- WORLD EDITIONAustraliaNorth AmericaWorld

Company Highlights

- Operates under a prospect generator model.

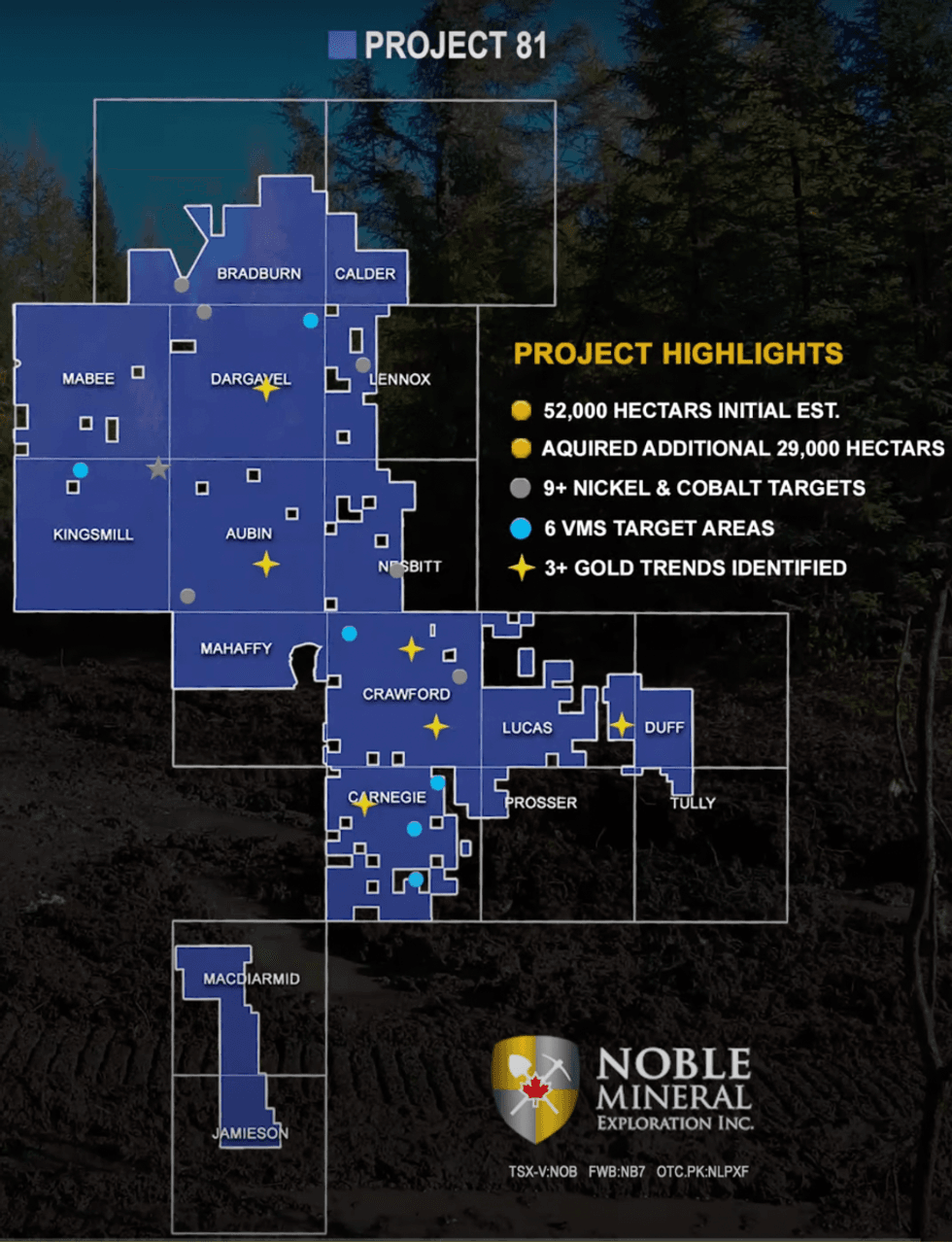

- Wholly owned 36,400-hectare Project 81 precious, nickel-cobalt and base metal property near Timmins, Ontario, adjacent to Glencore’s Kidd Creek VMS mine and milling complex.

- MOUs in place with First Nations communities.

- Created a pure-play nickel company, Canada Nickel, with the consolidation of 100 percent of the Crawford nickel sulfide project.

- Follow-up exploration planned in several areas of the project.

- Multiple acquisitions include 50 percent interest in claims in Carnegie, Kidd, Wark and Prosser townships near Timmins, Ontario; an agreement to cover the Nagagami Carbonatite Alkalic Complex, 65 kilometers northwest of Hearst, Ontario; 576 mining claims in Central Newfoundland; and a six-party agreement to acquire approximately 695 mining claims near Hearst, Ontario; The company acquired a precious metal prospect, acquiring 214 claims by staking that span 4,500 hectares in the Way Township after discovering a boulder that contained copper, zinc, gold, and platinum group metals.

Noble Extends Warrants

Overview

Noble Mineral Exploration (TSXV:NOB,FWB:NB7,OTCQB:NLPXF) is a Canadian junior exploration company with shareholdings in Canada Nickel, Spruce Ridge Resources and MacDonald Mines Exploration.

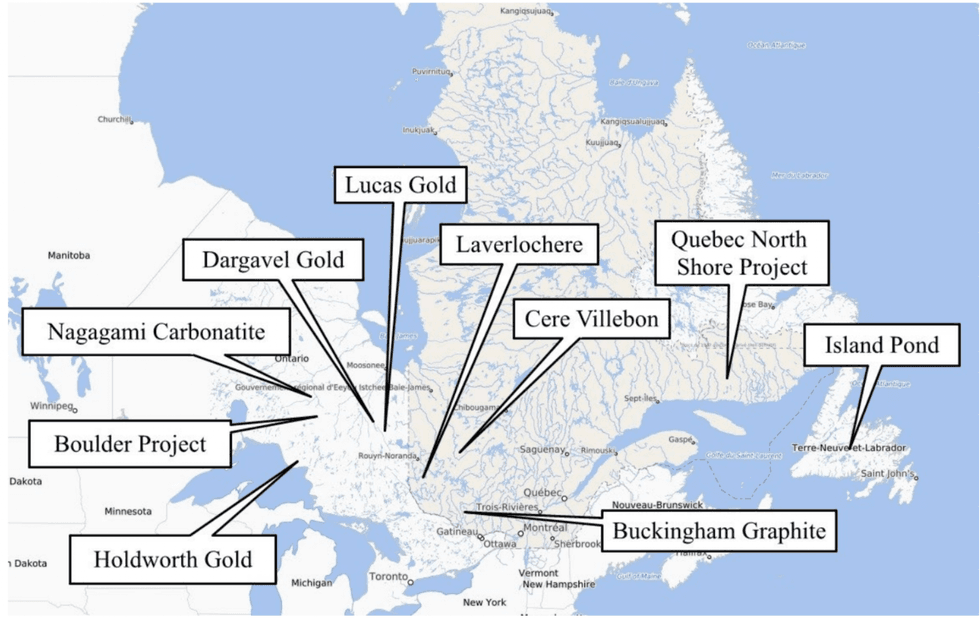

Noble holds approximately 90,000 hectares of mineral rights in various areas of Northern Ontario, Quebec and Newfoundland, upon which it plans to generate joint venture exploration programs. The company is exploring for nickel, cobalt, platinum group metals (PGMs), volcanogenic massive sulphide (VMS), gold, chromium, copper, zinc, silver and gold. The company owns one contiguous block of land totaling 25,000 hectares staked and patented mineral rights at Project 81 including a 50-percent interest in the Carnegie, Prosser, Wark and Kidd Twps (6,600 hectares ) claims, and an option on 4,800 hectares in Calder Twp.

Noble Mineral Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Overview

Noble Mineral Exploration (TSXV:NOB,FWB:NB7,OTCQB:NLPXF) is a Canadian junior exploration company with shareholdings in Canada Nickel, Spruce Ridge Resources and MacDonald Mines Exploration.

Noble holds approximately 90,000 hectares of mineral rights in various areas of Northern Ontario, Quebec and Newfoundland, upon which it plans to generate joint venture exploration programs. The company is exploring for nickel, cobalt, platinum group metals (PGMs), volcanogenic massive sulphide (VMS), gold, chromium, copper, zinc, silver and gold. The company owns one contiguous block of land totaling 25,000 hectares staked and patented mineral rights at Project 81 including a 50-percent interest in the Carnegie, Prosser, Wark and Kidd Twps (6,600 hectares ) claims, and an option on 4,800 hectares in Calder Twp.

Noble’s Project 81 properties have been sold to Canada Nickel for 3.5 million shares of Canada Nickel, which yielded dividends to Noble shareholders in the second quarter of 2022 by way of a return of capital. Noble has retained a 2-percent net smelter return (NSR) on claims in Bradburn, Mahaffy and MacDiarmid Twps subject to a 50-percent buyback at graduated rates per project.

The Crawford nickel sulfide project covers 9,000 hectares of the larger Project 81 property and is approximately 14 kilometers north of the Kidd Creek mine. After an initial drill program carried out by Spruce Ridge Resources, the Crawford Ni-Co-PGM deposit was taken over by Sprudge Ridge for 22 million shares of Canada Nickel.

Noble Mineral also holds interest in Mann et al Twps comprising 1,900 hectares in the Timmins area of Northern Ontario, for which it holds the mineral rights focusing on Ni-Co-PGM. The company plans a follow-up drilling campaign at the Nagagami River Carbonatite project covering 14,600 hectares of niobium and rare earth discovery near Hearst in Northern Ontario. Noble is also planning its 2023 drill campaign at the 4,600-hectare Boulder Project. Scheduled winter drilling for the same year is set for the 482-hectare Cere-Villebon and 3,700-hectare Buckingham graphite projects.

Noble Mineral has also formed numerous strategic financial and technical partnerships that apply state-of-the-art technology to help identify various types of mineralization. Some of the company’s partners include MacDonald Mines Exploration (TSXV:BMK), a Canadian precious metals explorer, Orix Geoscience, a geological consulting firm, BECI Exploration Consulting, an innovative airborne mineral exploration technology developer, CGG Multiphysics, a fully-integrated geoscience company providing leading geological, geophysical (airborne gravity gradiometer) and reservoir services, Windfall Geotek to produce artificial intelligence (AI), IBK, as their financial advisor, and Franco-Nevada (TSX:FNV), a net smelter royalty (NSR) holder.Company Highlights

- Operates under a prospect generator model.

- Wholly owned 36,400-hectare Project 81 precious, nickel-cobalt and base metal property near Timmins, Ontario, adjacent to Glencore’s Kidd Creek VMS mine and milling complex.

- MOUs in place with First Nations communities.

- Created a pure-play nickel company, Canada Nickel, with the consolidation of 100 percent of the Crawford nickel sulfide project.

- Follow-up exploration planned in several areas of the project.

- Multiple acquisitions include 50 percent interest in claims in Carnegie, Kidd, Wark and Prosser townships near Timmins, Ontario; an agreement to cover the Nagagami Carbonatite Alkalic Complex, 65 kilometers northwest of Hearst, Ontario; 576 mining claims in Central Newfoundland; and a six-party agreement to acquire approximately 695 mining claims near Hearst, Ontario; The company acquired a precious metal prospect, acquiring 214 claims by staking that span 4,500 hectares in the Way Township after discovering a boulder that contained copper, zinc, gold, and platinum group metals.

Key Projects

Project 81

The Project 81 property spans over 36,400 hectares and is located in the Timmins-Cochrane area of Northern Ontario. It comprises patented mineral rights, in addition to contiguous staked mining claims. The property remains mostly underexplored and is prospective for gold, silver, nickel, cobalt, platinum group metals (PGM), chromium, copper, lead, VMS and zinc deposits. Project 81 is within three kilometers of Glencore’s Kidd Creek zinc-copper-silver mine complex, 30 kilometers from the Porcupine-Destor main break, and within 25 kilometers of the City of Timmins, Ontario. The property is accessible by paved highway and has access to high-voltage transmission lines, hydropower, water, mining personnel and mining service suppliers and contractors.

Boulder Project

Noble Minerals has acquired a copper-precious-metal prospect near Hearst, Ontario, extending from about 4 to 15 kilometers southwest of the town of Hearst. The staked area is equivalent to approximately 4,500 hectares. A 140-kilogram boulder was found in the area containing significant concentrations of base and precious metals which, upon analysis conducted in 2019 by the Ontario Geological Survey, determined that the boulder contained: 71.8 percent copper; 3.5 percent lead, 1.09 percent zinc; 252 grams per ton (g/t) of silver, 3.79 g/t of gold; 4.43 g/t of palladium; and 2.22 g/t of platinum and consisted primarily of the mineral cuprite.

Drilling is planned in 2023 to follow up on airborne EM/Mag for Boulder producing more than 70 percent copper.

Nagagami River Carbonatite

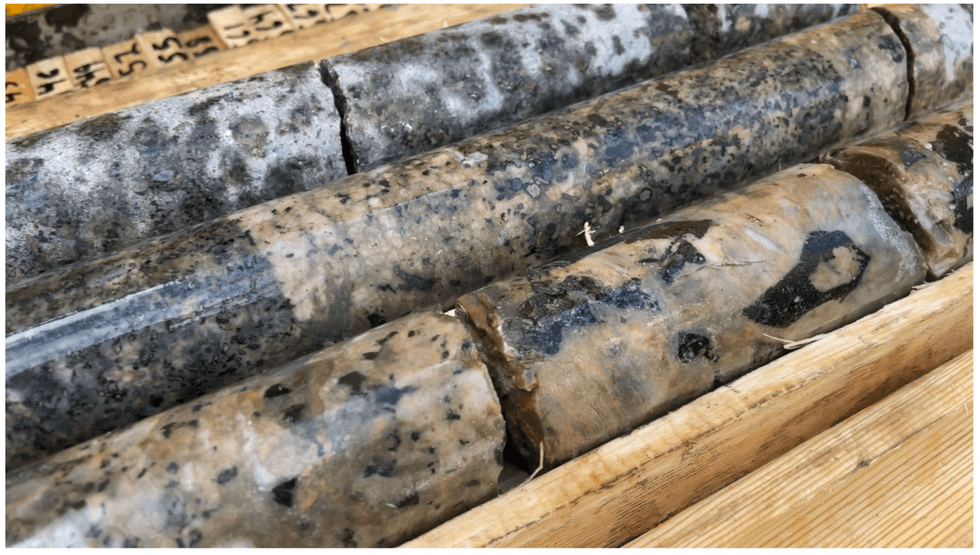

First core from Nagagami Complex

Noble acquired an estimated 14,607 hectares, including 695 mining claims, in the Nagagami River area. The carbonatite alkalic complex is positioned approximately 65 kilometers northwest of Hearst, Ontario. Project perspectives are based on magnetic study of the Nagagami land relative to the Niobec mine in Quebec. These geologically similar areas indicate donut-shaped structures with syenitic rocks forming the circular magnetic high, and carbonatitic rocks forming the central magnetic low where niobium and other rare earth mineralization is hosted.

Buckingham Graphite

The Buckingham graphite project comprises 3,700 hectares in the Outaouais area of Western Quebec. A 2022 fieldwork of a two-phase program was conducted to include reprocessing of data from a 2013 survey, property visits to locate trenches, grab samples and drill hole collars. The company has proposed to conduct infill drilling on the property in 2023.

Lucas Twp

Between the 1960s and 1980s, drilling and exploration were conducted at the Lucas gold project. No significant exploration work, however, has been completed on the property since the 1980s. Historic (not NI 43-101 compliant) drill highlights include 9.14 meters grading 3.14 g/t gold and 8.84 meters grading 3.5 g/t gold. The project also has six discrete parallel induced polarization (IP) anomalous trends that require follow-up exploration.

In 2012 and 2018, Noble Mineral completed airborne electromagnetic and magnetic geophysical surveys on the property. The surveys outlined an anomalous gold trend that was followed up with a 3,184-meter drill program over 650 meters of the 1,700-meter strike length. Highlights from the 2018 drill program include 5 meters grading 1.42 g/t gold and 9.5 meters grading 1.84 g/t gold.

The company believes that the gold mineralization at Lucas is structurally controlled and occurs as discrete lenses stacked within the pyrite-gold mineralized tuff unit. Noble Mineral intends to conduct follow-up drilling during future work programs.

Other Projects

- Mann et al Twps: 11,900 hectares in the Timmins area of Northern Ontario, for which it holds the mineral rights focusing on nickel-cobalt-PGM optioned to Canada Nickel

- Dargavel Gold Trend: 7 kilometers strike length with gold results reported

- Lucas Gold: 17 kilometers strike length with gold results reported

- Cere-Villebon: 482 hectares near Val d’Or, Quebec with historic copper-nickel-PGM results on the property with drilling scheduled for winter 2023

- Laverlochere: 518 hectares near Rouyn-Noranda, Quebec follow up work on nickel-copper-cobalt-gold and PGM results from 1960’s

- Havre St Pierre: 10,152 hectares untested nickel, copper, gold prospect

- Central Newfoundland: ~14,400 hectares untested VMS/copper/gold anomaly with a 15-kilometer strike length with airborne EM and Mag for 2023

- Holdsworth Gold: ~304 hectares gold project near Wawa, Northern Ontario

Management Team

H. Vance White - President, CEO and Director

H. Vance White has served as president and director of the company since 2003. He has been actively involved in the mineral exploration and production industry for over 50 years. White has also served as director and officer of several other reporting issuers, including Dickenson Mines, now Goldcorp/Newmont. He was the founder of AfriOre, now owned by Lonmin.

Robert Suttie - CFO

Robert Suttie currently works with Marrelli Support Services as its vice-president. He has more than 20 years of experience, 10 of which were in public accounting prior to his tenure with the Marrelli organization. He specializes in management advisory services, accounting and the financial disclosure needs of Marrelli’s public client base. Suttie also serves as CFO for a number of other junior mining companies listed on the TSX and TSXV, leveraging his skills and experience to become integral to the reporting issuers.

Wayne Holmstead – Exploration Manager

Wayne Holmstead brings Noble Mineral Exploration more than 40 years of exploration experience in Ontario and Quebec. He is a P.Geo who graduated from the University of Toronto holding positions of president, vice-president exploration, exploration manager and director for various junior mining companies over the years and has directed all aspects of mineral exploration in Canada.

He co-discovered and arranged financing for the MacLeod Lake copper-molybdenum-gold-silver deposit in James Bay, Quebec. He outlined 18 million tonnes of copper, molybdenum, gold and silver in the Main Zone, and discovered the South Zone and Rocky Point Zone at Macleod Lake through boulder tracing and beep mat prospecting.

Denis Frawley - Corporate Secretary

Denis Frawley is a corporate and securities lawyer at Ormston List Frawley LLP, where he has been practicing since 2006. He regularly advises companies involved in the mineral resource exploration and mining industries on matters related to corporate law, securities law, corporate governance and related areas. Frawley also routinely advises private and public companies on financings, mergers and acquisitions, joint ventures and general commercial and business matters. In addition, as part of his practice advising public companies, he frequently advises on reverse takeovers and other transformative transactions.

Prior to founding Ormston List Frawley LLP, Frawley was a partner in Toronto at another leading Canadian law firm. He received his bachelors of common and civil law degrees from McGill University and his Bachelor of Social Science in economics from the University of Ottawa. He is permitted to practice in Ontario and New York.

Birks Bovaird - Director

For the majority of his career, Birks Bovaird’s focus has been on the provision and implementation of corporate financial consulting and strategic planning services. He was previously the vice-president of corporate finance for one of Canada’s major accounting firms. He presently is the chairman of Energy Fuels Inc., a premier US-based integrated uranium miner listed on the TSX and NYSE. Bovaird is chairman of GTA Resources and Mining as well as a member of the audit committee. He has been involved with numerous public resource companies, both as a member of management and as a director. He is a graduate of the Canadian Director Education Program and holds the Institute of Corporate Directors (ICD.D) designation.

Michael C. Newbury - Director

Michael Newbury is a professional engineer, banker and project finance specialist with over 30 years of experience in the operation, financing and evaluation of natural resource projects. Newbury’s mining and technical expertise, as well as financial and engineering capabilities, enable the evaluation, assessment, development and operational plans and financial structures that manage project risk, minimize equity requirements and maximize shareholder value.

Newbury has a bachelor’s of science from McGill University, managed Barclays Bank’s World Mining Group and the Credit Suisse Corporate Banking Group. He was one of the initial partners in Endeavour Financial and provided his technical expertise to that group for over 10 years. He has extensive experience in the evaluation and financial structuring of natural resource projects in emerging market countries including Uzbekistan, Kazakhstan, South Africa, China and Venezuela, now Bolivarian Republic of Venezuela. Currently, he operates as an independent consultant and is on the Boards of a number of junior mining companies. He is Noble Mineral Exploration’s designated qualified person (QP) for geological reporting.

Yvan Champagne - Director

As the president of Blue Source Canada, the largest developer and marketer of projects to reduce greenhouse gas (GHG) in Canada, Yvan Champagne oversees project sourcing, offset sales, brokerage and advisory services for the Canadian market. An experienced leader and entrepreneur in carbon markets, Champagne has a great passion for and understanding of environmental technologies and GHG-reduction projects.

His broad experience includes GHG project screening, assessment and contracting, and advising companies and organizations across Canada on sustainable environmental strategies and programs. Champagne brings expertise in government relations, consulting in the energy sector, public affairs and marketing, and growing companies in new markets. Champagne obtained his Bachelor’s of arts in political science from Yale University with a focus on environmental policy and business-government relations. He is also a graduate of the Kellogg-Schulich Executive MBA program.

Dr. Samuel Peralta - Director

Dr. Samuel Peralta has 35 years of business experience in the energy and technology sectors, overseeing business development, product and process innovation and corporate transformation. He holds a PhD in physics, with an industry background in energy, mobile platforms and digital media, advanced sensors and semiconductors. Currently, he is CEO of Windrift Bay, which develops and manages a portfolio of technology and media properties. He was previously director of business and corporate development at Kinectrics, overseeing $70 million annually in high-tech programs for the energy industry.

Previously, he was CEO of Qvadis, a smartphone software provider and CTO for OH Solar, a photovoltaic firm based on an acquisition from Texas Instruments. Peralta served in key positions at Ontario Power Generation and the Ontario Laser and Lightwave Research Centre. He has served on the board of directors of public, private and non-profit firms, with committee leadership in governance, finance and audit, and special projects including mergers and acquisitions. Peralta served on the boards of Qvadis, Envergence, OPEL Solar, Axiom NDT, POET Technologies and the Organization of Canadian Nuclear Industries. He is currently sitting on the boards of Cobalt Blockchain, Noble Mineral Exploration and Windrift Bay.

Stephen Balch – Special Advisor

Stephen Balch, a professional geologist, has over 30 years of experience in mineral exploration as an exploration geophysicist. He is one of Canada’s leading experts on geophysical techniques used to identify nickel-copper sulfide and platinum-group-metal targets. Since 2010, he has served as president and a director of Triumph Instruments, a company that conducts airborne time-domain electromagnetic surveys in North America, China and Mexico.

Since 2001, he has been president of Balch Exploration Consulting, a company that provides consulting services to major mining and junior exploration companies. From 2007 to 2015, Balch served as the president and a director of Canadian Mining Geophysics, a geophysical data recording company. He currently serves as vice-president of exploration for Canada Nickel.

Dr Ed van Hees - Consultant

Dr. Ed van Hees is a registered professional geoscientist with over 40 years of domestic and international experience working in, exploring for, and doing research on the origin and geochemistry of Orogenic gold deposits. He has worked as an exploration field geologist, mine geologist, exploration manager, consulting geologist, research scientist and professor of geology. Most recently, van Hees was employed as the Regional Resident Geologist responsible for the Timmins and Sault Ste Marie Mining Districts with the Ontario Geological Survey Resident Geology Program. Here he supervised the professional staff and authored / co-authored 7 Annual Reports of Activity and 10 Recommendations for Exploration between 2016 and 2020. Starting in 2019 he was employed as a professor for the Haileybury School of Mines where he has taught and helped develop seven geology, geochemistry, geophysics and environmental courses. From 2001 to 2015, van Hees was a professor of geology at Wayne State University in Detroit, Michigan, where taught core geology courses including mineralogy, petrology, structural geology and exploration / economic geology, as well as conducting research on the geochemistry and structural geology of orogenic gold deposits, and the geochemistry of metal pollution. In total, he has authored/co-authored 36 publications.

*Disclaimer: This profile is sponsored by Noble Mineral ( TSXV:NOB ). This profile provides information which was sourced by the Investing News Network (INN) and approved by Noble Mineral in order to help investors learn more about the company. Noble Mineral is a client of INN. The company's campaign fees pay for INN to create and update this profile.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Noble Mineral and seek advice from a qualified investment advisor.

Noble Mineral Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects