Lead Outlook 2022: Demand to Recover, Prices Likely to Remain High

What’s the lead outlook for 2022? Read on to find out what analysts had to say about the market.

Click here to read the previous lead outlook article.

Following a rebound from lows hit in 2020, lead prices continued their upward trend in 2021.

Although volatility was high, prices reached their highest level in more than three years.

As the new year begins, the Investing News Network (INN) is looking back at the main trends in the lead space in 2021 and what’s ahead for prices, supply and demand. Here's what analysts and market participants had to say.

Lead trends 2021: Price performance review

Lead prices kicked off 2021 on a bright note after recovering from the uncertainty brought on by COVID-19 in 2020, but volatility reigned in the lead space for most of the year.

Speaking with INN about how lead performed in 2021, CPM Group’s Carlos Sanchez said lead was the weakest performer of all the base metals.

“One would have expected, given the performance of all other base metals, and really most commodities, for lead to have performed better,” he said.

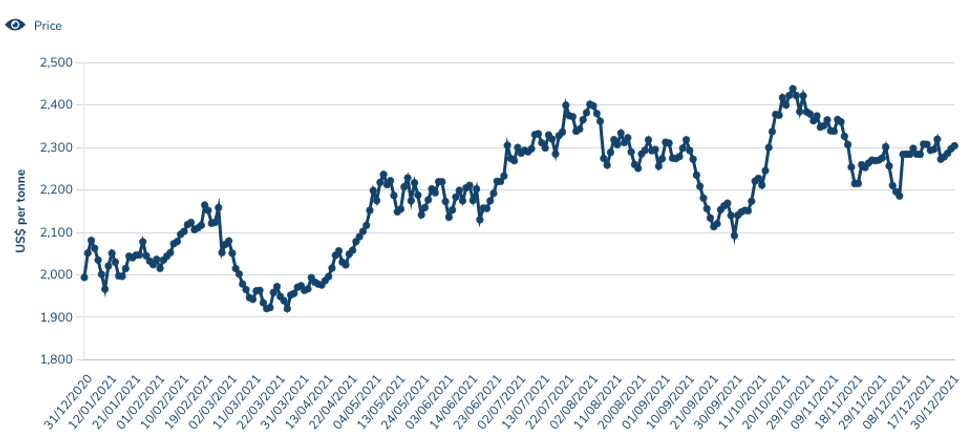

Lead prices started 2021 hovering around the US$2,000 per tonne mark and traded higher for most of the first quarter. But prices started to fall by the end of February, hitting their lowest point of the year by the end of March.

Lead's price performance in 2021.

Chart via the London Metal Exchange.

“Lead prices dropped, likely weighed on by higher US yields and still-downbeat demand for automotives,” FocusEconomics analysts said back in the first quarter of the year.

After plummeting by the end of Q1, prices turned to the upside as demand from top consumer China was firm.

“Moreover, healthier automotive production data in key manufacturing countries in March, particularly in China, Germany and the US, pointed to stronger demand for lead-acid batteries, thereby pushing lead prices further up,” FocusEconomics analysts said in a report on the market. “However, lower lead scrap prices in the US market amid ample supply seemingly capped the increase somewhat.”

The third quarter saw lead prices pull back again, although they continued to trade above the US$2,000 level.

“Ongoing energy shortages in China, which have resulted in production curbs, weighed on lead-acid battery output, with plants markedly reducing output from 23 September,” FocusEconomics analysts said. “On top of this, downbeat car manufacturing amid semiconductor shortages, as well as surging prices for silicon — essential for alloying purposes — likely exerted additional downward pressure on prices.”

The fourth quarter saw some recovery for lead prices, which achieved a Q4 high of US$2,469 on October 25 before ending the year sitting around the US$2,300 point.

Lead outlook 2022: What’s ahead for supply, demand and prices

As the new year begins, investors interested in the lead market should keep an eye on supply and demand dynamics, as well as catalysts that could impact the sector and, of course, prices.

The pandemic dealt a blow to lead demand as the metal's main use is in batteries, and the auto sector has experienced many hurdles in the past year, including a chip shortage.

In 2022, CPM is anticipating that the market will recover, assuming the world can get past COVID-19.

“Expect a recovery in lead to happen more in the second half of 2022,” Sanchez said.

Looking at how supply has performed, global lead mine production rose by 4.6 percent over the first 10 months of 2021 compared to the same period in 2020, as per the International Lead and Zinc Study Group. This was mainly due to increases in Bolivia, China, India, Mexico and Peru, which more than balanced a major reduction in Poland.

Additionally, world refined lead metal supply exceeded demand by 15,000 tonnes during the first 10 months of 2021, with total reported stock levels increasing by 31,000 tonnes.

Following the sharp contraction seen due to the global COVID-19 pandemic in 2020, global lead mine production is expected to rebound strongly during the 2021 to 2023 period, according toF itch Solutions.

“Output will be boosted by increased investment into copper, zinc and silver mines that produce lead as a by-product,” the firm said. “Lead mine production will grow most rapidly in Peru and Australia, while output growth will slow in dominant producer China due to tightening safety and environmental regulations in the country.”

Even with output rising, CPM is calling for the lead market to be tight in 2022, although a surplus is still expected.

“But that surplus is expected to be reduced in 2022 and likely be reduced further beyond this year,” Sanchez said.

Looking over to prices, CPM believes lead prices will pick up in 2022, in particular in the first few months of the year — a seasonally strong period for demand.

“Prices do retreat a little bit in the summer months because there's reduced demand for lead batteries,” Sanchez said. “But then, if we can get past this COVID virus, and the shortage in chips for autos no longer becomes an issue, I think you're going to see lead prices move sharply higher.”

CPM forecasts that lead prices will average US$2,600 for the year. Meanwhile, panelists recently polled by FocusEconomics see prices averaging US$2,057 in Q4 2022 and US$2,025 in Q4 2023.

“Although prices for lead are seen falling further ahead, positive fundamentals amid a gradually normalizing automotive sector should limit the decline next year and in 2023,” FocusEconomics analysts said. “The gradual phasing-out of lead-acid batteries, amid the global legislative push for green technologies, poses a key downside risk, while pandemic-related uncertainty casts a shadow over the outlook.”

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Nickel Outlook 2022: Balanced Market Ahead, Prices to Remain ... ›

- Copper Outlook 2022: Prices Likely to Remain High, Modest Surplus ... ›

- Zinc Outlook 2022: Analysts Expect Small Refined Deficit | INN ›

- Ways to Invest in Lead | INN ›

- 7 Top Lead-producing Countries | INN ›