Top 5 Canadian Nickel Stocks

How to Invest in Palladium Stocks, ETFs and More

How to Invest in Platinum Stocks, Bullion and More

Overview

The push for a greener economy has led the American and Canadian governments to identify more than 30 minerals as critical commodities. The US government has called for the development of a local supply chain of certain critical minerals –– including battery and platinum-group metals –– that are needed to meet the surging demand from green energy needs.

When it comes to sourcing battery and platinum group metals, one type of deposit stands out as a key target. Platreef-style deposits are massive in scale and feature disseminated nickel and copper sulfide mineralization that is enriched with platinum-group elements (“PGE”), gold, chrome, and more. These occur stratigraphically below the high-grade reef-style deposits typically associated with South African PGE mines which are the dominant global source of platinum group metals. Whereas these reef deposits are narrow and require high-cost selective mining methods, the wide widths of Platreef-style deposits are amenable to low-cost bulk tonnage mining methods, resulting in much lower operating costs. For example, Ivanhoe Mines’ (TSE:IVN) Platreef mine in South Africa is anticipated to be one of the largest and lowest cost platinum-group metals mines in the world at more than 1.1 million ounces of palladium, platinum, rhodium and gold production per year. Anglo American’s giant Mogalakwena mine and Platinum Group Metals’ Waterberg project bring the total endowment of the Platreef to over 400Moz PGEs, and tens of billions of pounds of nickel and copper, plus other minerals.

Today, Ivanhoe Mines’ Platreef mine has an indicated mineral resource estimate of 42 million ounces of platinum, palladium, rhodium, and gold, plus 3.66 billion pounds of nickel and copper, in a compelling and attractive mix of battery and platinum group metals that is comparatively rare. A growth-stage exploration company that shares this Platreef deposit style in a politically stable jurisdiction like the US would present an exciting opportunity for investors, particularly in light of the federal government’s quest to secure domestic supply of these critical elements.

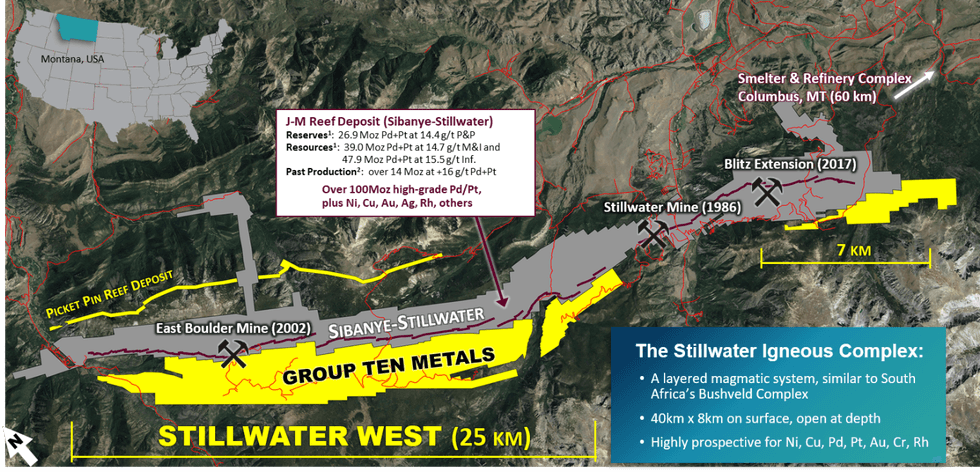

Stillwater Critical Minerals (TSXV:PGE, OTCQB:PGEZF, FWB:5D32) is a Canadian mineral exploration company focused on advancing its large-scale flagship Stillwater West platinum, palladium, nickel, copper, cobalt and gold project in Montana, USA. The project is located in the iconic Stillwater Complex of Montana, USA, a rare world-class magmatic system that is geologically similar to the Bushveld Complex in South Africa which hosts the Flatreef, Mogalakwena and Waterberg deposits as well as numerous high-grade platinum deposits within the Merensky and UG2 reefs. Similarly, the Stillwater district hosts Sibanye-Stillwater, currently operating the world’s highest grade PGE mines along the analogous J-M reef, as well as Stillwater Critical’s Stillwater West project.

Dr. David Broughton, former Chief Geologist for Ivanhoe Mines and co-recipient of AME BC’s 2016 Colin Spence Award for Excellence in Global Mineral Exploration for Ivanhoes’ Flatreef discovery stated in 2018 that “the recognition of a Platreef setting in the Stillwater district is an exciting development.”

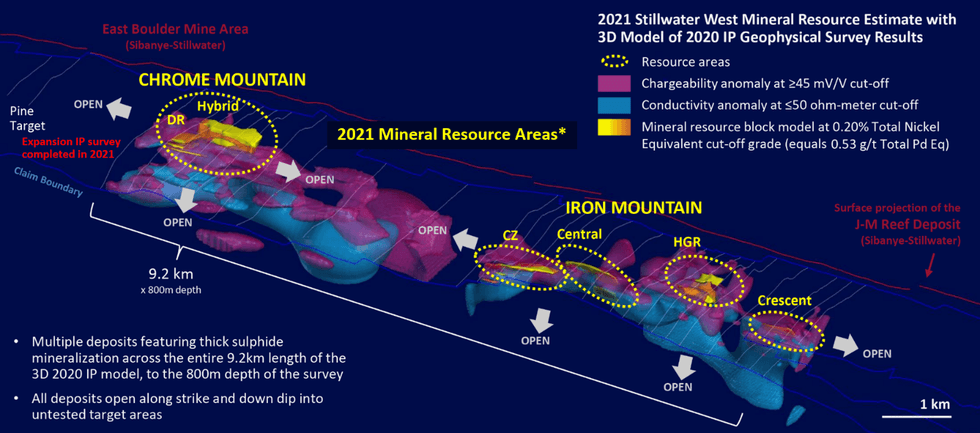

In October 2021, Stillwater Critical announced an inaugural NI 43-101 mineral resource estimate for the Stillwater West project which delineated a total of 1.1 billion pounds of nickel, copper and cobalt with 2.4 million ounces of palladium, platinum, rhodium and gold. The resource estimate was conducted in a constrained model totaling 157 million tonnes at an average grade of 0.45 percent total nickel equivalent (equal to 1.20 g/t palladium equivalent) using a 0.20 percent nickel equivalent cut-off grade.

The initial resource estimate is based on five deposits within the most advanced 9-kilometer core project area, less than one-third of the project’s overall strike length. The company sees excellent continuity and expansion potential and is focusing its efforts on expanding the inaugural resources within the core area while also advancing earlier stage targets across the 32-kilometer span of the project, which covers the same highly prospective magmatic stratigraphy as the core area.

Stillwater Critical Minerals completed its largest exploration program to date in 2021, with drill results expected to form the basis of an updated 43-101 resource estimate in the first half of 2022. Assays from the first two holes of the 14-hole campaign were announced in December and included the widest high-grade mineralized intercepts ever seen at Stillwater West. These first results were highlighted by 63.7 meters of 0.92 percent nickel equivalent (2.46 g/t palladium equivalent) at the CZ deposit and 728 meters of continuous sulphide mineralization at 0.27 percent NiEq, or 0.73 g/t PdEq at the Chrome Mountain target, which included contained intervals of successively higher grades.

Assays from the remaining 12 holes are expected to be announced over Q1 2022, followed by publication of an updated 43-101 resource estimate.

The company is led by a capable management team with more than 100 years of corporate and exploration experience with junior and major companies. Stillwater Critical Minerals’ exploration and development team has extensive experience in top-tier districts such as the Stillwater and Bushveld districts.

Stillwater Critical Minerals holds additional district-scale secondary assets which it is seeking to monetize. The company recently announced an earn-in deal on its Black Lake-Drayton project, a high-grade gold project located in Ontario, Canada. Black Lake-Drayton is situated in the Rainy River gold district which hosts major mines and projects in an area that has expanded rapidly since the 1990s including several recent discoveries. The Black Lake-Drayton project adjoins Treasury Metals’ (TSX:TML) recently consolidated Goliath Gold complex with more than 3 million ounces of gold. The project is located in the same greenstone belt as New Gold’s (TSX:NGD) Rainy River project which has more than six million ounces of gold, and is roughly 100km south of Great Bear’s Dixie gold project.

The company’s Kluane Ni-Cu-PGE project in Canada’s Yukon Territory positions Stillwater Critical with the largest land position in the Kluane Mafic-Ultramafic Belt, a large magmatic system that extends through the Yukon from northern British Columbia to central Alaska that hosts a number of PGE-Ni-Cu deposits. The Kluane project properties are each within 15km of the Alaska Highway and situated on trend with, and south of, the Nickel Shaw (formerly Wellgreen) deposit, one of the largest undeveloped PGE-Ni-Cu projects in North America at 6 Moz of Pt+Pd+Au and 3 Blbs of Ni+Cu in M&I resources and an additional 2 Moz of Pt+Pd+Au and 1 Blbs of Ni+Cu in Inferred resources. Although earlier stage than the company’s flagship Stillwater West project, the Kluane project shows excellent potential with massive sulfide mineralization returning up to 3.1 g/t of platinum, 1.4 g/t of palladium, 1.0 g/t of gold, 3.1 percent of nickel, 2.8 percent of copper and 0.2 percent of cobalt on the Spy claim block. Farther south, the Ultra claim block has trenching results of up to 5.5 g/t of platinum, 13.5 g/t of palladium, 0.5 g/t of gold, 4.1 percent of copper and 1.7 percent of nickel from an ultramafic sill.

The company is currently assessing and evaluating monetization strategies for the Kluane project.

Company Highlights

- Stillwater Critical Minerals has the second-largest landholding in the Stillwater Complex in Montana, USA, adjacent to Sibanye-Stillwater’s mine complex.

- The company’s 100 percent-owned flagship Stillwater West project is district-scale in size, covering a rare and world-class magmatic system that hosts five minerals that are listed as critical by the US government.

- The Stillwater West project features Platreef-style deposits of battery and precious metals with exceptional expansion potential, and also high-grade gold.

- Stillwater West has a significant inferred NI 43-101 mineral resource estimate of 2.4 million ounces of palladium, platinum, rhodium and gold as well as 1.1 billion pounds of nickel, copper and cobalt.

- Stillwater Critical Minerals Metals recently announced a deal whereby Heritage Mining may earn a 90% interest in the company’s Black Lake-Drayton gold project in the prolific Rainy River gold district in Ontario, Canada, by meeting specific exploration, development, and payment requirements.

- The company’s wholly-owned Kluane project is a district-scale, highly prospective platinum-group element, nickel and copper project located beside one of the largest undeveloped PGE-Ni-Cu deposits in the world in the Kluane mafic-ultramafic belt in Yukon, Canada.

- Stillwater Critical Minerals’ exploration and development team has extensive experience in top-tier districts such as the Stillwater and Bushveld districts.

- The company is well capitalized and fully permitted, with no debt.

Get access to more exclusive Cobalt Investing Stock profiles here