Nickel Trends 2020: Prices Surge on EV Demand Expectations

What nickel trends drove prices in 2020? We run through top supply, demand and price catalysts in this overview of the space.

Click here to read the latest nickel trends article.

Similar to most base metals, nickel has had an interesting 2020 ― a year where the coronavirus pandemic overshadowed forecasts across the board.

Despite the impact of COVID-19, nickel prices were able to rebound, with many investors speculating on the potential of the metal in electric vehicle (EV) batteries.

Here, the Investing News Network looks back at the nickel trends for 2020, supply and demand dynamics, how the metal performed and what analysts said quarter by quarter.

Nickel trends Q1: COVID-19 takes over

As the year kicked off, Indonesia’s already expected ban on nickel ore exports took effect two years ahead of schedule, with many predicting the measure could drive prices higher.

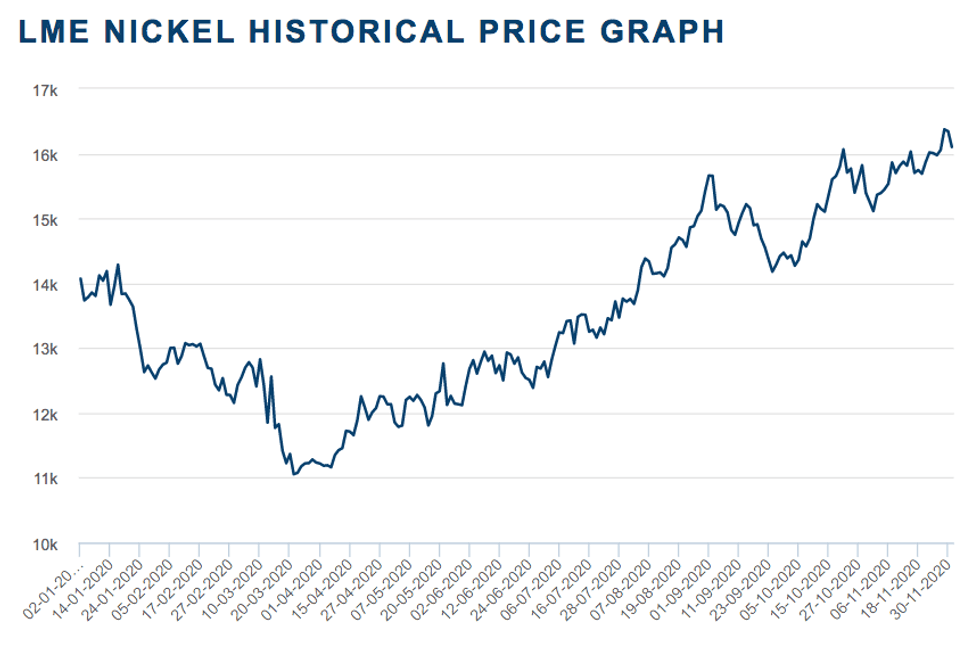

But instead nickel prices touched their lowest level in March, reaching U$11,055 per tonne when the COVID-19 pandemic hit commodities across the board.

2020 nickel price performance. Chart via the London Metal Exchange.

Mining and refining facilities for nickel were disrupted at a global scale, from the Philippines to Canada, as a result of coronavirus containment measures.

“We expect primary refined nickel supply to decline by a little more than 1 percent year-on-year in 2020 because of the disruptions,” Jack Anderson of Roskill said back in Q1. “However, Indonesian nickel pig iron production has soared through early 2020, which has helped to make up for falls in refined nickel supply elsewhere.”

For Anderson, nickel demand was more severely impacted as the virus eventually forced governments across the world to impose measures aimed at slowing the spread of the disease.

“Those measures, however, also resulted in a sharp slowdown in economic activity, which is expected to lead to a sharp deceleration in primary nickel demand,” he said at the time.

Nickel prices started the quarter trading at US$14,070 and ended the three month period at US$11,235.

Nickel trends Q2: Recovery begins

During Q2, nickel was able to rebound, making its way back above US$12,000 by the end of the period on the back of China’s recovery. Nickel’s price performance was a surprise to the upside in H1, according to Andrew Mitchell, Wood Mackenzie’s research director.

“This is not supported by fundamentals, (it’s) more sentiment and perception,” he said back in Q2.

CRU Group’s Nikhil Shah told the Investing News Network (INN) at the time that the surprise of the first half of the year was how quickly the rebound in prices happened given nickel’s fundamentals.

“I think that is a concern, given that fundamentally we look at the market being in surplus this year,” he said. “There’s potential for nickel prices to correct from current levels in the second half of the year.”

For Mitchell, supply was less impacted by the pandemic, as in most countries mining was deemed an important industry to maintain — that said, production was lost in Canada, the Philippines, New Caledonia and Madagascar, and to a lesser extent South Africa and Australia.

“The incredible growth in production in Indonesia, combined with the demand destruction of COVID-19, has moved our forecast from one of deficits and higher prices as of the end of 2019 to one of surplus and stagnating/lower prices,” Mitchell said back in Q2.

Q2 saw nickel demand picking up, especially in China. While the country was the first to be affected by the COVID-19 pandemic, it was also the first to begin to lift lockdown measures, Anderson said.

“Elsewhere, demand is expected to start recovering as lockdown measures begin to be lifted,” he added. “This should result in a gradual improvement in demand, albeit from a low base.”

When looking at nickel’s fundamentals, Mitchell told INN that the coronavirus has had a major impact on demand globally, and despite China’s strong return, the rest of the world will take a few years to get back to 2019 levels. “Stainless and superalloy being particularly affected, but also the EV sector,” he said.

Nickel prices started the quarter trading at US$11,220 to end the three month period at US$12,790.

Nickel trends Q3: Elon Musk calls for more nickel mining

During the summer, Tesla (NASDAQ:TSLA) CEO Elon Musk called for more mining of nickel, as it is an essential component of EV batteries.

“Tesla will give you a giant contract for a long period of time if you mine nickel efficiently and in an environmentally sensitive way,” Musk said.

Prices rallied after the CEO’s comments, sending nickel to its quarterly high of US$15,660.

At Tesla’s Battery Day, a dedicated event on batteries held in late September, Musk said that the automaker is looking to process nickel in a more efficient way, eliminating steps and addressing the waste of water. He also reiterated his request for more nickel mining, and said the company is developing cathodes that will contain higher nickel and no cobalt.

“The move to high-nickel cathodes has been widely accepted, and Tesla confirmed that it was in the same boat,” Sean Mulshaw of Wood Mackenzie told INN after the event. “(But) more nickel comes at the expense of cobalt, and this means lower stability of the cathode.”

During Battery Day, Musk also said the California-based automaker has found a simplified way to process nickel that suggests it will eliminate the Class 1 nickel dissolution process.

Currently, demand for nickel sulfate is based on present-day commercialized nickel raw material to cathode production routes, with Tesla now announcing its intention to utilize 100 percent nickel powder direct to cathode, Anderson explained.

“However, the difficulties of such with regards to process refinement, yield optimization and expanding to commercial scale should not be understated,” he added. “New developments in technology from first inception through to commercialization can span eight to 10 years; an industry track record indicating a minimum of five years longer is likelier than that of Tesla’s proposed three year plan.”

Should Tesla succeed in its battery cathode manufacturing ambitions, Roskill believes there is a greater supply shortage risk for suitable metal powder than there is for nickel sulfate.

“In addition to the availability of specific nickel products, there are growing concerns surrounding sustainability of the nickel supply chain. This is particularly important for the EV supply chain, where consumers are inherently aware of the environmental footprint of their purchase,” Anderson said.

Nickel prices started the quarter trading at US$12,555 to end the three month period at US$14,385.

Nickel trends Q4: Prices continue to trend upwards

Nickel continued its climb during the fourth quarter, hitting its highest level of the year so far on November 30 at US$16,343.

Prices were driven by higher demand from the stainless steel sector, in particular in China and Indonesia.

“Few anticipated the remarkable recovery in Chinese and Indonesian stainless steel production, particularly of the high-nickel 300-series grades,” Macquarie analyst Jim Lennon said.

“Preliminary soundings for October suggest production will remain solid at near record high levels, with Indonesian production rising to new record highs.”

Global demand for nickel is expected at 2.52 million tonnes in 2021 from 2.32 million tonnes this year, according to the International Nickel Study Group.

On the supply side, scheduled expansions of output capacity in Indonesia have been delayed until next year, which has increased concerns over supply tightness and pushed prices further upwards, according to a recent FocusEconomics report.

“Moreover, global nickel output is set to increase notably next year as Indonesian production ramps up, leading to supply surpluses,” analysts at the firm said. “A prolonged global health crisis, which could weigh on the pace of the economic recovery, poses an additional downside risk.”

Nickel prices started the quarter trading at US$14,430, and on December 1 they were at US$16,102.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.