Rare Earths Outlook 2021: REE Magnet Supply to Remain Tight

What’s the rare earths outlook for 2021? Here analysts share their thoughts on what’s ahead for the rare earths market.

Click here to read the latest rare earths outlook.

After a year where uncertainty hit the globe on the back of the coronavirus pandemic, the rare earths market continues to be of interest for investors and governments around the world.

Rare earths, used in the high-strength magnets found in much of the latest tech, from smartphones to wind turbines to electric vehicles (EVs), will be a primary focus for the resource sector well into the next decade as more countries in the west work to create supply chains less dependent on China.

As 2021 begins, what is the rare earths outlook for the year ahead? The Investing News Network (INN) reached out to analysts in the space to find out.

Rare earths trends 2020: The year in review

In the first few months of 2020, the resource space was shaken by the impact of COVID-19, with most metals hitting yearly lows across the board — however, the rebound during H2 was sharp.

The pandemic had a huge, mostly negative impact on the rare earths market in 2020, but there were also some unexpected upsides that emerged, Ryan Castilloux of Adamas Intelligence told INN.

“Prices performed as expected for the first three quarters of the year, but soared unexpectedly higher in the fourth quarter due to upstream bottlenecks and a strong resurgence of demand in China,” he said.

David Merriman of Roskill agreed, telling INN the surge in pricing in Q4 came as a bit of a surprise.

“(The rise was) mainly linked to market sentiment; speculation regarding trade restrictions of rare earths out of China in December — which didn’t materialize — and a surge in orders for wind turbines in domestic China in time to meet subsidy packages, which ran out at the end of 2020,” he said.

As mentioned, the rare earth element (REE) space felt the impact of COVID-19 most strongly during the first half of the year, as lockdowns and containment measures in China impacted the shipping of products domestically and to the rest of the world.

“We have seen demand from most REE end-use sectors fall back in 2020, with the exception of REE magnets, which continued to show growth in the year supported by increased use in wind turbines, EV/hybrid EV drivetrains and consumer electronics,” he said. “In H2 2020, the REE market recovered well, with supply returning and trade of materials returning to normal levels (and above).”

Adamas Intelligence estimates that global consumption of NdFeB permanent magnets fell by approximately 10 percent last year on account of the pandemic’s negative effects on demand for everything from automotive micromotors and sensors, to wind power generators, consumer appliances, cordless powertools and a number of other end uses and applications.

“However, on a more positive note, we estimate that global NdFeB magnet consumption for consumer electronics jumped 10 percent year-over-year,” Castilloux said.

“(This was the result of) an expected surge in sales of laptops, tablets, smart speakers and smart displays due to millions of employees and students now working from home.”

Adamas Intelligence also recorded a 21 percent jump in global NdFeB consumption for passenger EV traction motors in 2020, spurred higher by a rapid pandemic recovery in Asia and the introduction of attractive EV buyer incentives in parts of Europe in the second half of the year.

Speaking about the REE space in 2020, Luisa Moreno of Tahuti Global told INN she was surprised with the performance of REE companies on the stock market — in particular MP Materials (NYSE:MP), which recently listed on the New York Stock Exchange.

“MP is operating the rare earth Mountain Pass mine in California and not yet processing and separating rare earths, yet the valuation of the company is higher than that of Lynas (ASX:LYC,OTC Pink:LYSCF), (which is) is a miner and producer of refined rare earths,” she said.

For Moreno, the market may be entering a new bullish phase for rare earths companies, perhaps fueled by the global green agenda.

“The new US administration will likely join the Paris Agreement and have promised support for EVs,” she said. “These are important drivers for rare earths considering that permanent magnet motors are the preferred motors for EV automakers.”

Rare earths outlook 2021: Supply and demand

With the coronavirus pandemic still around, the dynamics for rare earths supply and demand are uncertain, but most analysts remain optimistic.

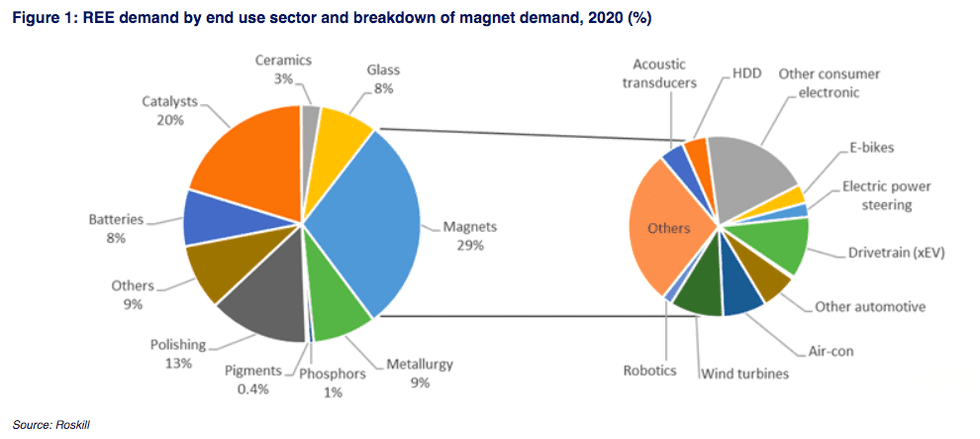

“In 2020, we saw demand from rare earth magnet applications continue to grow, forming 29 percent of demand volumes,” Merriman said. “Whilst the breakdown of this demand is still fairly diverse, we are seeing the EV drivetrain and wind turbine segments of demand growing strongly.”

Chart via Roskill — Rare Earths Market Outlook Report, 2021.

In 2021, REE demand from all automotive applications, including drivetrains for EV/hybrid EV models, is forecast to reach 34.3 kilotonnes of NdFeB containing roughly 12.75 kilotonnes of rare earth oxides, increasing about 26.5 percent year-on-year.

“This increase in drivetrains using rare earth permanent magnets is the main factor in the demand growth, a trend which is expected to continue throughout the remainder of the decade,” Merriman said.

Moreno also highlighted the EV market as the main driver for rare earths in the coming years.

“I expect EV sales to increase dramatically in the next five to 10 years,” she said. “Approximately 85 percent of automakers are using permanent magnet motors, which is very positive for rare earths.”

In 2021, Adamas Intelligence is expecting demand to rebound strongly for nearly all end-use categories for rare earths, in particular permanent magnets, which drive around 90 percent of the rare earth oxide market’s overall value.

“In 2021, we’re expecting global passenger battery EV, plug-in hybrid EV and hybrid EV sales to collectively increase by 20 to 40 percent year-over-year, translating to a 30 to 50 percent year-over-year increase in NdFeB permanent magnet demand,” Castilloux said.

Looking over to supply, Moreno said any new supply is likely to come from China.

“The projects outside Asia are still struggling with metallurgical issues, and public markets financing has not been easy,” she said. “If the financing market improves this year and governments (particularly the US, Canada, Australia, Europe) start offering aggressive monetary and fiscal incentives to REE companies, we may see an acceleration in the development of some of the REE projects and production after 2025.”

For its part, Roskill expects new supply to remain limited in 2021 as the investment and development time for new rare earth projects remains significant.

“Despite tight neodymium supply in 2021, this is expected to be met in future via expansions at existing producers, or those which are constructing/commissioning new production capacity currently, so there will be limited market space for new market entrants,” Merriman said. “We do see some success for companies providing raw material to the China domestic market, particularly in the form of monazite concentrates, which Roskill sees as a main area of growth within the REE industry.”

By 2028, Adamas Intelligence projects that global demand for freshly mined NdPr oxide will be increasing at a rate of approximately 7,000 tonnes per annum, requiring the addition of a new, fully ramped up Mountain Pass or new Mount Weld mine every year to keep up.

“I’m confident we will continue to see much-needed new supply come to market in the years ahead, but I’m not necessarily confident that we’ll see enough new supply come to market as fast as it is needed,” Castilloux said.

Markets for the magnet rare earths — neodymium, praseodymium, dysprosium and terbium — are expected to remain tight in 2021, exceptionally so if China’s State Reserve makes stockpile purchases in the near term, according to Adamas Intelligence.

For non-magnet rare earths, such as cerium and lanthanum, the firm expects the market to remain largely oversupplied in 2021, translating to little if any upward momentum in prices.

Roskill is also expecting to see a small deficit in neodymium supply in 2021, though this will likely be met by stockpiles and inventory held by producers, consumers and state authorities.

“All other REEs are expected to remain in surplus during 2021, though many are experiencing a tightening market over the coming years,” Merriman said.

Rare earths outlook 2021: US-China trade tensions to remain

Looking at trade relationships between China and the US, Roskill expects tensions to remain, though it is not likely that restrictions on REEs exported from China to the US will be observed. “We expect the situation to remain similar in 2021, with a slight easing in tensions overall,” Merriman said.

Europe and North America have started to take tangible steps toward the buildout of resilient rare earths supply chains that depend less on China, but these efforts are still in their infancy, as per Castilloux.

“It’s important that governments bear in mind that rare earth mines coupled with EV manufacturing do not collectively constitute a rare earth supply chain. There are many critical value-adding steps in between that also need to be addressed for an alternative supply chain to be resilient and sustainable,” he explained to INN.

For Merriman, the support that has been provided so far to build out resilient supply chains has been mixed, and has often been aimed at developing novel ways of extraction or new sources of materials; these will undoubtedly take longer to develop as commercial sources of REEs than traditional sources.

“The most important part for REE producers is ensuring that there will be an end market for their products in the region they are targeting,” he said. “Any gaps in the supply chain will likely result in material being shipped into China as the main center of existing refining/metal/alloy-making capacity.”

In terms of building out supply chains for REEs, Moreno highlighted European and Australian efforts.

“It seems the EU is prepared to invest directly in the rare earth supply chain, from exploration companies to metal and magnet producers,” she said. “In Australia, the government has announced that it will provide financial solutions, loans, guarantees and bonds to companies in the strategic metals space via the Export Finance Australia agency.”

For the expert, these announcements are very important steps that governments are taking.

“Hopefully they will actually start making sizeable investments in rare earths projects and along the supply chain,” she added.

Moreno explained that access to reagents and affordable electricity is important when deciding where to locate a rare earths chemical processing plant.

“(This is why) proximity to industrial sites is important,” she said. “Access to expertise in chemical processing and metal making is key for the development of the supply chain for magnets.”

Rare earths outlook 2021: What’s ahead

As 2021 begins, there are a number of factors to keep in mind, in particular for prices.

Going into 2021, magnet rare earths prices have largely held onto their 2020 gains, Castilloux said.

“In some cases (they’ve) increased further as the Chinese market awaits potential stockpile purchases from the State Reserve,” he said. “If these purchases do not go through, as is often the case, we believe prices may give up some gains by the end of Q1.”

In 2021, Roskill sees prices remaining strong in the first quarter before starting to fall back towards the end of the year. “Overall we do expect REE prices for magnet materials to settle at higher levels than in 2019 and 2020, as a result of underlying demand growth and a tight market for neodymium oxide remaining,” Merriman noted.

Commenting on where she sees prices going in 2021, Moreno pointed out that the prices of neodymium, praseodymium and terbium have continued to trend higher despite the deterioration of the COVID-19 situation this winter.

“If governments are able to control the virus in 2021 through vaccination, we may see an economic rebound this year, which should be positive for rare earths demand and prices,” she said.

Looking ahead, China’s five year plan will be a crucial event for the REE industry, and may bring some surprises, Merriman said.

“Progress at MP Materials and the construction/commissioning of refining capacity will also be an interesting story in 2021, and may cause some short-term price disruption,” he said.

For Moreno, a key factor investors should pay attention to going forward is developments in the EV sector, which is the main driver for rare earths. “They should follow EV sales as a percentage of total vehicle sales and monitor government efforts to accelerate adoption,” she said.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.