Overview

Noble Mineral Exploration (TSXV:NOB,FWB:NB7,OTCQB:NLPXF) is a Canadian junior exploration company with shareholdings in Canada Nickel, Spruce Ridge Resources and MacDonald Mines Exploration.

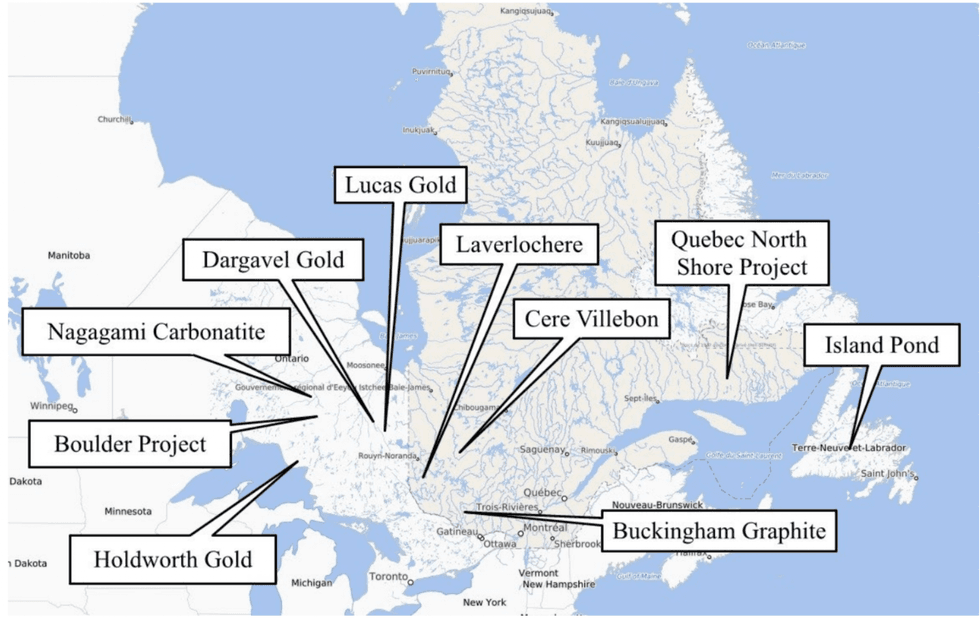

Noble holds approximately 90,000 hectares of mineral rights in various areas of Northern Ontario, Quebec and Newfoundland, upon which it plans to generate joint venture exploration programs. The company is exploring for nickel, cobalt, platinum group metals (PGMs), volcanogenic massive sulphide (VMS), gold, chromium, copper, zinc, silver and gold. The company owns one contiguous block of land totaling 25,000 hectares staked and patented mineral rights at Project 81 including a 50-percent interest in the Carnegie, Prosser, Wark and Kidd Twps (6,600 hectares ) claims, and an option on 4,800 hectares in Calder Twp.

Noble’s Project 81 properties have been sold to Canada Nickel for 3.5 million shares of Canada Nickel, which yielded dividends to Noble shareholders in the second quarter of 2022 by way of a return of capital. Noble has retained a 2-percent net smelter return (NSR) on claims in Bradburn, Mahaffy and MacDiarmid Twps subject to a 50-percent buyback at graduated rates per project.

The Crawford nickel sulfide project covers 9,000 hectares of the larger Project 81 property and is approximately 14 kilometers north of the Kidd Creek mine. After an initial drill program carried out by Spruce Ridge Resources, the Crawford Ni-Co-PGM deposit was taken over by Sprudge Ridge for 22 million shares of Canada Nickel.

Noble Mineral also holds interest in Mann et al Twps comprising 1,900 hectares in the Timmins area of Northern Ontario, for which it holds the mineral rights focusing on Ni-Co-PGM. The company plans a follow-up drilling campaign at the Nagagami River Carbonatite project covering 14,600 hectares of niobium and rare earth discovery near Hearst in Northern Ontario. Noble is also planning its 2023 drill campaign at the 4,600-hectare Boulder Project. Scheduled winter drilling for the same year is set for the 482-hectare Cere-Villebon and 3,700-hectare Buckingham graphite projects.

Noble Mineral has also formed numerous strategic financial and technical partnerships that apply state-of-the-art technology to help identify various types of mineralization. Some of the company’s partners include MacDonald Mines Exploration (TSXV:BMK), a Canadian precious metals explorer, Orix Geoscience, a geological consulting firm, BECI Exploration Consulting, an innovative airborne mineral exploration technology developer, CGG Multiphysics, a fully-integrated geoscience company providing leading geological, geophysical (airborne gravity gradiometer) and reservoir services, Windfall Geotek to produce artificial intelligence (AI), IBK, as their financial advisor, and Franco-Nevada (TSX:FNV), a net smelter royalty (NSR) holder.