Compelling Pre-feasibility Study for Lake’s Kachi Project

Lake Resources NL (ASX:LKE; OTC:LLKKF) has completed a compelling and robust Pre-Feasibility Study (PFS) into the technical and economic viability of Lake’s Kachi Lithium Brine Project in Catamarca, Argentina.

Update: Click here for the webinar recording

Compelling Pre-Feasibility Study (PFS) results for Lake’s Kachi Lithium Brine to produce sustainable, high purity, low impurity lithium carbonate to attract premium pricing to meet growing demand from battery makers.

- Long-life, low cost operation with annual production target of 25,500 tonnes of battery grade lithium carbonate by direct extraction using efficient Lilac Solutions technology, based on the Indicated Resource of 1.0 million tonnes LCE1 at 290 mg/L lithium (22% of current total resource).

- Unlevered post-tax NPV8 of US$748 million (A$1,180m) and IRR of 22%; with EBITDA of US$155 million (A$245m) in first full year of production, using forecast of US$11,000/t Li2CO3 CIF Asia.

- High margin project with EBITDA margin (operating margin) of 62%, using forecast prices.

- Competitive capital cost (capex) estimate of US$544 million including contingency, and

operating cost (opex) of US$4178/tonne Li2CO3. - Next steps involve delivering product samples from the pilot plant to potential off-takers, targeting lower up-front costs, and further resource development to extend project life. Financing and off-take discussions continue.

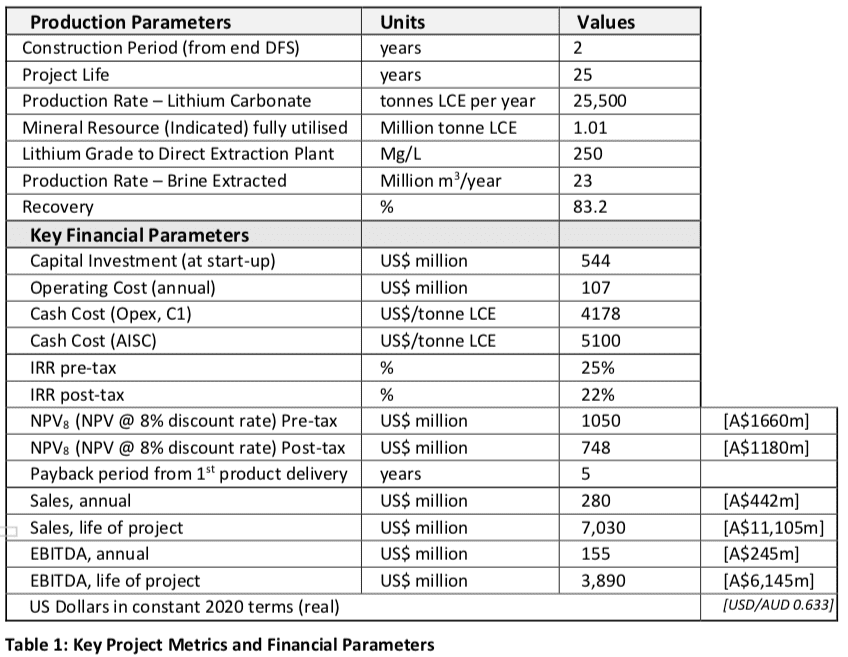

Lithium explorer and developer Lake Resources NL (ASX:LKE; OTC:LLKKF) has completed a compelling and robust Pre-Feasibility Study (PFS) into the technical and economic viability of Lake’s Kachi Lithium Brine Project in Catamarca, Argentina. The study demonstrates the project’s potential to deliver high purity product required by battery makers, based on a sustainable and scalable process (refer project details in Tables 1, :2 and 3).

The study focused on the engineering and costing of preferred process design options supported by direct lithium extraction test work by Lilac Solutions, with Hatch appointed to provide engineering and design services.

Lake’s Managing Director Steve Promnitz said: “This is a major milestone for Lake that allows us to ramp up project development initiatives. The PFS highlights the cost competitive nature and scale of the flagship Kachi Project using direct extraction, but has the benefit of producing high purity product capable of attracting premium pricing, while being a leader in sustainable lithium desired by Tier-1 electric vehicle makers. The PFS together with samples from the pilot plant will help advance discussions with off-takers and financiers.”

Lilac Solution’s CEO Dave Snydacker said: “Kachi is a globally important lithium project with its large brine resource and environmentally-friendly process. With this PFS, we have demonstrated a non-utilities OPEX of US$2,500 per tonne of lithium carbonate. The remaining 40% of OPEX is primarily due to energy from natural gas at US$21/mmBTU. Given the excellent solar resource on site, we have a great opportunity to incorporate solar PV and reduce OPEX. Looking at the capital cost structure, we see that 51% of CAPEX is related to site works and contingency, so opportunities exist for cost reduction in upcoming engineering studies. The Lilac team is excited to continue working closely with Lake to progress the development of Kachi.”

Financing discussions are underway. The potential for premium pricing for a preferred high purity product assist this process. The results and the data of the PFS provide a solid basis for these discussions as well as for a definitive feasibility study (DFS).

Financially Robust Project

The key conclusions of the PFS of the Kachi Lithium Brine Project’s commercial viability are presented in Table 1. The unlevered project delivers an attractive prospective financial performance, with conservative long term future price assumptions of US$11,000/t for battery grade lithium carbonate, with a pre-tax NPV8 of US$1050 million and an 25% IRR and post-tax NPV8 of US$748 million and an 22% IRR based on an annual production target of 25,500 tpa LCE which is supported by the Indicated Mineral Resource for an initial 25 years. The annual EBITDA for the project is US$155 million, with life of project EBITDA of US$3,890 million.

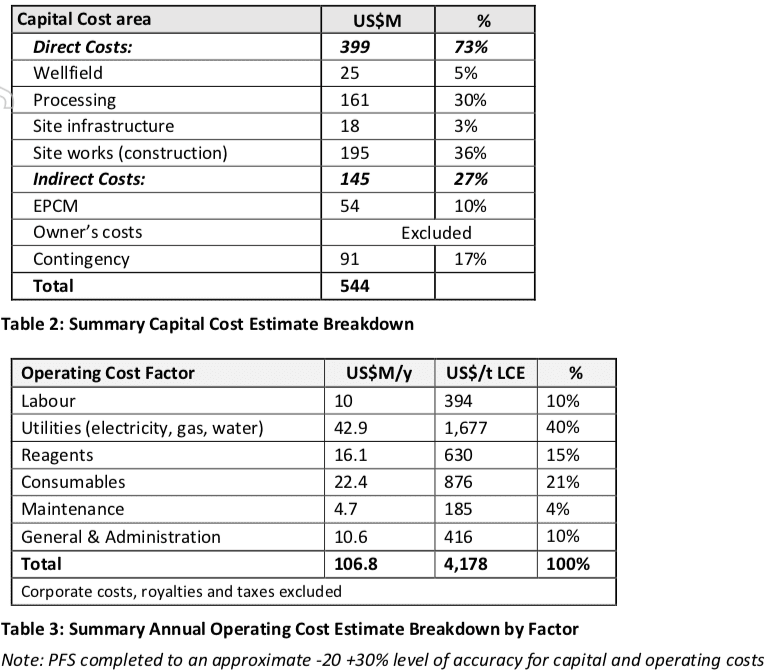

Operating and capital costs are presented on Tables 2 and 3. These are in October 2019 United States dollars, and estimated to an accuracy of about minus 20% to plus 30%. Australian dollars are for comparison only. Capital costs exclude owner’s costs whereas operating costs exclude corporate overheads, taxes and royalties. All costs associated with the direct extraction process were provided by Lilac Solutions, with the remainder based on engineering designs supported by OEM quotation, industry enquiries and supplier databases.

Project Location and Mineral Resource

The Kachi Lithium Brine project is based on the Salar de Carachi Pampa, which is part of the endorheic Carachi Pampa basin, located in La Puna region of north-western Argentina. More specifically, it approximately 50 km south of the town of Antofagasta de la Sierra, in the Province of Catamarca and 100km south of the lithium brine operation at Hombre Muerto, owned by Livent (previously FMC).

The explored area of the salar was 175 km2, hosted in a 700 to 880 metre deep fault-bounded north-west orientated depression filled with brine saturated sands, interbedded with silt and clay, capped by a salt crust and small lake. It is partially obscured by a basalt shield volcano and associated debris fan.

Lake Resources controls 100% of the project, which comprises 70,000 hectares of mineral concessions over the salar through its wholly owned Argentine subsidiary Morena del Valle Minerals S.A. Previously untested, Lake drilled 3150 metres in 15 holes into the salar, down to 400 metres depth, resulting in a maiden JORC resource reported to the ASX on 27 November 2018 of:

- 1.0 million tonnes LCE1 at 290 mg/L lithium (Indicated), and

- 3.4 million tonnes LCEat210mg/Llithium(Inferred).

This resource remains open at depth and laterally, and further drilling is expected to expand and upgrade it. It has low impurities as indicated by a Mg/Li ratio of 3.8 to 4.6, and an average drainable porosity at 8%. The 25,500 tpa LCE production target for the PFS was based on the full utilization (100%) of the JORC Indicated Resource. No Inferred Resource was used in the study.

Plant Design and Extraction Method

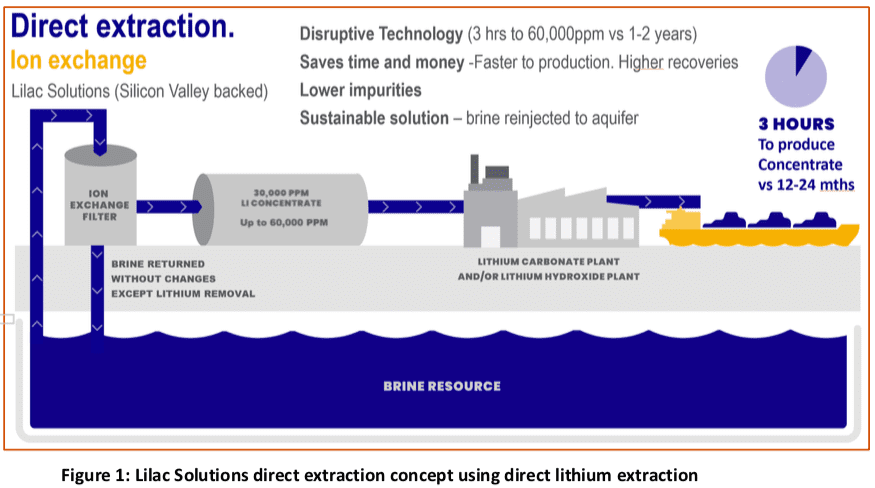

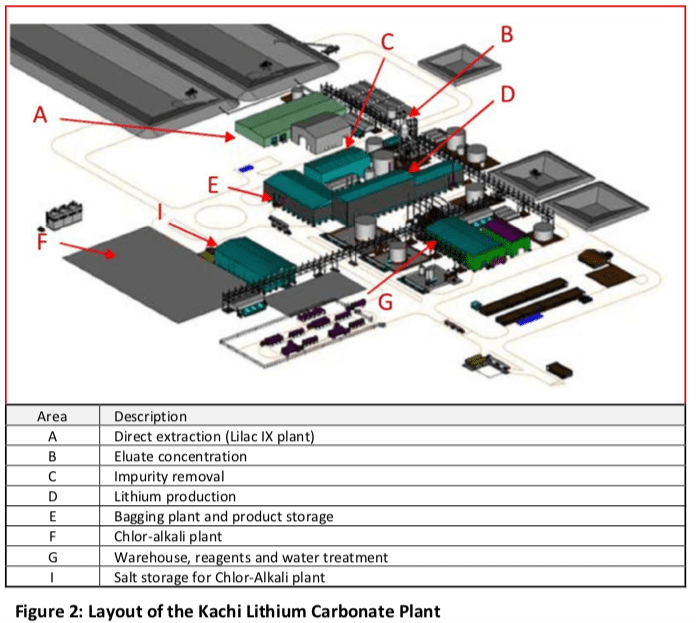

The plant design targets production of 25,500 tpa of battery grade lithium carbonate through the treatment of brine with direct lithium extraction technology based on ion exchange (IX) with the concept shown in Figure 1. The process involves the annual treatment of about 23 million cubic metres of brine at 250 g/L lithium, with an overall plant recovery of 83.2%. The eluate from the process is further concentrated and purified and fed into a conventional lithium carbonate plant. No solvent extraction plant is required to remove boron. While the study was based on 24,000 mg/L feedstock to the lithium carbonate plant (LCP), subsequent development by Lilac has shown that concentration to 60,000 mg/L lithium feedstock is possible for shipping of the lithium concentrate off site. No evaporation ponds are used. The lithium-depleted brine is free of any contaminants and can be reinjected underground to support the salar’s water balance and protect the environment.

The purified lithium concentrate was reacted with sodium carbonate to produce lithium carbonate. The plant layout is shown on Figure 2. Extraction test work has demonstrated that a 99.9% lithium carbonate product with low impurities (battery grade) can be produced by the Lilac process (Table 4) within several hours of extraction as opposed to 18 to 24 months for conventional evaporative concentration processes.

Next Steps

With this PFS, a robust engineering and cost case has been demonstrated. Further engineering studies will be focused on reducing operating and capital costs for the project. The operating cost can be reduced by partially replacing gas with a solar PV and storage system for 8-12 hours per day. The capital cost can be reduced by optimizing the plant layout to minimize earth works, concrete, and steel and by completing a pilot project to reduce contingency.

The next steps involve delivering product samples from the pilot plant modules to potential off-takers and further engineering work to reduce up-front capital and on-going operating costs. Further resource development would extend project life. Studies will be initiated to consider staged development commencing indicatively at 10,000 tpa LCE.

The PFS provides a solid basis for a definitive feasibility study and Lake is confident of progressing the project further based on these latest results.

Footnotes:

1 LCE = lithium carbonate equivalent, which is calculated as lithium metal content times 5.323

Cautionary Statements

General Statement and Cautionary Statement

This report has been prepared by Lake Resources N.L (Lake) for information and planning purposes, but may be received by sophisticated and professional investors, institutional investors and brokers and not any particular party. The information in this report is based upon public information and internally developed data, and reflects prevailing conditions and views as of this date, all of which are accordingly subject to change. The information contained in this report is not intended to address the circumstances of any particular individual or entity. There is no guarantee that the information is accurate as of the date it is received or that it will continue to be accurate in the future. No warranties or representations can be made as to the origin, validity, accuracy, completeness, currency or reliability of the information. No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation. Lake Resources NL accepts no responsibility or liability to any party in connection with this information or views and Lake disclaims and excludes all liability (to the extent permitted by law) for losses, claims, damages, demands, costs and expenses of whatever nature arising in any way out of or in connection with the information, its accuracy, completeness or by reason of reliance by any person on any of it. The information regarding any other projects described in this report are based on exploration targets, apart from Kachi project’s resource statement. The potential quantity and grade of an exploration target is conceptual in nature, with insufficient exploration to determine a mineral resource and there is no certainty that further exploration work will result in the determination of mineral resources or that potentially economic quantities of lithium will be discovered.

Forward Looking Statements

Certain statements contained in this report, including information as to the future financial performance of the Kachi Lithium Brine Project are forward‐looking statements. Such forward‐looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by Lake Resources N.L. are inherently subject to significant technical, business, economic, competitive, political and social uncertainties and contingencies; involve known and unknown risks and uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results, expressed or implied, reflected in such forward‐looking statements; and may include, among other things, statements regarding targets, estimates and assumptions in respect of production and prices, operating costs and results, capital expenditures, reserves and resources and anticipated flow rates, and are or may be based on assumptions and estimates related to future technical, economic, market, political, social and other conditions and affected by the risk of further changes in government regulations, policies or legislation and that further funding may be required, but unavailable, for the ongoing development of Lake’s projects. Lake Resources N.L. disclaims any intent or obligation to update any forward‐looking statements, whether as a result of new information, future events or results or otherwise. The words “believe”, “expect”, “anticipate”, “indicate”, “contemplate”, “target”, “plan”, “intends”, “continue”, “budget”, “estimate”, “may”, “will”, “schedule” and similar expressions identify forward‐looking statements. All forward‐looking statements made in this report are qualified by the foregoing cautionary statements. Investors are cautioned that forward‐looking statements are not guarantees of future performance and accordingly investors are cautioned not to put undue reliance on forward‐looking statements due to the inherent uncertainty therein. Lake does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Competent Person Statement

The information contained in this report relating to Exploration Results, Mineral Resource estimates, and the associated Indicated Resource, which underpins the production target utilised in the Pre-Feasibility Study, have been compiled by Mr Andrew Fulton. Mr Fulton is a Hydrogeologist and a Member of the Australian Institute of Geoscientists and the Association of Hydrogeologists. Mr Fulton has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a competent person as defined in the 2012 edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Andrew Fulton is an employee of Groundwater Exploration Services Pty Ltd and an independent consultant to Lake Resources NL. Mr Fulton consents to the inclusion in this presentation of this information in the form and context in which it appears. The information in this presentation is an accurate representation of the available data to date from initial exploration at the Kachi Lithium Brine project.