Zinc Stocks: 5 Biggest Canadian Companies in 2025

Overview

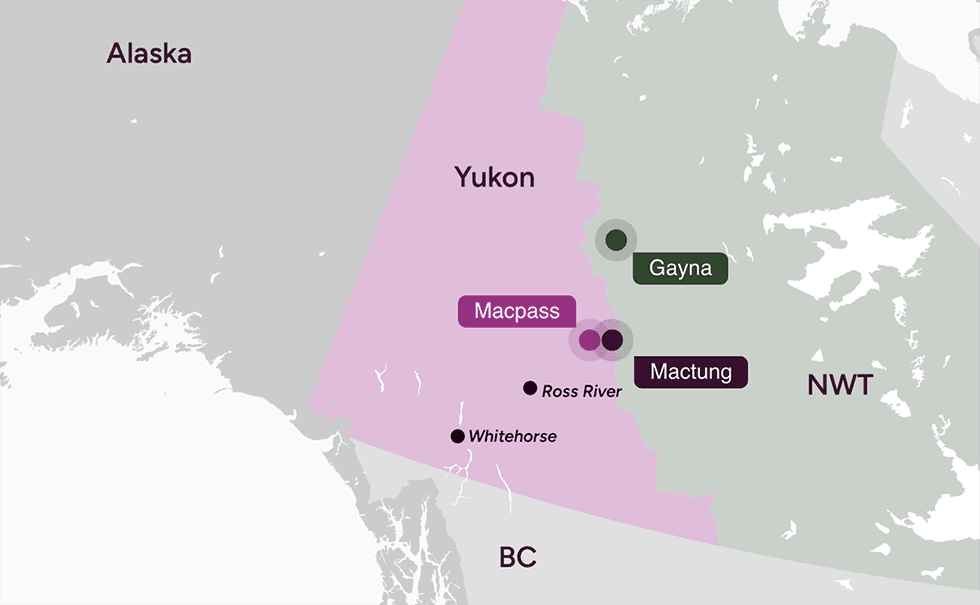

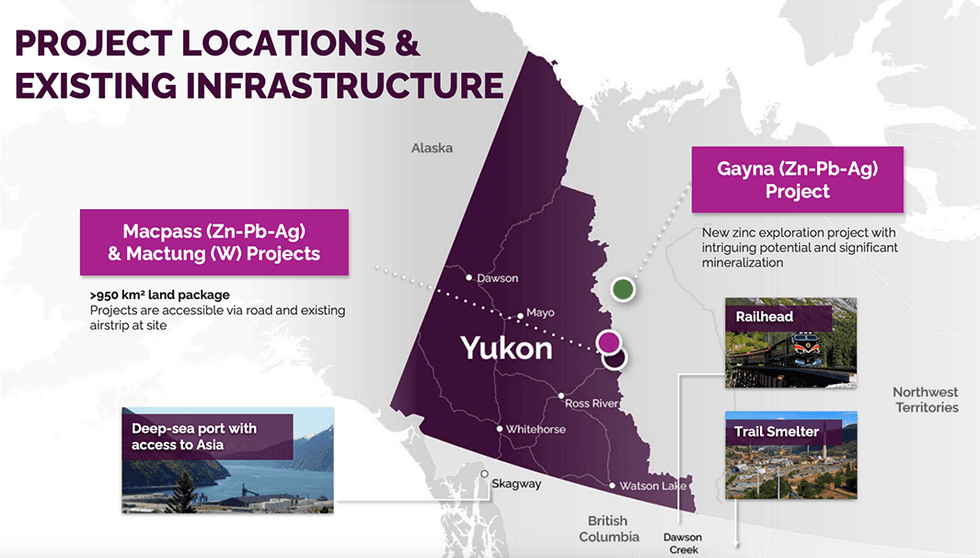

Fireweed Metals Corp. (TSXV:FWZ) is exploring for high-grade critical minerals at its wholly owned projects in Canada's Yukon and Northwest Territories (NWT). These projects, which focus on zinc and tungsten, should benefit from increasing government incentives under Canada’s Critical Minerals Strategy.

The Canadian government aims to shore up domestic supply of critical minerals needed to power the transition to green energy and reduce supply dependence on foreign countries, especially China, which currently dominates the global critical minerals supply chain. Under the Critical Minerals Strategy, the Canadian government provides mining companies with substantial tax and funding incentives, and a commitment to expedite the federal environmental impact review process.

The Yukon is home to deposits rich in critical minerals, such as copper, zinc, molybdenum, tungsten, tin, nickel and platinum group elements. The Yukon government's climate change plan, known as "Our Clean Future," lays the groundwork for increased investment in critical minerals, and positions the region to emerge as a world-class mining district.

The demand outlook for zinc and tungsten is robust. Zinc will remain in deficit over the coming decade, with a supply gap of around 6.9 million tons (Mt) by 2040. The tungsten market is anticipated to register strong growth due to its wide range of applications. According to Straits Research, the global market size for the metal was estimated at $4.4 billion in 2022 and is expected to reach $9.3 billion in 2031, representing a compounded annual growth rate of 8.7 percent. Fireweed’s focus on the exploration of critical minerals, such as zinc and tungsten, makes it an attractive investment candidate given the focus of Western governments on securing a 'friendly' supply of critical minerals in a market currently dominated by China.

The company has three core projects:

- The flagship Macpass Project represents one of the largest high-grade undeveloped zinc deposits globally*.

- The Mactung Project is one of the largest high-grade tungsten deposits, globally*.

- The Gayna Project is characterized by its high potential for zinc, germanium, gallium, lead and silver.

The successful 2023 drill program at Macpass, particularly the discovery of high-grade massive sulphide mineralization at the Boundary Zone, has increased the potential for the prospect to contribute significantly to a planned resource update in 2024, which should be accretive to the overall valuation of Fireweed. Further, the Mactung Project, as an advanced-stage development asset, holds substantial potential for medium-term production. The expected PEA study at Mactung in 2024 will reaffirm its potential as a leading domestic tungsten source in a North American market with marginal access to the commodity.

Company Highlights

- Fireweed Metals is a Canadian company that explores critical minerals, such as zinc and tungsten, in the Yukon and Northwest Territories in Canada.

- The company has three 100 percent owned projects in Canada — Macpass Project, Mactung Project and Gayna Project.

- The company’s flagship project — Macpass — boasts one of the world’s largest high-grade undeveloped zinc deposits*1.

- Likewise, the Mactung Project represents the world’s largest high-grade tungsten resource*2.

- The Gayna Project has high potential for discovering several minerals, including zinc, lead and silver, as well as gallium and germanium.

- Zinc, tungsten, gallium and germanium are on the U.S. and Canada’s critical mineral list as these countries try to shore up domestic supply to mitigate the supply dependence on China. Fireweed Metals is well-positioned to capitalize on the scarcity of these metals.

Get access to more exclusive Silver Investing Stock profiles here