- WORLD EDITIONAustraliaNorth AmericaWorld

Overview

As the world approaches what analysts refer to as the point of no return for climate change, governments and industry leaders are ramping up their commitments to clean energy and net-zero carbon emission. But commitment alone may no longer be enough, as global emissions in 2023 reached 37.4 billion tons.

If the world is to fulfill its climate goals, greenhouse gas emissions must be reduced by 7.6 percent each year between 2020 and 2030, according to a United Nations report. The corporate sector has increasingly taken a leadership role in this arena, collectively committing over $100 trillion of market cap to meet net-zero obligations. While it's certainly possible for businesses to achieve the necessary reduction goals internally, carbon offsetting fills a crucial gap for those striving to achieve their net-zero goals, especially when immediate large-scale emission reductions are challenging.

Carbon credits can be generated from a wide range of projects and systems — including direct air capture and fuel switching — and under a wide set of legal arrangements. Carbon credits are defined through a project design document, which specifies all relevant details about the carbon credit project, also known as a voluntary market carbon project. This includes land title, volume, measurability and additionality.

All voluntary market carbon projects are governed and managed by one or more independent standards agencies, depending on the region. These agencies operate similarly to the International Accounting Standards Body, which is responsible for establishing and maintaining international financial reporting standards.

In the case of restoration and conservation-based projects, carbon credit rights may either be associated with or separate from their underlying land title. In both cases, the company responsible for maintaining the project must demonstrate that investment will result in additional restoration beyond what is already present. Credits may either be purchased directly or deployed under streaming or royalty agreements, which offer a share of revenue in exchange for investing in development.

Nature-based voluntary carbon projects can unlock 65 to 85 percent of carbon credits. Nature-based solutions are an important part of addressing the climate challenge, given that deforestation and degradation account for 20 percent of global carbon emissions. Moreover, by targeting highly productive, low-cost jurisdictions, companies can generate significant returns to scale.

This is the basis of Carbon Done Right's (TSXV:KLX, FSE:QIC) value proposition. Carbon Done Right is a leading provider of high-quality carbon credits sourced exclusively from afforestation and reforestation projects developed and owned by the company and its stakeholders.

Founded in 2021 by James Tansey, who holds a PhD in environmental science, Carbon Done Right conducts industrial-scale carbon exploration and development across multiple jurisdictions. Drawing on 15 years of experience leading the development of carbon projects — which has produced over 50 million tonnes of carbon credits to date — Tansey’s vision for Carbon Done Right is to become a leader in the protection and restoration of natural systems.

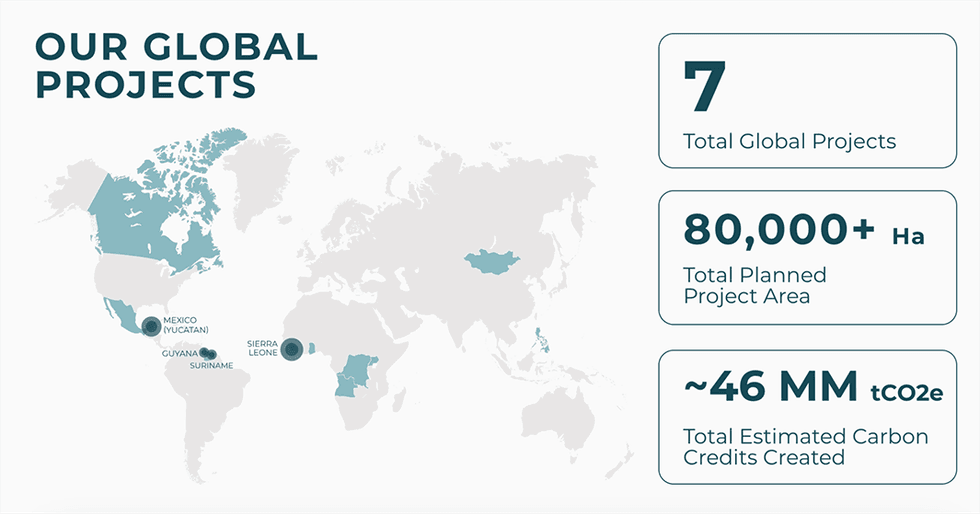

With some of the most senior executives from the carbon and resource sectors as part of its leadership team, Carbon Done Right works at the national level and develops nature-based carbon projects on an unprecedented scale. Currently, it owns between 40 and 100 percent of three initial assets and has a development pipeline with over 3 million tons spread across Latin America, Asia and Africa. With a total of seven global projects consisting more than 80,000 hectares, Carbon Done Right will create approximately 46 million tons of total carbon credits.

The company's operations in Sierra Leone and its commitment to delivering high quality carbon credits have been proven through rigorous third-party protocols and the success of its first financial partnership with UK-based BP Carbon Trading involving a funding agreement of US$2.5 million.

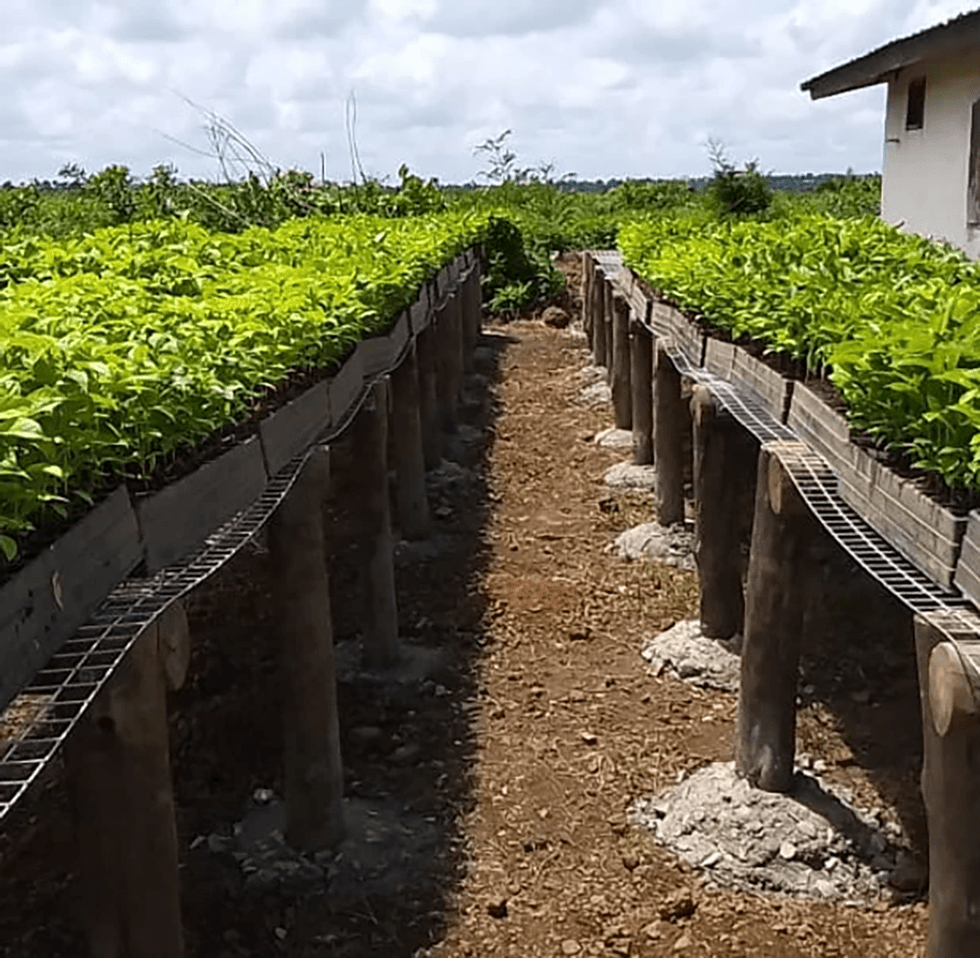

Carbon Done Right is developing a large-scale rewilding and reforestation project in Sierra Leone, for an initial area of 5,000 hectares, which will produce up to 1.9 million tons of validated and verified Verra carbon credits over 30 years. A Fortune 100 company has earlier pre-purchased the rights to carbon credits for the initial 5,000 hectares. The project area can be extended by a further 20,000 hectares.

The company has completed almost 1,500 hectares in the 2023 planting season and has submitted the project design document for final approval with an independent validation company. In late 2023, the company made the decision to switch to the new restoration protocol announced by Verra, the global registry for carbon projects. Switching to the new protocol ensures all Carbon Done Right projects are aligned with the company’s commitment to high-integrity credits. The change is not expected to create any significant delays to its projects.

To date, Carbon Done Right has mapped and verified almost 20,000 hectares of land for restoration and is working with NGO Namati to ensure landowner agreements are concluded under independently observed free and prior informed consent. There are large areas of degraded land that could be restored under this same model and the company is pursuing a mangrove restoration and conservation project covering up to 10,000 hectares.

Carbon Done Right projects generate substantial economic benefits for the communities in the regions where they operate. The company shares income through employment opportunities, smallholder lease payments, and revenue-sharing agreements, particularly in regions with high levels of poverty and unemployment.

In further pursuit of quality credits, Carbon Done Right launched a proprietary remote sensing and monitoring technology, called the Carbon Quantification System (CQS). Powered by artificial intelligence and machine learning, the technology is expected to be a significant advancement in the precision, traceability and accountability of the company's carbon credit generation process.

In March 2024, the company announced its intention to acquire the London Carbon Exchange (LCE), a fully developed blockchain-enabled carbon trading platform. The platform offers key capabilities within the block-chain-enabled carbon trading ecosystem: transparency, traceability and verification of carbon credit transactions; a decentralized marketplace for carbon credits; and tokenization and trading of carbon credits. Combined with the highly innovative CQS, the LCE acquisition further supports Carbon Done Right's commitment to the rapid growth of investment in large-scale carbon credit restoration and conservation projects on degraded and threatened land.

Carbon Done Right is backed by a leadership team consisting of veterans from both the carbon and resources sectors, led by its CEO James Tansey. Director Celia Francis is a pioneer in the climate tech space. Board member Abayomi Akinjide has substantial experience in complex cross-border mergers and acquisitions alongside a host of other legal challenges. And Kevin Godlington, director of operations, is a specialist in post-conflict stabilization, stemming from his position as a former member of the British Foreign Office.

Company Highlights

- Carbon Done Right is a carbon credit project developer focused on natural based solutions such as conservation, reforestation and mangrove restoration.

- Through collaboration with jurisdictional government and its own network of partners and developers, Carbon Done Right develops low-cost carbon offset projects in highly productive jurisdictions.

- The company already maintains between 40 and 100 percent ownership of three initial assets alongside a development pipeline of 3 million tons of carbon credits diversified across Asia, Latin America and Africa.

- With a total of seven global projects consisting more than 80,000 hectares, Carbon Done Right will create approximately 46 million tons of total carbon credits.

- Carbon Done Right has secured a pre-purchase agreement with a Fortune 100 company for the rights to the carbon credits from an initial 5,000 hectares in the Sierra Leone project. Almost 1,500 hectares of planting have been completed in 2023.

- The company works with some of the largest buyers in the world including Fortune 100 companies.

- Carbon Done Right currently maintains a 60-percent interest in sustainable coconut and spice producer and processor Pomeroon.

Get access to more exclusive Cleantech Investing Stock profiles here