Silver Price Update: Q1 2023 in Review

The silver price kicked off 2023 on a strong note, and experts are already calling for another large deficit this year. Here's a closer look at Q1 developments for the white metal.

Silver has had a strong start in 2023, climbing to highs it hasn’t seen since 2020.

With both precious and industrial sides, silver faces demand from various sources. This widespread usage created a record deficit in 2022, and experts are already calling for a large shortfall in 2023; however, prices aren't necessarily expected to react.

Here the Investing News Network (INN) presents an overview of how silver performed in the first quarter of 2023.

Silver price picks up after 2022's frustrations

Greg Taylor, chief investment officer at Purpose Investments, told INN silver is off to a decent beginning in 2023 after it was “ignored and forgotten” for the last couple of years.

“I think people were frustrated with silver passively through 2021 and 2022,” he said, pointing to disappointment from investors who expected the precious metal to perform significantly better.

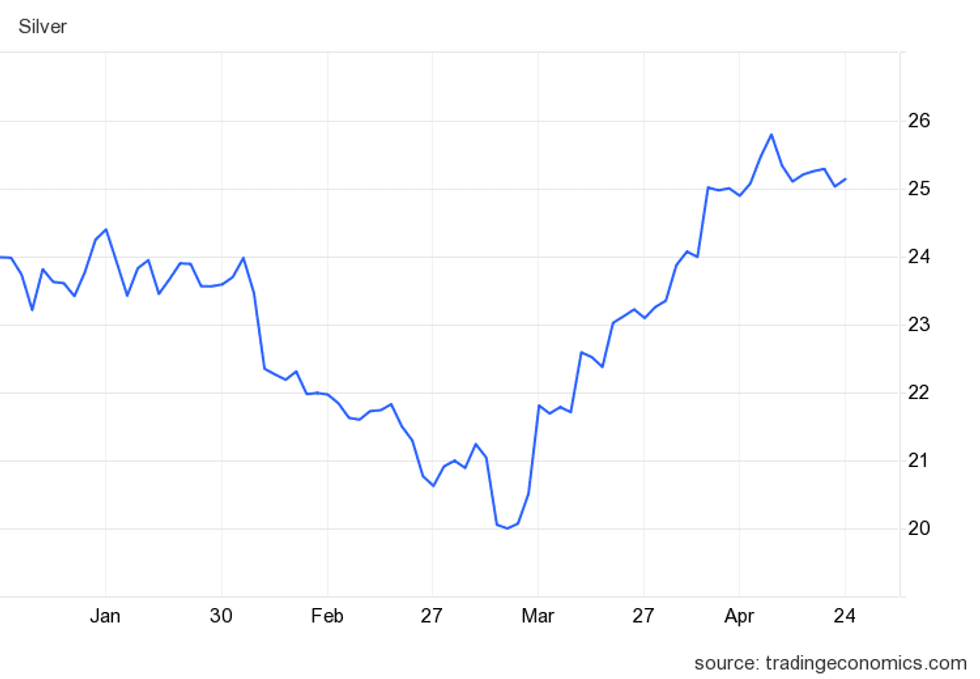

Silver price chart, January 1, 2023, to April 24, 2023.

Chart via Trading Economics.

Silver kicked off 2023 at a strong price of US$24.10 per ounce, and despite dropping to a low point of US$20.04 around the start of March, the precious metal has seen a great recovery. The white metal hit a high for the year of US$25.80 in April.

“When silver goes it really goes,” Taylor said, suggesting that times are changing for silver.

Experts project another big silver deficit in 2023

In the latest edition of its World Silver Survey, the Silver Institute indicates that it expects a “hefty deficit” for silver in 2023. It's calling for the market to be underserved by 142.1 million ounces (Moz), down from 2022's record deficit of 237.7 Moz.

Last year's deficit was driven by a lack of supply gains due to mining project declines, coupled with a marginal increase in recycling.

“That is a very, very wide deficit for any market to be dealing with,” Shree Kargutkar, managing partner at Sprott (TSX:SII,NYSE:SII), told INN.

The Silver Institute also notes that when combined with 2021's silver deficit, last year's shortfall "more than offset the cumulative surpluses of the previous 11 years." Even so, the organization doesn't expect these fundamentals to boost the price in 2023.

Instead, the Silver Institute points out that professional investor activity tends to move the market, and notes that “institutional investment will eventually run out of steam” this year. The researchers see this happening due to a wrong assumption that the US Federal Reserve will cut rates in the second half of 2023.

Kargutkar emphasized the increasing industrial demand for silver, which is being aided in large part by the green energy technology space — particularly solar panels.

“Given the rapid growth of photovoltaic (PV) installations, the consumption of silver powder has increased significantly over the years,” the Silver Institute states in its latest survey. “Our statistics show that global consumption of PV silver powder in 2022 reached 140.3Moz (4,365t), almost triple the level in 2010.”

The pressure on supply created by this high solar panel demand has helped to sustain the deficit in the silver market.

“There is no magic bullet here to meet the supply deficit that exists in silver right now,” Kargutkar said.

The Sprott expert explained that as investor excitement surrounding the gold builds, silver could see increased attention too.

“When you're talking about a billion ounce market, trading at roughly US$25 … It does not take a lot of money to create very large, very sustained price moves, especially to the upside,” he said.

Investor takeaway

When it comes to the price of silver, the Silver Institute expects to see an average of US$23 for the year.

“This is based on our view that, even if the interest rate hike pace slows, the hikes will continue through to the middle of this year, and potential rate cuts (if any) will be marginal,” the researchers said.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.