Top 5 Australian Mining News Stories of 2025

Overview

The price of gold hit all-time highs in 2020 when it reached US$2,070 per ounce. This surge in prices benefited gold producers who reported record-high margins as a result. However, this upswing in prices and increased margins for gold producers means that they are also subject to downswings in prices and decreased margins.

Gold royalty companies, on the other hand, effectively outperformed gold based on a 12-month analysis due to their robust business model. In the analysis, gold royalty companies produced attractive revenues and shareholder value while relying on less debt when compared to their gold counterparts. As a result, gold royalty companies present an exciting opportunity for investors seeking to invest in gold and hedge the market volatility of gold prices.

Orogen Royalties (TSXV:OGN) is a junior royalty company that is focused on creating, identifying and acquiring highly prospective precious metal royalties. Orogen Royalties was created from the merger of two very well-established exploration companies called Evrim Resources and Renaissance Gold. The company is led by a highly experienced management team with over a decade of experience working in executive roles with major and junior mining companies.

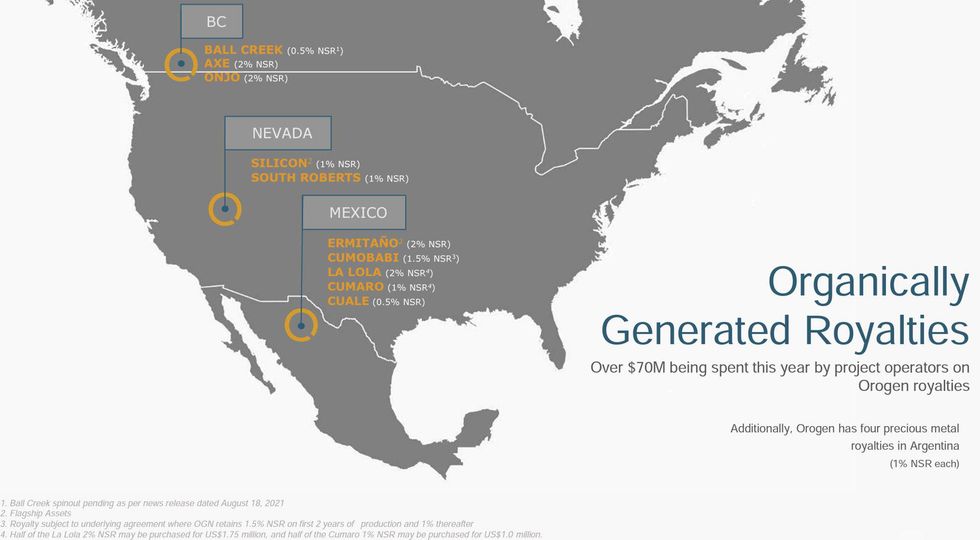

The company established shareholder value and long-term value creation as an organic royalty generator through project generation and strategic partnerships. Orogen Royalties grows their exploration assets in highly prospective and prolific gold and copper regions, including the Golden Triangle in northwestern British Columbia in Canada, the Laramide Belt in Mexico, and the Walker Lane in Nevada, USA.

Orogen differs from other gold royalty companies in three distinct ways:

- Mineral exploration: The company boasts a “boots on the ground” team with deep expertise in rich mineral exploration, as well as exploration teams in Vancouver, Canada, Nevada, the United States, and Hermosillo, Mexico.

- Organic royalty generation: Funding for the company’s exploration programs comes from joint venture partners, meaning partners can acquire projects for royalties, cash or shares, or obtain a minority equity interest.

- Acquire royalties strategically: Orogen takes a strategic approach to royalty discovery by using its business development and industry expertise to identify projects that are likely to go into production

Orogen has two flagship royalty assets.

The Ermitaño project, owned and operated by First Majestic Silver Corp. (TSX:FR). has impressive inferred resources of 11 million ounces of silver and 522,000 ounces of gold which is a whopping 59 percent increase from the resources that were inferred in 2019. Orogen has a 2 percent NSR on the project and is located near the producing Santa Elena mine. First Majestic is putting together a Pre-Feasibility Study and prepares to start production at the end of 2021.

The second key royalty asset is Silicon Gold project, located in the mineral-rich Southwest Nevada Volcanic Field that hosts reserve and production resources of more than 60 tonnes of gold and 150 tonnes of silver. Orogen Royalties has a 1 percent NSR on the project. The Silicon Gold project also leverages strategic positioning near the Lynnda Strip owned by Corvus Gold Inc. that has significant mineral resource estimates. Significant gold discoveries have been made in the last four years along a newly defined north-south trending belt at least 6 kilometers long. From north to south, these discoveries include the Central Silicon zone, being drilled by AngloGold Ashanti, the Merlin zone, also being drilled by AngloGold Ashanti, the Lynnda Strip zone, drilled by Corvus Gold, the C-Horst zone, being drilled by Coeur Mining, and the Mother Lode zone, also drilled by Corvus Gold.

In 2021, Anglogold Ashanti announced they would acquire Corvus Gold for approximately US$370 million. The transaction implied a total equity value for all Corvus common shares and outstanding options to acquire common shares of approximately US$450 million.

Total reported production and resources for the greater Beatty area are now more than 8 million ounces gold, not including resource estimates by AngloGold at Silicon or Merlin, Coeur Mining at C-Horst or Corvus at Lynnda Strip. Exploration work by AngloGold is ongoing to delineate the ore bodies at both Silicon and Merlin in greater detail. AngloGold intends to report an initial mineral resource in 2022, followed by a conceptual development plan for the district. Production is anticipated to start between 2024 and 2025 on the North Bullfrog deposit followed by Silicon and Merlin, including Lynnda Strip.

Orogen Royalties boasts a strong cash position with over $9 million on hand. The company expects to become cash-flow positive in 2022. The company also has a tight share structure with 177.1 million shares outstanding, including 23 million warrants and 5.4 million options.

Exploration and development have been conducted on its joint venture projects since the company’s inception; joint venture partners have funded over $65M on Orogen’s exploration projects. Drilling programs have also been completed on the Ermitaño and Silicon Gold projects.

Company Highlights

- Orogen Royalties is a junior royalty company that is focused on creating, identifying, and acquiring highly prospective precious metal royalties.

- Orogen Royalties differentiates itself from other gold royalty companies by generating royalties organically through exploration, and strategic royalty acquisition.

- Orogen Royalties has a robust portfolio of assets, including royalties, joint ventures and alliances located in highly prospective and prolific gold and copper regions, including the Golden Triangle in northwestern British Columbia in Canada, the Laramide Belt in Mexico, and the Walker Lane in Nevada USA

- Flagship royalty Ermitaño project is Orogen’s first producing royalty asset.

- Flagship asset Silicon project is located in the mineral-rich Southwest Nevada Volcanic Field that hosts reserve and production resources of more than 60 tonnes of gold and 150 tonnes of silver. The company holds a 1 percent NSR.

- The company boasts a strong cash position and share structure. Orogen Royalties became cash-flow positive in 2022.

- The company is led by a highly experienced management team with over a decade of experience working in executive roles with major and junior mining companies.

- Orogen created three royalties in the Lake Victoria Gold Fields in western Kenya and one royalty in the Sarape Gold project in Mexico.

Get access to more exclusive Gold Investing Stock profiles here