a one stop shop for Web 3 businesses.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.