Investor Insight

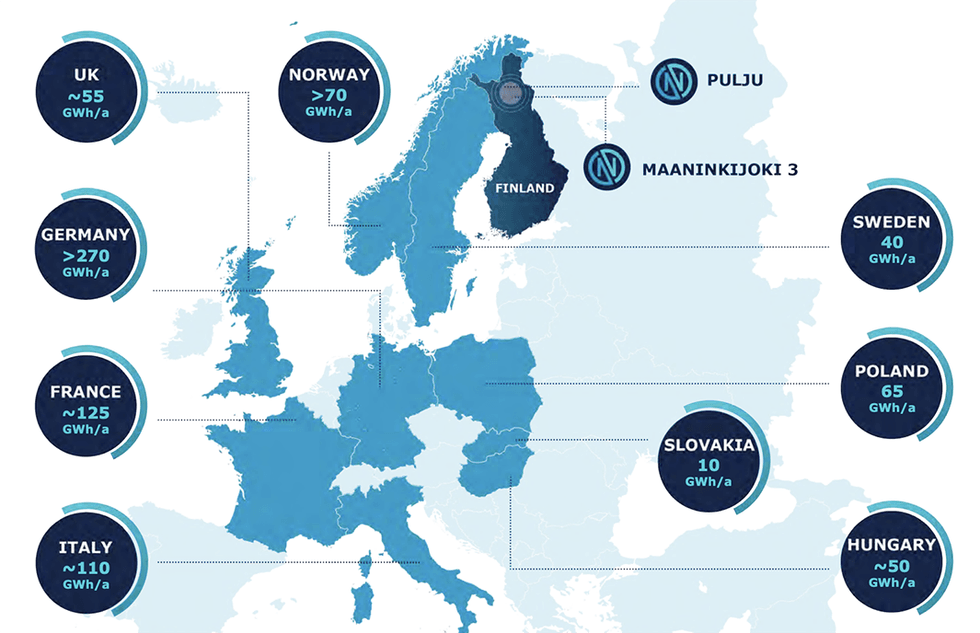

Nordic Resources presents investors an opportunity to gain exposure to the European Union’s critical minerals play, with its highly prospective nickel deposit at its flagship Pulju project in Northern Finland - a tier 1 jurisdiction with a long mining history.

Overview

Nordic Resources (ASX:NNL) is a nickel sulphide and battery minerals exploration and development company focused on becoming a major supplier of sustainably sourced, traceable, high-purity class 1 nickel and battery minerals through its portfolio of highly prospective assets in Finland. A highly credentialed team with a solid track record and experience throughout the mining industry leads the company in executing its exploration and development strategy.

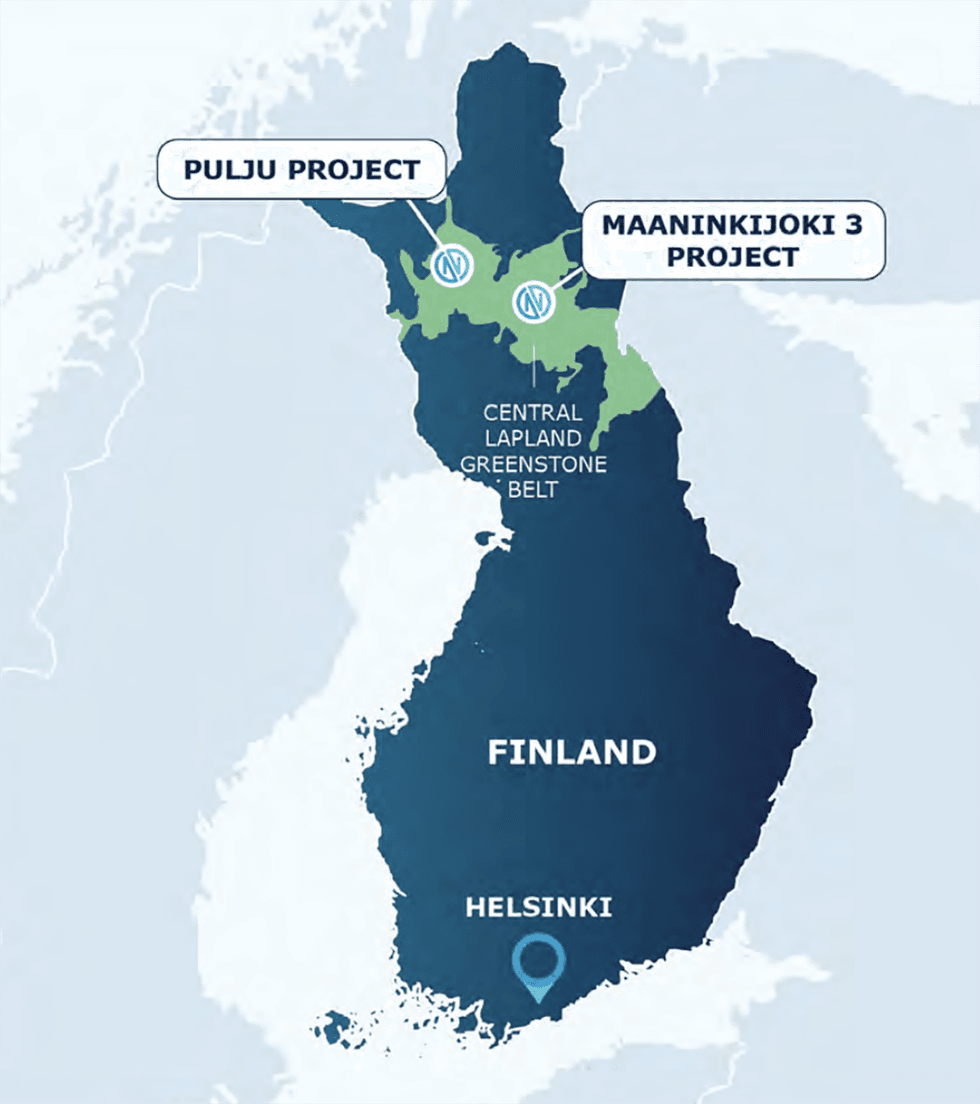

Finland is a Tier-1, mining-friendly jurisdiction with a long mining history in the Central Lapland Greenstone Belt. Additionally, the country is incentivising battery mineral projects and is positioned to become a major player in the full battery value chain, making it an ideal jurisdiction for exploration and development.

The European Union Critical Raw Materials Act includes nickel as a critical mineral and will play a vital role in the transition to clean energy and decarbonization.

Nordic Resources’ 100-percent-owned flagship Pulju project already has a JORC-compliant mineral resource estimate of 418 million tons at 862,800 tons of nickel, 40,000 tons of cobalt and 22,100 tons of copper .

The Pulju project’s unique mineralisation is amenable to a dual exploration strategy of both near-surface disseminated nickel as well as high-grade massive sulphide lenses. The project is in an area of known mineralisation and several major discoveries, including the 304-Mt, open-pit nickel, copper, gold, Kevitsa Mine, owned by Swedish mining company Boliden, and the world-class 44-Mt Cu-Ni-PGE Sakatti Deposit discovered by Anglo American. Historical drilling has been shallow with no modern geophysics, which Nordic Resources has now undertaken. Multiple electromagnetic anomalies have been identified.

In 2023, Nordic Resources secured an additional exploration licence (EL) for the Pulju project. The newly granted EL, known as Hotinvaara, is highly prospective for nickel sulphide mineralisation and is three times the size of the Hotinvaara prospect, which has been the focus of Nordic’s maiden exploration program and the company's resource development activities to date.

Nordic Resources released an updated mineral resource estimate (MRE) for the Hotinvaara prospect which increased to 418 million tons (Mt) @ 0.21 percent nickel, 0.01 percent cobalt and 53 parts per million (ppm) copper for 862,800 tons of contained nickel, 40,000 tons of contained cobalt and 22,100 tons of contained copper. Indicated resource is now 42 metric tons @ 0.22 percent nickel, for 92,700 tons of contained nickel, and inferred resource of 376 metric tons @ 0.21 percent nickel, for 770,100 tons of contained nickel. The updated MRE effectively establishes Pulju as a globally significant nickel sulphide project, given its proximity to the fast-growing European battery materials and EV sector.

Nordic Resources' second project, the Maaninkajoki 3 (MJ3) asset, comprises 30 square kilometers of exploration licenses and is also in a region of known mineralisation or similar mafic/ultramafic lithologies to the nearby Sakatti deposit. The company has an earn-in agreement to acquire 75 percent of the asset as exploration continues.

A management team with a range of expertise throughout the mining industry builds confidence in the company’s goal to explore its assets fully. Expertise includes corporate administration, geology and international finance.

Get access to more exclusive Nickel Investing Stock profiles here