Crypto Market Update: Bitcoin Price Retreats Again After Mid-week Rise

Cryptocurrencies slid sharply as market volatility intensified and investor sentiment tipped into “extreme fear.”

Here's a quick recap of the crypto landscape for Friday (February 25) as of 1:30 p.m. UTC.

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrency market news.

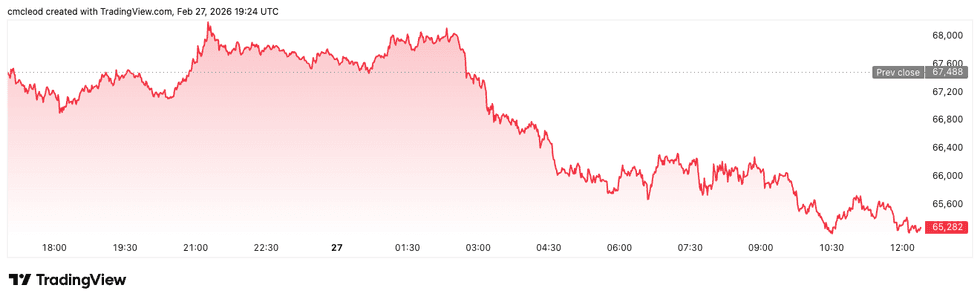

Bitcoin (BTC) was priced at US$65,260.11, down by 3.6 percent over the last 24 hours.

Bitcoin price performance, February 27, 2026.

Chart via TradingView.

A US$8.9 billion crypto options expiry drove “extreme fear” in the market, with price manipulation and re-hedging resulting in volatility. Bitcoin fell below the US$66,000 support level after a corrective rebound earlier in the week lost momentum, reflecting the fragility of the balance between risk appetite and available liquidity in global markets.

According to XS.com senior market analyst Rania Gule, Bitcoin's swift pullback suggests the recent uptick was merely a technical bounce within a more complex macro environment, rather than the beginning of a sustainable bullish wave.

“In the near term, I expect Bitcoin to remain within a broad range between US$64,000 and US$70,000, with a slight bearish bias if geopolitical pressures persist and equity market momentum weakens," she said.

Ether (ETH) was priced at US$1,917.34, down by 5.5 percent over the last 24 hours.

Altcoin price update

- XRP (XRP) was priced at US$1.35, down by 3.7 percent over 24 hours.

- Solana (SOL) was trading at US$81.42, down by 5.5 percent over 24 hours.

Today's crypto news to know

Buterin sells US$43 million worth of Ether

Ethereum co-founder Vitalik Buterin sold approximately 17,000 ETH worth about US$43 million at the time of sale, with the funds set to go toward privacy and security initiatives.

Marathon partners with Starwood on AI data center

Shares of Bitcoin miner Marathon Digital Holdings (NASDAQ:MARA) surged after the company announced a partnership with Starwood Capital Group, a leading global private investment firm focused on real estate.

The two entities plan to build data centers for the artificial intelligence (AI) sector.

In a Wednesday (February 25) blog post, Zach Pandl, Grayscale's head of research, called the relationship between AI and blockchain “complementary from a fundamental standpoint.”

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.