The discovery of new trends like Cortez provides investors with an advanced opportunity to invest in what could be the next big thing in Nevada gold mining.

The Cortez trend is the lesser-known relative of the famous Carlin trend — the Nevada site home to the most productive accumulation of gold deposits in North America. In the last quarter of a century, the Cortez trend has been a prolific and profitable site, but experts believe that the Cortez fault corridor could be older, larger and far more valuable than Carlin over the longer term.

And with Nevada continuing to be one of the best regions for gold mining, it’s no surprise why companies operating in this region present a desirable investment opportunity. In Q2 2020 alone, Barrick Gold’s (TSX:ABX,NYSE:GOLD) Carlin project was the largest global mining operation, producing 382 koz — a 105 percent increase over Q2 2019.

A geological overview of the Cortez trend

The Cortez trend in Nevada is home to a string of gold and other mineral deposits along the southern section of the Battle Mountain-Eureka trend. The Cortez trend is similar in size to the Carlin trend, which is located approximately 50 miles to the northeast. The Carlin trend is North America’s largest gold producing region, second only to South Africa’s Witwatersrand.

The Carlin and Cortez regions are similar in many ways. Both have extremely complicated faulting systems, which makes it tricky for geologists to identify the different systems from multiple geological eras.

In simple terms, the Cortez trend contains areas of mineralization in line with the lower plate of the wider Eureka-Battle Mountain area. This lower plate mineralization is responsible for the large amount of gold deposits found within the Carlin trend. As a result of this composition, there is a high degree of confidence that Cortez has the potential to be at least as valuable as Carlin.

The trend runs from the Marigold mine in Humboldt County, owned by SSR Mining (TSX:SSRM,NASDAQ:SSRM), through to the Ruby Hill mine in Eureka.

The untapped potential of the Cortez trend

Despite its proximity to the Carlin trend, and the fact that it exists in a region known for gold production, Cortez has been largely overlooked but the explanation is rather simple. The same pressure on the Earth’s crust that leads to creation of fault lines like the Cortez has also resulted in the deposits being buried underground — making the reward for finding these hidden orebodies extremely lucrative.

Cortez was one of the earliest of the bonanza silver mining camps in Nevada. It was then believed that where one great mineral deposit has been found, there is a high probability of finding others. In 2012, a technical report submitted to the State of Nevada indicated that Cortez deposits are “Carlin”-style sedimentary rock-hosted and porphyry/epithermal deposits.

Today, the Cortez trend’s potential is clear to many of the industry’s major players. With this consensus, a whole host of mining and junior exploration companies have flocked to the region looking to take advantage of a new opportunity in one of the world’s friendliest gold mining regions.

Players to watch in the region

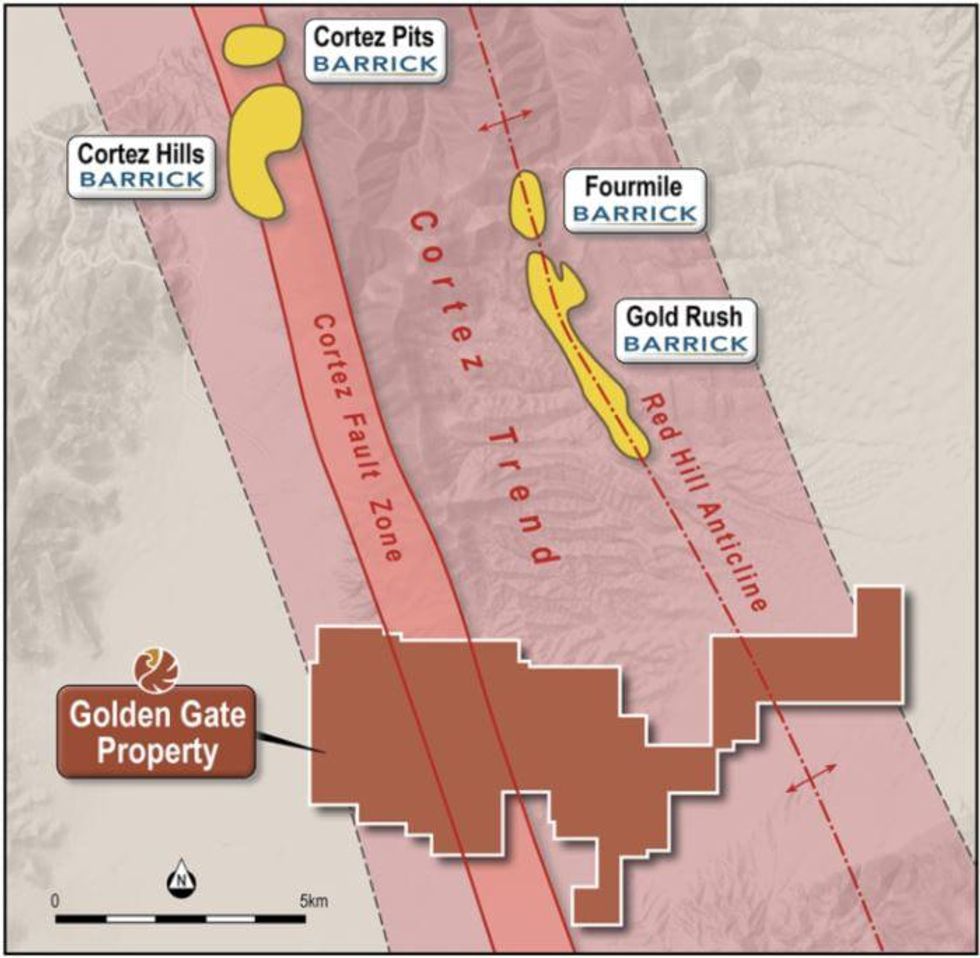

Big players in the gold mining industry like Nevada Gold Mines (NGM), have been operating in the southeast portion of the Cortez trend since the 1990s. NGM holds the Cortez Complex, arguably one of the top gold mining operations in the world. The complex hosts the Pipeline and Cortez Hills mines. Together, these mines have produced more than 25 million ounces of gold since 1996, but estimates say that they still contain 50 million ounces.

Despite these operations, the area still remains full of potential. The Cortez Complex is also home to the Goldrush, Four Mile and Robertson projects. Goldrush is expected to come online later in 2021.

NGM is a 2019 collaboration between Barrick Gold and Newmont (TSX:NGT,NYSE:NEM). Founded in Colorado, Newmont is now the world’s largest producer of gold, since purchasing Goldcorp in 2019. The mining giant has a 38.5 percent stake in NGM.

Toronto-based Barrick Gold owns the Cortez mine in Lander County, situated close to the Cortez Pipeline and Cortez Hills properties. Formerly the largest gold mining company in the world, Barrick Gold had 71 million ounces of gold reserves as of January 1st 2020.

Ther Cortez property is widely considered to be one of the most valuable mining sites in the region, thanks mostly to the Goldrush development. But the entire portfolio of NGM properties is full of deposits similar to those found in the Carlin region.

It’s not only the two big industry players getting involved. There are many junior exploration firms and development companies attempting to capitalize on the region’s potential. McEwen Mining (TSX:MUX,NYSE:MUX) owns the Gold Bar mine, a former past-producer resurrected by the company and brought back into commercial production in 2019.

US Gold (NASDAQ:USAU) is actively exploring its Keystone project, covering 20 square miles in the Cortez trend and highly prospective for new Carlin-type gold discoveries.Formerly known as Silver Standard Resources, Vancouver-based producer SSR Mining is also active in the region. Their Marigold mine, which was acquired in April 2014, is believed to contain reserves of 3.6 million ounces of gold. The wider SSRM group declared total reserves of 8 million ounces at the end of 2020. Their gold measured and indicated mineral resources has grown to 15 million ounces.

Golden Gate: Is it the next big thing?

Just to the south of Goldrush lies the Golden Gate project — a consolidation of two projects named Golden Trend and Garden Gate, owned by junior exploration firm American Eagle Gold (TSXV:AE). The Golden Gate project spans 7,574 acres and covers the entire southern end of the Cortez trend window, which places the company on the southern extensions of both the Cortez Hills and Goldrush structural trends. According to American Eagle Gold CEO Anthony Moreau, “Golden Gate now covers over thirty square kilometres of this highly prospective area of the Cortez trend.”

American Eagle Gold’s Mark Bradley is extremely confident of success in the region. Recently joining the team from Barrick Gold, he said, “I see a chance to find a big deposit at depth here like we did at Goldrush. Golden Trend is the last property on this window that hasn’t been extensively drilled.”

Moreau said, “It is promising to see how well our 2021 exploration program has progressed so far. Our vice president of exploration, Mark Bradley, helped lead the team that made the Goldrush discovery next door, and we are excited at the prospect of making a similar discovery at Golden Trend. The Cortez trend is a world-class gold district, and I believe we have just scratched the surface in terms of its potential.”

Takeaway

Nevada’s unique geological history makes it the ideal location for gold exploration, production, and processing. The wide variety of established and junior mining companies operating in this region only serve to validate just how important this region is to the gold industry. The discovery of new trends like the Cortez trend provides investors with an advanced opportunity to invest in what could be the next big thing in Nevada gold mining.

This INNSpired article was written as part of an advertising campaign for a company that is no longer a client of INN. This INNSpired article provides information which was sourced by INN, written according to INN's editorial standards, in order to help investors learn more about the company. The company’s campaign fees paid for INN to create and update this INNSpired article. INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled. If your company would benefit from being associated with INN's trusted news and education for investors, please contact us.