Powering the Clean Energy Revolution Begins with Lithium Exploration

Increased EV adoption is among the drivers for rising lithium demand, creating an opportunity for investors to participate at the ground level of the burgeoning lithium supply chain.

As lithium becomes increasingly critical in the global transition to clean energy, the strategic importance of lithium exploration has never been more pronounced, presenting unique opportunities for investors and companies alike.

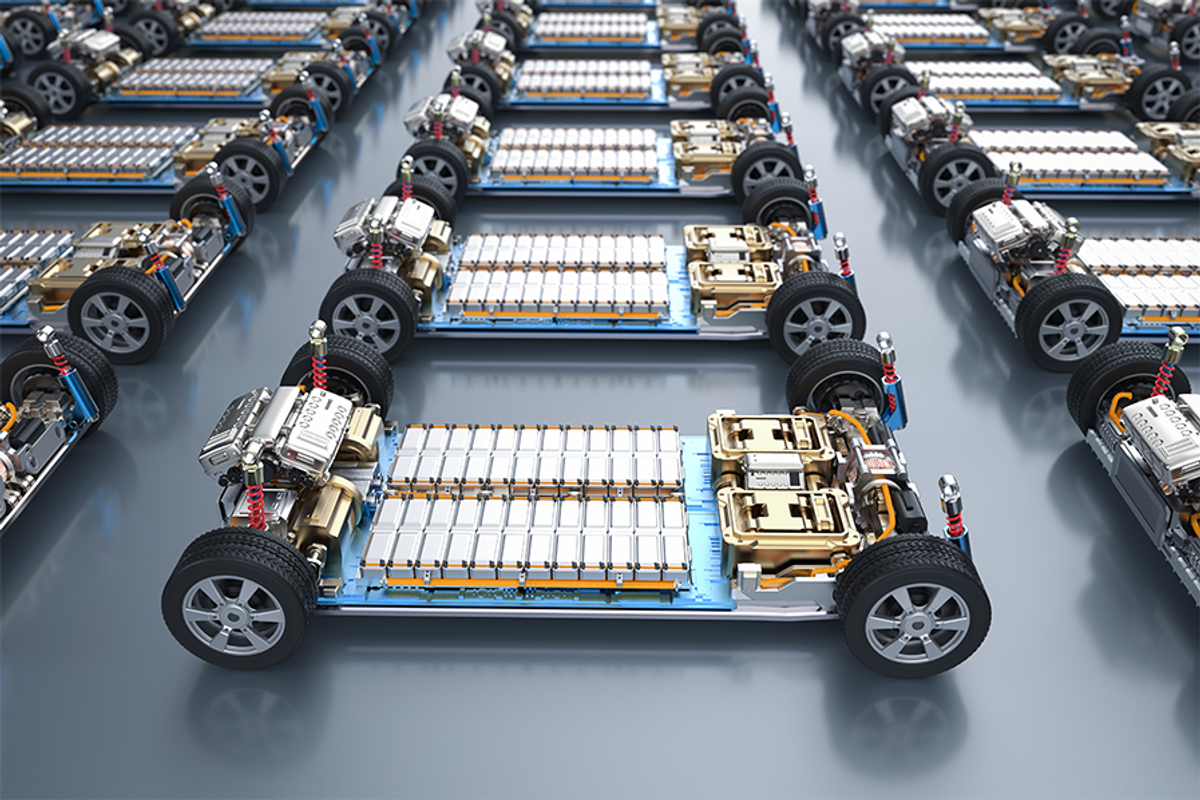

This versatile metal, often dubbed "white gold," is at the heart of the renewable energy revolution, playing a pivotal role in electric vehicle (EV) batteries and grid-scale energy storage systems. Gaining an understanding of where the opportunities lie within the lithium exploration space can help investors make strategic investment decisions.

Surging demand for lithium in clean energy applications

The skyrocketing demand for lithium is driven primarily by the rapid adoption of EVs and the expansion of renewable energy infrastructure. According to the International Energy Agency, demand for lithium could potentially increase up to 42 times its 2020 levels by 2040. This staggering projection underscores the metal's critical role in the global energy transition.

EVs represent the largest driver of lithium demand. As governments worldwide implement stricter emissions regulations and automakers commit to electrifying their fleets, the need for lithium-ion batteries will only continue to surge. The demand is further amplified by the growing deployment of large-scale energy storage systems to support intermittent renewable energy sources like wind and solar.

Savvy investors also understand that any discussion of the growing lithium demand won’t be complete without considering the potential environmental implications of exponentially increasing the supply of this critical mineral. While lithium is essential for clean energy technologies, its extraction and processing can have environmental impacts. However, when compared against fossil fuel extraction and use, the net environmental benefit of lithium-based clean energy solutions are substantial. In addition, exploration and mining companies are increasingly recognizing the socioeconomic benefits of environmental, social and governance undertakings, and many have committed to meaningful efforts toward sustainable operations throughout the value chain.

Critical role of lithium exploration in supply chain

As demand outpaces current supply, the importance of lithium exploration cannot be overstated. Exploration companies are at the forefront of addressing the looming supply deficit, working to discover and develop new lithium resources to meet future needs. These companies play a crucial role in the lithium supply chain, acting as the first link in a process that ultimately leads to the production of batteries and other clean energy technologies.

The potential rewards for successful lithium exploration are significant. Companies that can efficiently identify and develop new lithium deposits stand to benefit from the metal's rising value and strategic importance. Investors in these exploration companies have the opportunity to participate in the early stages of what could become major lithium production projects, potentially yielding substantial returns as demand continues to grow.

Brunswick Exploration: Pioneering lithium discovery in strategic locations

Brunswick Exploration (TSXV:BRW,OTCQB:BRWXF) is one company that exemplifies the strategic approach to lithium exploration that investors should consider. The company has positioned itself at the forefront of lithium discovery, focusing on high-potential districts in Canada and Greenland.

This strategic focus aligns with the global need for new lithium sources in politically stable jurisdictions.

Recent developments highlight Brunswick Exploration's progress and potential:

- In October 2024, Brunswick made a significant breakthrough by discovering a lithium-bearing pegmatite containing spodumene within its Nuuk License in Greenland. This marks the first such discovery in the region, underscoring Greenland's potential as a new frontier for lithium exploration.

- The company has expanded its holdings in Greenland, capitalizing on the country's favorable geological conditions, including exceptional outcrop exposure that facilitates exploration efforts.

- Previous drilling activities have yielded encouraging results, indicating promising lithium mineralization across Brunswick's project portfolio.

These milestones position Brunswick Exploration favorably in the competitive landscape of lithium exploration. The company's commitment to exploring new high-grade spodumene deposits strategically responds to the anticipated surge in lithium demand, making it a potentially attractive option for investors looking to gain exposure to the lithium market's growth potential.

Key investment considerations

For investors considering the lithium sector, companies like Brunswick Exploration offer an opportunity to participate in the ground level of the lithium supply chain. While exploration companies inherently carry higher risk compared to established producers, they also offer the potential for significant returns if successful in their endeavors.

Key factors for investors to consider include:

- The company's exploration strategy and the geological potential of its project areas

- Management team experience and track record in mineral exploration

- Financial position and ability to fund ongoing exploration activities

- Geopolitical factors affecting the regions where exploration is conducted

As the global demand for lithium continues to rise, driven by the clean energy transition, the importance of companies engaged in lithium exploration is likely to grow. Successful explorers will play a crucial role in ensuring the availability of lithium to meet future needs, potentially offering significant value to investors who recognize this opportunity early.

Investor takeaway

The strategic value of lithium exploration in the context of the global shift towards clean energy cannot be overstated. For investors, the lithium exploration sector offers a unique opportunity to participate in the clean energy revolution from the ground up, with the potential for substantial returns as the world increasingly embraces sustainable technologies.

Moving forward, the success of lithium exploration efforts will be crucial in determining our ability to meet the ambitious goals set for clean energy adoption and climate change mitigation.

This INNSpired article is sponsored by Brunswick Exploration (TSXV:BRW,OTCQB:BRWXF,FWB:1XQ). This INNSpired article provides information which was sourced by the Investing News Network (INN) and approved by Brunswick Exploration in order to help investors learn more about the company. Brunswick Exploration is a client of INN. The company’s campaign fees pay for INN to create and update this INNSpired article.

This INNSpired article was written according to INN editorial standards to educate investors.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Brunswick Exploration and seek advice from a qualified investment advisor.