There is a risk that the US dollar is breaking out and that a new leg of the US dollar bull is underway with negative implications for commodities.

Previous analysis of the DX indicated a range bound US dollar collared by 92.50 on the low end and 100.40 on the high end. Recent action has the US dollar above resistance with negative implications for commodities if this break-out is confirmed.

It is very possible for this to be a head fake as an over-reaction to the US elections and for the DX to reverse back below the resistance level and for the US dollar to once again trade back into the prevailing range that has been the status quo for the better part of the last 18 months.

As previously discussed, it is very typical in a bull market for a period of consolidation at the midway point which would suggest that if this is the case, there is a lot more upside for the US dollar relative to its peers. I’m not convinced that this is the case and I would expect a retracement back to resistance and for that level to now act as support. If support holds, then we have a confirmed break-out of the US dollar index and need to act accordingly. If, as I suspect the US dollar reverses back below the 100.40 level with conviction then this is a false alarm and it is business as usual.

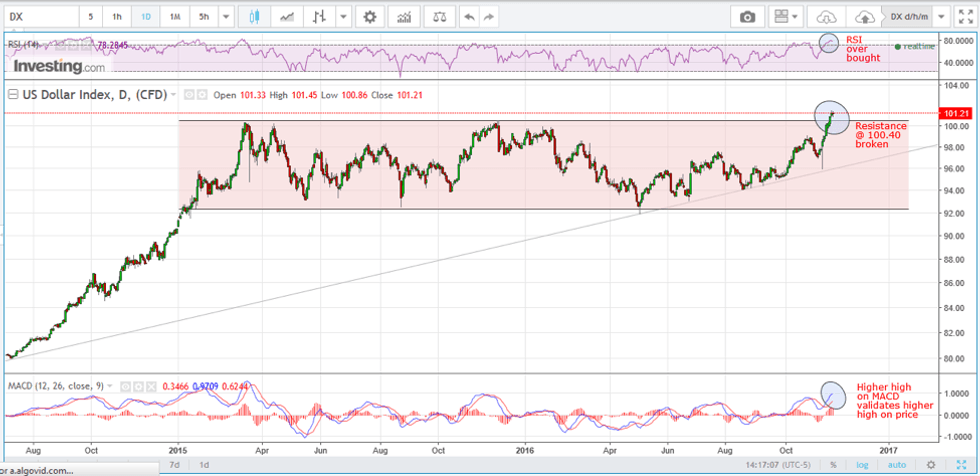

In the daily chart below, you can see the well-defined channel that the US dollar index has traded the last 18 months. The recent surge, coincident with the US elections and its aftermath, have taken the DX above the channel which has bullish implications. In the case of a continuation, a measured move would suggest that 115 to 120 is a reasonable upside target over the coming months or longer. A very overbought RSI (relative strength index) suggests at the very least a pause, if not a retracement here, which is why I am skeptical in the veracity of this break-out. MACD (moving average convergence divergence) however does indicate that this could be the real thing so further confirmation is required.

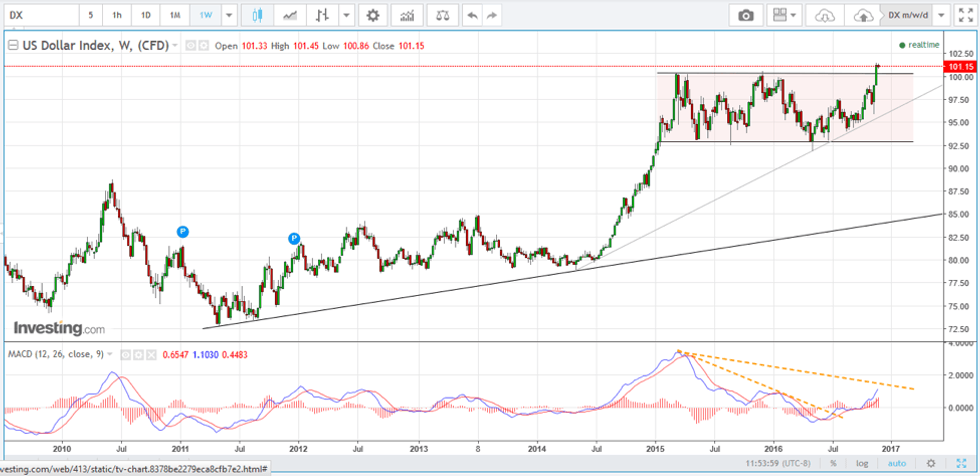

The weekly chart goes further to add to my skepticism that this a resumption of the US dollar bull and is more likely, in my opinion, an interim top. The main indicator that I see that contradicts this break-out is non-validation by MACD. In fact, what has formed and what is still forming is negative divergence between price and MACD where you see a higher high on price coincident with a lower high on MACD.

This is not generally a bullish sign and a bull would want to see higher highs on MACD confirming higher highs on price. This is one of the most reliable indicators that I follow and a negative divergence is what I look for at an inflection point to suggest a turning point. It is especially significant when this appears on the weekly chart.

Conclusion

There is a risk that the US dollar is breaking out and that a new leg of the US dollar bull is underway with negative implications for commodities. Further confirmation is required and the door is still slightly ajar for a reversal back into the consolidation channel which would also indicate that this could ultimately prove to be an interim top for the US Dollar index.

Terry Yaremchuk is an Investment Advisor and Futures Trading representative with the Chippingham Financial Group. Terry offers wealth management and commodities trading services. Specific questions regarding a document can be directed to Terry Yaremchuk. Terry can be reached at tyaremchuk@chippingham.com.

This article is not a recommendation or financial advice and is meant for information purposes only. There is inherit risk with all investing and individuals should speak with their financial advisor to determine if any investment is within their own investment objectives and risk tolerance.

All of the information provided is believed to be accurate and reliable; however, the author and Chippingham assumes no responsibility for any error or responsibility for the use of the information provided. The inclusion of links from this site does not imply endorsement.