Recent discoveries by Vizsla Silver and Prismo Metals’ drill campaign have generated renewed interest in the promising mining district of Panuco.

The Mexican state of Guanajuato has many claims to fame. It's the birthplace of the famous muralist Diego Rivera, the heart of Mexico's revolution and the Mexican War of Independence. It is also where the country’s mining sector began, which soon became a global powerhouse, making Mexico the top silver-producing country in the world for twelve consecutive years.

With a rich mining history that spans nearly five centuries, Mexico is home to over 20 mines, 13 of which produce silver. These include MAG Silver's (TSX:MAG) Juanicipio, McEwen Mining’s (TSX:MUX) El Gallo Mine, America Gold and Silver's (TSX:USA) San Rafael Mine, and Kootenay Silver's (TSXV:KTN) Copalito Silver-Gold project.

The country's mining industry continues to display strong growth, with plans to invest $5.5 billion by the end of the year, representing a 15.2 percent increase from 2021. This is in spite of a global recession, growing security problems and a recent decision by the government to raise taxes and stop granting concessions.

Although the Mexican mining sector is not without its challenges, it nevertheless remains an incredibly attractive target for mining investment, owing to its established infrastructure, large talent pool and free trade agreements with economies like Canada and the United States. The promising development of mining districts such as Panuco only add further promise.

A promising discovery

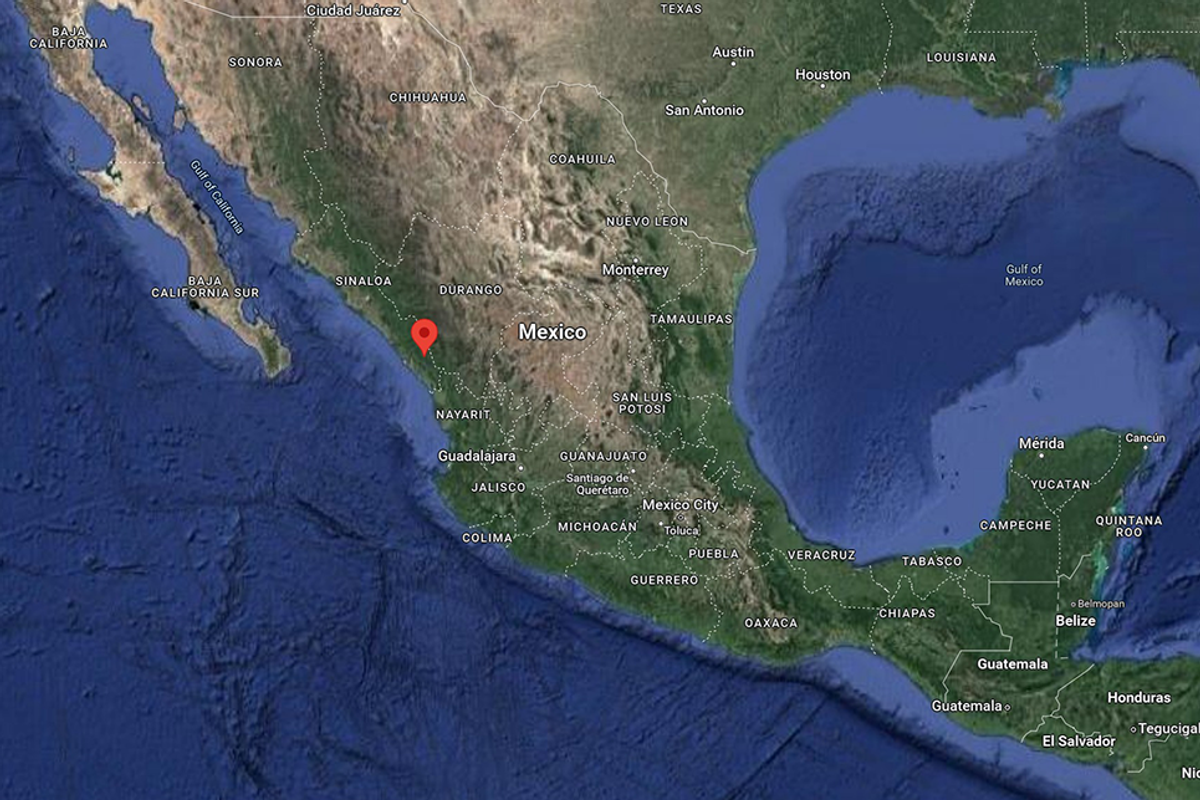

Although the state of Guanajuato remains one of Mexico's principal silver-producing states, it is far from the only region that shows promise. In recent years, nearby Sinaloa has become a hotbed of mining activity. The historic Panuco mining district in particular has caught the attention of both investors and mining companies, courtesy of junior mining company Vizsla Silver (TSXV:VZLA).

In September 2019, Vizsla signed a $43-million option agreement in the Panuco district. Situated near the city of Mazatlán in southern Sinaloa, the 6,754 hectare district houses more than 86 kilometers of total vein extent, a 500 ton per day mill and 35 kilometers of pre-existing underground mines, tailings, facilities, roads, power and permits. Vizsla has itself noted that the project is comparable in size and geology to First Majestic Silver’s (TSX:FR) San Dimas mine, considered by many to be one of Mexico's most significant precious metal deposits.

When Vizsla began its first drill program on the site in early 2020, the results were middling, at best. For a time, it seemed as though there might be little of note in the region. When COVID-19 forced a two-month shutdown of exploration efforts, the company's geologists took it as an opportunity to re-evaluate their efforts.

The company resumed drilling months later and eventually discovered the Napoleon Ore Body, one of the highest-grade silver intercepts in Mexico's recent history.

Currently, Vizsla is engaged in a 120,000-meter, nine-drill rig exploration and resource expansion program at the Napoleon vein and the nearby Tajitos vein. Unsurprisingly, the project has attracted multiple investors to Panuco, as it is now clear there is the potential for district-scale mineralization. Of these, the GR Silver Mining (TSXV:GRSL) and Prismo Metals (CSE:PRIZ) represent two of the most promising.

Major exploration potential

GR Silver already had a strong presence in Sinaloa before Vizsla's exploration of Panuco, with multiple gold and silver projects throughout the Rosario mining district — many in close proximity to Mazatlán. These include the 1,250-hectare San Marcial Silver project, the 8,515-hectare Plomosas Gold and Silver project, and the La Trinidad Gold Mine, acquired in 2021 with GR Silver's purchase of Marlin Gold Mining Limited.

Along with La Trinidad, GR Silver also gained ownership of 12 highly-prospective mining concessions which together comprise more than 107,392.5 hectares. Other projects owned and operated by GR Silver include El Habal, Yauco, Villa Union and El Placer II, all situated within the Rosario mining district. Notably, Villa Union also borders Panuco's western edge.

Prismo Metals currently maintains two separate mining projects — Palos Verdes in the Panuco district and Los Pavitos in the Alamos region of southern Sonora.

One of the unique aspects of the Palos Verdes property is that it is surrounded by Vizsla Silver. Prismo Metals’ CEO acquired the Palos Verdes prior to Vizsla Silver assembling the rest of the district. Prismo Metals is currently assessing the region with a drilling program set to finish in early November with a planned minimum of 2,000 meters. The drilling program is designed to test the Palos Verdes vein at depths where it is believed that potential for a large ore shoot is present, similar to the drilling accomplished by Vizsla Silver on its adjacent land package.

This program recently intercepted a wide vein structure with wide structural zones intersected at depth where the vein branches into multiple strands ranging from 0.5 meters to 9 meters wide, with narrow veins and veinlets separated by andesite wall rock.

Craig Gibson, the president and CEO of Prismo Metals, recently commented: “Although not yet assayed, the wider zones with multiple stages of mineralization provides additional opportunities to encounter significant high-grade mineralization that the district is known for. The veins are multistage with several crosscutting and brecciation events, and exemplary epithermal vein textures are visible in the core. Another new feature of these deeper intercepts is the presence of darker gray quartz with sulfides and some fracture fillings of sulfide minerals with relatively minor gray quartz fill in the andesitic rocks adjacent to discrete quartz veins.”

Los Pavitos is the larger of Prismo Metals' two projects. Covering 5,829 hectares over a single concession in the Alamos area of Sonora state, the project contains multiple areas of strong oxidation with mineralization that suggests either an orogenic gold deposit or an epithermal vein. The company notes that it has signed a formal access agreement with Francisco Villa Ejido, the surface owners over the Los Pavitos Project in Sonora State, Mexico to allow for exploration work, including drilling.

Takeaway

The recent discoveries by Vizsla Silver and Prismo Metals’ drill campaign have generated renewed interest in this promising jurisdiction. The Sinaloa region still represents an incredibly attractive target, with multiple, high-potential discovery and exploration projects. Although these projects do carry an element of risk, they are likely far outstripped by the potential returns.

This INNSpired article is sponsored by Prismo Metals (CSE:PRIZ,OTCQB:PMOMF). This INNSpired article provides information that was sourced by the Investing News Network (INN) and approved by Prismo Metals in order to help investors learn more about the company. Prismo Metals is a client of INN. The company’s campaign fees pay for INN to create and update this INNSpired article.

This INNSpired article was written according to INN editorial standards to educate investors.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Prismo Metals and seek advice from a qualified investment advisor.