When Will Silver Go Up?

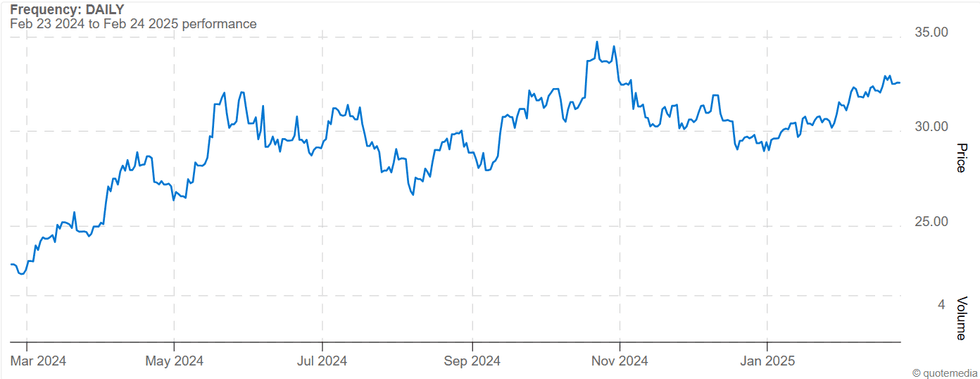

It’s no secret that the silver market can be incredibly volatile. From February 2024 to February 2025 alone, silver has seen price levels ranging from lows of US$22.42 per ounce to highs of US$34.72 per ounce.

Many investors are highly focused on the precious metal’s movement. After all, silver is a safe-haven asset that generally fares well during turmoil, and recent times have been packed with tense geopolitical events, environmental disasters and economic uncertainty. While it's trended up over the last 12 months, silver has struggled to maintain the US$30 level.

Why is silver going up? With the support of looming lower interest rates, lower holding costs for bullion, increased central bank interest in precious metals, and the threat of trade wars under US President Donald Trump, the price of silver is trading at highs not seen in nearly decade. But, can silver go even higher? And when?

Answering the question, “When will silver go up?” is tricky. Even seasoned analysts can’t tell the future, and it’s difficult to find a consensus on the topic of when the metal could take off.

Nevertheless, it’s definitely possible to track down different opinions on the topic. Market participants interested in investing in silver would do well to keep these ideas top of mind as they try to determine where the spot price may move.

In this article

What is silver's price performance year-on-year?

It’s useful to look at silver's past price performance when trying to determine when silver will go up.

As mentioned, silver has had ups and downs over the past year, although it has largely been trending higher.

Early in 2024, silver fell to a low of US$22.08 per ounce on January 21, and traded mostly flat for much of the remainder of the first quarter before rising to a Q1 high of US$25.62 on March 20. While it had long seemed like silver would never go up above US$30, the upward momentum in the second quarter sent the silver price surging by nearly 40 percent to a 12 year high of US$32.33 per ounce on May 20.

In Q3 2024, the price of silver slid down below the US$27 mark to a low of US$26.64 on August 7, tracking its industrial cousin copper, but pulled back above US$30 in mid-September.

Moving into Q4, in October the price of silver continued to the upside, brought along by upward momentum in the gold price as the yellow metal repeatedly broke record highs. By October 22, the precious metal reached US$34.72 per ounce, its highest level in 12 years.

This rally came in the lead-up to the US election while Middle East tensions were escalating and the possibility of coming Fed interest rate cuts drove safe-haven demand for precious metals. Positive sentiment for stronger industrial demand was also supportive of silver prices.

However, silver encountered resistance in the lead up to the US presidential election as investors began to favor interest-bearing assets more. By November 27, the price of silver had retreated to a quarterly low of US$30.11 per ounce.

By December 11, the metal was trading at US$31.88 in anticipation of a rate cut by the Federal Reserve. The Fed’s rate cut of 25 basis points and hawkish sentiment toward any future rate cuts spurred profit-taking on the part of investors, sending the silver price down to US$29.69 per ounce on December 19.

Silver's performance from February 23, 2024, to February 24, 2025.

Chart via the Investing News Network.

So far in the first quarter of 2025, silver is tracking gold higher on rising geopolitical concerns, as well as persistent inflationary pressures brought on by Trump’s aggressive tactics with tariffs and the risk of the Fed keeping interest rates higher for longer.

As of February 7, 2025, the price of silver had risen nearly 10 percent since the beginning of the year.

What factors affect silver supply and demand?

Now that the silver price is trading above US$30, investors wondering if now is a good time to sell silver or buy it should evaluate its current fundamentals. Global geopolitical events and rate changes from the US Federal Reserve are key factors to watch when it comes to silver.

Growing expectations that the Fed is not keen on lowering interest rates further and rising geopolitical uncertainties are responsible for this latest peak in silver prices. Additionally, macroeconomic conditions are supporting silver industrial demand.

Silver’s potential to continue its upward trajectory will ultimately depend on the ability of these factors to support prices above the critical US$30 level.

What do we know about silver supply and silver demand? Many market watchers look to the World Silver Survey for information; it is published each year by the Silver Institute using data provided by Metals Focus. While we await the 2025 World Silver Survey publication expected in April, we can take a look at the Silver Institute's January 2025 silver market forecast, backed by Metals Focus research.

The Silver Institute expects to see the silver market record its fifth consecutive supply deficit in 2025 as industrial demand for silver is projected to reach record volumes.

"Concerns about US President Donald Trump’s anticipated tariff policies have fueled short covering and deliveries of silver (and other precious metals) into CME warehouses since late 2024,” the firm stated. “This, coupled with rising economic and geopolitical uncertainties, has underpinned a healthy recovery in silver prices since the start of 2025.”

Overall silver demand is forecast to reach 1.2 billion ounces, driven by both industrial applications and retail investment. Demand-side growth will likely be tempered by weakness in the jewelry and silverware sectors.

Looking more specifically at silver industrial fabrication, this segment is expected to see 3 percent growth for the year, bringing volumes past the 700 million ounce mark for the first time. The solar photovoltaics, automotive industry and consumer electronics are seen as the biggest drivers of this demand growth.

In terms of physical silver investment, forecasters expect to see a 3 percent jump, especially on demand from Europe and North America.

On the supply side, the Silver Institute’s outlook includes 3 percent growth in total global silver supply in 2025 to reach an 11 year high of 1.05 billion ounces. This gain is expected to come from a seven-year high in silver mine production at 844 million ounces as output increases out of both existing and new mines, particularly in China, Canada, Chile and Morocco.

Silver recycling is expected to increase by 5 percent to a 13-year high of more than 200 million ounces.

Despite this growth on the supply side, the silver market is forecast to post a deficit at 149 million ounces in 2025.

What is the outlook for silver?

Over the past year, the Investing News Network (INN) has spoken with several experts about the silver price, and they shared the reasons they were bullish on silver's outlook.

In an April 2024 interview with INN, longtime resource sector investor Don Hansen said he is optimistic that signs are pointing to a precious metals bull market.

"The interesting thing is that most of the gains in these bull markets is in the last two or three years (of the bull market). And I think we are at the beginning of that period, which is why I think there's so much potential for gold and silver investors," Hansen told INN, and encouraged investors to consider adding gold and silver mining stocks to their portfolios.

In an April 9 email to INN, Peter Krauth, editor of Silver Stock Investor and author of "The Great Silver Bull," pointed to silver's performance compared to gold during the first quarter of 2024.

“Silver also typically lags gold, then catches up and surpasses it. We’re starting to see that happen in spades right now. Since the end of February, gold is up about 15 percent, while silver is up about 22 percent. Those are breathtaking gains in just a matter of weeks,” he said.

Moving forward, Krauth sees decreasing silver inventories at the COMEX, London Bullion Market Association and the Shanghai Gold Exchange as a major driver of the silver price in 2024. However, silver’s industrial side is another factor to watch this year. Concerns over a looming recession may dampen gains; on the flip side, interest rate cuts may spur economic growth and provide upside for the silver price.

INN spoke with Krauth again on May 24, after the silver price had rallied above US$30 and held there.

He said that the gold price's climb that began three months ago spurred the silver price's own move. While it has since fallen just below US$30, Krauth wasn't concerned about that scenario.

"Maybe we'll see a test of US$28, maybe even sort of a washout test as low as US$26. But I don't see much weaker than that ... (and) if we do drop below, ultimately we will regain US$30 and that will become a new floor," he said.

On May 28, INN spoke with Chris Marcus, founder of Arcadia Economics and author of "The Big Silver Short," about his outlook for silver after it broke through US$30.

"I think silver in the long term — everything that we've talked about is why it's still to me a good long-term bet," Marcus said. "In the short term I would expect you're going to see it pretty darn volatile. I mean, is there a chance for US$50 this year? There are scenarios in which that could happen, but I don't know that I would say that we're in a guarantee of that. But certainly with some of the things that are building beneath the surface, yeah it's possible."

Speaking with INN in October 2024, Randy Smallwood of Wheaton Precious Metals (TSX:WPM,NYSE:WPM) said that we're not likely to see a real breakout in the silver price until western retail demand heats up. Looking at the fundamentals, he sees this as a nearer-term possibility. "I think it's really only a matter of time until that retail market wakes up in the silver space," he said.

David Morgan, publisher of the Morgan Report, shared his 2025 outlook for silver with INN in November 2024. He thinks the white metal could reach US$40 per ounce, and continue its upward trajectory in 2026.

Mind Money CEO Julia Khandoshko told INN in December 2024 that she sees silver potentially reaching US$35 in the coming months as the supply and demand gap widens. While the white metal could then pull back to the US$30 level, she believes silver will make another run and potentially surpass US$50 per ounce.

Peter Krauth, author of "The Great Silver Bull" and editor of the Silver Stock Investor, is also looking for silver to reach US$35 in the first quarter of 2025, with the metal possibly hitting US$40 or more later in the year.

However, he cautions investors that broader macroeconomic trends could put a damper on silver price gains. “There is a serious risk of significant correction in the broader markets and of a recession. A broad market selloff could bleed into silver stocks, even if only temporarily,” Krauth said.

For investors, a key point to remember is that the resource space operates cyclically — while a commodity like silver can experience price rises and falls, ultimately what goes up must come down and vice versa. The advice to “buy low and sell high” is repeated often for a reason, and though it’s nigh impossible to predict market bottoms, low points in the cycle can be a good time to flex your purchasing power.

This is an updated version of an article first published by the Investing News Network in 2015.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.