Palladium Price Update: H1 2022 in Review

How are the war, inflation and depressed automotive demand impacting palladium? Our palladium price update outlines market developments and explores what could happen moving forward.

Click here to read the previous palladium price update.

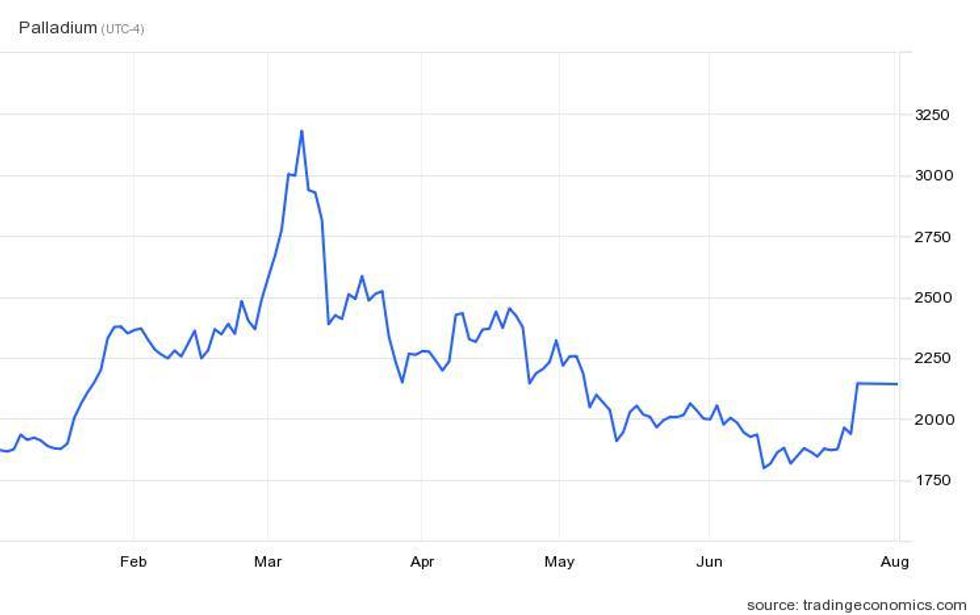

Palladium prices rose to a new all-time high during the first three months of 2022, but then battled headwinds over the second quarter, reducing the metal's H1 gains to 5.2 percent.

Excess supply from 2021 kept palladium prices below US$2,000 per ounce at the beginning of the year as the market looked to absorb the excess material. Despite a previously projected deficit, weak demand from the auto sector pushed the market into a surplus for the first time in a decade.

Valued at US$1,839 in January, tailwinds soon began propelling palladium higher. By the end of the month, production positivity out of the auto sector aided in the metal’s move to US$2,361, a 23 percent increase.

A reduction in recycled and scrap supply served as an additional catalyst for the metal through early February.

Soon after, Russia's invasion of Ukraine weighed on already fragile supply chains, while also raising issues regarding palladium production. In 2021, Russia produced 74,000 kilograms of palladium, and the country accounts for as much as 37 percent of primary palladium supply. The uncertainty caused palladium to skyrocket to an intraday all-time high of US$3,189 on March 9.

Palladium's H1 2022 price performance.

Chart via TradingEconomics.

By the end of March, some fear in the market had dissipated, and values had returned to the US$2,270 range.

The second quarter of 2022 proved much more challenging for palladium, with Q1's gains eroded by factors like a four decade high in inflation, rising energy costs and supply chain issues. As H1 concluded, prices for the platinum-group metal (PGM) were hovering around US$1,935.

Palladium price update: Value tied to auto sector performance

The autocatalyst segment is the primary end user of palladium, and much of the metal’s performance is tied to the demand for internal combustion engine vehicles. Like many markets, the auto sector was in the midst of a slow post-COVID-19 recovery when inflation began to climb to levels not seen since the 1980s.

In the face of declining disposable income, lingering semiconductor shortages, supply chain challenges and high gas prices, Metals Focus is projecting a small increase in palladium demand from the auto sector.

“Primarily owing to the partial rebound in automotive production this year, palladium autocatalyst demand is set to increase four percent year-over-year, still some seven percent shy of 2019’s peak,” the consultancy's annual report on PGMs states.

On a similar note, Rohit Savant, vice president of research at the CPM Group, is anticipating a decline across the board this year in fabrication demand for palladium, which encompasses the auto segment as well as electrical, dental, petrochemical and jewelry demand.

“Palladium fabrication demand is forecast to suffer more in the current year,” he said during a July PGMs market outlook webinar. “You have a number of headwinds for palladium fabrication demand this year.”

Savant went on to explain that the uncertainty in the auto sector — the main end point for produced palladium — will come from a number of factors.

“Production is still hurting from that chip shortage; you have ongoing increases in (the) battery electric vehicle market share, you have slowing economic growth, high inflation, high interest rates, high gasoline prices, which could push consumers towards smaller cars and battery electric vehicles,” he said.

Palladium price update: Platinum substitution a major headwind

Even with its 14.67 percent decline in Q2, palladium prices are still in historically high territory.

“Palladium prices have risen very sharply for about five years, and they continue to rise,” said Jeffrey Christian, managing partner at CPM Group, during a late July presentation. “They have shown some weakness; the average was up 9 percent last year, but it was already very high.”

The metal's sustained higher price point has led to automakers to substitute the metal for platinum.

This is highlighted by Metals Focus, whose report states, “Globally, the metal continues to face headwinds from semiconductor shortages, particularly in the first half of the year, and from substitution into platinum."

The metals consultancy also notes that substitution will occur in the industrial demand segment of the palladium market. “The elevated palladium price continues to incentivise substitution in sectors where alternatives are available, namely electronics and medical,” it explains.

As Savant pointed out during his presentation, the price discrepancy between the sister metals will continue to make platinum more attractive.

“(The) platinum-to-palladium price ratio, which remains at historically low levels, has clearly been something that has benefited platinum, with increased interest for platinum both from investors as well as fabricators.”

The auto sector's growing move to swap palladium for platinum is a long-term platinum driver. “Fabricators in the auto industry, for example, have started to reintroduce platinum in gasoline autocatalysts, which is one of the most positive fabrication demand fundamentals for platinum in the medium to long term,” Savant said.

Palladium price update: Concerns over Russian supply to impede growth

In addition to the demand issues that substitution presents, the supply side of the PGMs market is also in a precarious position due to the large role Russian production plays.

“Concerns over supply disruptions, as well as tailwinds from safe haven inflows into the wider precious metals space have boosted (PGM) prices,” the Metals Focus PGMs overview reads. “However, the second-order effect of the crisis could prove negative for PGMs as new supply chain challenges, energy price boosts and harm to consumer sentiment could all weigh on vehicle production.”

This is especially true for palladium, which is more susceptible to fluctuations in Russian output. The risk the war has infused into the palladium market could serve as another catalyst for the platinum market, as Paul Wilson, CEO of the World Platinum Investment Council, said in a press release.

“Security-of-supply concerns, particularly for palladium, have arisen in the wake of Russia’s invasion of Ukraine and given Russia’s importance to the global supplies of mined palladium and, to a much lesser extent, platinum,” he commented. “This could increase platinum for palladium substitution efforts and modify the procurement and inventory management strategies of a wide range of market participants.”

Palladium price update: Potential price catalysts

Even though palladium substitution is increasing, there are factors that could add tailwinds to the palladium price for the remainder of the year.

Strength in investment demand is likely to continue as palladium prices retain their higher values. According to CPM Group’s Savant, investors continued to absorb aboveground stock of the metal in 2021 in hopes that a resurgence in auto demand would drive prices even higher.

“Investors have remained interested in palladium during 2022, in part because of palladium's ability to sustain high prices over several years and in part because of supply-side concerns,'' he said.

The vice president of research also explained that declines in broad auto sector demand could be offset by an uptick in large vehicle sales in the US, as well as the need for higher loadings to meet more stringent environmental regulations, all of which would “support palladium demand.”

On the supply side, in addition to Russian output challenges, the market may see disruptions in South Africa, the leading producer of both platinum and palladium. In total, mine supply is projected to contract 5 percent in 2022.

“Like platinum, (palladium) output from South Africa is forecast to decline as a result of the depletion of semi-finished inventories and planned smelter maintenance,” Metals Focus points out.

The supply constraints are likely to erode 2021’s surplus as well, the report continues.

“Palladium, the most exposed PGM to Russia, is expected to see lower supply from that country as well as South Africa,” it reads. “Coupled with stronger autocatalyst demand, we forecast a return to a market deficit of 521,000 ounces.” Metals Focus is projecting that the 2023 average price for the metal will be US$2,290.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- War, Decarbonization Could Catalyze Platinum as Palladium Stays ... ›

- Palladium Outlook 2022: Auto Demand to Determine Price Movement ›