Australia Precious Metals Update: Q1 2022 in Review

What has happened so far this year in the precious metals sector? INN reviews the major updates for gold, silver, platinum and palladium.

Dmitry Demidovich / Shutterstock

Click here to read the latest Australia precious metals update.

The first quarter of 2022 was a profitable one for the precious metals sector, with all four primary metals (gold, silver, platinum and palladium) registering value increases over the three month period.

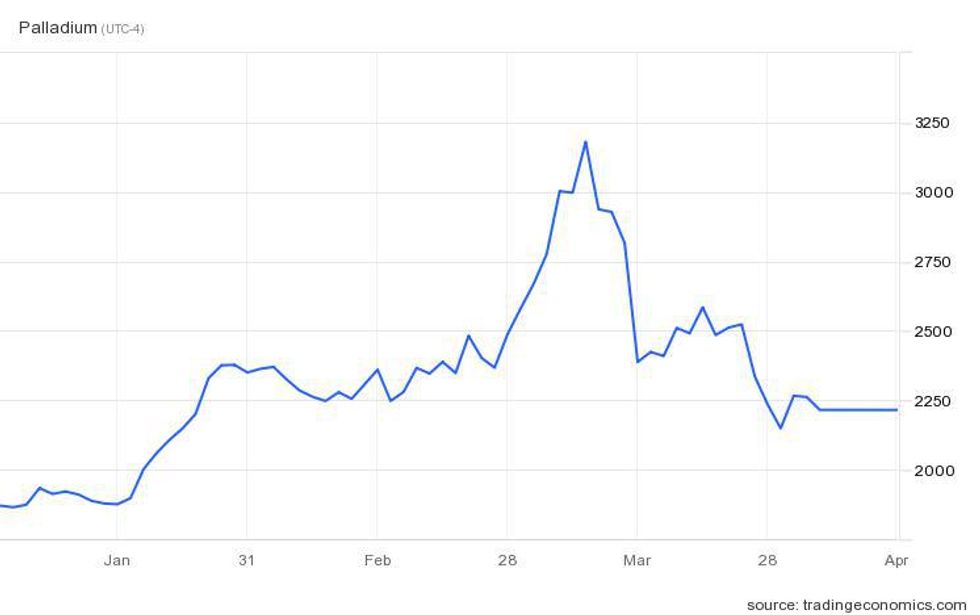

Palladium was the primary gainer, adding 22.77 percent to its value over the quarter, driven higher by constrained supply and demand fundamentals. In fact, between January and March 8, the automotive metal rose by 72 percent, starting the year at US$1,849 per ounce and rising to US$3,198.60.

By the end of March, palladium had shed some of the positivity to hold in the US$2,270 level.

Volatility inserted into markets stemming from Russia's invasion of Ukraine added tailwinds to all the precious metals, with palladium and platinum especially impacted by the war.

As the second largest producing country for both metals, concern over future supply was an impactful catalyst to price performance early in the year.

Platinum made more modest gains during the first three months of the year, up just 2 percent by the end of March. The metal made its most significant uptick between January and March 8, when values rose 23 percent from US$957.42 per ounce to US$1,154.80.

March 8 proved to be an important date in the sector with all four metals recording their biggest gains for the quarter on that day. The second week of March was punctuated with increasing concerns over inflation, which were reflected in the surging cost for energy, grain and base metals.

The realization that the worsening situation in Ukraine would not be quickly resolved also added to the uncertainty that sent precious prices higher.

“Commodity prices reached record high levels in 2021 due to the pandemic and the war has further pushed prices upwards,” said Paul Mitchell, global mining and metals leader at EY.

“Inflationary fears triggered a rush for safe haven investments during the ongoing market volatility that pushed the gold price up to US$2,000 per ounce," he continued. "Rising cash flows have enabled gold miners to improve their reserves through M&A, expansion of existing operations through exploration or developing new projects.”

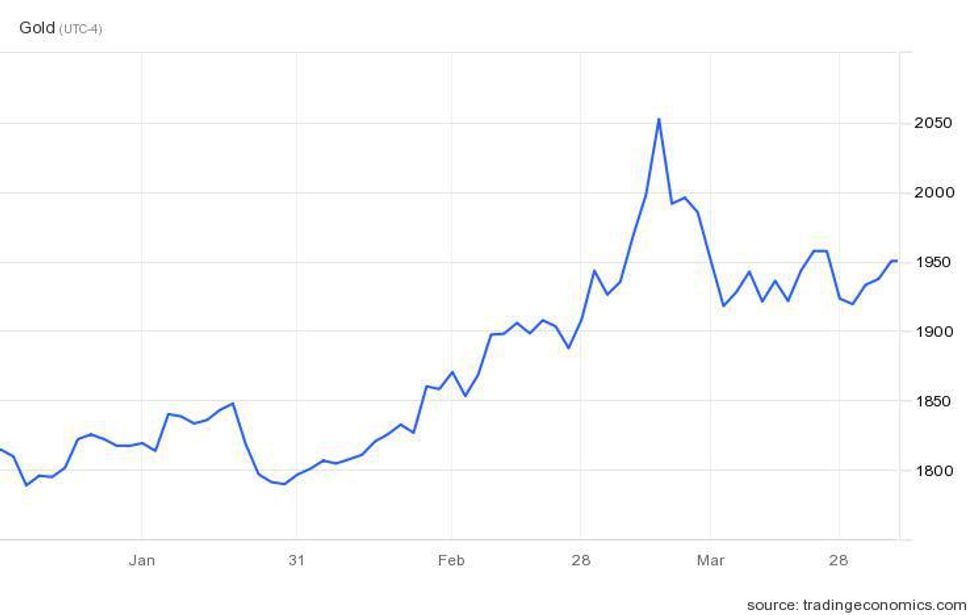

Australia precious metals update: Gold price marks another high

The yellow metal saw its biggest increase between January 30 and March 8, adding 14 percent to an 18 month intraday high of US$2,053.

Gold's Q1 2022 price performance.

Chart via Trading Economics.

Despite commodity prices soaring over the first 10 weeks of the year, as Rob Murdoch of Austex Resources explained there was a disconnect between gold’s rising value and the price of gold shares on the index.

“Gold shares have been dragged up by the market plus 4 percent, with the ASX resource sector overall up plus 12 percent,” the principal consultant said. “At the beginning of the year, I thought gold might do well with inflation, but the boycott of Russian mineral exports and the war in Ukraine have lifted the demand for other minerals, particularly oil, gas, coal, aluminum, fertilizers etc., resulting in interest elsewhere, and that demand has overridden inflation impacts so far this year.”

The broad interest across the resource sector has had another knock-on effect as well.

“The result has been that a number of Western Australia gold explorers have turned their hand to lithium exploration,” Murdoch said.

Diversifying a project not only makes it more economical, but it also entices investors looking to maximize their investment dollars.

“Everyone in business wants to grow. We have 30 percent more ASX resource companies today than three years ago,” he said, noting that mergers and acquisitions (M&A) across the entire Australian resource sector are likely to continue.

“In Western Australia, mills are hungry (for gold),” he added. “The cost of successful intersections has doubled in recent times. Gold producers will continue to have a look across the back fence and if they like what they see, they will acquire it.”

Gold will remain big business, with annual production estimated to grow an average of 6.8 percent annually over next three years, reaching an annual peak production of 390 tonnes in 2025 to 2026.

Demand is also on an upward trajectory. According to the Australian Government’s Resource and Energy Quarterly, global gold consumption increased by 9.9 percent year-on-year to 4,021 tonnes in 2021.

“The economic recovery from the pandemic provided support to gold jewelry demand in 2021, up 52 percent year-on-year, to 2,124 tonnes,” the March report reads. “China and India have led this recovery, as lower and more stable gold prices (compared with 2020) and rising personal income lifted gold demand.”

Last year, Australia’s gold sector contributed AU$23 billion to the economy from heightened demand paired with a gold price holding above US$1,775 an ounce for much of 2021.

Inside the gold sector there was also a lot of activity with several key mergers and acquisitions.

“In 2021 there were AU$13.65 billion gold deals completed and of those, AU$6.2 billion targeted Australian gold projects/companies,” EY’s Mitchell said. “Gold company valuations stabilized through 2021 as the gold price averaged US$1,800 for most of the year, and as a result, execs have been more willing to consider deals or acquisitions to increase their gold project pipeline.”

The country’s status as second largest producer of gold and its favourable jurisdiction also benefited the sector.

“Australia has the world’s largest gold mine reserves,” he said. “Currently, there are 100 gold projects under development in Australia, of which 11 are currently undergoing construction, with anticipated operation commencement dates between 2022 to 2025.”

Gold’s overall market fundamentals for the next three years are another factor Mitchell believes makes the yellow metal alluring for miners and explorers.

“The scarcity of gold assets, market pressure to bulk up firm valuations and depleting gold reserves should prompt large mining companies to consider the acquisition of smaller miners in 2022, to access higher-quality projects with large reserves and active mines,” Mitchell told INN.

“We are seeing interest from investors in Western Australia’s goldfields region, in particular on St. Barbara (ASX:SBM).”

Australia precious metals update: Silver price growth could drive investment

As for sister metal silver, despite having some of the largest global silver reserves, Australia ranks fifth in annual production.

Output of the white metal often takes a back seat to other more profitable metals. Of the 1.3 thousand tonnes of silver that were mined across Australia in 2021, the vast majority was a by-product of underground lead-zinc or copper mines.

Although this trend could change as miners look to optimize deposits through diversification and sustained silver price growth.

“The price is actually up 11 percent over the past 12 months whereas the price of gold has fallen 4-5 percent,” Austex’s Murdoch said. “But all other metals have done better than silver, so it has lagged behind. Maybe silver will catch up should the increased interest in gold prices occur.”

Silver prices started 2022 hovering just below US$23 an ounce and rose 19 percent by March 8. By the end of March prices consolidated at the US$24.85 level an 8.33 percent increase from January.

Australia precious metals update: Platinum, palladium benefit from mounting demand

Bolstered by soaring demand and the precarious production situation, palladium and platinum are forecasted to see more price upside in the months ahead, especially if the Russia/Ukraine conflict is not resolved.

“War in Ukraine has impacted global demand supply dynamics of commodities. Speculative buying and commodity hoarding are leading to supply tightness,” Mitchell said.

“Platinum supply is tight as most platinum stockpiles have been processed. Russia represents about 10 percent of the world's platinum supply, and demand is set to rise as companies look to substitute it for palladium.”

Palladium's Q1 2022 price performance.

Chart via Trading Economics.

With an ounce of platinum selling for US$918 (April 26) compared to an ounce of palladium trading for US$2,203, the transition may be sooner than later.

In fact, platinum demand from the auto sector, in which it is a critical component in catalytic converters, is anticipated to grow 19 percent this year to 3.2 million ounces.

Consistent price growth across the platinum group metals (PGM) suite has led to increased interest from explorers and miners.

“There is a lot more interest in PGM not only due to the price of platinum rising 17 percent over the last 12 years, but the exploration success of Chalice Mining (ASX:CHN) at Julimar in Western Australia,” Murdoch explained. “Exploration success like that in a certain geological province will always stimulate other exploration in the hope of finding a ‘look alike.’”

Chalice’s multi-metal Julimar project is poised to be a significant addition to the region's resource mix.

“We have seen some interest in PGMs in Australia, e.g. Chalice’s large Julimar discovery, (which has) a mix of platinum, gold, palladium, nickel, copper and cobalt,” Mitchell said. “PGM exploration is likely to increase as countries seek alternative sources as Russian supply is removed from the market due to sanctions.”

The global mining and metals leader at EY went on to point out that the New South Wales government is experiencing increased demand for exploration licenses.

“Demand for licenses for gold, critical minerals and high-tech metals reached a 10 year high last year,” he said. “So far this year, more than 226 applications have been granted or approved — the highest figure since 2008, and only the third time it has passed 200 in two decades.”

Australia precious metals update: Geopolitical tensions and jurisdictional ranking drive foreign investment

As the supply of goods coming out of Russia and Eastern Europe becomes more unstable, Australia becomes more attractive as a safe jurisdiction for mining and investment. This has been reflected in Western Australia's recent ranking atop the list of best mining investment destinations.

“The Fraser Institute’s mining survey is the most comprehensive report on government policies that either attract or discourage mining investors, and Western Australia ranks highest of anywhere in the world,” Elmira Aliakbari, co-author of the report, wrote in the press release.

South Australia also made the list, ranking 10th.

The nation’s provinces ranking in the best jurisdictions for mining investment is already evident through the enhanced exploration for battery and critical metals in Australia, which are needed for new, rapidly evolving industries, according to Rob Murdoch.

“Exploration for lithium and rare earths are booming at present, also nickel,” Murdoch said. “(There is also) great research going on here in Australia that will hopefully lead to cheaper and better ways to explore, mine and produce metals.”

For Mitchell, the mounting geopolitical uncertainty elsewhere will be a key factor in bringing new investment dollars to Australia.

“Australia is attractive geologically, has a mature mining industry and expertise in extraction/processing, robust standards and is a stable jurisdiction,” Mitchell said. “With the exception of 2020, foreign investment into Australia has been steadily increasing and we expect this to continue as demand rises for minerals critical to the energy transition, and government policy supports the building of a safe and productive mining industry.”

Australia precious metals update: What’s next for precious metals?

Both experts INN spoke to see the duration and impact of the war having a significant effect on the metals sector in the months ahead, as well as inflation and the monetary policy used to combat it.

“Inflation is at record highs, and this is likely to continue into Q2, keeping commodity prices high,” Mitchell told INN. “We expect central banks to continue increasing interest rates and this will have the effect of slowing economic growth, which would mean less demand for commodities, potentially pushing prices down over the medium-term.”

Continued supply chain and transport issues lingering from the pandemic could also impact the broader resource sector. Longer term, the energy transition will play a key role in demand and supply.

While investment is on the rise, Murdoch warned, “As far as resources specifically are concerned, the lack of exploration success could be an issue for many companies should funds become harder to source.”

He added, “We have 30 percent more explorers hunting for treasure on the same area of land.”

Don’t forget to follow us @INN_Australia for real-time news updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Canaccord Analyst: Gold Sector Volatility Presents “Good Value ... ›

- 5 Top Australian Gold Stocks - Investing News Australia ›

- Gareth Soloway: Next Buying Level for Gold, Oil Outlook After Price ... ›

- Matt Watson: Silver Mine Supply Needs to Double, What's in Store ... ›