Crypto Market Recap: Strategy Buys US$180 Million Worth of Bitcoin, GENIUS Act Stalls

A statement from a group of lawmakers has thrown the immediate future of the GENIUS Act into question.

Here's a quick recap of the crypto landscape for Monday (May 5) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ethereum and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ethereum price update

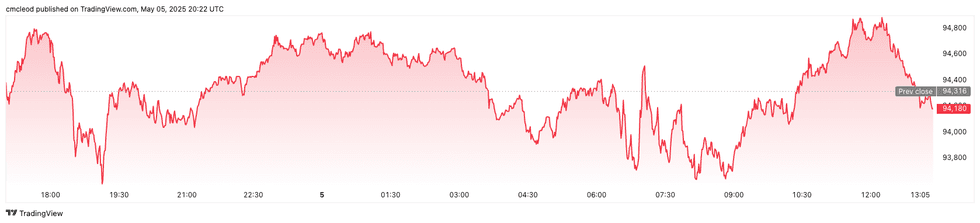

Bitcoin (BTC) was priced at US$94,808.21 as markets wrapped for the day, down 1.2 percent in 24 hours. The day's range has seen a low of US$93,704.12 and a high of US$94,838.85.

Bitcoin performance, May 5, 2025.

Chart via TradingView.

Bitcoin's price has been stuck in a range of US$93,000 to US$97,900 since late April, failing to break above the US$98,000 resistance level. Profit-taking volume above statistical norms suggests strong selling pressure despite a large portion of Bitcoin's supply being in profit, creating potential for volatile price swings.

Analysts are waiting to see if Bitcoin can break above US$95,000 and then US$98,000 to aim for higher prices, while failure could lead to a drop toward US$92,000 or even lower targets between US$85,000 and US$75,000. Positive exchange-traded fund inflows and the upcoming US Federal Reserve meeting could provide bullish catalysts.

Ethereum (ETH) ended the day at US$1,824.90, a 0.7 percent decline over the past 24 hours. The cryptocurrency reached an intraday low of US$1,798.96 and saw a daily high of US$1,825.38.

Altcoin price update

- Solana (SOL) reached its peak at the end of the day, hitting a value of US$146.95, up 0.2 percent over 24 hours. SOL experienced a low of US$143.72.

- XRP is trading at US$2.16, reflecting a 1.5 percent decrease over 24 hours and its highest point of the day. The cryptocurrency recorded an intraday low of US$2.11.

- Sui (SUI) is priced at US$3.47, showing an increase of 5.4 percent over the past 24 hours. It achieved a daily low of US$3.40 and a high of US$3.48.

- Cardano (ADA) is trading at US$0.6716, down 3.3 percent over the past 24 hours. Its lowest price of the day was US$0.6566, and it reached a high of US$0.6717.

Today's crypto news to know

Saylor’s Strategy buys US$180 million worth of Bitcoin

Michael Saylor’s Strategy (NASDAQ:MSTR) has acquired another 1,895 BTC at an average price of US$95,167, bringing its total Bitcoin holdings to a staggering 555,450 BTC worth over US$38 billion.

The latest US$180.3 million purchase, funded through proceeds from 2024 common and STRK at-the-market offerings, signals the firm’s unwavering commitment to a Bitcoin-centric treasury strategy.

As of Sunday (May 4), Strategy’s average purchase price across all of its holdings stood at US$68,550 per coin, showing the company’s profitable long-term conviction. The market is watching closely as Strategy continues to be one of the largest institutional holders pushing Bitcoin as a macro asset.

Australia's path forward on crypto regulation

The Australian Labor Party secured a landslide victory in Saturday's (May 3) election, garnering 54.9 percent of the two-party-preferred vote compared to 45.1 percent for the coalition of the Liberal and National parties.

While both major groups committed to cryptocurrency reform during their campaigns, the opposition specifically promised to release draft legislation within 100 days of the election.

The burgeoning Australian cryptocurrency industry has been actively advocating for the government to prioritize the development and implementation of clear and supportive regulations. In a Monday statement, the government said a draft of digital asset legislation is slated to be released next month.

Bipartisan concerns stall GENIUS Act

A group of bipartisan lawmakers set back progress on the GENIUS Act on Saturday, issuing a joint statement regarding an updated version of the text released last week. This story was first reported by Politico.

These lawmakers, who voted in March to advance the bill, have indicated they would not support the legislation if it proceeds through Congress in its current form, highlighting the contentious nature of the proposed legislation and the need for potential amendments to garner broader support in the Senate.

The group is calling for “stronger provisions on anti-money laundering, foreign issuers, national security, preserving the safety and soundness of our financial system and accountability for those who don’t meet the act’s requirements."

“We must advance legislation that enshrines American leadership in the digital asset space and protects the US dollar for centuries to come. That time is now," Senator Bill Haggerty, one of the bill’s authors, posted on X.

“We have a choice here. Move forward and make any remaining changes needed in a bipartisan way, or show that digital asset and crypto legislation remains a solely Republican issue.”

The Senate is expected to begin considering the stablecoin bill in the coming days, with the first procedural vote anticipated as soon as next week. The bill needs support from at least seven Democrats to pass.

Arizona governor vetoes Bitcoin Reserve bill, labels crypto "untested investment"

In a decisive move against digital asset adoption at the state level, Arizona Governor Katie Hobbs vetoed a controversial bill that would have allowed the state to invest in Bitcoin using seized funds.

Senate Bill 1025 narrowly passed state legislature and aimed to establish a crypto reserve managed by the state, a first-of-its-kind initiative in the US. However, Hobbs dismissed the proposal, saying Arizona’s retirement and treasury systems should avoid “untested investments like virtual currency,” and emphasizing fiscal conservatism and a cautious approach to emerging financial instruments, even as crypto assets gain traction globally.

The veto effectively halts what could have been a landmark experiment in state-level Bitcoin adoption.

Maldives courts crypto billions in bid to become a blockchain finance hub

The Maldives, traditionally known for luxury tourism, is pivoting toward digital finance with a massive US$8.8 billion crypto investment deal led by MBS Global Investments, the family office of Sheikh Nayef bin Eid Al Thani.

The deal, which dwarfs the island nation’s US$7 billion GDP, involves building a massive blockchain-focused financial hub spanning 830,000 square meters and employing up to 16,000 people.

Maldives Finance Minister Moosa Zameer called the initiative crucial for economic diversification and a potential solution to mounting foreign debt obligations due over the next two years. Early financing commitments have already surpassed US$4 billion, with the remainder to be raised via equity and debt.

The proposed Maldives International Financial Center would transform the country into a key player in the global digital asset space. If realized, it could mark the most aggressive national pivot to crypto infrastructure in the Global South.

Binance to roll out crypto payments in Kyrgyzstan

Binance has signed a landmark partnership with Kyrgyzstan’s National Agency for Investments, aiming to introduce crypto payments and blockchain education as part of a broader national tech initiative. Through a memorandum of understanding, Binance Pay will soon enable crypto transactions for local residents and tourists, while Binance Academy will collaborate with Kyrgyz financial regulators and institutions to build out educational infrastructure.

The agreement was announced during Kyrgyzstan’s first Council for the Development of Digital Assets, with President Sadyr Japarov in attendance, highlighting high-level state support for crypto integration.

Binance’s regional head, Kyrylo Khomiakov, stressed the importance of the partnership in shaping regulatory clarity and fostering innovation in the country. Kyrgyzstan also committed to launching a central bank digital currency, the “digital som,” after a law granting it legal tender status was signed on April 18.

Tether teases launch of new AI platform

After announcing it was developing a website for an artificial intelligence (AI) tool in December 2024, Tether is teasing the upcoming launch of Tether AI, a new platform designed to offer “personal infinite intelligence."

The platform, originally slated to launch by the end of Q1 2025, will be able to directly interact with and facilitate payments made using USDt and Bitcoin through a peer-to-peer network.

It will not use API keys or depend on a single point of control. Instead, Tether AI will feature a fully open-source AI runtime operating on an intentionally resilient and censorship-resistant peer-to-peer network deeply integrated with Tether's open-source Wallet Development Kit (WDK), which was released in November 2024. By leveraging the WDK, Tether aims to facilitate self-custodial (or non-custodial) management of USDt and Bitcoin.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.