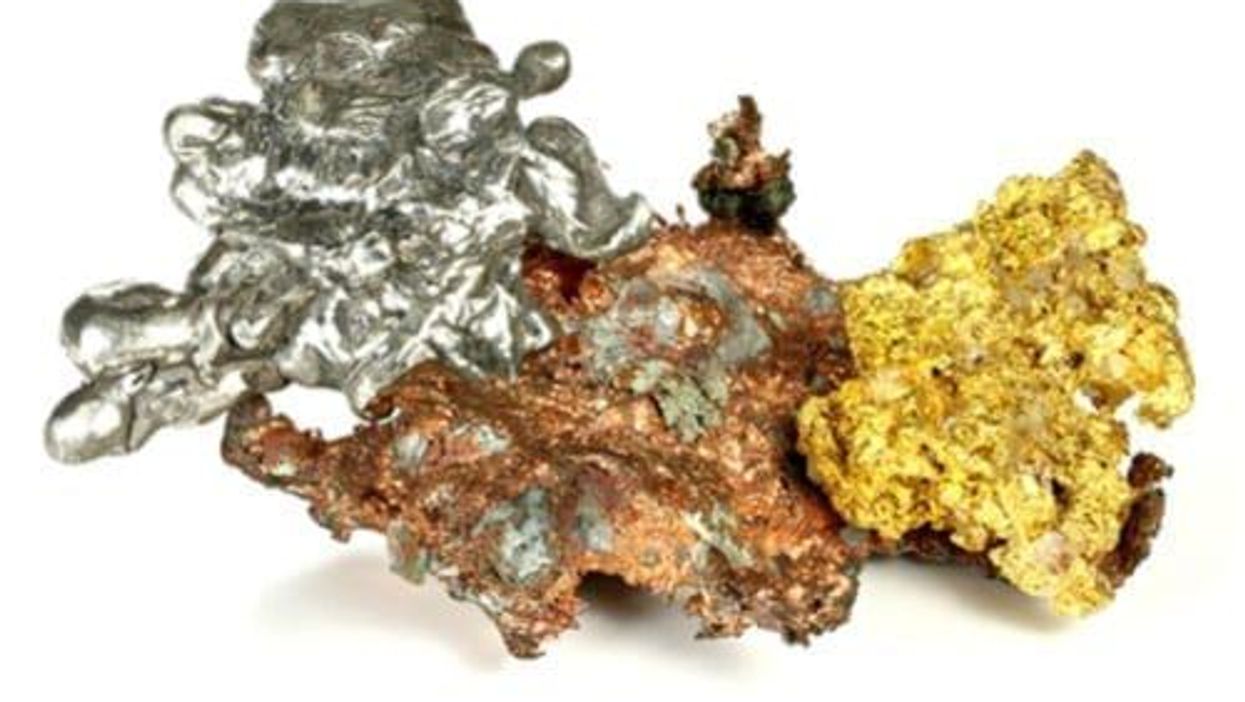

Precious Metals Weekly Round-Up: Gold Dips, Silver Shines

While gold was down slightly thanks to robust US jobs data, silver continued to shine, maintaining highs not seen since 2016.

Gold firmed on Friday (July 26) after losing more than 1 percent in the previous session thanks to positive US jobs data.

The yellow metal made back some of its losses as investors leaned towards its safe haven nature. Investors believe next week’s two day US Federal Reserve meeting will drive future sentiment.

“The market will now focus its attention on next week’s Fed meeting … if Fed Chair Powell indicates that a rate cut cycle is imminent, the dollar is likely to depreciate, which should in turn benefit gold,” Commerzbank (OTC Pink:CRZBY) said in a note quoted by Reuters.

The gold price is currently on track for its first weekly decline in the last three weeks, as the US dollar has begun to gain back some of the momentum it lost in the last month.

The greenback got additional support on Thursday (July 25) when the European Central Bank (ECB) stated it will not be cutting interest rates and even cautioned against acting too fast on policy easing. The comments from the ECB sent the US dollar rallying, while stocks, and ultimately gold, tumbled.

“Gold is consolidating in a broad range from US$1,400 to US$1,440,” said Jigar Trivedi, commodities analyst at Mumbai-based Anand Rathi Shares & Stock Brokers. He added that support has been provided by ECB hints of stimulus from September.

Furthermore, any gains that the yellow made earlier in Friday’s session have been capped by the greenback securing an almost two month high as market participants await Q2 US gross domestic product numbers. The market is expecting results, which will be released at 12:30 p.m. EDT on Friday, to show the slowest growth in more than two years.

Also in the precious metal’s corner are the ongoing tensions between the US and the Middle East.

“We expect gold prices to reduce further in coming sessions … nonetheless as geopolitical risk in the middle east has escalated, there might be limited downside,” noted Trivedi.

As of 10:52 a.m. EDT on Friday, gold was trading at US$1,420.60 per ounce.

Silver continued its rally from last week, when it made gains not seen since July 2016 as it jumped close to 7 percent. The white metal has climbed close to 2 percent for the week and is headed for its third consecutive week in the green.

As the price of gold continues to escalate, investors have begun to look at the white metal as a cheaper safe haven asset.

“Silver is cheap relative to gold, so it has bigger potential. It is going to pull back lower … any dip below US$16 could push buying,” said Gianclaudio Torlizzi, managing director at consultancy T-Commodity.

Silver’s recent rally could lend to the theory that it will outperform gold in the not so distant future. As David Morgan, publisher of the Morgan Report, recently told the Investing News Network (INN), everything surrounds gold, and once it takes off silver will follow.

“Once investors return to the precious metals, silver will catch up and most likely overtake gold, bringing the gold silver ratio back to a level of 70 to 1 or lower,” he explained.

Analysts at FocusEconomics agree with Morgan, saying in a recent note, “The rally in gold prices, which has widened the price differential between the two metals, could also spill over into the silver market (moving forward).”

Johann Wiebe, lead analyst at Thomson Reuters’ GFMS division, told INN in April that he expects silver prices to be around US$16.75 per ounce in 2019 and US$17.50 in 2020 thanks to rising economic and political turbulence weighing on the US dollar and supporting precious metals.

As of 11:17 a.m. EDT on Friday, silver was changing hands at US$16.38.

As for the other precious metals, platinum took some hits and was down over 1 percent for the week. Despite the dip, many analysts believe that platinum is set to make gains this year.

Analysts at FocusEconomics see the price of the metal rising slightly from its current level thanks to strong investment demand.

“The extent of substitution for palladium in vehicles and the evolution of the global economy will all be important factors to watch going forward,” they said in a note.

As of 11:23 a.m. EDT on Friday, the metal was trading at US$860 per ounce — still above the levels seen this time last week.

For palladium‘s part, it was also down just over 1 percent on Friday, teetering close to falling out of the US$1,500 per ounce range.

However, there are still many market participants in palladium’s corner, with Metals Focus stating that it believes the metal will continue to rise. The firm forecasts that autocatalyst demand will more than likely go up by 3.6 percent in 2019, setting records at 8.59 million ounces due to tighter emissions standards.

As of 11:27 a.m. EDT, palladium was trading at US$1,507.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Nicole Rashotte, hold no direct investment interest in any company mentioned in this article.