Gold rallied to a three and a half-month high this week, with the US and UK considering military intervention in Syria.

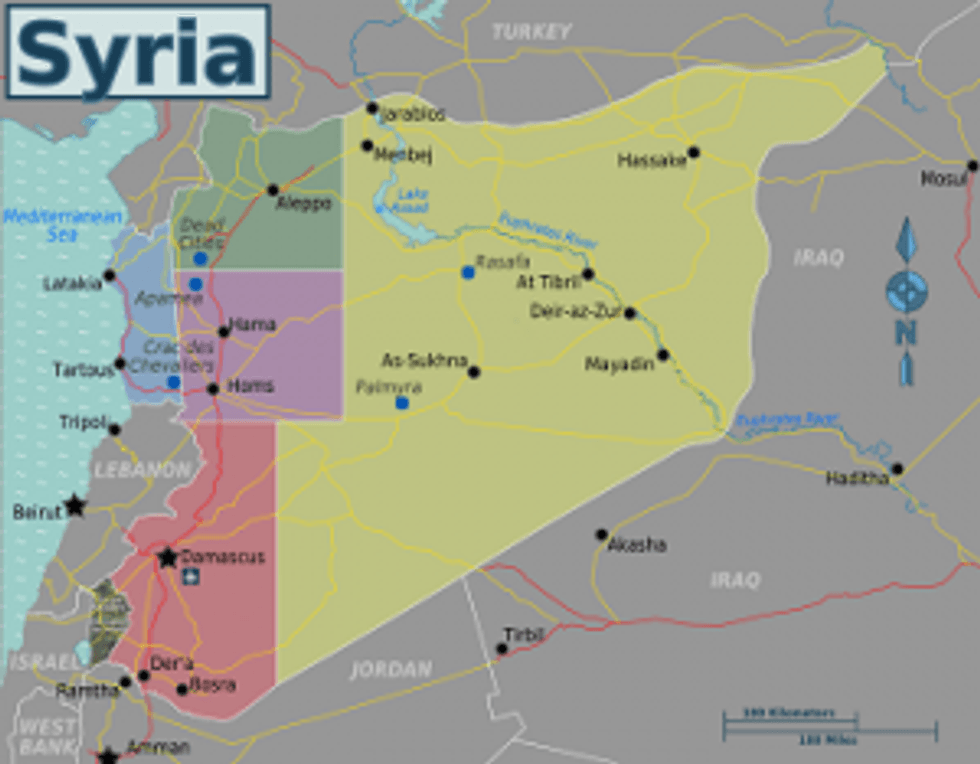

A wave of fresh safe-haven demand had gold breaching three and a half-month highs this week as the United States and United Kingdom contemplated military intervention in Syria.

On Tuesday, following weekend reports of a chemical weapons attack believed to be orchestrated by the Syrian regime, gold futures gained $24 to finish the day at $1,417.20 an ounce, while gold on the spot market rose $12.70 to end at $1,418. Gold traders had a healthy appetite for the metal after US officials said growing intelligence points to Bashar Assad’s government as the culprit in a chemical weapons attack that killed hundreds. In London, meanwhile, politicians are divided over the matter, with the Opposition Labour Party under fire for not backing Prime Minister David Cameron’s motion paving the way for military strikes, the BBC reported.

Gold, a safe-haven asset that normally rises on geopolitical tensions, has rallied nearly 20 percent since plumbing three-year lows under $1,200 an ounce on June 28. Along with Syria, the gold price has benefitted from surging physical demand from top gold-consuming nations China and India, and an end to ETF liquidations that occurred in the second quarter. Ambiguity surrounding the timing of the US Federal Reserve’s pullback on quantitative easing has also been a factor in gold’s rise.

Gold kept climbing on Wednesday, reaching as high as $1,434 as saber-rattling over Syria continued, but by Thursday the buying frenzy had subsided, leading to a loss in momentum. MINING.com reported that doubts over airstrikes on Syria, combined with news that the US economy is expanding more rapidly than previously predicted, had the precious metal dropping $15, to $1,405. At the close of trading, spot gold was down $6.80, at $1,411.50, while December gold futures finished the day down $8, at $1,410.80.

While gold bugs will be rejoicing over the bump Syria has given to the price, some commentators are skeptical that it will continue. Gold market observer Julian Phillips wrote in a commentary on Thursday that the “Syria factor” is already waning as a catalyst for the gold price. Phillips said safe-haven demand over Syria is not as important a factor as other forces such as falling supply and Asian demand.

Another commentator, Jason Hamlin, wrote in The Market Oracle that gold will likely be going higher this fall whether or not the US Federal Reserve “tapers” its quantitative easing program, which currently involves printing $85 billion a month to purchase bonds in order to keep interest rates low. Hamlin, publisher of Gold Stock Bull newsletter, said he believes the Fed will not taper QE in September as expected, which will result in continued elevation of gold and silver prices. “In the short term, this upward trajectory will likely be accelerated by increasing tensions in the Middle East and the potential of a new war with Syria,” he concluded.

South African miners on tenterhooks

As of Thursday, there was still no resolution of talks in South Africa between unions and the mining industry over proposed wage increases. Yahoo News reported that South Africa’s unions on Tuesday rejected a 6.5-percent wage increase offered by the Chamber of Mines — a far cry from the 60 percent increase they were demanding — opening the door to widespread strikes.

Company news

Embattled Newcrest Mining (ASX:NCM,TSX:NM) finally had some good news to share on Monday. The Australian gold producer, which recently booked a $5.75-billion writedown and is this year’s worst performer among Australia’s 50 biggest public companies, rose to its highest level since June on the back of a two-month high for the gold price, Bloomberg reported.

Reuters reported that Niger is planning to bid for Semafo’s (TSX:SMF) 80-percent stake in the Samira Hill gold mine in an effort take full control of the project. Canada-based Semafo is also negotiating with Australian company Middle Island Resources (ASX:MDI) for the stake sale.

Junior company news

Liberty Mines (TSX:LBE) said today it has entered into a binding term sheet with QMX Gold (TSX:QMX) to acquire the Snow Lake gold project in Manitoba for a cash payment of US$20 million. Liberty is targeting a potential 80,000 ounces of gold per year at Snow Lake at cash costs of $852 per ounce. The property has proven and probable reserves of 3.477 million tonnes graded 4.04 grams per tonne, or 451,900 ounces of contained gold.

Nevada-based Comstock Mining (NYSE:LODE) today completed a previously announced public offering of 4.146 million common shares, with proceeds of $8.75 million. Comstock said $3 million will go towards expansion of the heap leach pad, with the remainder used for the purchase of lands and general corporate purposes.

Richmont Mines (TSX:RIC,NYSE:RIC) closed a Senior Secured Credit Facility for up to C$50 million with Macquarie Bank to advance its Island Gold Deep project in Ontario. “The loan provides Richmont with additional flexibility and financial strength to unlock Island Gold Deep’s potential and allow the Corporation to enter its next phase of growth,” Richmont President and CEO Paul Carmel said in a statement.

Northern Vertex Mining (TSXV:NEE) announced on Wednesday that it will proceed with a private placement equity financing totalling approximately $5 million. Proceeds will go towards reactivating the Moss mine gold-silver heap leach project in Arizona, where Northern Vertex has an earn-in agreement with Patriot Gold (OTCMKTS:PGOL).

Securities Disclosure: I, Andrew Topf, hold no direct investment interest in any company mentioned in this article.

Related reading: