- WORLD EDITIONAustraliaNorth AmericaWorld

Overview

The uranium market is on the rise. Market research expects global demand for the mineral to continue to grow in the coming years, with more than a dozen nuclear reactors slated to come online, followed by steady rollouts.

These changes in the energy space pose great growth opportunities for junior companies. As the market expects price adjustments for uranium to accommodate a limited supply and growing demand, companies developing uranium assets could be an integral part of producing the building blocks of energy futures.

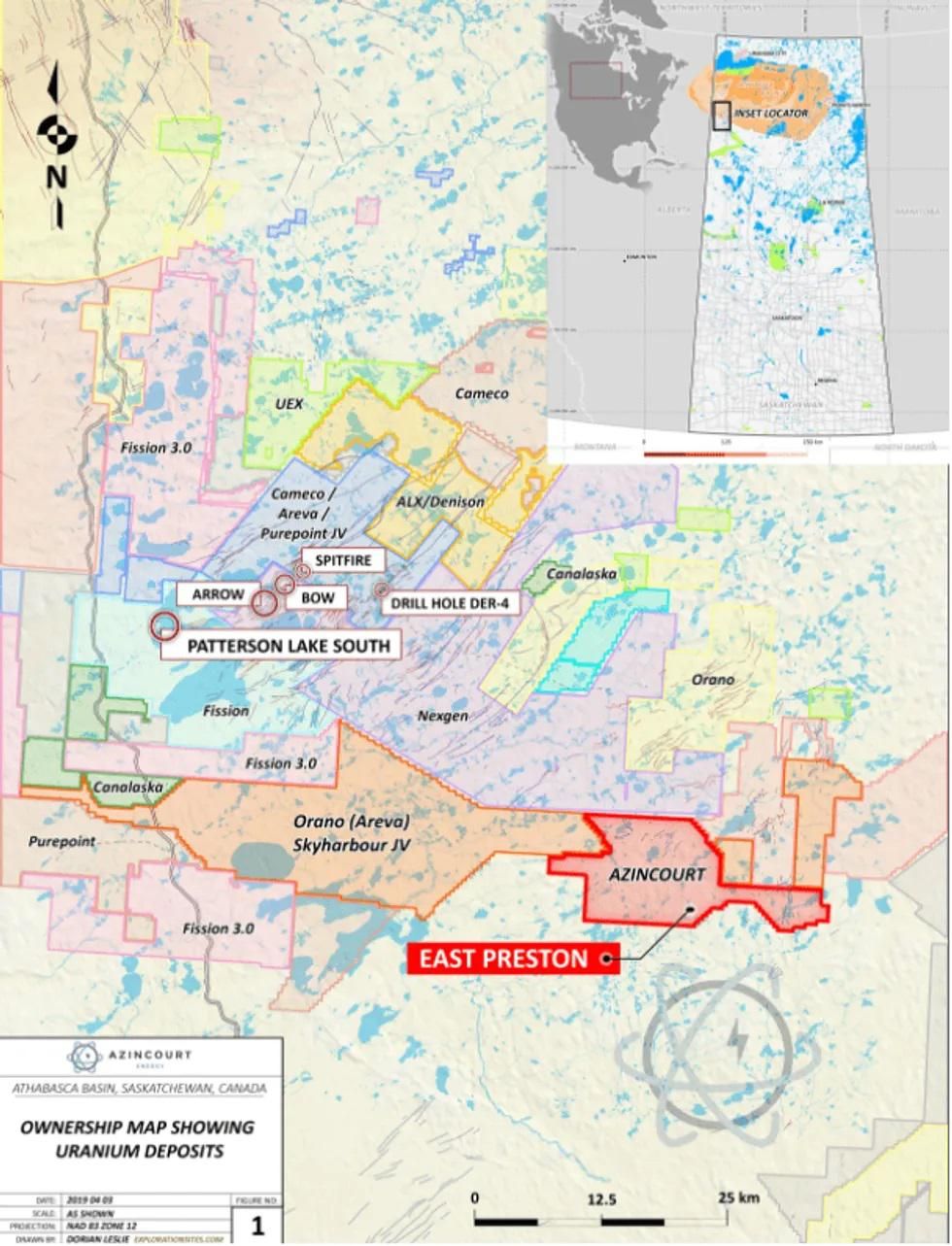

Azincourt Energy (TSX.V:AAZ, OTCQB:AZURF, FSE:A0U2) is a Canadian resource company focused on acquiring, exploring and developing critical alternative energy projects for uranium and lithium. The company is currently developing its joint venture East Preston uranium project in the Athabasca Basin, Saskatchewan, Canada, as well as the Escalera Group uranium-lithium project located in Peru’s Picotani Plateau.

The company’s joint venture partners for the East Preston uranium project include Skyharbour Resources (TSXV:SYH) and Dixie Gold (TSXV:DG), both with 15 percent ownership. Azincourt controls a majority interest of 70 percent in the asset, having spent C$2.5 million on the project and paid C$1 million in cash payments since 2017.

The surrounding Athabasca Basin region is a world-class district with the largest, highest grade uranium deposits in the world. The property leverages a rich uranium mining history, a stable political climate and pro-mining policies on the federal and provincial government levels.

The East Preston project is adjacent to NexGen Energy (TSX:NXE), which has a market cap of C$1.69 billion, and Orano, the second largest uranium producer in the world. The overall area surrounding the property contains over C$10 billion in market capitalization.

In Peru, Azincourt’s Escalera Group property consists of three concessions: Escalera, Lituania and Condorlit. They cover a combined area of 7,400 hectares of prospective exploration targets for volcanic-hosted supergene/surficial uranium and lithium on the Picotani Plateau in the Puno district of Southeastern Peru.

The properties are located in a mineral-rich district where mining giants like Minsur and Rio Tinto operate alongside growing mid-tiers and juniors like Bear Creek Mining and Plateau Energy Metals.

A world-class leadership heads Azincourt Energy. The team brings years of expertise in mineral exploration, venture capital markets and geology. Together they have vested institutional support and built a highly attractive mining project portfolio prepped for success.

Company Highlights

- The uranium market is on the cusp of significant supply deficits despite growing demand.

- As of 2018, there were 151 planned and 335 proposed reactors to be constructed globally.

- Azincourt Energy is focused on acquiring, exploring and developing alternative energy assets involving uranium, lithium and other critical clean energy elements.

- The flagship East Preston uranium project is a 25,000 hectare land position in the prolific Athabasca Basin, Saskatchewan.

- The Escalera Group in Puno, Peru, is a 7,400 hectare asset that leverages the strategic positioning as an emerging uranium-lithium district with a strong base metal presence.

- The company has a world-class management team and boasts strong institutional support with funds owing approximately 30% of the total shares outstanding.

Get access to more exclusive Uranium Investing Stock profiles here