The most recent Resource Investing News biannual Investor Survey reveals that while investors remain optimistic about the long-term potential of the commodities markets, a large majority are hedging their bets on precious metals like gold and silver.

By Melissa Pistilli—Exclusive to Silver Investing News

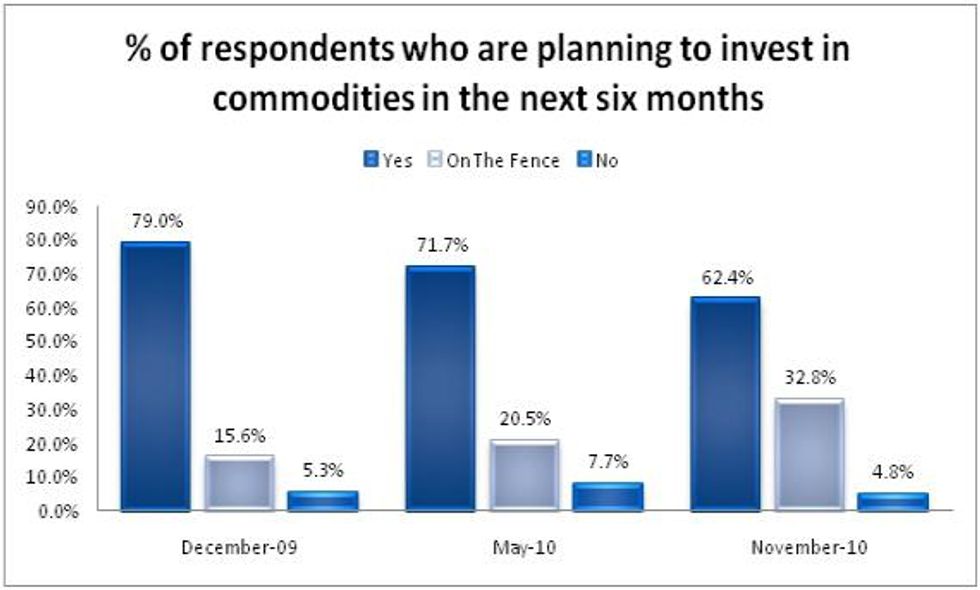

The most recent Resource Investing News biannual Investor Survey reveals that while investors remain optimistic about the long-term potential of the commodities markets, a large majority are hedging their bets on precious metals like gold and silver.The number of survey respondents who indicated they plan to invest in commodities in the next six months fell 9.3 percent points from the May 2010 survey to 62.4 percent. This percentage is an alarming 16.6 percent below the number reported in the December 2009 survey.

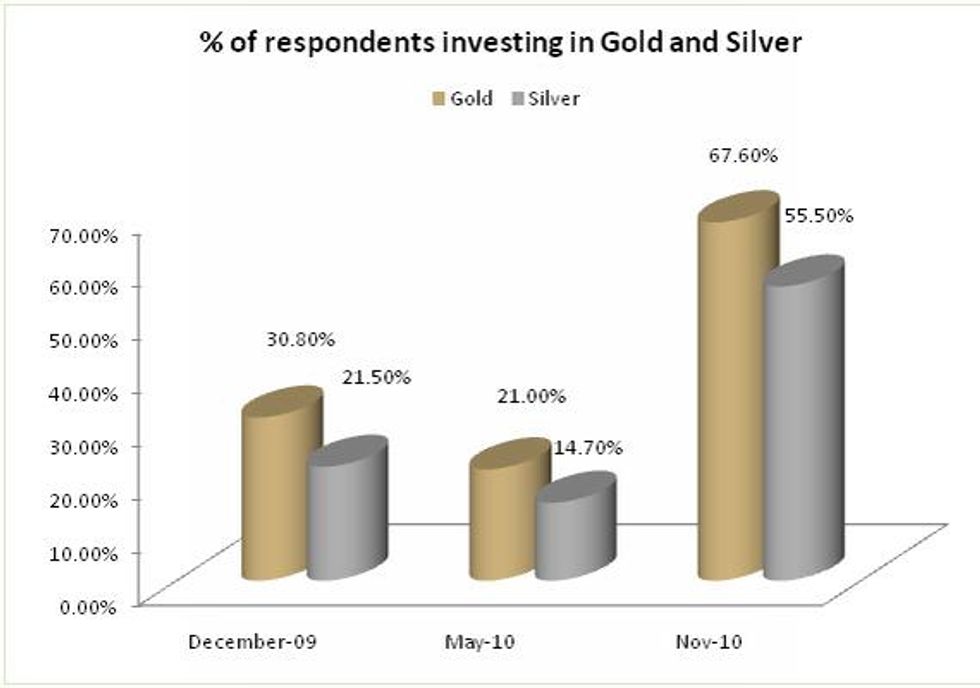

Despite this significant pullback in investor confidence, the percentage of respondents invested in gold and silver this year is up an impressive 46.6 and 40.8 percent respectively from the previous survey to 67.6 percent for gold and 55.5 percent for silver.

This remarkable surge in investor demand for precious metals has fueled the equally phenomenal rally in gold and silver prices this year.

On November 9, the spot price of gold reached a record $1,424.60 an ounce as silver flirted with the $29 an ounce level.

On Thursday, COMEX gold prices touched a high of $1399.70 an ounce on renewed dollar weakness and continuing eurozone debt issues before falling back to close at $1385.90 an ounce. Silver briefly jumped to $29.05 before closing at $28.56 an ounce in New York.

Investor appetite for precious metals as safe-haven assets has grown exponentially since the most recent global economic meltdown late in 2008.

Two years ago, in early December of 2008, gold prices were hovering around $780 an ounce with silver prices around $9.50 an ounce. By early December of 2009, gold prices had shot up over $400 to near $1215 an ounce in New York with silver trading at the $19 level.

Gold futures went on to break all-time highs in June of 2010 and silver zoomed to 30-year highs in September as its yellow cousin broke over $1300 an ounce.

The ongoing debt crisis in Europe, the teetering U.S. economy and the slowdown in economic growth in other regions of the world are pushing investors to seek the perceived safety of precious metals assets. Add to those troubles the mounting fears of inflation and currency debasement that may occur as result of governments trying to repair their broken economies and one can see why more and more investors are rushing to hold gold and silver.

Investment demand for gold is most notably seen in the rise and success of physically backed gold ETFs such as SPDR Gold Shares (NYSE:GLD), which has acquired about $56 billion with holdings that rival that of many central banks.

Asian demand for the yellow metal is heating up as well with China and India now battling for top spot in global gold consumption. Recent reports show investment demand has driven China’s gold imports up 600 percent in the first 10 months of 2010. Over the next ten years, China’s gold market is anticipated to double on retail investment and jewelry demand, says the World Gold Council. The Council also reports that gold imports to India for 2010 have exceeded 2009 levels.

Silver investment demand

Like gold, the silver price rally has benefited from the popularity of investor-friendly ETFs.

“Inflows in silver ETFs have evidently compensated for the withdrawal of speculative oriented financial investors. Nine hundred thirty-two tons of silver has flown into the world’s largest silver ETF, iShares Silver Trust, alone since the end of September,” said Commerzbank, as reported by Kitco’s Debbie Carlson last month.

At the recent New York Silver Dinner sponsored by the Silver Institute, GFMS chairman Philip Klapwijk attributed increased investment and rebounding industrial demand for silver’s spectacular price performance. A large part of investment demand is linked to silver-backed ETFs. “There’s been a tremendous run-up in silver ETF holdings over the past several months. These have been very sticky investments so far,” said Klapwijk.

The net value of total silver demand for 2010 is expected to reach about $4 billion, GFMS.

The gains of silver may be due in part to the price of gold becoming out of reach for the average individual investor. In India, the world’s largest importer of gold, there is a growing sentiment that silver is replacing the yellow metal. “Several major jewelry chains across India are promoting silver as affordable and modern jewelry in place of gold,” stated a report on Commodity Online. For the first half of 2010, silver imports in India rose 579 percent, for a total of $1.69 billion.

Forecasts for 2011 and 2012

Analysts expect the precious metals rally to extend into 2011. Both Deutche Bank and Commerzbank put gold at $1450 in 2011. Ronald Stoeferle, analyst at Erste Group Bank AG in Vienna anticipates gold reaching $1600 an ounce by June of 2011.

Goldman Sachs sees gold prices rising throughout the next year to peak at $1750 an ounce in 2012. BNP Paribas recently raised its 2011 gold price forecast 20 percent to $1500 an ounce and says it expects gold to average around $1600 in 2012. CIBC also raised its gold forecast to $1600 an ounce for 2011, and $1700 an ounce for 2012.

As for silver prices, CIBC anticipates silver prices averaging $28 an ounce in 2011 and $30 an ounce in 2012. Last month, GFMS announced it sees silver reaching $30 an ounce in 2011. And Scotia Capital set its long-term silver price target for 2011 at $26 an ounce with near term peaks of $30. The bank also sees silver reaching as high as $35 an ounce in the next 24 months.

While many precious metals fans are literally banking on rising gold and silver prices, the factors needed to take the metals, especially gold, to those levels are not favorable for most of the world in terms of standard of living.

In a recent blogpost, Floyd Norris, New York Times Chief Financial Correspondent, said it best:

“Betting that $1,400 gold will soon be $1,800 gold or $2,500 gold is basically a bet that the West really is in permanent decline this time, with countries facing the prospect of bankruptcy or sharp reductions in spending on everything from schools to pensions. Or perhaps all of the above. Let’s hope the bet is wrong.”