Crypto Market Update: Morgan Stanley Files for Bitcoin and Solana ETFs, Ethereum Trust

Following intensifying competition among traditional asset managers, Morgan Stanley has gradually widened crypto access for clients since last year.

Here's a quick recap of the crypto landscape for Wednesday (January 7) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ether price update

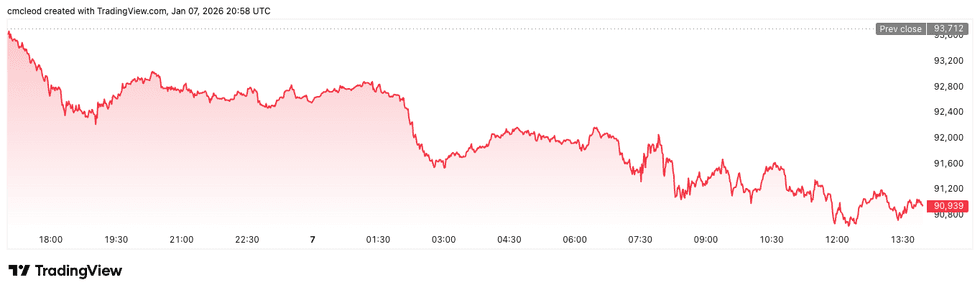

Bitcoin (BTC) was priced at US$90,954.60, down by 1.7 percent over 24 hours.

Bitcoin price performance, January 7, 2026.

Chart via TradingView.

Ether (ETH) was priced at US$3,136.30, down by 3.3 percent over the last 24 hours.

Altcoin price update

- XRP (XRP) was priced at US$2.18, down by 3.6 percent over 24 hours.

- Solana (SOL) was trading at US$135.63, down by 2.3 percent over 24 hours.

Today's crypto news to know

Morgan Stanley files for Bitcoin, Solana ETFs

Morgan Stanley (NYSE:MS) has filed registration statements for Bitcoin and Solana exchange-traded funds (ETFs), marking its first direct entry into the rapidly expanding US crypto ETF market. The bank also submitted paperwork for an Ethereum trust, signaling a broad-based push into digital assets rather than a single-product experiment.

The filings outline trusts that would hold the underlying assets, with the Solana product set to include a staking component that would generate yield from network participation. The trusts would be sponsored by Morgan Stanley Investment Management, according to regulatory documents.

Following intensifying competition among traditional asset managers, Morgan Stanley has gradually widened crypto access for clients, including opening limited exposure through its wealth management arm last year.

a16z invests in Babylon

a16z crypto has invested US$15 million in Babylon's $BABY token to support turning idle Bitcoin into active collateral for DeFi lending, according to a Wednesday announcement.

The core problem Babylon addresses is that Bitcoin, while a premier store of value, lacks easy utility for applications like loans or earning interest. Babylon's solution is a protocol enabling native Bitcoin staking and lending via "trustless vaults." This technology effectively unlocks Bitcoin's potential beyond its traditional role.

Starting as a Bitcoin staking platform, Babylon quickly expands its scope to lending. By utilizing advanced technology like witness encryption in its trustless vaults, the protocol allows Bitcoin to power DeFi natively, removing the need for wrappers or custodians. This provides credibly neutral collateral essential for loans, perpetuals and stablecoins.

Polymarket, Dow Jones partner for prediction market data distribution

Prediction market Polymarket and Dow Jones announced an exclusive partnership through which Down Jones will distribute Polymarket's real-time prediction market data across Dow Jones consumer platforms, including the Wall Street Journal, Barron’s, MarketWatch and Investor’s Business Daily.

This collaboration will offer audiences greater visibility into prediction market signals across economic, political and cultural topics. Polymarket data will be displayed via dedicated modules on Dow Jones digital properties and in select print. Dow Jones will introduce new consumer features incorporating this data, such as a custom earnings calendar showing market-implied expectations for corporate performance, with more data-driven experiences planned.

Dow Jones CEO Almar Latour stated the firm is making this source of real-time collective insight accessible to help users interpret market sentiment and assess risk alongside traditional financial indicators.

Polymarket founder and CEO Shayne Coplan noted the partnership combines journalistic insight with real-time market probabilities on key business news, like public company earnings, creating a truly comprehensive news experience.

Strategy shares rise after MSCI abandons index exclusion plan

Shares of Michael Saylor's Strategy (NASDAQ:MSTR) climbed in premarket trading after MSCI (NYSE:MSCI) dropped a proposal to exclude crypto treasury firms from its equity indexes.

The decision eased near-term concerns for companies that hold large digital asset positions as part of their balance sheets, often referred to as digital asset treasury companies. MSCI had argued that such firms resemble investment funds, which are typically barred from inclusion, a stance that rattled the sector when floated last fall.

Strategy, formerly MicroStrategy, is widely viewed as the archetype of the model after amassing a massive Bitcoin position beginning in 2020.

Digital Asset, Kinexys to bring JPM Coin to Canton Network

Digital Asset and JPMorgan's (NYSE:JPM) blockchain unit, Kinexys, have announced plans to collaborate on the native issuance of Kinexys' deposit token, JPM Coin (JPMD), on the Canton Network.

JPMD is the first bank-issued US dollar-denominated deposit token. According to the announcement, integrating JPMD with Canton creates a secure foundation for regulated, interoperable digital money, enabling institutions to issue, transfer and redeem JPMD near-instantly within the Canton ecosystem

Under the terms of the deal, the integration will be phased in throughout 2026. The partnership will also explore integrating other Kinexys Digital Payments products, like JPMorgan's Blockchain Deposit Accounts, to broaden offerings for Canton ecosystem participants.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.