Platinum made headlines on Monday as its price fell to a six-year low. According to the The Wall Street Journal, platinum for July delivery fell 0.8 percent, to $1,088.60 per troy ounce, on the New York COMEX, the lowest since March 2009.

The price drop was driven in part by concerns about growing platinum stockpiles. Mine workers’ five-month strike last year cut into platinum output from South Africa, but the world’s largest platinum producer is now ramping up output again as operations run by Anglo American Platinum (OTCMKTS:AGPPY,LSE:AAL), Lonmin (LSE:LMI) and Impala Platinum Holdings (OTCMKTS:IMPUY) get back on track.

“Weak demand at a time when the South African producers have normalized production…has dragged platinum down,” Robin Bhar of Societe Generale (EPA:GLE) told the Journal.

That statement falls in line with predictions from William Tankard, director of precious metals and mining at Thomson Reuters (TSX:TRI,NYSE:TRI). He stated back in March that even though platinum is still in deficit, continued ramp ups from producers could undermine long-term fundamentals.

“I think what you have is probably a certain amount of positioning around investors taking the view that if the supply side is not going to cut, where is the industry going to end up?” he said at the time, suggesting that one might infer that producers could run the risk of “[producing] themselves out of a deficit market into a surplus market.”

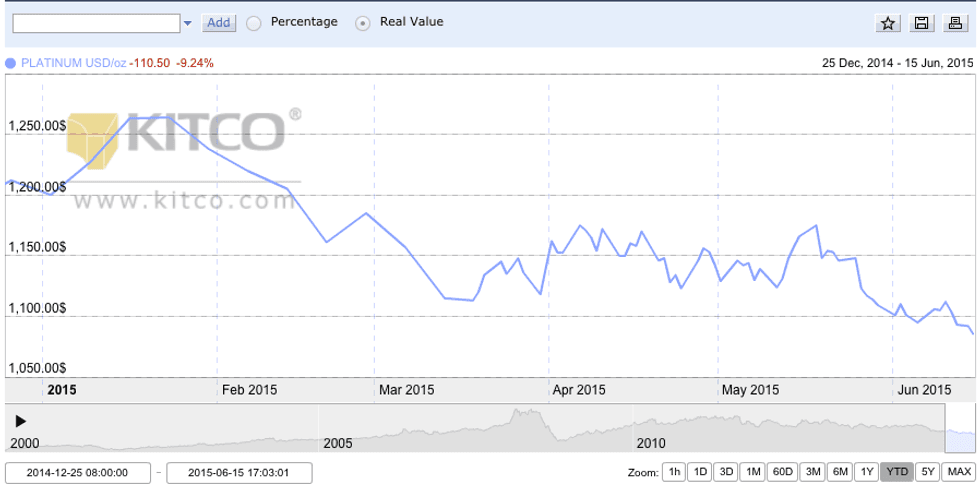

Platinum price year-to-date, courtesy of Kitco.

Meanwhile, fresh worries over Greek debt have also had a negative effect on the platinum price. As Bloomberg explains, talks regarding a Greek bailout are still at a standstill, meaning that auto demand in Europe could drop, hurting demand for catalytic converters in vehicles. Europe accounts for roughly a quarter of global automobile demand, and platinum is specifically used for catalytic converters in diesel engines; there’s more of a market for those in Europe (platinum’s sister metal, palladium, is used for converters in gasoline engines.)

European auto sales have been dropping in recent months, falling another 24 percent in April. Mike Dragosits of TD Securities told the news outlet that demand could fall again next month. “Judging by reporting from some of the major European countries like Germany, the U.K. and France, you can amalgamate that auto sales will be down in the aggregate in May,” he said.

Overall, the spot platinum price is down just under 10 percent so far this year, and as Bloomberg notes, that’s the biggest drop in the precious metals space overall. Gold has fared much better in light of recently renewed Greek worries, gaining 0.38 percent to trade at $1,185.80 per ounce on Monday.

To be sure, the factors mentioned above aren’t great for the platinum price. But on the bright side, there have been a few glimpses of positivity, such as Anglo American’s move to help incubate platinum demand by supporting fuel cell production.

In any case, platinum investors will continue watching the talks in Greece and will keep an eye on vehicle sales in Europe going forward.

Securities Disclosure: I, Teresa Matich, hold no direct investment interest in any company mentioned in this article.

Related videos:

Why is Platinum Cheaper Than Gold?

WPIC’s Latest Update on Aboveground Platinum Stocks

Thomson Reuters GFMS: Platinum & Palladium Survey 2015