Nickel Price 2023 Year-End Review

Nickel trended down in 2023 as lower demand and higher supply created price pressure. Here's a look at the main trends that impacted the market over the course of the year.

Nickel soared to its highest price ever in 2022, breaking through US$100,000 per metric ton (MT).

2023 was a different story. As governments worked to combat inflation and investors faced considerable uncertainty, commodities saw a great deal of volatility. Nickel was no exception, especially in the first half of the year.

Ultimately the base metal couldn't hold onto 2022's momentum and has spent the last 12 months trending downward. Read on to learn what trends impacted the nickel sector in 2023, moving supply, demand and pricing.

How did nickel perform in 2023?

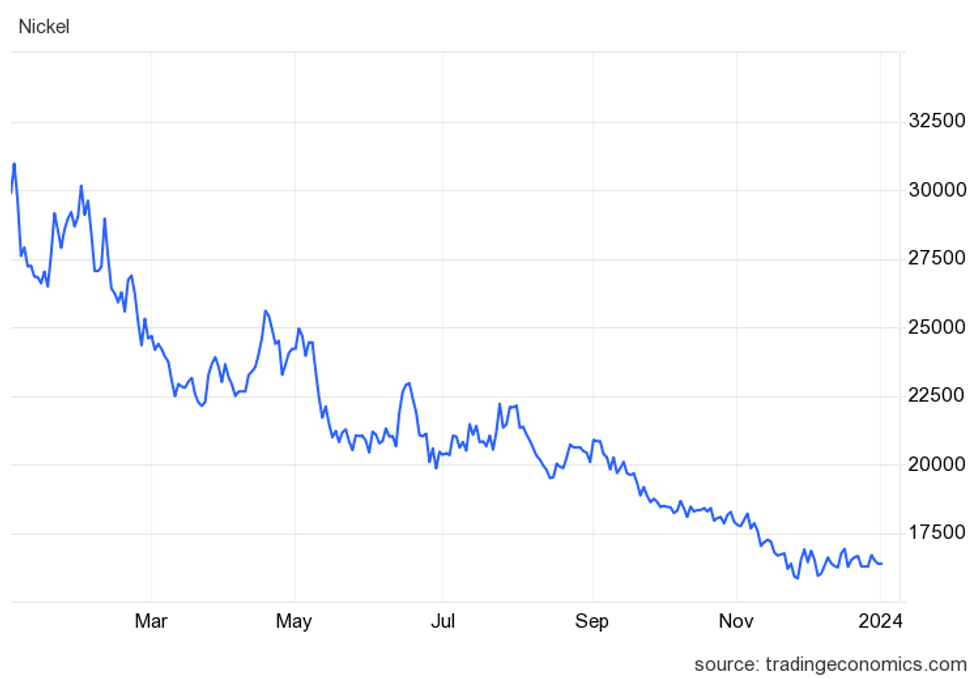

Nickel price from January 2, 2023, to December 29, 2023.

Chart via Trading Economics.

Nickel opened 2023 at US$31,238.53 on January 2, riding on the back of momentum that started in Q4 2022, and flirted with the US$31,000 mark again on January 30. As January closed, the metal began to retreat, and by March 22 nickel had reached a quarterly low of US$22,499.53. It made slight gains in April and May, but spent the rest of the year in decline, reaching a yearly low of US$15,843 on November 26. In the final month of the year, the nickel price largely fluctuated between US$16,000 and US$17,000 before closing the year at US$16,375, much lower than where it started.

Despite nickel's return to normal price levels, 2022's rise to more than US$100,000 made more headlines this past year. The substantial increase came after a short squeeze, and the London Metal Exchange (LME) was criticized by some market participants for halting trading and canceling US$12 billion in contracts.

In June 2023, Jane Street Global Trading and hedge fund Elliott Associates filed a lawsuit for US$472 million in compensation for the canceled trades, stating that the LME acted unlawfully. However, judgment came down in favor of the LME on November 29. Elliott Associates has been granted permission to appeal the decision, which it intends to do.

Indonesian supply growth weighs on nickel price

At the end of 2022, analysts were predicting that nickel would enter oversupply territory due to increased production, primarily from Indonesia and China. Speaking to the Investing News Network (INN) at the time, Ewa Manthy of ING commented, "We believe rising output in Indonesia will pressure nickel prices next year."

This prediction came true — production surpluses continued to be a theme in 2023, weighing on prices.

Indonesia continued its aggressive increase in nickel production, more than doubling the 771,000 MT it produced in 2020. A forecast from an Indonesian government official in early December indicates the country is on track to reach production in the 1.65 million to 1.75 million MT range, further adding to a growing supply glut.

In an email to INN, Jason Sappor of S&P Global Commodity Insights said nickel was the worst-performing metal in 2023 due to expanding supply. “We consequently expect the global primary nickel market surplus to expand to 221,000 MT in 2023. This would be the largest global primary nickel market surplus in 10 years, according to our estimates,” he said.

The reason for Indonesia's higher output in recent years is that the country has been working to gain greater value through the production chain, and in 2020 strictly regulated export of raw nickel ore. This decision forced refining and smelting initiatives in the country to ramp up rapidly and brought in foreign investment.

In H2, Indonesia's attempts to combat illegal mining led to delays in its mining output quota application system. While the country originally said it would begin to process applications again in 2024, lack of supply forced steel producers to purchase nickel ore from the Philippines to meet demand, and Indonesia ultimately issued temporary quotas for Q4.

Nickel demand hampered by weak Chinese recovery

Supply is only part of the problem for nickel. Coming into 2023, Manthy suggested demand would be impacted by China’s zero-COVID policy, which had been affecting the country's real estate sector. “China’s relaxation of its COVID policy would have a significant effect on the steel market, and by extension on the nickel market,” she said.

This idea was echoed by analysts at FocusEconomics, who noted, “The resilience of the Chinese economy and the country’s handling of new COVID-19 outbreaks are key factors to watch.”

While China ended its zero-COVID policy in December 2022, the year that followed was less than ideal for the country, with sharp declines in real estate sales and two major developers seeing continued troubles. In August, China Evergrande Group (HKEX:3333) filed for bankruptcy in the US, and at the end of October, Country Garden Holdings (OTC Pink:CTRYF,HKEX:2007) defaulted on its debt. Because the Chinese real estate sector is a major driver of steel demand, this has had a dramatic impact on nickel and is one of the primary causes for its price retreat.

There have also been wider implications for the Chinese economy. Deflation has been triggered in the country as its outsized property sector implodes, with downstream effects for the more than 50 million people employed in the construction industry. Some, including the International Monetary Fund and Japanese officials, have compared the situation in China to Japan in the 1990s, when that country’s housing bubble burst and created economic turmoil.

With uncertainty rife, China’s central bank still isn’t ready to begin cuts on its key five year loan prime interest rate, but it has been working to improve market liquidity to stimulate real estate sector growth. In aid of that, it cut the reserve requirement ratio by 25 basis points twice in 2023, lowering the amount of cash reserves banks have to keep on hand.

So far, these stimulus efforts haven’t had much effect on the real estate market, and its continued struggles have ensured that commodities attached to the sector, including nickel, are still trading at depressed prices. China has vowed to continue to work on its fiscal policy by removing purchasing restrictions on home buying and providing better access to funding for real estate developers.

EVs not boosting nickel price just yet

Nickel is one of many metals that has been labeled as critical to the transition to a low-carbon future. It’s essential as a cathode in the production of electric vehicle (EV) batteries, and when INN spoke to Rodney Hooper of RK Equity at the end of 2022, he noted that people were initially quite conservative on their estimates of EV sales.

However, that's now begun to change. “That’s all turned on its head now. EVs represent a big percentage of nickel demand, and they will continue to rise going forward," Hooper explained at the time.

While the EV outlook remains bright, the sector hasn’t grown fast enough to make up for declining steel sector demand for nickel. And with limited charging infrastructure, range concerns and the effects of higher-for-longer interest rates, EV sales slowed in 2023. The slowdown is welcome news for battery makers as it will allow them time to build out factories and further develop technology, but it’s not good for investors and producers of nickel looking for pricing gains.

Investor takeaway

2023 wasn’t a great year for nickel. It faced increasing supply against lowered demand from both the Chinese real estate sector and slower EV sales. The rebound in the Chinese economy that was hoped for after COVID-19 restrictions were removed never occurred, and instead it has regressed further, pushing into deflationary territory.

Nickel investors may feel a little stung at the close of the year, especially as uncertainty in the market persists.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.