OPINION — Past is Prologue: Why the Next Decade Could Belong to Gold and the Miners

The fundamentals and technicals for gold and silver both point in the same, argues John Newell. They are entering a phase of renewed strength, and the companies that mine them present an opportunity.

This opinion piece was submitted to the Investing News Network (INN) by John Newell who is an external contributor. INN believes it may be of interest to readers and has copy edited the material to ensure adherence to the company’s style guide; however, INN does not guarantee the accuracy or thoroughness of the information reported by external contributors. The opinions expressed by external contributors do not reflect the opinions of INN and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

By John Newell

It’s fascinating how investor psychology changes depending on where we are in the cycle. Gold and silver are trading near record highs, major producers are generating more free cash flow than at any time in history, and yet the dominant question I hear is: “When should we sell?”

That’s a fair question, if you believe we’re late in the game. But what if the game has just begun?

When Amazon broke out to new all-time highs in ~2015, no one was asking when to sell or that the RSI was extended. Investors were trying to understand how high it could go. Now, with gold and silver quietly building momentum and mining shares starting to outperform, it’s worth asking whether we’re entering a similar long-duration growth phase.

When you step back and look at the long-term charts, the picture changes completely. The patterns, the ratios and the fundamentals all point to the same conclusion: we are likely in the early innings of a new metals bull market, one that could last the better part of a decade. As Mr. Ross Beatty, chairman of Equinox Gold (TSX:EQX,NYSEAMERICAN:EQX), said in a recent interview, “the real danger that investors are facing is selling to soon.”

The fundamentals: Why gold and silver are rising

The macro backdrop has rarely been this supportive for precious metals and the companies that mine them.

1. Monetary policy and global debt

Governments are trapped in a cycle of deficit spending. Even as central banks talk about “tightening,” real rates remain well below long-term averages. Debt levels are so high that sustained high interest rates would risk destabilizing entire economies. That reality ensures a policy bias toward easy money, and that’s historically bullish for gold.

2. Currency debasement

Since 2020, the global money supply has exploded. The purchasing power of fiat currencies continues to erode as governments print to cover deficits. Investors and central banks alike are turning to tangible stores of value and buying gold. Gold remains the anchor asset in a world of floating currencies.

3. Geopolitical instability

Conflict, sanctions, trade fragmentation and the weaponization of financial systems have made global markets far less predictable. Gold thrives in such environments because it exists outside the control of any single government or central bank.

4. Industrial demand for silver

Silver’s dual role, as both a monetary metal and an industrial material, makes it unique. The accelerating demand for solar energy, electronics and electric vehicles has added an entirely new source of structural demand. In every major bull cycle, silver eventually outperforms gold, and that cycle appears to be setting up again.

5. Mining companies are depleting their own businesses

Every day a miner operates, it consumes a finite resource. As production continues, reserves decline, forcing companies to either buy or discover new deposits to survive. With record profits and cash flow, the majors now face a choice: replace ounces through acquisition or face a long-term production cliff. That dynamic creates a powerful incentive to invest in juniors, the discovery pipeline of the industry.

The technical case: Charts tell the real story

The ratio and index charts reveal what price action alone can’t: we’re seeing early-stage breakouts across multiple timeframes.

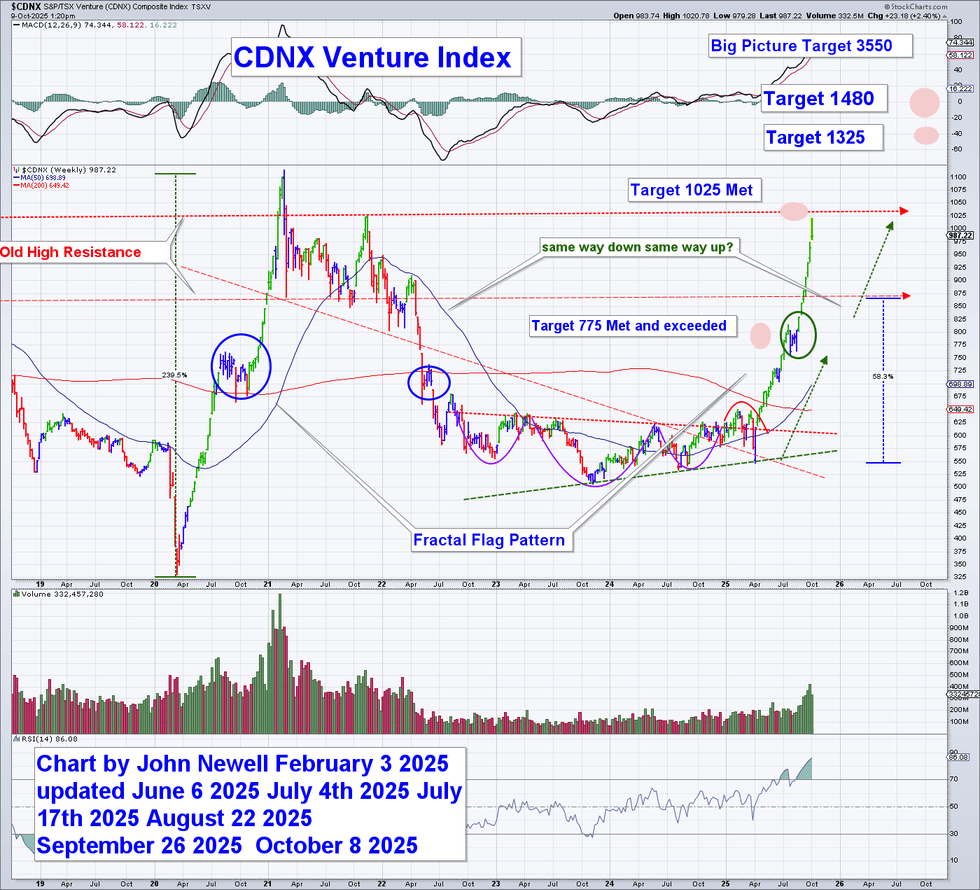

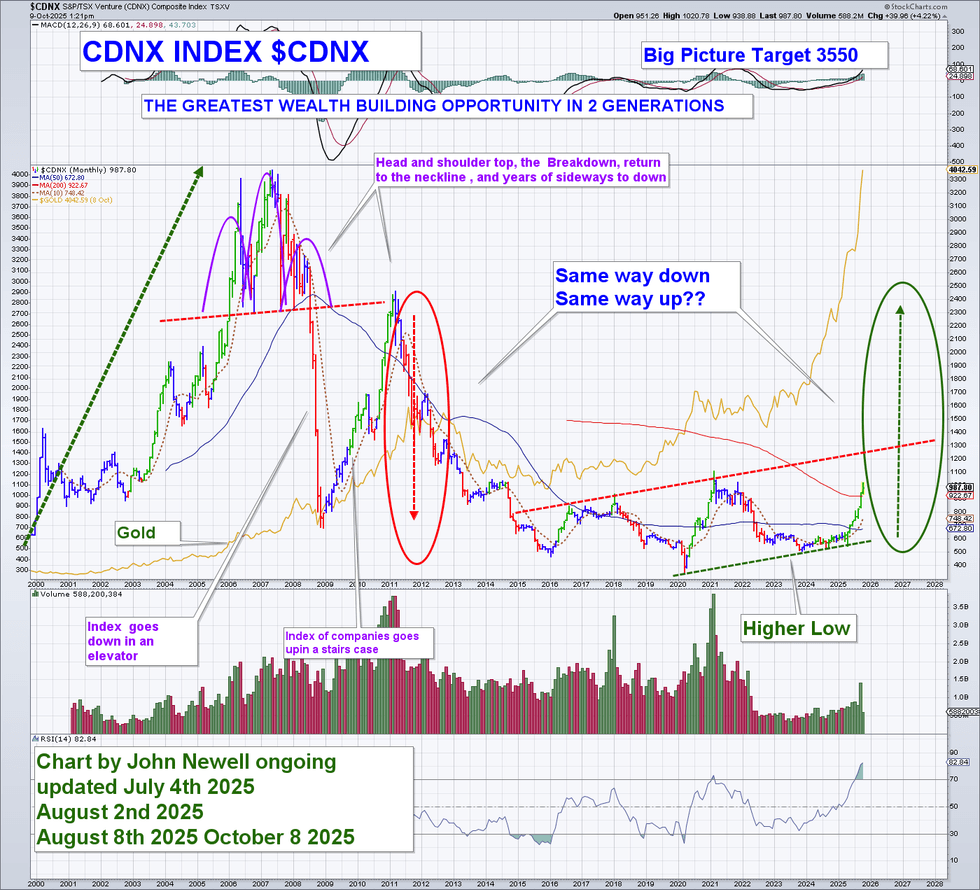

1. CDNX Venture Index: The junior renaissance

The TSX Venture (CDNX) has spent years in a deep base, mirroring the early stages of past bull cycles. It has now broken through major resistance levels, meeting and exceeding its first two targets. Historically, once the index clears these levels, it signals renewed appetite for high-risk, high-reward discovery stories.

In prior cycles, this setup led to multi-year advances where the CDNX outperformed both gold and the broader equity markets by wide margins.

2. CDNX vs. gold: A deep discount waiting to revert

The Venture Index once traded at a premium to gold. Today, it trades at a steep discount. If history is any guide, this imbalance won’t last. As capital rotates back into the exploration stage, that relationship could normalize, driving the index, and the companies within it, significantly higher.

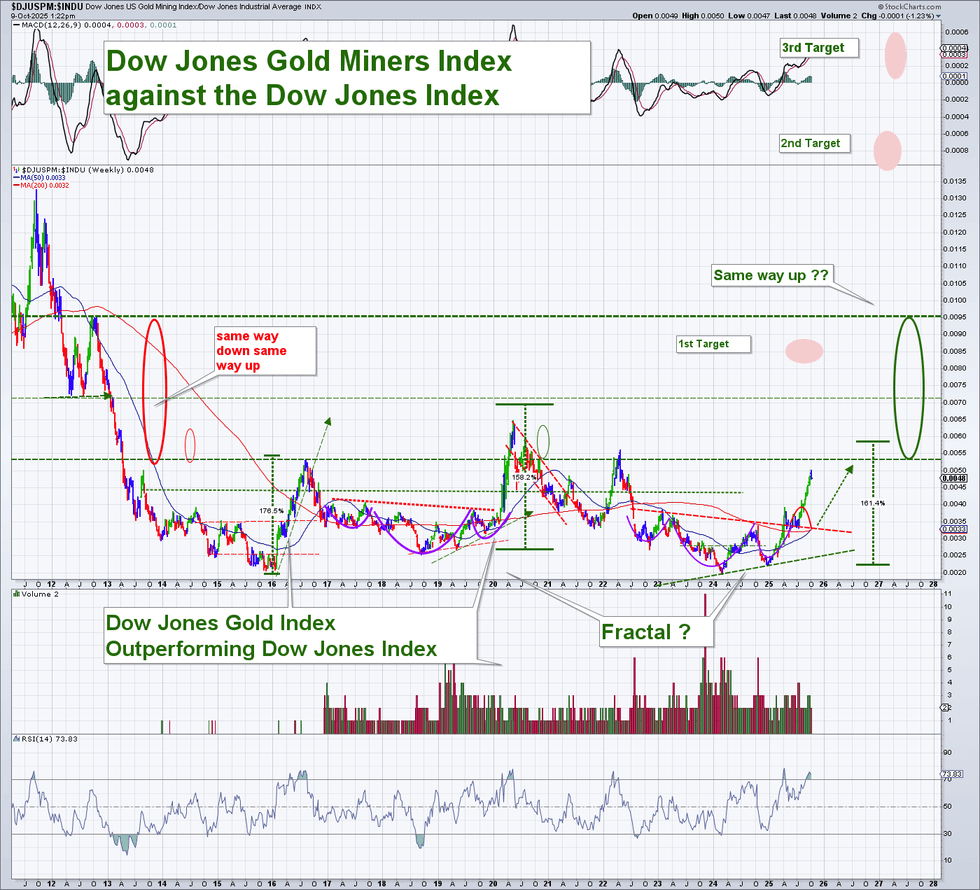

3. Dow Jones Gold Miners Index vs. Dow Jones Industrial Average

This ratio has turned decisively higher for the first time in years. It shows that miners are beginning to outperform the general market, a key hallmark of every past bull market in precious metals. The fractal nature of the pattern suggests the move could be substantial, with targets projecting multiple legs higher.

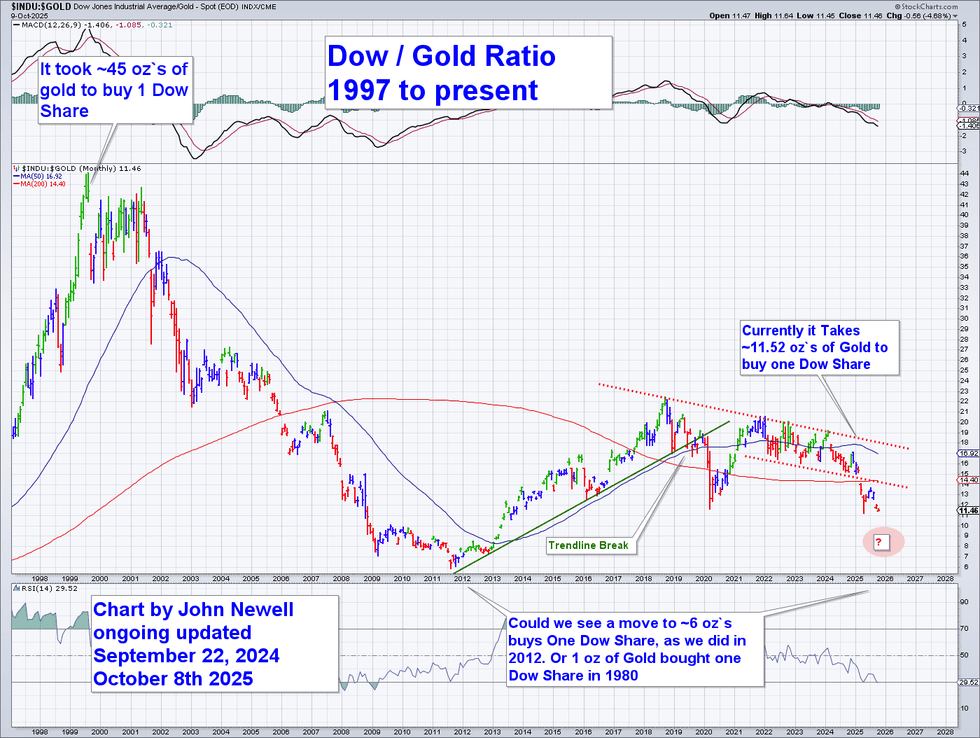

4. Dow/gold ratio: A decade-long turning point

It currently takes about 11.5 ounces of gold to buy one Dow share. At gold’s 1980 peak, that number was 1:1. In 2012, it dropped to about 6:1. The current level sits near the midpoint of the long-term range, not near a top. If this ratio revisits previous lows, gold could trade far higher even if the Dow simply holds its ground.

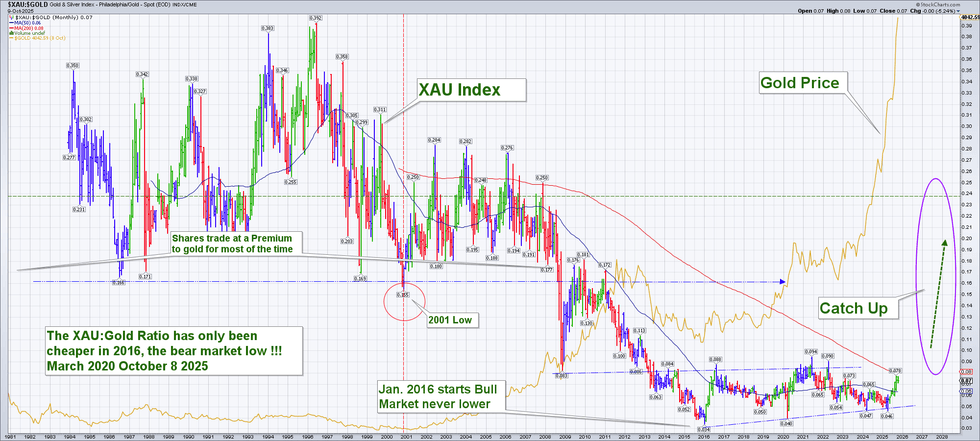

5. XAU/gold ratio: The catch-up trade

The XAU Index (a basket of gold, silver and copper companies) remains near historic lows relative to gold itself. Historically, when this ratio reverses, the move is sharp and powerful as equities “catch up” to the metal. That catch-up phase is where the biggest gains tend to occur.

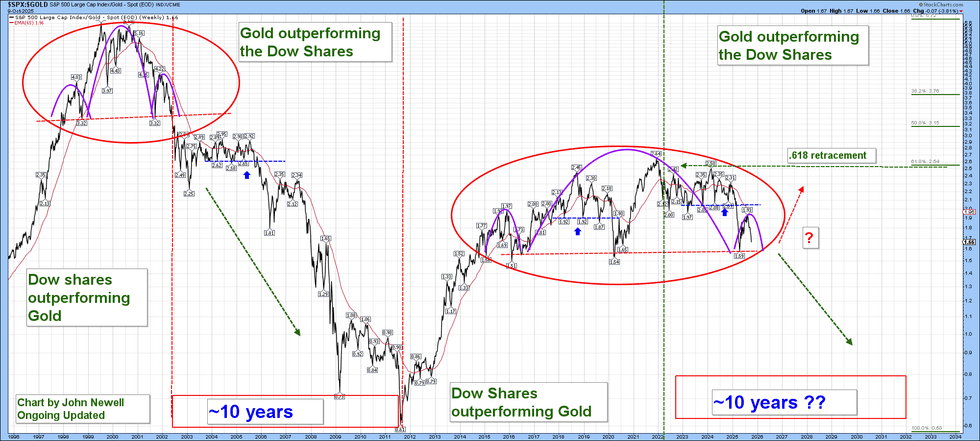

6. The S&P 500 vs. gold: A 10 year rotation cycle

The long-term ratio between the S&P 500 and gold reveals a striking rhythm: roughly every decade, leadership flips between paper assets and hard assets.

In the late 1990s through 2000, gold began outperforming stocks for nearly ten years. Then from 2012 to 2022, the pendulum swung back as equities dominated. Now, as the chart shows, that cycle appears to be reversing once again.

The pattern is clear, a broad topping structure has completed, marked by a .618 Fibonacci retracement that often defines the exhaustion point of an equity-dominant phase. If the pattern repeats, we could be entering another 10-year period where gold outperforms the S&P 500.

For investors, this rotation isn’t about short-term trades, it’s about understanding the secular shift underway. In past cycles, those who recognized the turn early captured extraordinary gains as capital flowed out of overvalued equities and into undervalued tangible assets like gold, silver and the mining shares that leverage them.

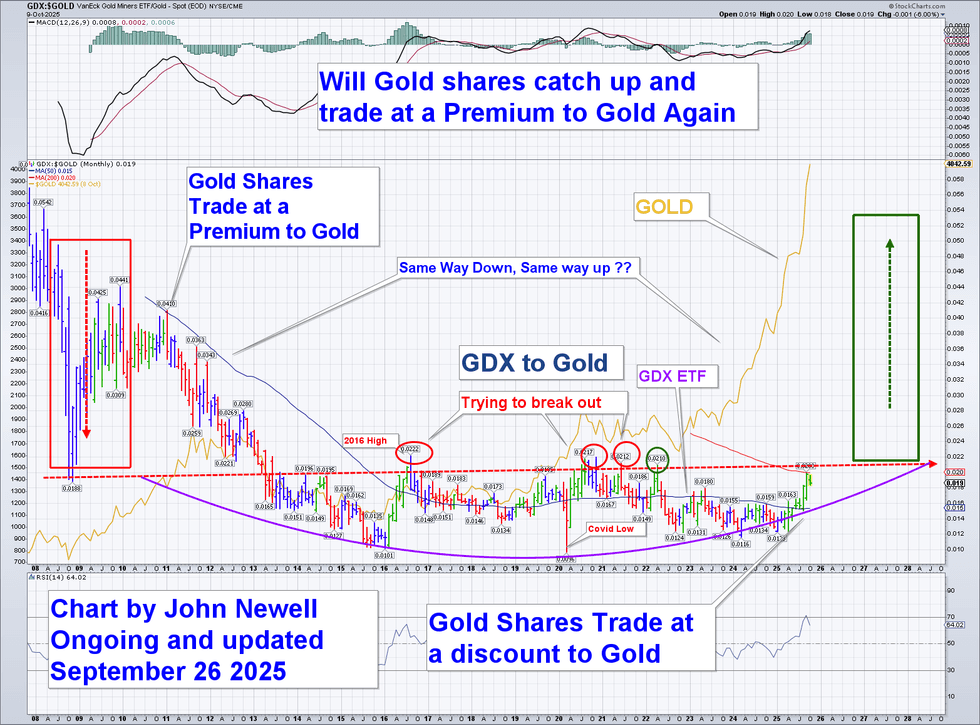

7. GDX to gold: The senior miners’ breakout

The GDX-to-gold ratio compares the performance of gold mining shares to the price of gold itself. Historically, gold equities have traded at a premium to gold because they offer leverage to rising metal prices.

Today, they trade at a deep discount. The ratio has based for nearly a decade and is now pressing against key resistance levels.

The question is simple: Will gold shares catch up and trade at a premium again?

Each time this ratio has turned higher, such as in 2001 and 2016, it marked the beginning of a powerful multi-year rally for miners. The symmetry is striking “same way down, same way up”. GDX is now attempting to break out from that base, suggesting that institutional money is rotating back into the sector.

If this breakout holds, it could confirm the start of the “catch-up phase,” where gold equities finally begin to outperform the metal once again.

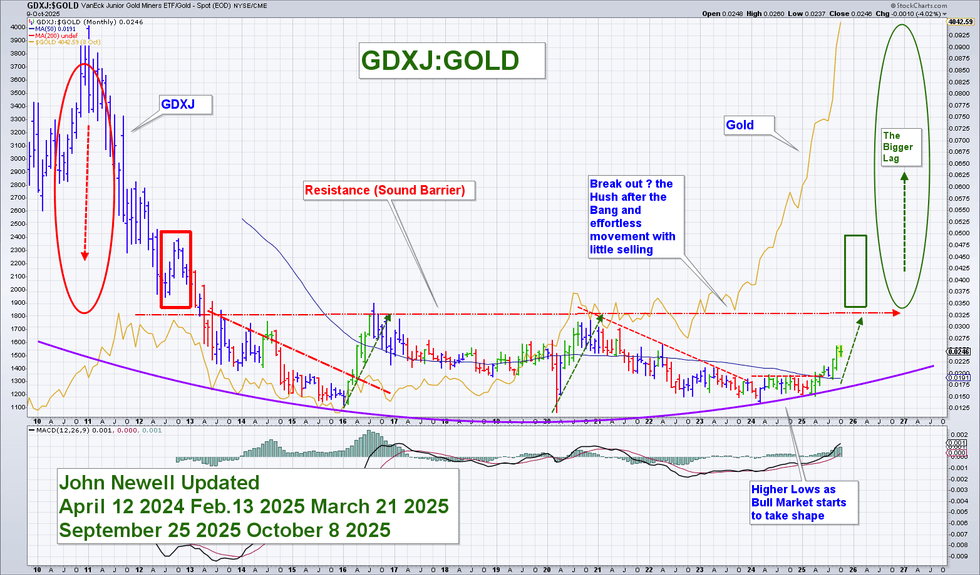

8. GDXJ to gold: The juniors poised to lead

The GDXJ-to-gold ratio tracks junior miners versus gold. This chart captures the heartbeat of the speculative cycle.

After years of decline and a long basing pattern, GDXJ has begun making higher lows, a classic sign that a bull market is taking shape beneath the surface. The ratio is now approaching its “sound barrier”, a resistance line that, once cleared, has historically unleashed sharp, low volume moves higher.

I call this the “hush after the bang”, that effortless movement when sellers are exhausted and buyers begin to chase.

The setup looks like the early 2000s, just before juniors exploded in value as capital flowed down the ladder from producers to explorers.

If this breakout confirms, it will mark the transition from disbelief to recognition, the moment when retail and institutional investors finally return to the exploration trade.

9. The US dollar: Losing strength at the end of a 15 to 16 year cycle

The final piece of the puzzle is the US dollar itself. Every major gold bull market has coincided with a multi-year decline in the US dollar, and the chart suggests that another one may be starting now.

Over the last five decades, the dollar has moved in 15 to 16 year cycles, peaking roughly every decade and a half before undergoing significant multi-year declines. The peaks in 1985, 2001 and 2017 all led to major rallies in gold.

We now appear to be completing another similar cycle. The chart shows a repeating fractal pattern, strong dollar rallies ending in exhaustion, followed by years of gradual weakness. The most recent cycle has lasted about 15 years, placing us right on schedule for the next major turn lower.

If this pattern repeats, the implications are clear: the dollar could be entering a period of long-term structural weakness, which historically corresponds with powerful moves higher in gold, silver and mining equities.

It’s not just about short-term fluctuations; it’s about the end of a currency cycle. When the world’s reserve currency weakens, capital seeks refuge in hard assets. That’s when gold doesn’t just outperform, it re-prices the entire system.

10. Gold’s big picture: A plausible path to US$8,000

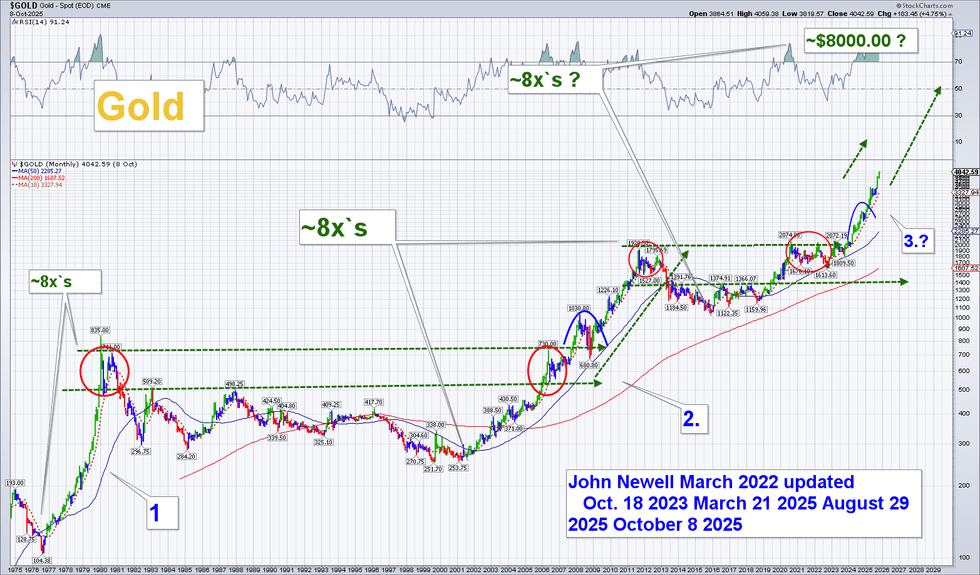

The long-term monthly gold chart provides historical perspective. Since the 1970s, every major bull cycle in gold has produced roughly an eightfold increase from its base.The 1970s bull saw gold rise from ~$100 to ~$850. The 2001–2011 cycle took it from ~$250 to ~$1,900, again, about eight times higher.

Using the same logic, the current move that began around $1,000 in 2015 projects to roughly $8,000 per ounce over the coming years. That may sound bold, but it’s simply the historical rhythm of the metal, repeating across decades of inflation, monetary expansion and geopolitical tension.

If we are indeed at the start of a 10-year cycle where gold outperforms stocks and currencies, $8,000 is not an outlier. It’s the logical extension of the same long-term fractal pattern that has played out twice before.

Why timing matters

Markets are driven by psychology as much as fundamentals. The best opportunities rarely appear comfortable.

After years of neglect, the mining sector has become deeply undervalued. Institutional ownership is low, sentiment is muted and yet the backdrop could hardly be more favorable. These are the conditions that have preceded every major bull run in the resource space.

The technical breakouts we’re now seeing, across the CDNX, the Dow/Gold ratio and the miners vs. market indices, signal a profound shift in capital flows. It’s not just about gold hitting new highs; it’s about where the next wave of money goes once investors realize the sector’s relative undervaluation.

Meanwhile, the largest mining companies are making record profits and record free cash flows but always face declining reserves. They will buy growth and /or merge. And they’ll likely buy it from the juniors, the companies that can still create ounces in the ground.

For investors, this means timing isn’t about calling the top; it’s about recognizing when a new multi-year cycle is starting. The evidence suggests it already has.

Conclusion: The early innings of a generational bull market

Every major gold bull market starts in disbelief. The early stages are quiet, defined by slow accumulation and skepticism. Then momentum builds, ratios turn and capital begins to flow.

Today, both the fundamentals and the technicals point in the same direction. Gold and silver are entering a phase of renewed strength, while the equities that mine them are still priced for a bear market that ended long ago.

Investors waiting for a top may be missing the start of something much bigger. If past is prologue, this could be the beginning of a new chapter where the mining sector leads global markets for the first time in decades.

About John Newell

John Newell is the president and CEO of Golden Sky Minerals (TSXV:AUEN) and serves as president and CEO of Thunderbird Minerals (TSXV:BIRD). A seasoned market professional, John has been writing about precious metals and exploration companies since 2001. He has worked as a portfolio manager and precious metals fund manager and now takes a leadership role in the exploration sector, where his company recently completed an earn-in joint venture with a major mining firm. John blends technical analysis with on-the-ground experience to provide a unique perspective on the evolving precious metals markets.

Don't forget to follow us @INN_Resource for real-time updates!