Inflation High, Markets Volatile — Experts Talk Strategies for Navigating Tough Times

Inflation and recession concerns are just two of the many factors weighing on markets this year. Experts at the Rule Symposium offered guidance on what investors should do.

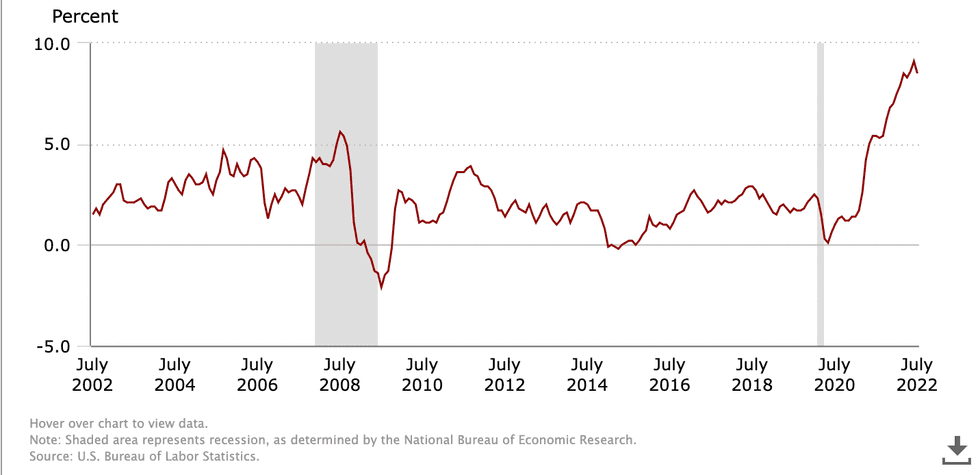

Markets got a mid-August bump after July’s US Consumer Price Index (CPI) data showed inflation slowed to 8.5 percent during the seventh month of the year.

After breaching a 41 year high of 9.1 percent in June, lower energy costs and better-than-expected job additions drove inflation lower for the first time since June 2020.

The positive news pushed all of North America’s major markets higher as many speculated that with inflationary pressures easing, the US Federal Reserve will be less likely to raise interest rates by another 75 basis points.

20 year Consumer Price Index percentage change.

Chart via the US Bureau of Labour Statistics.

However, rising markets, more jobs and better wages could all be precursors to higher inflation in the fall.

The outlook for inflation and how the Fed will tackle it were prominent topics at this year's Rule Symposium, held during the last week of July in Boca Raton, Florida. The annual investor-focused event coincided with the central bank's July increase, which pushed interest rates up 75 basis points to a range of 2.25 to 2.5 percent.

Fed must choose between fighting inflation or recession

Speaking at the event, Danielle DiMartino Booth, a Fed critic, as well as the CEO and chief strategist at Quill Intelligence, immediately pointed out that the Fed is at a crucial crossroads.

“Are they going to beat down inflation? Or are they going to combat the recession?” DiMartino Booth said. “It’s not a good choice, right? But we can't do both. And I think that that's what we have to focus on.”

DiMartino Booth attributed skyrocketing inflation to pandemic stimulus efforts, which injected “43.2 percent of cash (GDP) into the veins of US households” — with nothing to show for it.

With more money available for consumers and inflation rising, market participants could begin to see what James Rickards of Paradigm Press and Strategic Intelligence described as “demand pull inflation," which he said stems from the demand side of the economy. Here consumers “get an inflationary mindset” and make large purchases immediately in order to avoid paying more later; this further propels inflation.

In DiMartino Booth's view, the Fed seems to have chosen the inflation fight over the battle against a recession, which is defined as two consecutive quarters of negative growth. The US economy officially slipped into this territory at the end of June, when Q2 GDP shrank by 0.9 percent; this was preceded by Q1’s 1.6 percent decline.

She believes that the July rate hike that rallied markets, particularly the tech-heavy NASDAQ Composite (INDEXNASDAQ:.IXIC), which is 18 percent (3,000 points) off its January start, reveals the Fed's choice.

“It's up because Jay Powell said, 'I'll fight the recession, not inflation' (on July 27). That's why the NASDAQ was up."

Energy an inflationary driver and a good investment

DiMartino Booth also participated in a panel discussion entitled “Taming Inflation — What Will it Take?” alongside David Stockman, Dr. Nomi Prins and symposium host Rick Rule.

During that discussion, DiMartino Booth explained that the Fed is more concerned about the perception of inflation rather than actual mounting costs for consumers.

“Inflation expectations are nothing more than how people view gasoline prices,” she said of the rate that is used to gauge what consumers expect of inflation in the future.

Dr. Prins, a financial expert and author, cited energy as the main catalyst behind today’s rampant inflation. The Wall Street critic, who has held several senior roles at major financial institutions, prefaced her remarks by saying that “Wall Street doesn’t truly care about what's going on in the real world.”

“What they care about is how they can position their books, and how much money is coming in as cheaply as possible in order to position those costs,” she added.

Dr. Prins went on to say that Wall Street “is going to be okay” because it has positions on both sides.

“With respect to energy, obviously, the real economy and inflationary figures for CPI are connected to the energy crisis,” she said. "I think what we saw (on July 27) is the Fed is looking at what's going on in terms of the medium parts of inflation that are driving that core number up and driving the headline up, which is all related to energy.”

Sky-high debt thorn in the Fed’s side

Stockman, who served as director of the Office of Management and Budget under former US President Ronald Reagan, compared Fed Chair Jerome Powell’s response to inflation to that of Paul Volcker.

Volcker chaired the Fed between 1970 and 1987, and is credited with navigating the US economy out of the Great Inflation (1965 to 1982) using stringent economic measures.

“Had we been at the level Volcker faced in late 1979, early 1980, there would be US$36 trillion in debt on the US economy. Today there's actually US$88 trillion,” Stockman said.

According to Stockman, this massive debt load will leave the Fed with few options. “The difference is where the rubber will meet the road … the Fed has no choice except to keep tightening, because inflation is far more deeply embedded,” he said. “And it's going to last a lot longer up in that (9 percent) range than anybody's expecting.”

Mike Larson, income and dividend analyst at Weiss Ratings, also addressed the Fed’s efforts to quash inflation during his presentation. He underscored the inverted bond yield curve as a sign that something worse is brewing.

“With the Fed jumping into essentially overdrive — a very aggressive rate policy — what you're seeing is the yield curve inverting severely, and not just on a minor basis, but a persistent, consistent severe inversion cycle,” he said.

Displaying a chart, Larson explained that the yield curve was severely inverted ahead of the Fed’s July meeting. This occurs when the two year bond yield exceeds the 10 year bond yield, and it is often a recession precursor.

“That's more inverted and more deeply inverted than in the mid-2000s, right before the housing market began to go belly up, the Great Financial Crisis and all that,” he said. “It's almost in the range of what we had both before the dotcom bust (1995 to 1997), and what we had at the tail end of the 1980s heading into the 1990s.”

Larson’s concerns were rightly founded, as the yield curve hit a 40 year extreme on August 10 after July's CPI data. An ensuing trading blitz pushed the two year yield 58 basis points higher, the most extreme swing in 40 years.

How to position as uncertainty reigns supreme

Whether or not inflation has peaked, investors should know how to structure their portfolios in times of tumult.

“In any market, the idea is to try and be more defensive to focus on income on sustainable gains,” Larson said.

The analyst suggested looking at higher-income, higher-rated stocks. “We want stocks and exchange-traded funds that are going to give you the chance to beat inflation, or to generate those sustainable gains,” he said.

The second area Larson pointed to was precious metals to hedge against inflation and uncertainty. “We want to be boosting your allocation of precious metals and mining shares, given what's happening with inflation, given that we're in a higher-volatility regime. People are going to be looking for what I call ‘chaos insurance,’” he said.

Gold’s role as a store of wealth is likely to also come into play as economic uncertainty mounts.

“The yield curve inversion pretty much tells you you're going to have credit issues going forward,” Larson said. “Gold or precious metals are protected from that.”

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

- Beating Inflation With a Pocketful of Gold ›

- The Silver Edge to Inflation Hedging ›

- From Gold to Uranium: How High Inflation is Affecting Prices and Companies ›

- Oil Price and Inflation: What’s the Correlation? ›

- The Red-Hot Case for Copper as an Inflation Hedge ›